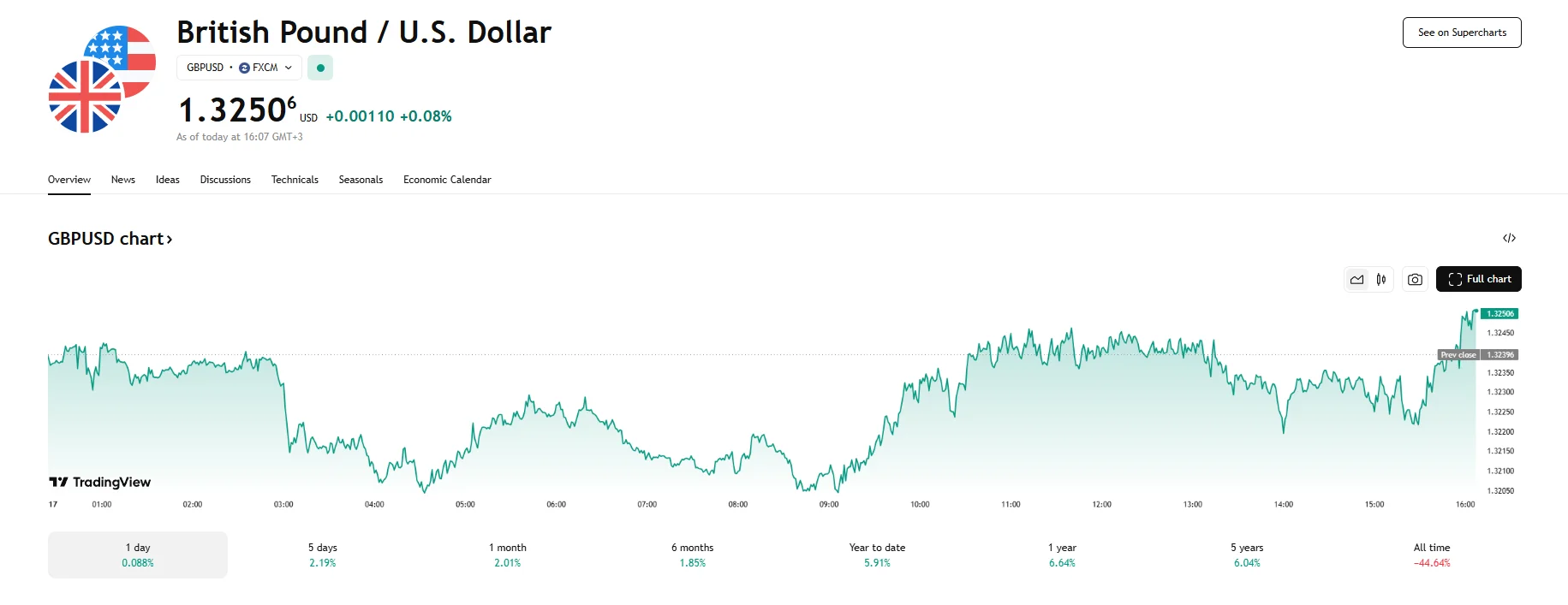

GBP/USD Attempts Climb Toward 1.3300, Weak Inflation Weighs on the Sterling GBP/USD Attempts Climb Toward 1.3300, Weak Inflation Weighs on the Sterling

Key momentsThe GBP/USD pair managed to hit the 1.3250 mark today but has yet to reach 1.3300The US Dollar Index is trading above recent slumps near 99.000.March saw the UK’s key interest rate reach 2.

Key moments

- The GBP/USD pair managed to hit the 1.3250 mark today but has yet to reach 1.3300

- The US Dollar Index is trading above recent slumps near 99.000.

- March saw the UK’s key interest rate reach 2.6%, lower than previously projected.

UK Inflation Undershoots Forecasts, Casting Doubt on Pound’s Upside Potential

Thursday saw the British Pound encounter headwinds against the resurgent US Dollar, leading to a temporary decline in the GBP/USD exchange rate. The currency pair experienced a 0.13% decrease in value today, dropping below 1.3230 before a modest climb saw it fluctuate under the recent 1.3300 peak. These movements coincided with a strengthening of the US Dollar, as evidenced by the Dollar Index’s 0.13% climb to reach 99.412.

The US Dollar found renewed support as the trade discussions between the US and Japan hinted at a potential deal in the near future. Market participants interpreted these developments as a potential easing of the global economic uncertainties that dominated markets due to the Trump administration’s tariffs. The growing anticipation that the US might favor bilateral trade agreements over widespread trade conflicts instilled a degree of confidence in the greenback, prompting investors to increase their holdings. In addition, the US Dollar Index’s rebound from a recent plunge toward 99.000 has been supported by March’s retail sales figures, which exceeded analyst expectations.

Conversely, the Pound Sterling faced downward pressure following the release of softer-than-anticipated inflation figures within the United Kingdom, as the key inflation has hit 2.6%. Data revealed a deceleration in the UK’s services sector inflation, which is down to 4.7% compared to last year’s 5%.

This easing of inflationary pressures has fueled speculation that the BoE might be inclined to adopt a more accommodative monetary policy stance, potentially including interest rate reductions in the future. Furthermore, concerns regarding the UK labor market outlook, partly attributed to an anticipated increase in employers’ social security contributions, have further affected the Pound’s performance and efforts toward a decisive rebound.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.