How to verify an IC Markets account

Secure trading and full access to IC Markets services by verifying your account。

Secure transactions and gain full accessPermission to the IC Markets service requires verification of your account。Here are the steps you need to complete。

IC Markets is one of the most popular brokers founded in 2007。The Australia-based company is known for supporting a wide range of tradable assets such as forex, precious metals and CFDs, and is suitable for traders with different strategies such as scalping, day trading and more.。IC Markets has lower commissions and spreads than other brokers。In addition to operating in Australia, the company is also popular in Asia, Europe and North America。

In terms of security,IC Markets is considered safe because it is regulated by several financial institutions including the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).。As a regulated broker, IC Markets is subject to a number of policies, including customer authentication to prevent fraud and fraud.。

IC MarketsCustomer Validation for

As a financial services provider,IC Markets aims to create a secure trading environment for all customers。To do this, brokers need to first understand who they are dealing with。This is why customer authentication is required。

Basically, when you create an account, the broker will ask you for certain information related to your identity。You need to upload certain files to prove that you are a real person and not a liar。The broker will then evaluate these files to verify your account。Once the verification process is complete, you can start trading on your account and enjoy the full services of the broker。

IC Markets is an online forex broker for International Capital Markets Pty Ltd。Traders subject to Australian law are traded by IC Markets AU, based in Australia and approved by the Australian Securities and Investments Commission (ASIC).。

On the other hand, non-Australian traders who have opened accounts with the broker are registered at the Seychelles-basedIC Markets SEY and regulated by the Seychelles Financial Services Authority (SFSA)。This dual operation is the result of ASIC's relatively new rules, which prohibit their regulated brokers from offering trading services outside Australia.。

IC Markets is classified as an ECN broker offering clients trading platform options such as MetaTrader 4, MetaTrader 5 and cTrader。The broker has also followed market trends with cryptocurrencies as one of its products, enriching its already wide selection of trading assets, including currencies, indices, precious metals, energy, soft commodities, stocks and bonds.。

with other australiaCompared to ASIC-regulated brokers, IC Markets has a minimum deposit in the middle range of $200 per client.。The broker also regularly prepares market analysis materials to provide important content tailored by market experts for their traders, demonstrating their ability to serve traders.。

in terms of payment methods,IC Markets allows recharges and withdrawals via wire transfers, credit cards, PayPal, Skrill, Neteller, FasaPay, UnionPay, and BitPay's Bitcoin。The more interesting aspect of this broker is its multiple base currencies, includingUS Dollar, Australian Dollar, Euro, British Pound Sterling, Singapore Dollar, New Zealand Dollar, Japanese Yen, Swiss Franc, Hong Kong Dollar and Canadian Dollar。

因为IC Markets' trading technology is equipped with co-located servers and extremely low latency (especially on cTrader). This broker is widely known for its ability to meet the special needs of high-frequency trading and scalping trading。

Anyway,IC Markets are ideal for finding well regulated active traders。IC Markets also has flexibility in terms of base currency and payment methods, indicating that they welcome traders from outside their home countries.。As of the end of 2019, the official website of IC Markets is available in 18 international languages, including English, Korean, Indonesian, French, Spanish, Italian, Malay, German and Chinese.。

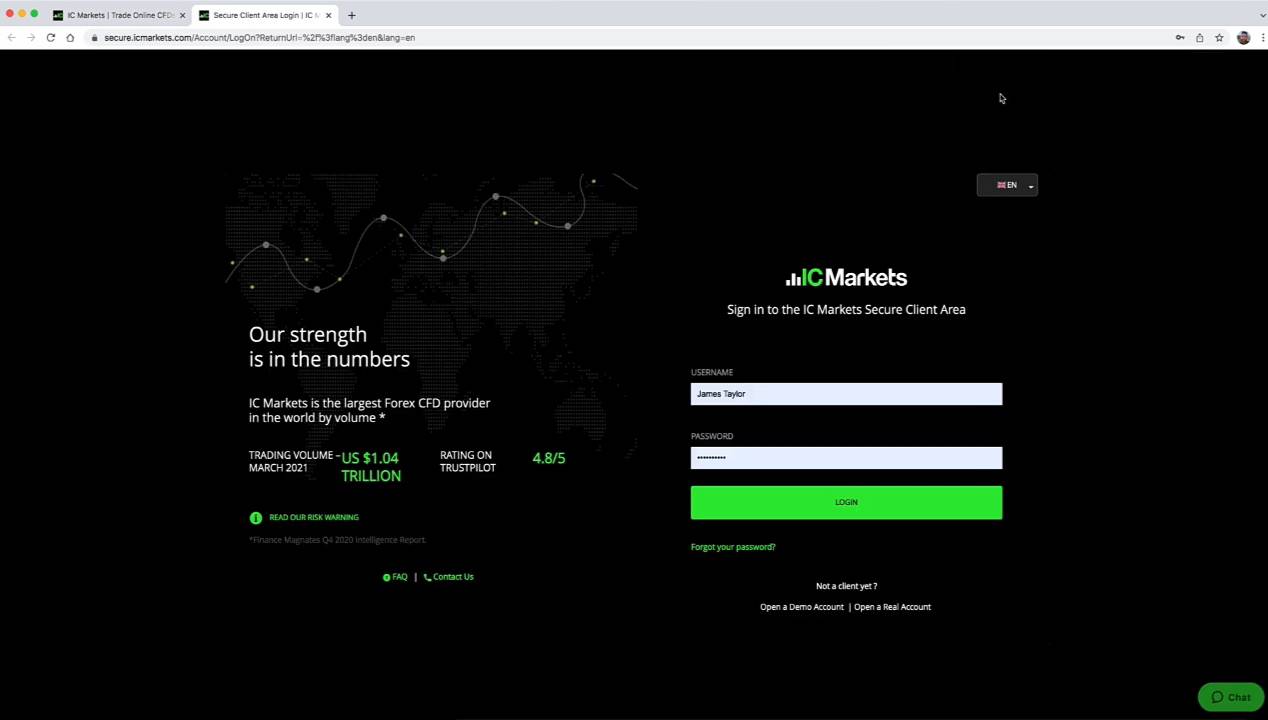

How to verify yourIC MarketsAccount

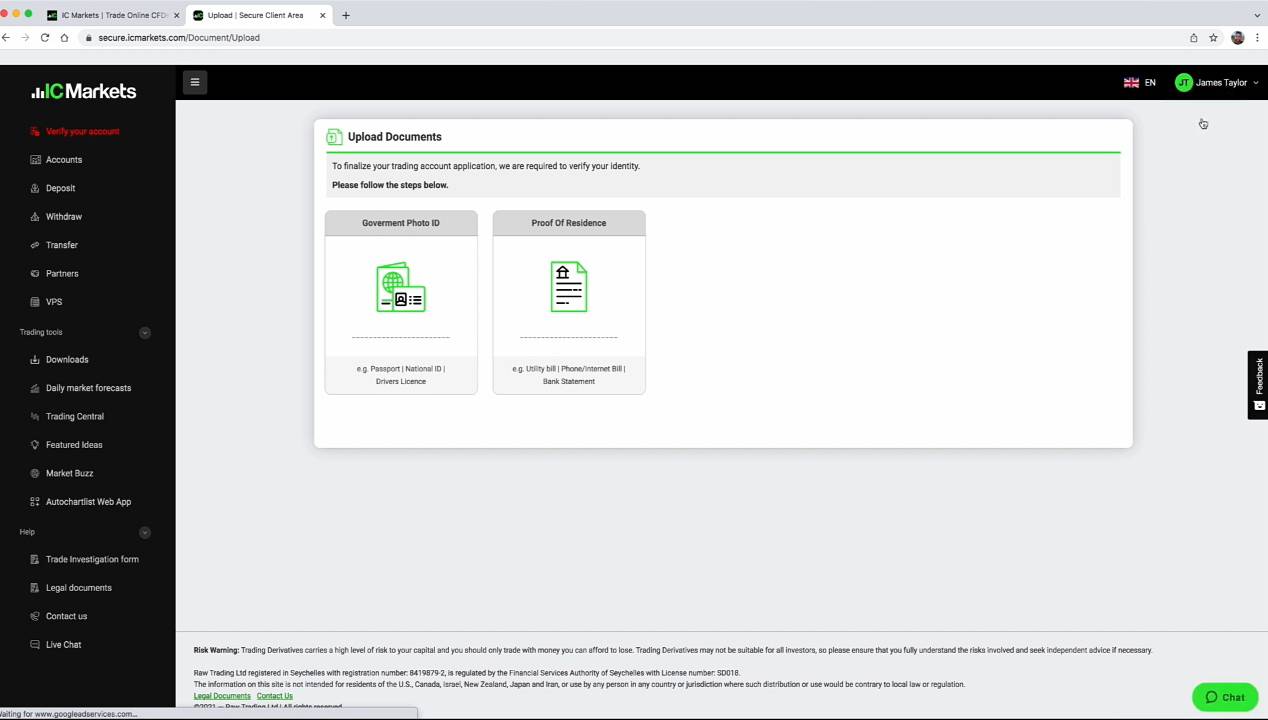

Customer authentication process may vary from broker to broker。Some may take days to complete and involve multiple approval steps。Fortunately,Authentication for IC Markets is simple。You only need to upload two types of documents, namely government photo identity documents (national identity card, international passport or driver's license) and proof of residence (utility bill or bank statement)。The broker will then process these files and notify you within 24 hours。

IC MarketsAccountVerifyThe steps of:

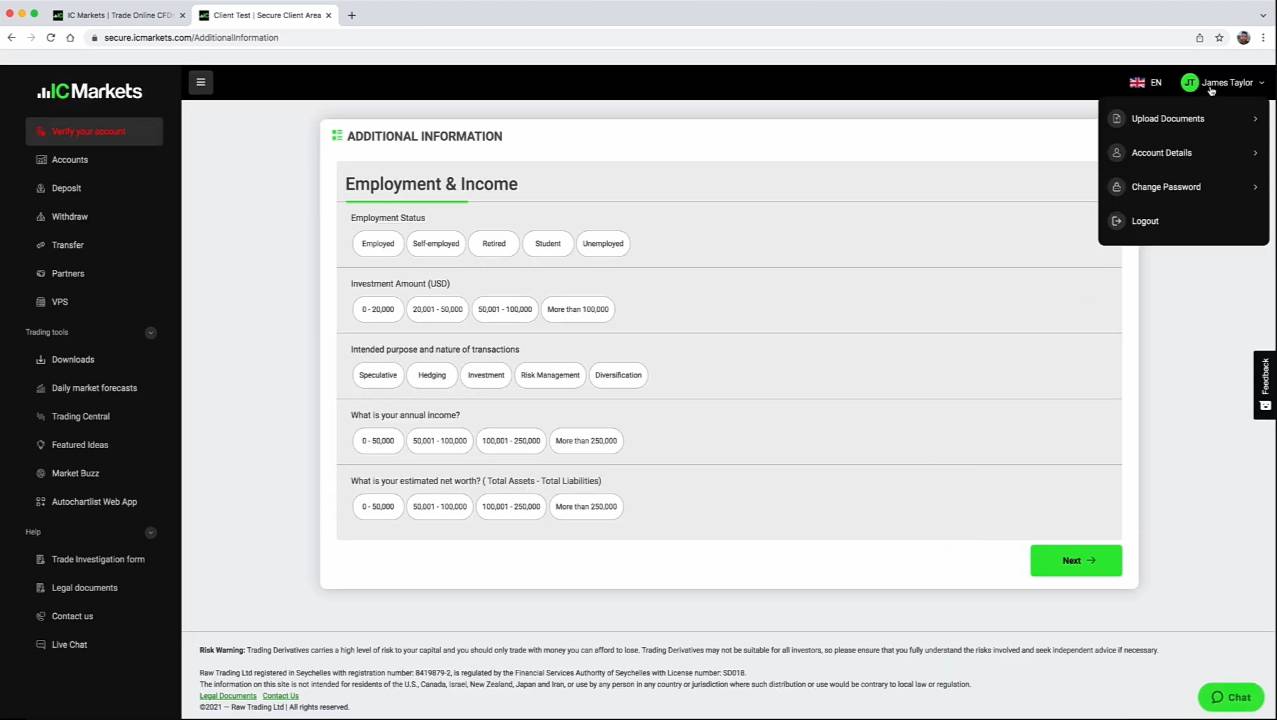

2.Tap your profile at the top right of the screen, then tap "Upload File" in the drop-down menu。Then you will be taken to the upload page。

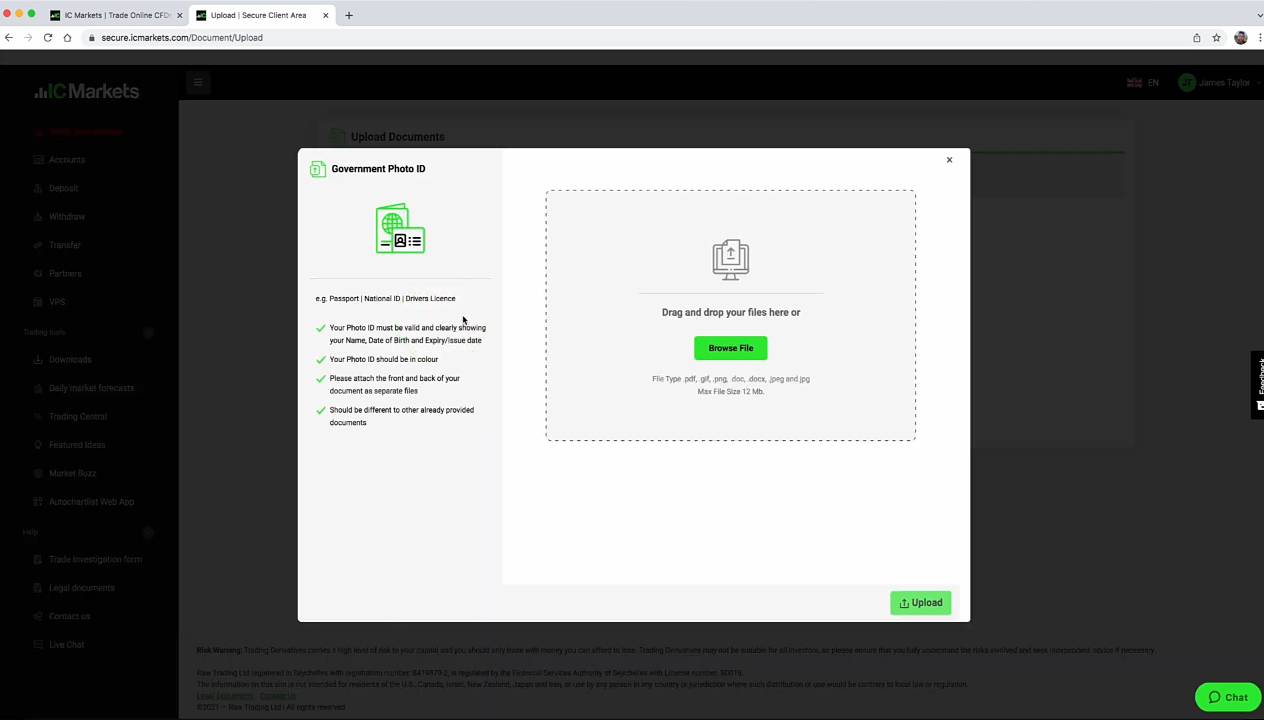

3.Click "Government Photo ID" to upload your identification document, which can be your national ID card, international passport photo or driver's license。

4.Click "Browse Files" to find a copy of the file in your device and click "Upload"。Make sure to read the requirements on the left side of the screen。

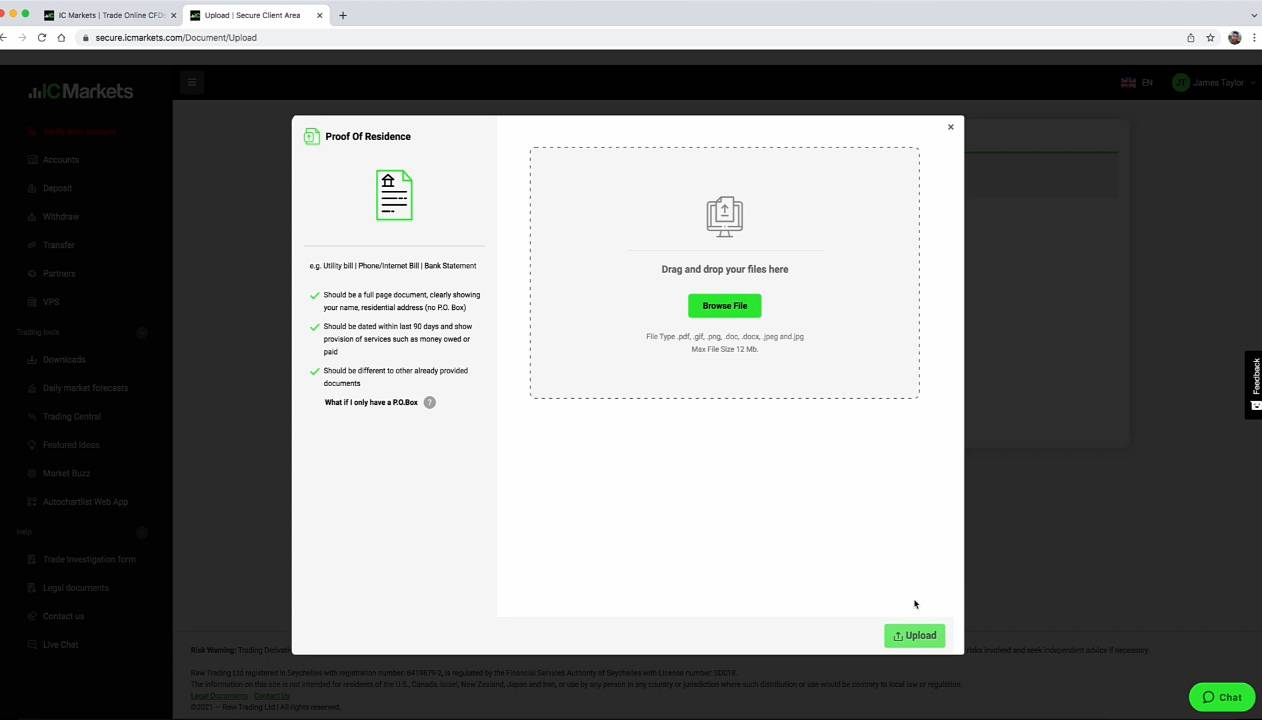

5.Then you need to upload proof of residence。You can use utility bills or bank statements to complete the formalities。Please make sure your full name and address are on the file and the date is within the last 3 months。

Similar to the previous step, click"Browse files" Find a copy of the file in your device and click "Upload"。

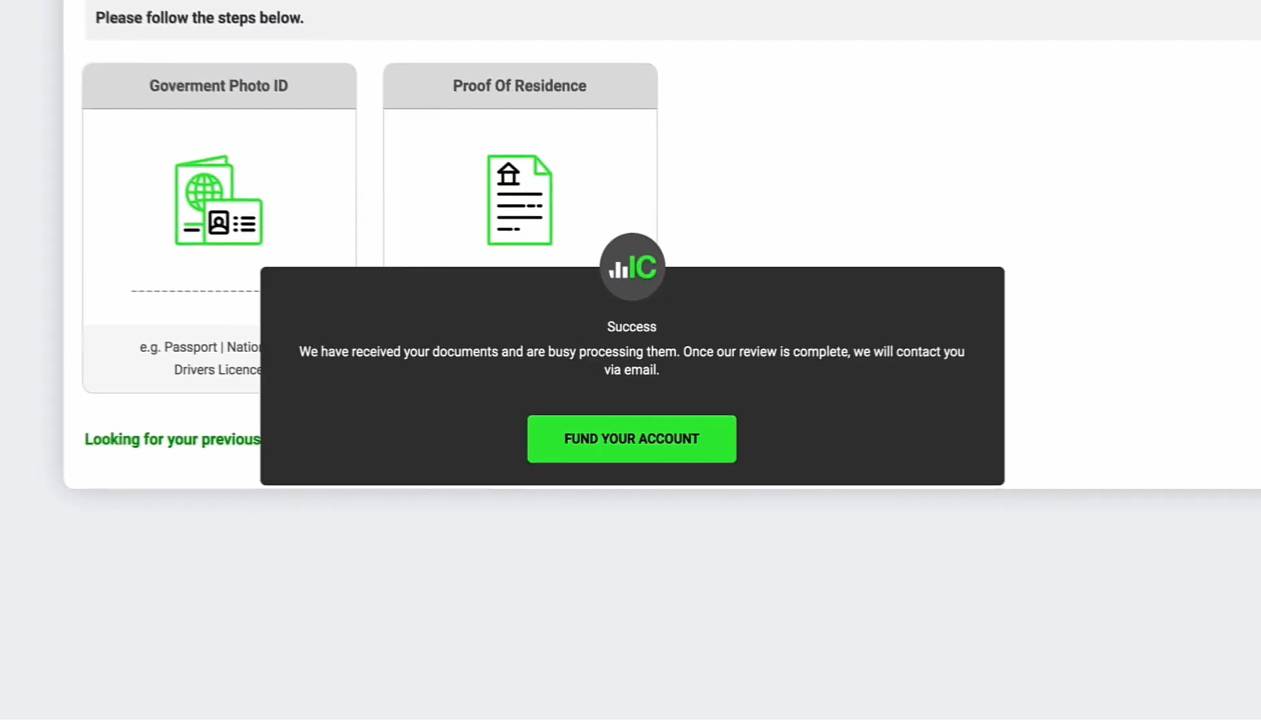

The authentication process for IC Markets typically takes about 1 business day。Once your account is ready, you will be notified via email。

Authentication is essential to ensure the security of brokers and clients。Due to the increased risk of fraud and money laundering cases, brokers need to implement such procedures to understand who they are dealing with and ensure that other clients are fully protected。However, the process is not always simple。In some online brokers, it may even take several days due to inefficiency。This will not only cause unnecessary trouble, but also bring relatively poor experience to new customers。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.