ECB's July interest rate resolution: subtle shift in wording as rate hikes come to an end?

The weak shift in wording has caused infinite reverie in the market, with some arguing that the wording suggests that the ECB may have ended its rate hike cycle。

On July 27, local time, in almost no suspense, the European Central Bank held a July monetary policy meeting, the euro zone's three key interest rates are raised by 25 basis points, since August 2, the main refinancing rate, marginal lending rate and deposit mechanism rate were raised to 4..25%, 4.50% and 3.75%。Since the start of the rate hike process in July last year, the bank has raised interest rates nine times in a row, totaling 425 basis points.。

'Subtle changes' in ECB wording amid high interest rates

Unlike the United States, the ongoing process of raising interest rates in the eurozone has been a serious drag on the region's economy.。Last month, the euro zone's 20-nation economic growth rate for the fourth quarter of 2022 had been revised down from zero to -0.1%, the first quarter of this year's growth data also from 0.1% down to -0.1%。While the eurozone economy grew slightly in the first quarter, sharp changes in German and Irish data sent the eurozone economy into contraction, according to Eurostat estimates.。

According to a survey this week, corporate demand for loans in the euro zone saw its biggest drop on record in the second quarter, with demand for housing loans, consumer loans and household loans in the region falling across the board, driven by persistently high interest rates。In addition, according to the euro zone business activity data released earlier this week, the euro zone's two largest economies, Germany and France, their economic data also showed varying degrees of decline。According to previous OECD statements, economic growth in the euro area is expected to stay at zero this year..9%, about half the growth rate of the U.S. economy。

Worryingly, despite the economic malaise, inflation in the eurozone remains high。According to preliminary statistics released by Eurostat on June 30, the euro zone inflation rate in June was still as high as 5.5%。Although the data is lower than the 6 in May.1%, but still far from the ECB's 2% inflation target。On a country-by-country basis, inflation rates in Germany, France, Italy and Spain, the major EU economies, were 6.8%, 5.3%, 6.7% and 1.6%, the ECB's inflation governance task remains daunting。

In its statement on interest rate decisions, the ECB reaffirmed its determination to combat inflation。The bank said future decisions by the Governing Council would ensure that the ECB's key interest rate remains at a level tight enough, if necessary, to achieve a timely return of inflation to its medium-term target of 2 per cent.。The Board will continue to use the data-dependent approach to determine the appropriate level and duration of restrictions。In particular, interest rate decisions will continue to be based on its assessment of the inflation outlook based on upcoming economic and financial data, underlying inflation dynamics, and the strength of monetary policy transmission.。

It is worth noting that in this statement, the ECB's wording has undergone some subtle changes.。In its resolution last month, the bank said: "Future decisions by the Governing Council will ensure that the ECB's key interest rates will rise to levels that are sufficiently restrictive to achieve a timely return of inflation to the medium-term target of 2 per cent and will remain at these levels for as long as necessary."。But this time the bank changed to: future decisions by the Governing Council will ensure that interest rates are set at a level that is sufficiently stringent, as long as necessary, to achieve a timely return to the medium-term target of 2 per cent inflation.。

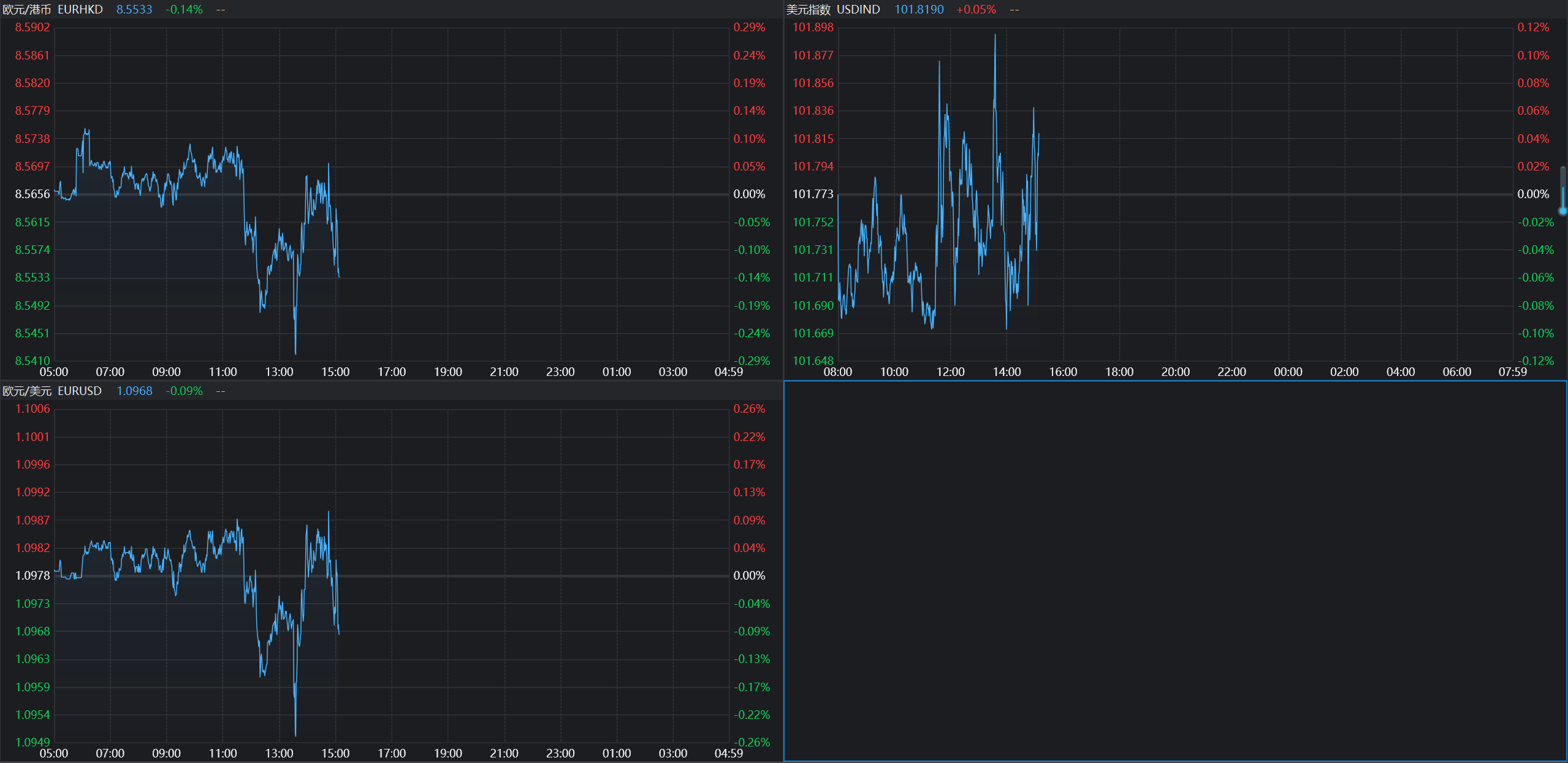

The weak shift in wording has caused infinite reverie in the market, with some arguing that the wording suggests that the ECB may have ended its rate hike cycle。After the announcement of the resolution, the short-term decline of the euro against the dollar widened to 1..1098。

Lagarde: There is a possibility of a pause in interest rate hikes

At a press conference following the announcement of the interest rate decision, ECB President Christine Lagarde attended and responded to concerns.。

Regarding the inflation situation in the euro area, Lagarde said that euro area inflation is expected to fall further this year, but may exceed the medium-term target of 2% for a longer period of time.。She went on to say that the ECB would use the inflation data as a basis to bring the key eurozone interest rate to a sufficiently high and restrictive level and maintain it at that level if necessary, prompting inflation to fall back.。

Lagarde also stressed that while some indicators are moving lower, overall underlying inflation remains high due to, among other things, the ongoing impact of previous energy price increases on overall economic prices.。

Regarding the economic deterioration trend in the euro area, Lagarde believes that the recent weakness in demand in the region is an important factor.。She said high inflation and tighter financing conditions were dampening spending, which was particularly weighing on manufacturing, which was also affected by weak external demand.。Housing and business investment are also showing signs of weakness, with the economy expected to remain weak in the near term.。

Nevertheless, Lagarde said that "the pace of interest rate hikes will not stop," she believes that there is a possibility of a pause in interest rate hikes, but "the pause cycle will not be too long."。

As of press time, the euro was down 0 against the Hong Kong dollar on the day..14% at 8.5533; EUR / USD down 0 on day.09%, reported 1.0968; the dollar index rose 0.05%, reported 101.8190。

For the future trend of the euro, Dahua said, 24 hours, yesterday we did not expect the euro volatility soared。Up to 1.After 1143 high, Europe and the United States fell to 1.0964。Not surprisingly, the crash made it oversold.。However, the decline in Europe and the United States has not yet stabilized.。Europe and the United States may fall below important support level 1 today..0965, but may not be able to maintain under it, it is unlikely to touch the next support 1.0920。Resistance at 1.1010, then 1.1035。

The next 1-3 weeks, although Europe and the United States may fall below 1.1010, but currently falls to the next important support level 1.The possibility of 0965 is not high。Europe and the US broke our 'strong resistance' level yesterday 1.1135 (up to 1.1143) after falling to 1.Low of 0965。Since then, Europe and the United States may be further lower。As long as the next few days remain at 1.Below 1070, Europe and the United States still face a significant drop below 1.The risk of 0965。Looking ahead, Europe and the United States in 1.Attention 1 below 0965.0920 and 1.0865 points。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.