2023Q2美国GDP数据解读:经济软着陆概率逐步上升

投资方面为美国二季度GDP增长的最大亮点,该数据分项环比大增5.7%,对GDP的贡献达0.97个百分点。

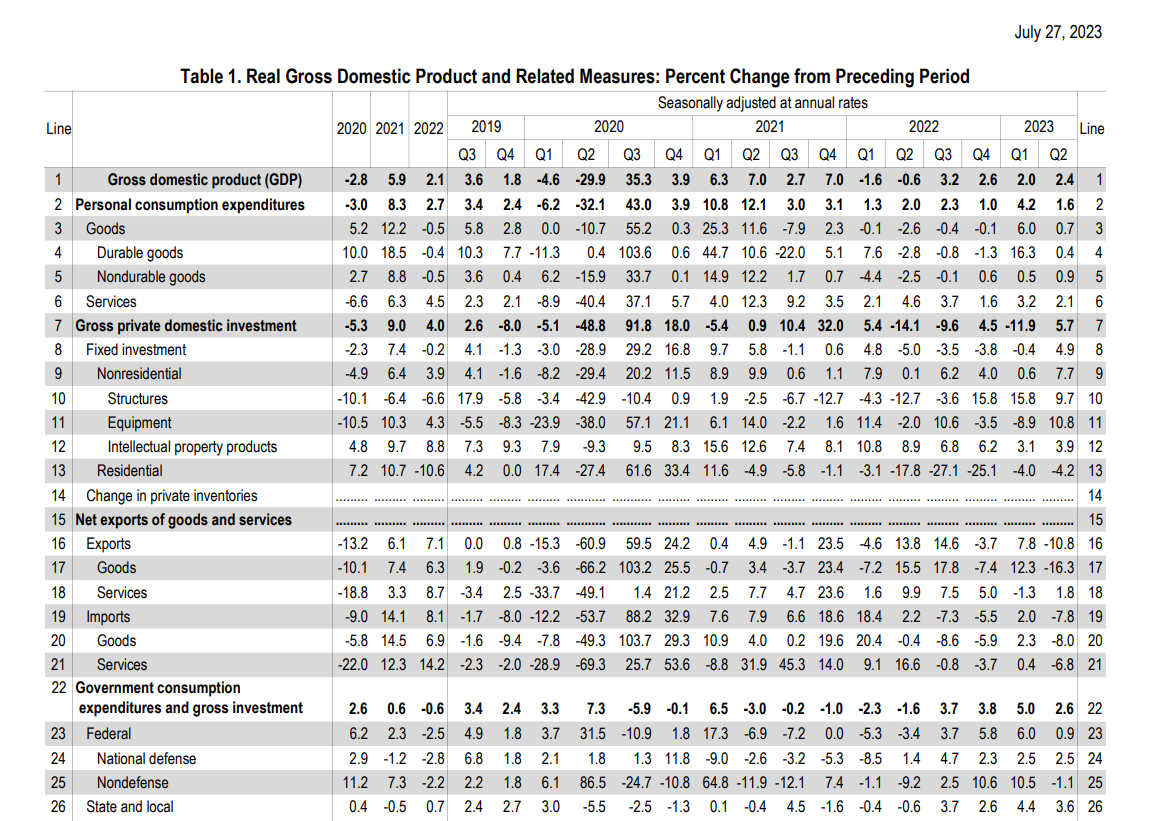

当地时间7月27日(上周四),美国商务部公布了2023年第二季度美国实际国内生产总值(GDP)的首次预估数据。数据显示,美国经济韧性仍在:二季度GDP环比折年率录得2.4%,高于前值的2%,并好于预期的1.8%,主要受进口、消费和投资拉动。

随着信息更新,美国商务部也会不断对当期的GDP数据重新进行估算。根据日程,该部门将于当地时间8月30日公布今年第二季度GDP的第二次预估数据。美国商务部表示,与今年一季度相比,二季度GDP增长加快主要反映了私营部门库存投资回升和非住宅类固定投资增加,但消费者支出减弱、出口下降和政府开支减少部分抵消了以上因素的影响。

公布数据好于预期,叠加日央行货币政策调整的预期发酵,数据公布当天,美债、美指走强,三大股指走弱: 10年期美债收益率上行13bp至3.99%,美元指数走强至101.77;标普500指数下跌0.64%,纳斯达克指数下跌0.55%,道琼斯工业指数下跌0.67%。

消费动能仍在 非住宅投资增长亮眼

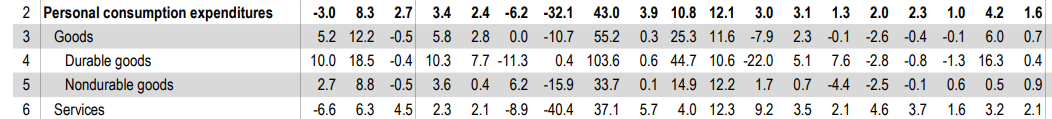

具体而言,消费方面,二季度个人消费支出环比增1.6%,超出市场预期的1.2%,对GDP的贡献达1.12个百分点。其中商品消费表现较弱,环比增0.7%,服务消费环比增2.1%,对GDP超预期上行起到推动作用。

究其原因,美国居民健康的资产负债表是消费支出的有效保证。公开数据显示,截止2023年一季度,美国居民净资产占可支配收入的比重仍有约760%,虽然较前期高点明显回落,但仍比疫情前高约58个百分点,代表美国居民资产负债表较为健康,对居民消费行为构成潜在支撑。

美国当前趋紧的劳动力市场也对名义工资和消费者信心形成较强支撑。目前,美国的职位空缺率停留在5.9%,失业率仍处于3.6%的历史低位。另外,美国通胀的持续回落也有效地推动居民可支配收入地迅速回升,对消费形成提振。根据当地时间7月29日公布数据,美国6月核心PCE物价指数同比上升4.10%,为2021年9月以来最小增幅。

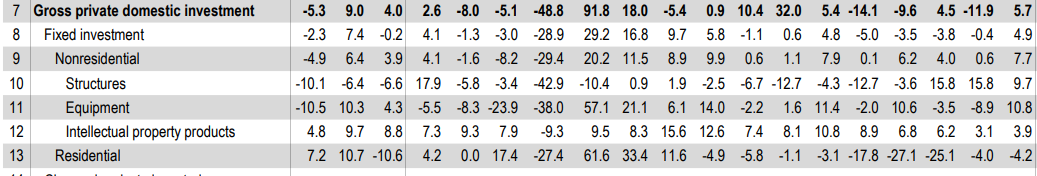

投资方面为美国二季度GDP增长的最大亮点,该数据分项环比大增5.7%,对GDP的贡献达0.97个百分点。虽然住宅投资方面环比连续第九个月回落,下滑4.2%,拖累GDP达0.16个百分点,但是其非住宅投资二季度环比增速高达7.7%,为2022年一季度以来最高水平。

据了解,非住宅投资的提高主要受益于芯片法案支持下与高科技制造相关的建筑投资的上升。据白宫数据,在拜登政府支持下,私人企业至今已宣布2310亿的半导体和电力投资、1330亿的电车和电池投资、1030亿的清洁能源投资、190亿的生物制造投资,上述投资虽然无法对应到季度层面,但不可否认的是,这些赛道类投资会在一定程度上减缓高利率下私人投资的顺周期性下行。

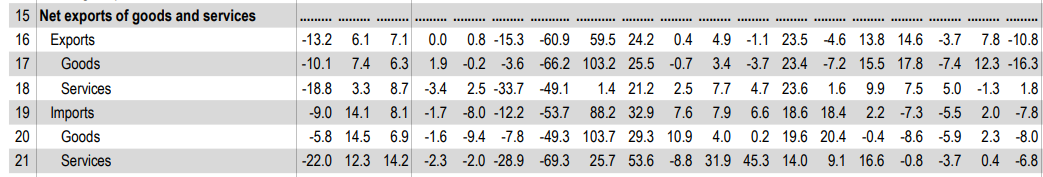

净出口方面,二季度,美国进出口数据均出现大幅回落。出口来看,美国二季度出口环比降幅为10.8%,前值为增长7.8个百分点;进口来看,美国二季度进口环比降幅为7.8%,前值为增长2个百分点,净出口整体拖累GDP增速0.1个百分点

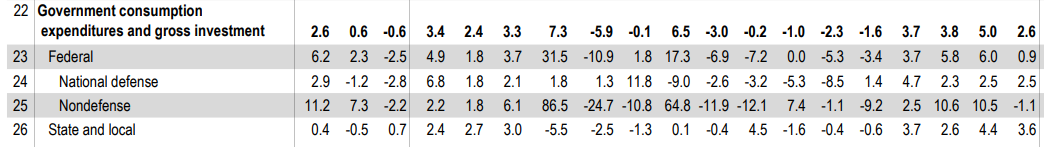

政府支出方面,该数据分项增速从5%下行至2.6%,拉动GDP增长约0.45个百分点。其中,政府消费支出增速有所下滑,从4.9%回落至1.2%;投资支出增速上行,从5.2%升至8.5%。分级别看,联邦政府支出增长0.9%,州和地方政府支出增长3.6%。州和地方政府支出增加,主要反映了州和地方政府雇员薪酬的上涨以及建筑投资的增加。

机构观点:美国经济韧性超预期 软着陆概率上升

展望未来,多家机构表示美国经济“软着陆”的可能性正逐步增强。

光大宏观表示,展望来看,消费韧性、投资回暖是决定美国下半年经济“软着陆”的核心线索。该机构称,结合近期公布的美国非农数据、零售数据,以及本次超预期的经济数据,都表明美国经济维持较强韧性。考虑到下半年美国消费缓慢退坡,回落速度有限,投资端受益于加息周期见顶,房地产出现回暖迹象,以及拜登政府通过各项法案拉动制造业回流等因素的支撑,经济趋向“软着陆”,衰退风险进一步降低。

广发宏观称,回看二季度美国经济,韧性来自于三个线索:一是低失业率对于收入和消费的支撑;二是供应链问题缓解带来的衍生投资;三是新一轮技术变革所带来的投资。往后看,就业市场松动会导致收入和消费动能放缓,供应链回补的影响脉冲可能会逐步减弱,经济仍继续存在放缓动能,但软着陆概率在上升。

国泰宏观也认为,基准情形下我们仍维持美国经济将陷入温和衰退的看法,但对下半年美国经济的看法边际上更加乐观,将温和衰退的开始时点推迟至2023年年底至2024年一季度,同时经济软着陆(不衰退)的概率在增大。该机构认为,美国经济预期边际乐观的转变主要源于两点:第一,通胀出现超预期回落;第二,经济韧性超预期。

财通证券则发表观点称,总体来看,美国经济韧性超出预期,考虑到消费回落速度或将放缓,同时投资受益于房地产和库存周期未来也出现回暖迹象,年内衰退可能性不大,我们认为美国经济软着陆有可能会实现。一方面,如果美国经济实现软着陆,消费韧性和库存周期曙光或将拉动进口,进而支持我国出口增速。另一方面,美国经济表现越强,在不出现系统性风险的情况下,美联储降息的可能性就会越小,限制性利率可能持续更久。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。