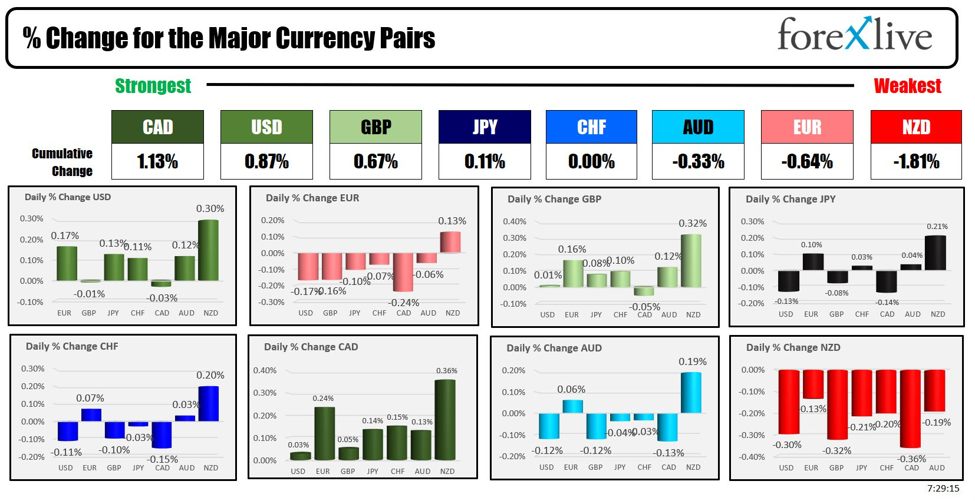

随着 NA 会话的开始 , CAD 最强 , NZD 最弱

随着北美会议的开始 , CAD 最强 , NZD 最弱.美元大多走强 - 但温和 - 与所有主要货币相比都有所上涨 , 但 t 除外.

随着北美会议的开始 , CAD 最强 , NZD 最弱.美元大多走强 - 但温和 - 与所有主要货币相比有所上涨 , 但加元和英镑除外 ( 几乎没有变化 ).

隔夜 , 欧洲央行核心 CPI 上涨至 2.9% 对 2.预期为 8 % ( 与上个月持平 ).然而 , 标题数据符合预期.

一夜之间有很多欧洲央行的讲话.一些亮点 :

- Wunsch said there is room for second breakup barring any major negative surprises. Most are expecting 1 to 2 by the end of the year.

- Lane said that June inflation data seems in line with our assessment, Buck commented that service inflation remains essential and that the ECB needed to take a bit of time to assess inflation.

- di Guindos said we are not following a predetermined path on interest rates and that uncertainty remains high.

- Muller agreed that we can probably cut rates again before year end, but should not rush to do so and the patient with further rate cuts.

- Centeno said that every meeting is open for us to make a decision but said that we were to be prudent on rates. He did add that there is confidence that inflation will hit 2%percent target next year.

- Vasle at that we can cut rates further things go as expected, but need more data to confirm inflation trajectory.

在澳大利亚 , ING 隔夜表示 , 他们现在预计下一次澳洲联储利率决定将加息.上周澳大利亚 CPI 数据上涨 4.1% 对 3.8% 之前 (点击这里查看完整的故事).

有一些美联储官员在一夜之间发表讲话.纽约联储主席约翰 · 威廉姆斯表示有信心美联储有望持续实现其 2 % 的通胀目标.他指出 , 他继续看到价格压力放缓 , 强化了他对美联储当前道路的信念.威廉姆斯在国际清算银行会议的视频中发表了这些言论.

在其他闲聊中 , 芝加哥联储主席奥斯坦 · 古尔斯比表示 , 目前的利率是限制性的 , 如果维持太久 , 可能会成为问题.他强调了就业市场中出现的警告信号 , 并强调了监测就业报告和价格数据的重要性.古尔斯比指出 , 美国的通胀数据出现了一系列改善.S.暗示可能回到 2% 的通胀目标.他表示 , 如果通胀正常化 , 利率也将回到更典型的水平.今天 , 鲍威尔在美国东部时间 1330 GMT / 0930 在辛特拉的欧洲央行论坛上发表讲话.欧洲央行行长将加入他的行列.拉加德在面板上.期间工作到工作报告将在周五 BLS 工作报告之前添加就业数据.对职位空缺的期望是在 7.9600 万从 8.上个月 6 亿.展望周五 ,非农就业岗位预计将增加 195, 000 个 , 而上个月为 272, 000 个.

北美会议开始时其他市场的快照显示 :

- Crude oil is trading up $0.71 or 0.84% at $84.07. At this time yesterday, the price was at $81.96

- Gold is trading down $9.98 or -0.43% at $2321.69. At this time yesterday, the price was trading at $2338

- Silver is trading down $0.17 or -0.59% at $29.27. At this time on yesterday, the price is trading at $29.29

- Bitcoin trades at $62,680. At this time yesterday, the price was trading up at $62,600

- Ethereum is also trading at $3448.10. At this time yesterday, the price was trading at $3458.90

在盘前市场中 , 主要指数的快照在昨天上涨之后在盘前交易中走低。.在第二幕中 , 以创纪录的水平结束.

- Dow Industrial Average futures are implying a loss of -143 points. Yesterday, the Dow Industrial Average rose 50.66 points or 0.13% at 39169.53.

- S&P futures are implying a decline of -24.34 points. Yesterday, the S&P index rose 14.61 points or 0.27% at 5475.10.

- Nasdaq futures are implying a decline of -119.10 points. Yesterday, the NASDAQ index rose 146.70 points or 0.83% at 17879.305

欧洲股指在昨日全面上涨后走低 :

- German DAX, -1.27%

- France CAC -1.06%

- UK FTSE 100, -0.54%

- Spain's Ibex, -1.79%

- Italy's FTSE MIB, -1.23% (delayed 10 minutes)..

亚太地区市场的股票涨跌互现

- Japan's Nikkei 225, +1.12%

- China's Shanghai Composite Index, +0.08%

- Hong Kong's Hang Seng index, +0.29%

- Australia S&P/ASX index, -0.42%

看美债市场 , 收益率较低.

- 2-year yield 4.747%, -2.5 basis points. At this time yesterday, the yield was at 4.758%

- 5-year yield 4.403%, -3.7 basis points. At this time yesterday, the yield was at 4.392%

- 10-year yield 4.443%, -3.6 basis points. At this time yesterday, the yield was at 4.414%

- 30-year yield 4.609%, -3.4 basis points. At this time yesterday, the yield was at 4.579%

从国债收益率曲线来看 , 利差正在继续上升 , 并在负收益率曲线上逐渐消失 :

- The 2-10 year spread is at -30.3 basis points. At this time yesterday, the spread was at -34.4 basis points. A week ago, the spread was at -50.6 basis points

- The 2-30 year spread is at -13.8 basis points. At this time yesterday, the spread was at -18.4 basis points. A week ago the spread was at -37.3 basis points

欧洲基准 10 年期收益率涨跌互现 :

Disclaimer: The views in this article are from the original author and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.