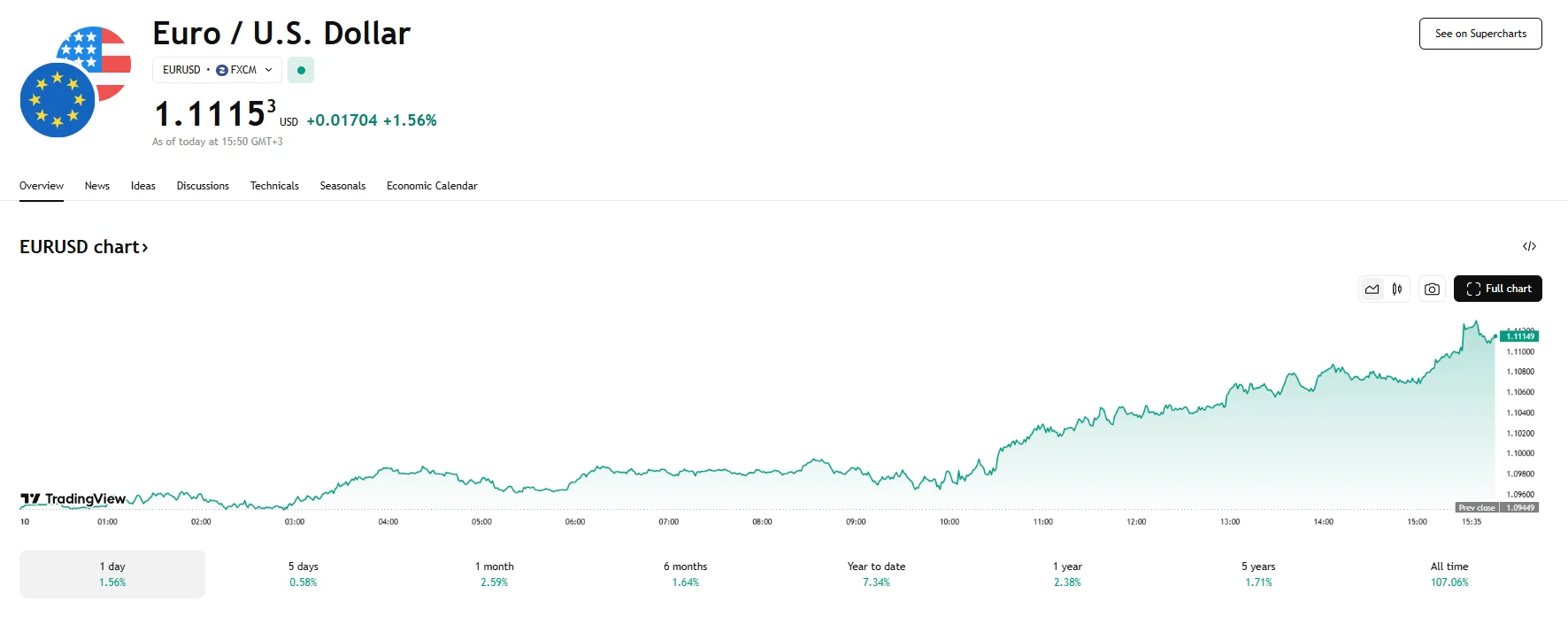

US March CPI Up 2.4%, Dollar Index Drops Over 1.20% as EUR/USD Hits 1.1115 US March CPI Up 2.4%, Dollar Index Drops Over 1.20% as EUR/USD Hits 1.1115

Key momentsEUR/USD climbed 1.56% to 1.1115 on Thursday.According to a report published by the Bureau of Labor Statistics, the US CPI rose 2.4% in March, short of analyst expectations.The US Dollar Ind

Key moments

- EUR/USD climbed 1.56% to 1.1115 on Thursday.

- According to a report published by the Bureau of Labor Statistics, the US CPI rose 2.4% in March, short of analyst expectations.

- The US Dollar Index dropped 1.24%, continuing to trade below 200.

Tariff Woes Weigh on US Dollar, EUR/USD Stays Above 1.1000

The EUR/USD currency pair continued its upward trajectory on Thursday, achieving a notable surge of 1.56% to reach 1.1115. This sustained climb occurred as the US Dollar Index weakened by 1.24%, falling to a level of 191.626.

The trajectory of the US Dollar has been notably influenced by the shifting landscape of international trade. On Wednesday, US President Trump announced a temporary halt of the majority of tariffs exceeding the 10% baseline duty. However, this pause notably excluded China. In fact, the US administration further escalated trade friction with Beijing by increasing the tariff rate on Chinese goods to 124%. This continuation and intensification of trade disputes with China served as a persistent headwind for the US Dollar.

Adding another layer of complexity to the dollar’s performance is today’s release of the March US Consumer Price Index (CPI) data. The figures revealed that the headline CPI increased by 2.4% year-over-year. The YoY core CPI, which excludes the often-volatile food and energy sectors, registered a rise of 2.8%. Crucially, both of these inflation metrics fell short of analysts’ projections, particularly those polled by news agency Reuters, who cited a jump of 2.6%.

The fact that price increases were more moderate than anticipated can exert downward pressure on the US Dollar. Essentially, lower-than-expected inflation can temper expectations for aggressive monetary policy tightening by the Federal Reserve, which in turn can diminish the attractiveness of the dollar to international investors.

The EUR/USD’s climb serves as a showcase of the sensitivity of currency markets to both geopolitical developments, such as tariff announcements and fundamental economic data, particularly inflation. The dollar’s struggle, despite the partial rollback of tariffs, highlights the continued impact of the unresolved trade conflict between the US and China. The market will continue to closely monitor trade developments and key economic indicators for further signals regarding the future direction of these major currencies.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.