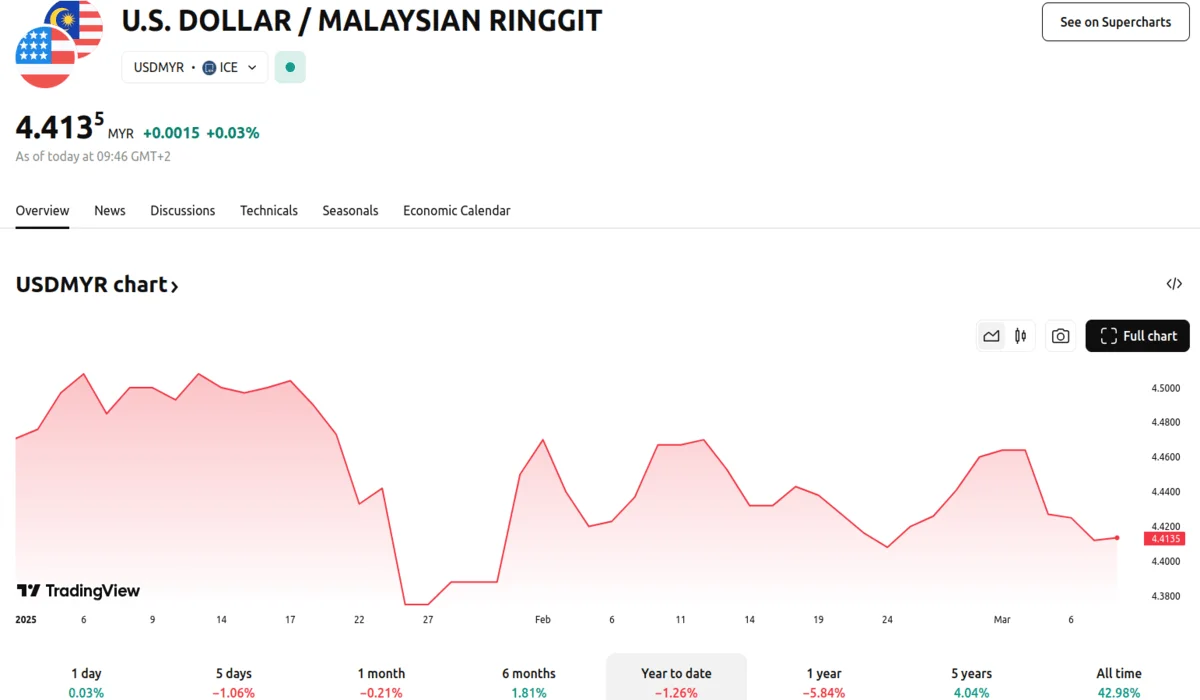

Ringgit Strengthens to 4.210 Against Dollar as DXY Drops to 103.830 Ringgit Strengthens to 4.210 Against Dollar as DXY Drops to 103.830

Key momentsThe ringgit appreciated to 4.4085/4210 against the US dollar, up from 4.4110/4145 at the previous Friday’s close.The US Dollar Index (DXY) fell to 103.830 points, paving the way for further

Key moments

- The ringgit appreciated to 4.4085/4210 against the US dollar, up from 4.4110/4145 at the previous Friday’s close.

- The US Dollar Index (DXY) fell to 103.830 points, paving the way for further ringgit appreciation.

- The ringgit also strengthened against the pound sterling, reaching 5.7011/7172 from 5.7070/7115 last Friday.

Malaysian Ringgit Appreciates amid US Economic Uncertainty

The Malaysian ringgit experienced a notable strengthening against the US dollar, a key focal point of market activity. This appreciation from 4.4110/4145 to 4.4085/4210 was driven by growing market expectations of a reduction in the US Federal Funds Rate. This movement was significantly influenced by a decrease in the US Dollar Index (DXY), which reached 103.830 points, hinting at a further positive outlook for the Ringgit.

US job market data highlighted a weakening trend, with the labor force participation rate declining to 62.4%, the lowest since January 2023. Additionally, the unemployment rate rose to 4.1% in February, from 4.0% in the preceding month. These figures, combined with statements from US President Donald Trump about a “period of transition” for the US economy, contributed to heightened market volatility.

The ringgit also demonstrated strength against other major currencies. It appreciated against the British pound, moving to 5.7011/7172. Gains were also recorded against the euro as the ringgit rose from 4.7903/7941 to 4.7876/8012. The Malaysian currency also increased against the Japanese yen from 2.9909/9935 to 2.9872/9961.

Furthermore, the ringgit performed well against several ASEAN currencies. It saw an increase against the Singapore dollar, moving to 3.3152/3251 from 3.3185/3214. MYR also rose against the Thai baht, to 13.0657/1109 from 13.1124/1290, and the Indonesian rupiah, to 270.5/271.4 from 270.6/271.0. However, it remained stable against the Philippine peso, holding at 7.71/7.74.

Market analysts anticipate that overall market sentiment may remain defensive in the near term, due to uncertainties surrounding US economic policies. The fluctuations in the US Dollar Index, along with the shifting economic indicators, are expected to continue to influence the ringgit’s performance. The weakening of the DXY, coupled with the rising unemployment rate in the US, has increased the pressure on the US Federal reserve to cut interest rates. This expectation is a major driver of the ringgit’s climb. The inconsistent tariff policies from the US are also a contributing factor to the market volatility.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.