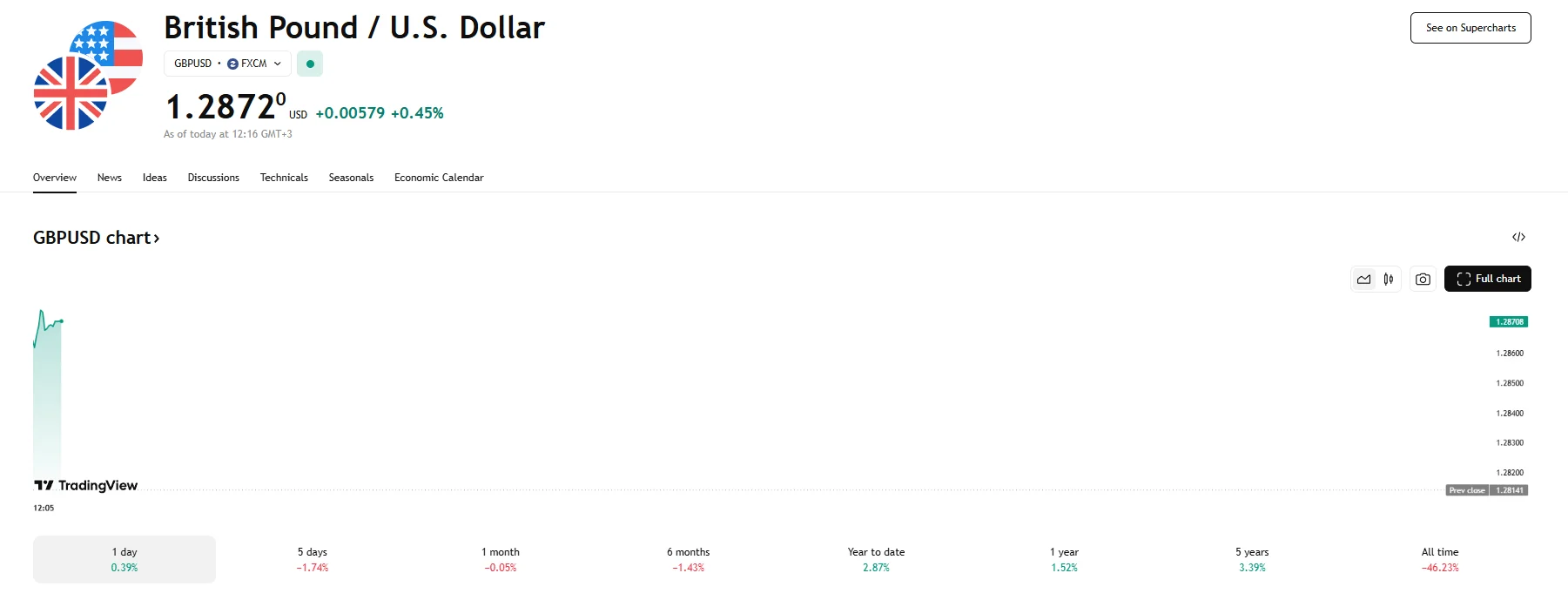

GBP/USD Bounces 0.45% to 1.2872 GBP/USD Bounces 0.45% to 1.2872

Key momentsThe British Pound appreciated 0.45% against the US dollar on Thursday, with the exchange rate reaching 1.2872.The sterling was bolstered by news of the Trump administration temporarily halt

Key moments

- The British Pound appreciated 0.45% against the US dollar on Thursday, with the exchange rate reaching 1.2872.

- The sterling was bolstered by news of the Trump administration temporarily halting most US tariffs of over 10%.

- The FTSE 100 also reacted positively to the news, with Barclays PLC climbing just over 10.80%.

Tariff Relief Fuels British Pound

The British Pound to US Dollar exchange rate witnessed a notable recovery on Thursday, climbing by 0.45% to surpass the 1.2870 mark. This surge followed an earlier dip that saw the currency pair approach the 1.2800 level, and the upward movement can be largely attributed to the announcement of a 90-day suspension of heightened tariffs by the United States.

It is important to note, however, that the United Kingdom and many other US trading partners will still be subject to the established baseline tariff of 10%. Despite this continued levy, the temporary halt to further increases appears to have been sufficient to inject optimism into the UK financial markets. The FTSE 100 index staged a significant rally, surging by over 5% and subsequently hovering around the 8,000-point threshold. Several prominent UK companies experienced particularly substantial gains, as shares in Barclays PLC and Melrose Industries both soared by more than 10%. Furthermore, Rolls Royce Holdings also saw a significant increase in its share price, climbing nearly 7.20%.

The US dollar remains volatile. Although Trump declared a temporary cessation of new tariff implementations for a significant number of nations, the simultaneous decision to escalate tariffs on goods imported from China to 125% continues to weigh on the dollar and the global trade landscape. This mixed message prompted market participants to reassess their outlook, impacting the strength of the US Dollar and consequently providing a lift to the GBP/USD and other pairs.

Prior to this tariff pause, there had been growing concerns about the potential economic repercussions for the UK, given the importance of its trading relationship with the United States. The US accounts for a substantial portion of the UK’s international trade volume, representing over 17%.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.