美联储官员连续放鹰 黄金日内承压回落

在美联储11月宣布暂停加息后,或许感受到了市场过于乐观的情绪,美联储的官员们在这几天纷纷下场给市场泼凉水。

11月7日,现货黄金日内微跌0.05%,目前交投于1968.07美元/盎司。

黄金的走弱和美联储官员们在近期的发声息息相关。在美联储11月宣布暂停加息后,或许感受到了市场过于乐观的情绪,美联储的官员们在这几天纷纷下场给市场泼凉水。

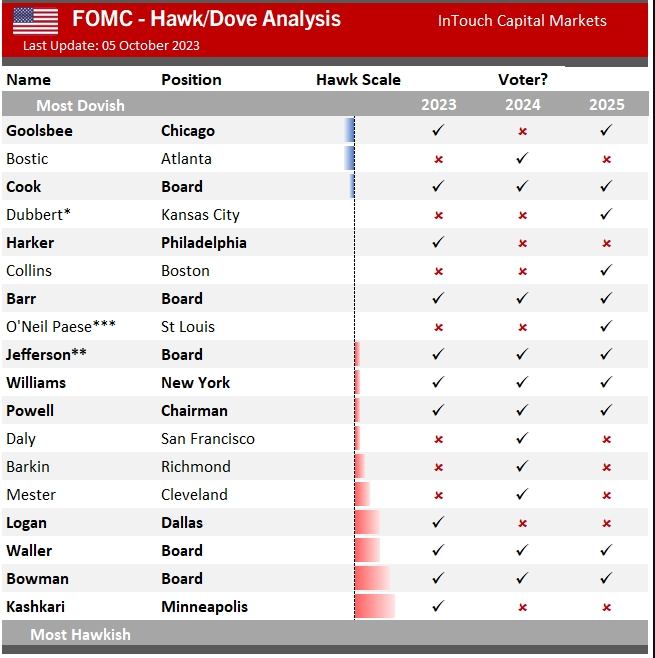

首先出场的是美联储内部鹰牌代表人物,明尼阿波利斯联邦储备银行行长卡什卡利。他在近期的发言中再次重申了坚定遏制通胀的离场,他表示,宁可过度收紧货币政策,也不愿意在采取措施将通胀降至央行2%的目标方面做得不够。他还称,过去的经验表明,美国经济具有弹性,他担心通胀会“再次上行”,而“紧缩不足”将很有可能使通胀不会再合理的时间内回到2%水平。

其次是芝加哥联邦储备银行行长古尔斯比。他在日前接受采访时表示,如果长期国债收益率保持在较高水平,那很可能相当于收紧政策,但重申“改变利率立场的首要任务是通胀的进展”。

古尔斯比的讲话主要是回应了美联储在11月议息声明中关于“美债收益率攀升带来金融环境收紧”的部分——美联储的官员们曾表示,美债收益率攀升带来的金融环境收紧,可能对经济和通胀带来影响。鲍威尔也称,金融状况的收紧,正是我们想要实现的目标。

专家认为,作为“全球资产定价之锚”,美国十年期国债收益率象征的是获取美元的成本,对其它资产具有定价属性。当国债收益率不断攀升之际,美国居民的消费成本和借贷成本也会随之一并水涨船高,这将对经济产生抑制作用,减少美联储的政策负担。根据华尔街经济学家的测算,在过去几个月间,美股大幅下跌和债券收益率上升对经济的抑制作用相当明显,程度相当于美联储加息3至4个基点。

但是,在古尔斯比的眼中,长期利率对政策收紧产生作用需要满足两个条件。一是长期利率够高,二是长期利率够长,假如这两个条件都满足,还要视通胀的情况才能判断是否需要加息——这无疑是又把问题的焦点从国债利率上转回至通胀,是鹰派的表现。

达拉斯联邦储备银行行长洛根更是直截了当地表示,美国的通胀仍然过高,数据看起来是朝着3%而非2%的方向发展。另外,美联储理事沃勒也认为,美国三季度的经济正在蓬勃发展,美联储正在密切地关注这一情况。

值得注意的是,这四人都是今年FOMC的票委,在12月利率决议中享有投票权。其中,沃勒在2024年还将继续担任FOMC的票委,说话分量很重。

对于未来黄金走势,光大期货表示,整体来看,美联储官员表态略微偏鹰,施压贵金属走势。从技术图形走势来看,黄金连短线价格继续回落整理,尚未看见明确企稳的信号,下方最近的支撑区间是1950-1970美元/盎司,需要观察金价在此区间能否维稳。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。