The minutes of the ECB's June monetary policy meeting announced that the divergence between European and American currency pairs has intensified.

Markets are beginning to put pressure on dollar bulls due to recent weak data, which could lead to increased divergence between European and American currencies。

On July 13, local time, the European Central Bank released the minutes of its June monetary policy meeting.。At present, the market has little objection to the bank's interest rate hike at its July 27 policy meeting, focusing instead on its monetary policy actions in September.。

ECB: not ruling out more measures

On the overall economic front, according to the minutes, the global economy is gradually on track as risk events are gradually brought under control。As economic tail risks recede and global market conditions normalize further, financial market volatility has declined significantly and systemic risks are now contained, the minutes said.。

In terms of risk events, for the banking crisis, the minutes highlight that the eurozone banking sector weathered the March turmoil relatively well。At the same time, financing conditions for banks have tightened and the cost of credit for businesses and households has become increasingly high.。Overall, financing conditions have tightened since the May monetary policy meeting, with past rate hikes strongly channelled into the financial and financing sectors.。

For the energy crisis, the minutes point out that the European economy is gradually coming out of the mire as the energy crisis subsides, but given external pressures such as the Russian-Ukrainian conflict and continued tight monetary policy, the European economic outlook remains highly uncertain, with manufacturing activity very weak and likely to spread to the services sector in the coming months.。

For the Russia-Ukraine conflict, according to the minutes, members still believe that the risk event will pose a significant upside risk to the inflation outlook as it could push up energy and food costs again.。In addition, members were concerned that long-term wage pressures would lead to more persistent domestic price pressures, especially as economic growth weakened and firms continued to maintain pricing power, with rising unit labour costs.。

Data show that in the first quarter of 2023, real wages rose by an average of 5.2%, but agreement wages rose by only 4.3%, representing the labor market heat。Accordingly, members agreed that wage pressures have become an increasingly important source of inflation。

On monetary policy, members argued that the inflation view was not yet clear and did not rule out the possibility of more measures.。According to the minutes of the meeting, apart from energy, the momentum of price increases remains strong.。In addition, core inflation is very stubborn and continues to be higher than expected, indicating greater persistence.。

Based on the above background, members agreed that further interest rate increases were necessary to tighten monetary policy, but members considered the magnitude of the rate hike at that meeting, the minutes noted.。

It is understood that the members were originally concerned that high inflation was too persistent and becoming sticky, initially inclined to raise interest rates by 50 basis points, but as past interest rate hikes are being favorably transmitted to the financial environment and have an impact on the economy as a whole, the members finally agreed to raise interest rates by 25 basis points.。

Continued weak data market pressure dollar bulls U.S. index breaks 100 mark

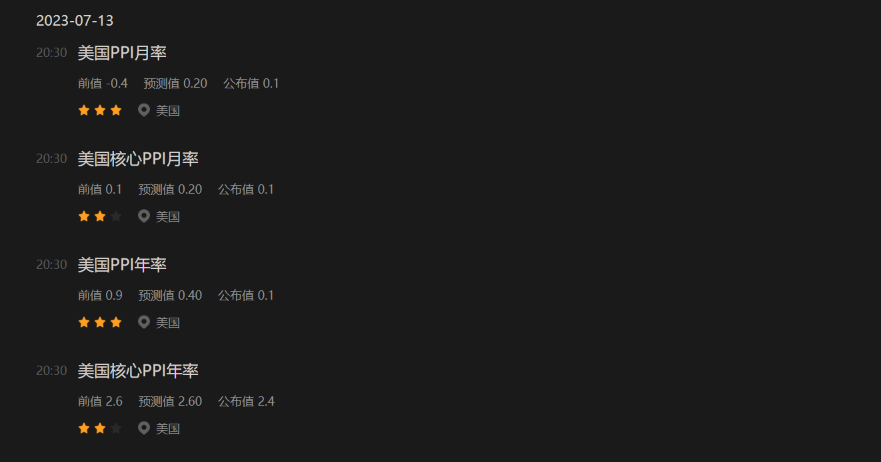

On the dollar side, following the release of weak CPI data, U.S. June PPI data fell short of expectations again。

According to data released on July 13, local time, the monthly rate of PPI in the United States rose slightly by 0 in June..1%, the same annual rate of 0.1%, both languishing, with the latter recording its smallest year-over-year increase since August 2020。Among them, U.S. service prices rose slightly in June by 0.2%, but core commodity prices climbed 0 in May.1% followed by a decline of 0.2%。

Separately, according to U.S. jobless claims data released overnight last week, job growth, while already showing signs of slowing, remains resilient。According to the U.S. Labor Department on Thursday, initial jobless claims for the week ending July 8 were 23.70,000, down 1 percent from last week..20,000, below economists' consensus estimate of 250,000。Public data shows that U.S. jobless claims have largely stabilized at historic lows over the past few months, and U.S. employers added 209,000 employees last month, the fewest since the end of 2020.。

It's worth noting that some analysts say that jobless claims will surge again in early September, when summer temporary workers will be laid off。

Markets are beginning to put pressure on dollar bulls due to recent weak data, which could lead to increased divergence between European and American currencies。On July 14, the dollar index fell below the 100-round mark for the first time since April 2022 and has fallen for six consecutive days.。As of press time, the dollar index was at 99.8070, up 0 in the day.04%。

In response, Everbright said the most direct trigger for the recent decline in the dollar was the unexpected fall in employment and inflation in June.。The U.S. economic outlook is weakening, with markets betting on the end of the Fed's rate hike, which could end as soon as July, dragging down the dollar; while the ECB's relatively hawkish performance also has some negative impact on the dollar.。

The bank also said that the weakening of the U.S. dollar overall favorable yuan and other non-U.S. currency trends, although the U.S. dollar follow-up trend may still exist some repetition, but the U.S. dollar interest rate hike cycle is nearing the end, the U.S. economic outlook is slowing, the European Central Bank continues to move towards restrictive interest rates, etc., will constrain the future upward space of the U.S. dollar。

Bank of America: Dollar expected to weaken moderately by end of next year

For Europe and the United States after the market, the major banks have expressed their views。

At this stage, it seems difficult to offer a strong rebuttal to the bearish dollar argument, and while there will be some correction after the huge rally and the rally may be excessive, the short-term outlook for the euro against the dollar is likely to remain broadly bullish.。The agency said the euro could stabilize at 1 against the dollar today..1200, and may even correct down to 1 in the current highly volatile environment..1170-80 Zones。

Bank of America notes that the dollar is expected to weaken moderately by the end of next year and that strong productivity growth will not be counted in the dollar outlook。Despite optimism that technological progress will lead to higher productivity, we expect the United States to maintain a weaker growth pattern in the medium term。This means that the euro will be at 1 against the dollar by the end of next year..15 level, and eventually to 1.Fair value of 20。

For its part, UOB believes that momentum in Europe and the United States remains strong and may rise further to 1.1200, even up to 1.1250, but as long as the euro remains at 1.Above 1035, upside risk remains。

As of press time, the euro was down 0 against the dollar on the day..06%, reported 1.1219; Euro down 0 against HKD.13%, reported 8.7697; EUR / CNY (CFETS) down 0.19%, reported 7.99。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.