老虎证券Tiger Brokers如何买美股、兑换货币

本文整理老虎证券Tiger Brokers下单买美股、ETF的流程、挂单、设定止损和货币兑换的详细操作。投资美股,等于投资全世界最好的公司!

想要参与投资美国、香港、新加坡股票和ETF,或是期权、期货等金融衍生性产品,较为容易方便的方式是通过海外券商下单交易。这篇文章为大家整理港美股券商——老虎证券 Tiger Brokers 下单买股票、ETF 的流程、老虎证券提供哪些下单方式、货币兑换的详细操作,自己就能独立完成全部交易手续。

老虎证券是科技型证券商,在新加坡、北京、纽约等城市均设有公司,并且取得新加坡、美国、新西兰、澳洲等地的券商牌照或许可。

它的优势之一,是用户用一个账户就可玩转全球市场,投资美国、香港、新加坡、中国、澳洲等市场。美股和 ETF 是市场最低佣金之一,而且不征收其他额外费用,如托管费、出入金费用、货币兑换费、账户闲置费等等,让用户以最低廉的成本,最大化投资收益。

买卖股票前小提醒

注册和入金老虎证券账户(现金账户、保证金账户)后,登录Tiger Trade App 就可以下单交易。

在开户时可点击专属开户链接,进入官网注册户口。之后在正式操作和交易时才使用Tiger Trade App,就能随时随地看盘、追踪个股表现和下单了。

当然,如果一开始还没入金,想预先体验与熟悉 Tiger Trade 交易平台的操作方式,老虎证券提供了10万美元额度的虚拟账户,让用户进行模拟交易。

老虎证券官方交流群

欢迎加入我们的群聊!在这里,您可以第一时间获取最新的优惠活动、专业咨询和精彩活动通知。

老虎证券交易平台界面介绍

开户成功后,老虎证券将自动开通多币种证券账户,能同时持有新元、港元、新元、人民币和澳元资产。

登录 Tiger Trade App,在「交易」页面可一次浏览账户和总资产信息,包括持仓状况、持仓盈亏、风控值、现金额、最大购买力和槓桿情况。

同时也能进入查询订单状况、账户分析、换汇、闲钱管家、入金等功能窗口。

港股、美股、新加坡股等持仓账户独立显示,方便用户追踪个别市场的交易和盈亏状况。

老虎证券下单流程

老虎证券下单买卖股票和 ETF 的流程很简单:

1. 注册账户和汇款入金

2. 点选想要买卖的标的,按下交易,选择买入/做多,或卖出/做空

3. 设置下单资料(订单类型、价格、数量、有效期、盘前盘后等)

4. 确认下单信息后送出即可

接下来,我们会以多图文形式,一步步介绍老虎证券下单买股票、ETF 的流程。下单过程会以 Tiger Trade App 繁体中文为主,只要1分钟就能完成下单交易。

你可以随时切换至简体中文或英文进行操作。

方法是到 我的 > 右上角 设置 > 通用 > 语言设置 > App 展示语言 > 选择想要的语言,点击保存即可。

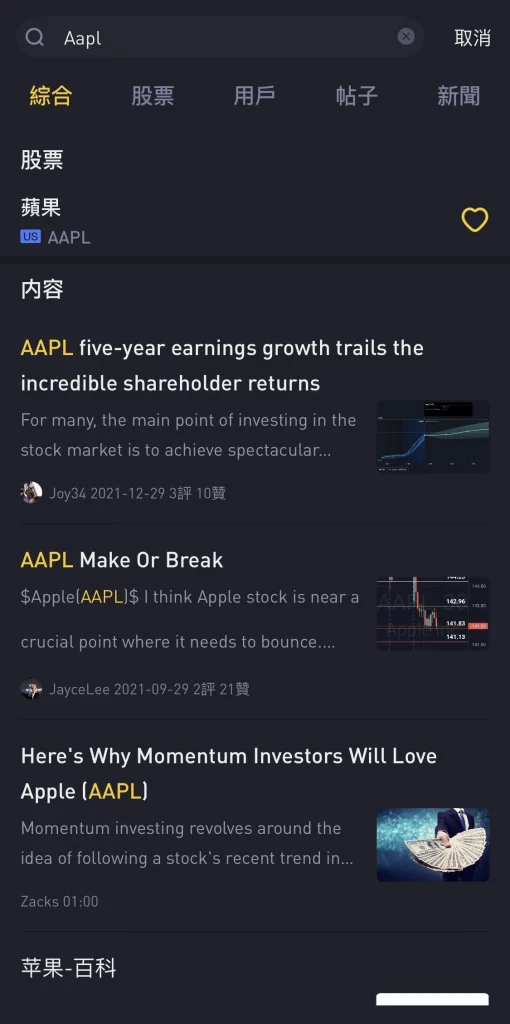

第一步:选择想要下单的标的♥

登录 Tiger Trade App 个人账户,默认主界面是用户的自选股单和最新报价。在界面右上方的搜索栏,输入股票、ETF 或其他投资产品的名称或代码。比如特斯拉股票 Tesla(代码 TSLA)、追踪纳指 NASDAQ-100 的 Invesco QQQ Trust(代码:QQQ)。

举个例子:下单苹果股票(代码 AAPL),在搜索栏输入 AAPL,会自动弹出相关投资产品、用户发布的贴文内容、公司百科等。点击苹果股票,进入标的的详细行情页面。

有想追踪观察的标的,也可以点击右边♥加入自选股单。

第二步:选择交易方向「买入」或「卖出」

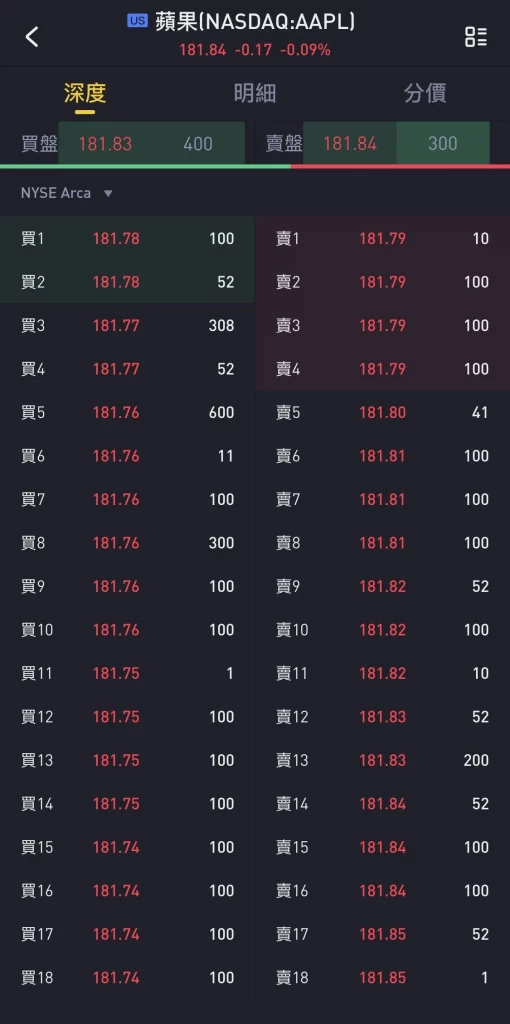

在投资标的的「行情」页面,可以查阅标的的行情内容,包括最新报价、买盘和卖盘的报价行情和下单量、股价走势、个股信息、筹码分布、资金流向分析、期权链、最新动向和新闻、用户贴文分享、做空数据分析、财报信息等。

老虎证券提供了免费美股 Level 2实时行情,可以看到美国第二大电子股票交易所 NYSE ArcaBook 最多40档买盘和卖盘的报价行情,以及不同成交价的成交量,以便更精准出价。

在页面下方的工具栏,点击「交易」,并选择交易方向:买入/做多,或卖出/做空。想要平仓或交易期权,也可在这里选择。

提醒大家,在没有持有标的资产的情况下,选择卖出代表融券交易,也就是做空股票,先和老虎证券借股票交易,合约到期后再买回股票,还给老虎,从高卖低买中赚取差价。

第三步:设置下单资料(订单类型、价格、数量、有效期、盘前盘后)

在设置下单资料前,和大家介绍交易订单的设置,包括订单类型、价格、数量、有效期、盘前盘后。

设置好订单类型、价格、数量、有效期,和是否允许盘前盘后交易后,点击「买入下单」或「卖出下单」。

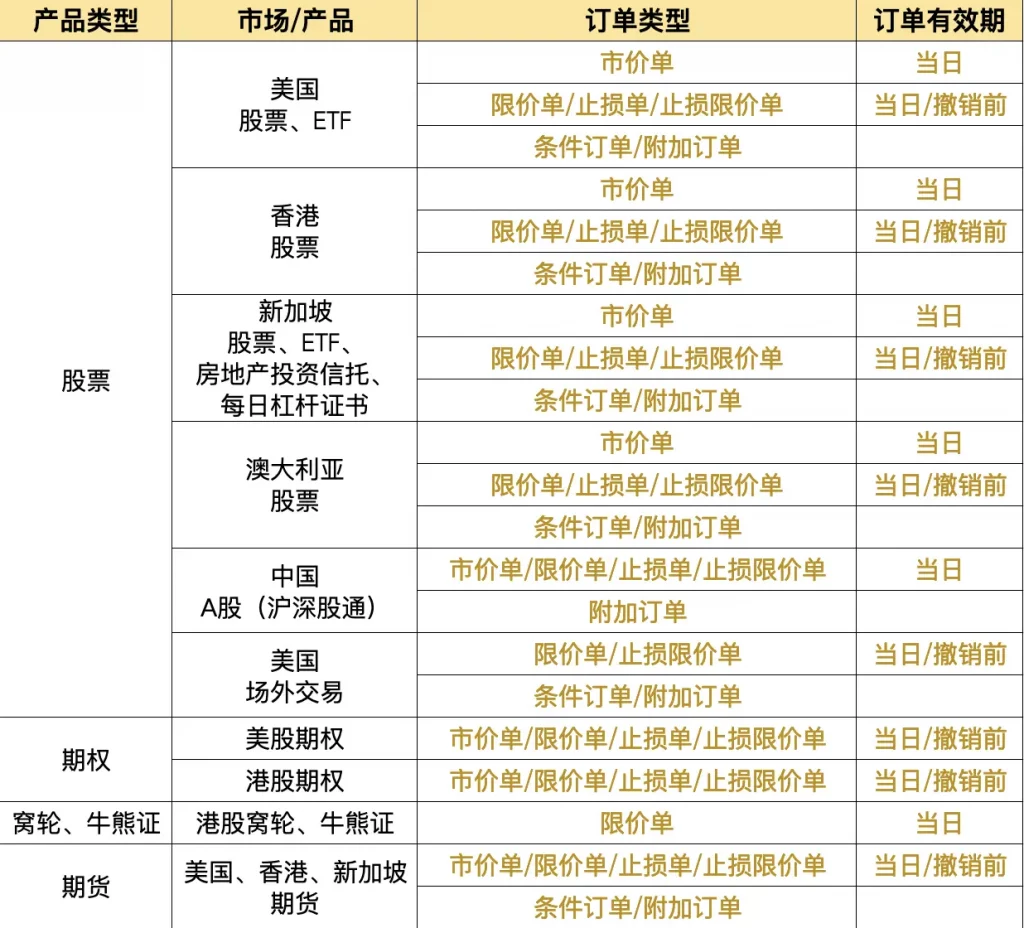

订单类型

老虎证券提供6种订单,包括限价单、市价单、止损单、止损限价单、条件订单、附加订单。下个章节会详细说明这6种订单的区别。

价格

想要以什么价格买进或卖出标的,假如选择非市价单的订单类型,如限价单、止损单,必须设定限价(或触发价)。

数量

买进或卖出的单位数量,美股最小单位是1,港股最小单位则不一定(有100股、400股不等,视不同标的而定)。

系统会根据账户持有的现金和可使用的融资额度(margin),建议这次交易可操作的数量。假如使用融资交易,系统会提醒本次交易将产生多少金额的借款。融资交易需要支付利息,一般不超过0.018%。

有效期

在挂单时(非市价单),可以选择订单的有效期,包括当日有效、撤单前有效。

盘前盘后

美国市场有一项盘前、盘后交易机制,让投资者在普通交易时段外也能交易。

第四步:确认下单信息,开立交易

检查订单明细,确认所有信息后,点击「确认」即可完成下单。

老虎证券订单类型

老虎证券支持6种订单类型,下面逐一整理说明不同订单的区别。

——资料来源:老虎证券官网

限价单 Limit Order

限价单(Limit Order)是以特定的价格下单买卖。订单只在两种情况下执行与成交:

达到指定价格时,或达到更好的价格时(比指定的买入价更低,或者比指定的卖出价更高时)

优势:可以锁定呈交价格范围,甚至以更好的价格成交,也就是以更低的价格买入,或者以更高价格卖出。

注意事项:如果价格一直没有达到指定价格,订单就不会被执行。因此这张订单有可能会无法成交,而错过投资的行情。

市价单 Market Order

市价单(Market Order)是以当前的市场价格下单买卖,不需要自己设定价格,决定要成交的数量即可。

优势:能以最快的速度成交订单,达到把握行情机会、止损或止盈的目的。

注意事项:市价单只有在股市开盘时才能下单。而且市价单可以保证成交,但不保证成交价格。简单来说,成交的价格跟着市场浮动,可能会以更高或更低价格执行。

止损单 Stop Order

止损单(Stop Order)是指在订单中设置一个指定的止损触发价格(Stop Price),当股价达到触发价格时,系统自动提交一份买入或卖出的市价单。

优势:提前设定止损的目标价,能够控制亏损程度,保护本金。

注意事项:设置止损单,不能保证100%下单和成交成功,会受到购买力不足、持仓不足等因素影响,导致触发下单失败。而且也不保证系统的下单,一定能在当天成交,因为和普通订单一样,视乎市场的买卖盘。假如在当天没有成交,就会撤销订单。

止损限价单 Stop Limit Order

止损限价单(Stop Limit Order)是指在订单中设置一个指定的止损触发价格(Stop Price)和限价(Limit Price),当股价达到触发价格时,系统自动提交一份买入或卖出的限价单。

止损限价单和止损单最大的区别是多了「限价」的部分。止损单会以市价单的方式,让订单尽可能快速成交,但不保证成交价格;

而止损限价单则会以限价单这种挂单方式,来保证成交价格,但不保证订单一定会成交。

优势:以限价单的方式下单,可以避免成交价格和预期的价格有太大落差。

注意事项:下单买入时,限价(Limit Price)要大于触发价格(Stop Price);卖出时,触发价格(Stop Price)要小于限价(Limit Price),以避免价格快速下滑导致损失扩大。

举个例子,以100美元买进A公司股票,希望将最大损失控制在10%,可以下一个卖出的止损限价单,触发价格(Stop Price)是91美元,限价(Limit Price)是90美元。

当股价下跌到91美元,系统就会自动提交一个卖出订单,限价90美元(在90美元卖掉A公司股票)。当股价下跌到90美元,这笔卖出订单就有机会成交。

条件订单 Conditional Order

条件订单(Conditional Order)需要同时满足几个触发条件,比如股价涨跌趋势、触发价格(Stop Price)、限价(Limit Price)等,系统将会自动提交一份买入或卖出的限价单或市价单。

用户可随时修改和撤销订单。假如触发条件还没有被满足,也可以修改触发条件。

简单来说,条件单是灵活度更高的限价单,而且能够指定股价「涨至」或「跌至」的趋势来提交限价单。

优势:适合在行情稳定时操作,想要设定交易的止盈和止损点,都能运用条件订单操作。

注意事项:条件订单只会在盘中触发,盘前盘后的股价波动不影响触发条件。

附加订单 Additional Order

附加订单(Additional Order)是在主订单之外,再加一个子订单,可以是限价单(止盈用途)、止损单(止损限价单/止损单,止损用途),达到帮主订单止盈或止损的效果。

优势:起到止盈和止损的操作

注意事项:目前附加订单不支持盘前盘后交易时段成交,主订单只能附加一个子订单,当主订单被撤销,关联的子订单也会被撤销。当然,也可以只撤销子订单。

老虎证券订单有效期限

和大部分券商一样,老虎证券提供2种订单有效期(Time in force),分别是当日有效、撤销前有效。

当日有效 Valid For The Day

当日有效订单(Day)只在下单当天的股市交易时段内有效,未成交的订单会在当天收盘后,被系统自动撤销。

撤单前有效 Good Till Canceled

撤单前有效订单(Good Till Canceled, GTC)会一直保持有效,直到订单成交,或者被手动撤销。

老虎证券支持盘前盘后交易

盘前盘后是美股的特殊交易机制,而老虎证券支持盘前盘后交易,让投资者在普通交易时段外也能交易。

交易时段如下:

盘前交易

◇ 美东时间 4:00~9:30

◇ 夏令时马来西亚时间 16:00~21:30

◇ 冬令时马来西亚时间 17:00~22:30

盘后交易

◇ 美东时间 16:00~20:00

◇ 夏令时马来西亚时间 4:00~8:00

◇ 冬令时马来西亚时间 5:00~9:00

户口持有不同的货币,如何交易不同海外市场?

前面说过,用户可在老虎证券持有多国货币,如美元、港元、新元、人民币和澳元资产。

在下单时,证券账户必须持有相应的货币资产,比如交易美股,必须持有美元;交易新加坡股市,必须持有新元。

假如户口不持有该货币资产,想投资其他市场,有两种方式:

◇ 使用内建的货币兑换功能

◇ 先使用融资交易,再换汇把借款还给老虎证券

使用内建的货币兑换功能

举个例子,户口入金新元,想投资美股,可以使用老虎证券内建的货币兑换功能,将新元转汇至美元即可。

方法是到「交易」,在中间的功能栏目,选择「换汇」,设定要转汇的货币与金额即可。

系统会显示当前汇率为多少,最大可兑换的现金是多少。一般兑换的所需时间是 T+2,约需要2至3个工作天处理。

换汇完成后,老虎证券会通过 App 推送和电邮通知。

换汇时需注意:

◇ 只能以现金资产进行货币兑换,可兑换的最高限额以户口持有多少现金为准。

◇ 老虎证券支持的货币兑换的币种包括:新元、美元、港元、人民币、澳元、纽元、欧元、英镑、日圆。

◇ 货币兑换的汇率是实时变动的,以实际的成交汇率为准。

◇ 货币兑换时间:交易日 06:20 至第二天 04:55(新加坡时间)。注意,由于系统结算需要,12:00 至 13:00 之间不支持货币兑换。

◇ 老虎证券不收取货币兑换手续费。

使用融资交易

因为换汇需要 T+2 处理,假如不想错过投资的机会,也可先使用融资交易(margin),再换汇把借款还给老虎证券。

举个例子,户口有1万新元现金,还没有换汇到美元,可以先用这1万新元现金,以融资交易的方式买美股,之后再把新元现金转汇到美元,还给老虎证券即可。

在下单时,假如户口不持有现金,就会自动以融资方式成交。而这笔借款会产生利息,每天利息一般不超过0.018%。

总结

以上就是老虎证券下单买卖股票,以及货币兑换的流程。在交易时,可使用现金或融资交易。务必注意融资交易会产生每日利息,也有杠杆的风险,投资前要小心。

有任何问题,欢迎留言与我们交流。

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。