XRP`s Overvaluation Could Hinder Its Return to All-Time High

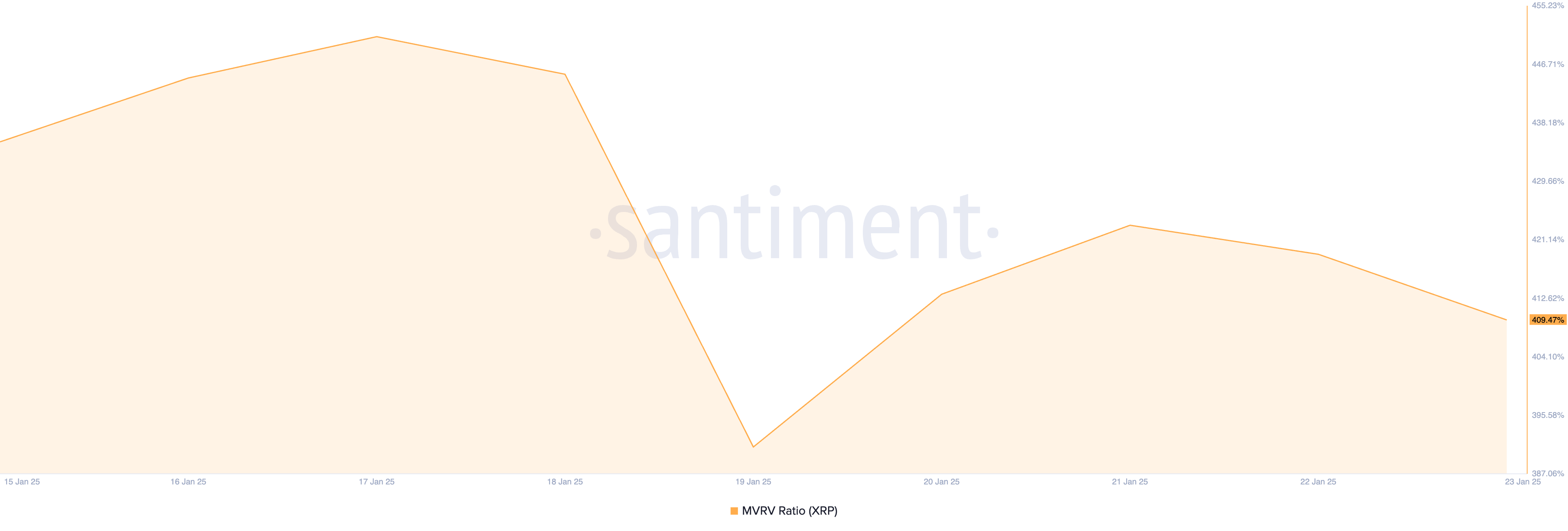

XRP price overvaluation, confirmed by its 409.47% MVRV ratio, triggers profit-taking and risks price drops below $2.45 support.

- XRP surged 35% last week, but at $3.10, concerns over overvaluation hinder its ability to surpass its ATH of $3.41.

- On-chain metrics show XRP’s MVRV ratio at 409.47%, highlighting high profit margins for investors and likely triggering sell-offs.

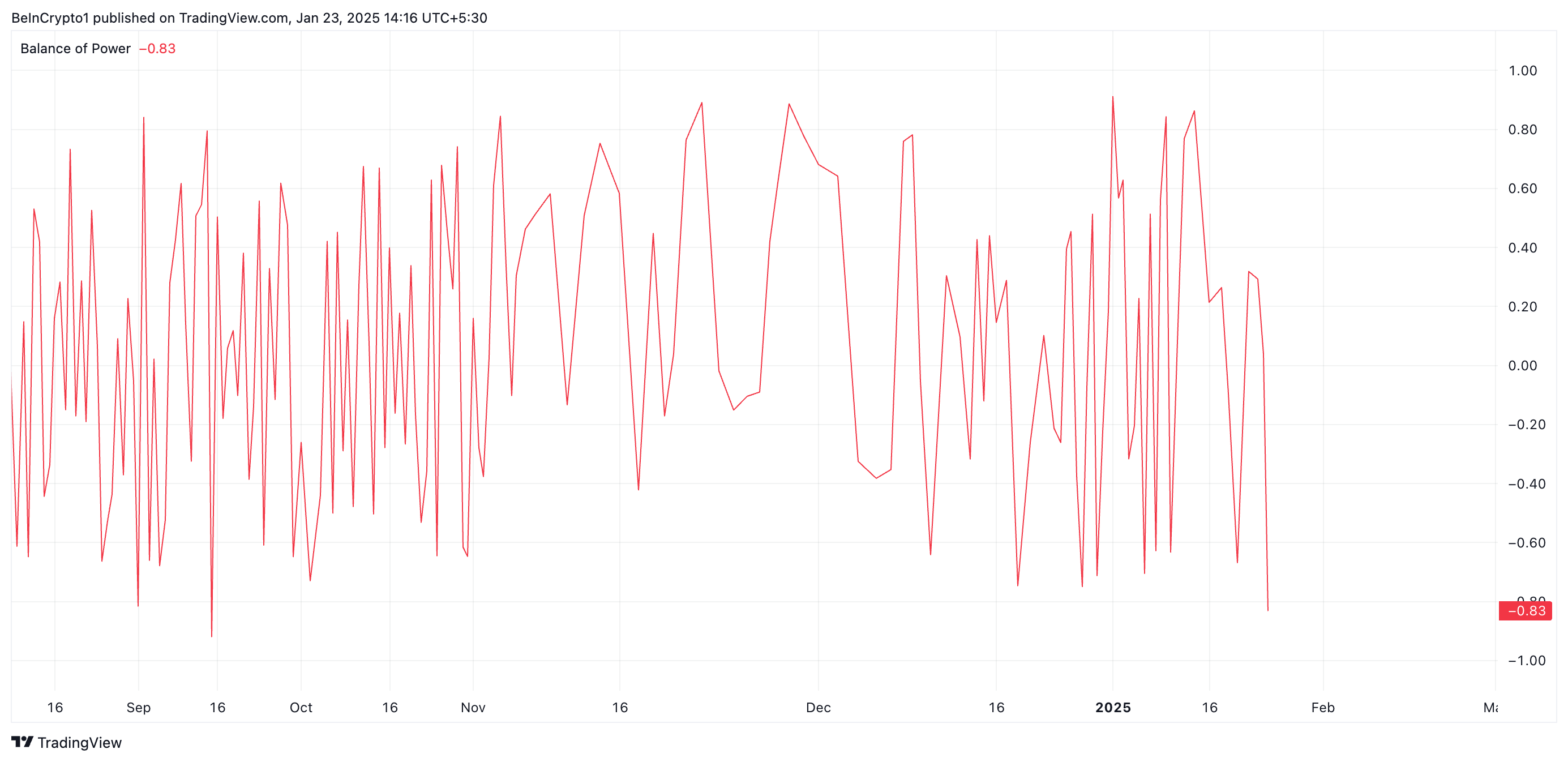

- Negative Balance of Power (-0.83) signals increased selling pressure, with XRP’s price potentially dropping to $2.45 support levels.

XRP has witnessed a notable rally in the past week, climbing by 35%. The altcoin currently trades at $3.10, slightly below its all-time high of $3.41.

However, on-chain data suggests the token may be overvalued at its current price point. This raises concerns about its ability to break above its all-time high (ATH) as profit-taking straightens among traders.

XRP’s Overvalued Status Could Trigger More Selloffs

XRP’s market value to realized value (MVRV) ratio highlights its overvalued status, standing at 409.47% at press time, according to Santiment data.

The MVRV ratio evaluates whether an asset is overvalued or undervalued by comparing its market value to its realized value. A positive ratio indicates the market value exceeds the realized value, suggesting overvaluation. Conversely, a negative ratio means the market value is below the realized value, indicating the asset is undervalued compared to its original purchase price.

At 409.47%, XRP’s MVRV ratio shows that its market value is 409% higher than its realized value — the price at which tokens were last moved or acquired. In simpler terms, this means that, on average, investors who purchased XRP are seeing a 409% profit compared to their initial purchase price. This could prompt increased selling pressure.

Notably, XRP’s negative Balance of Power (BoP) confirms that this profit-taking is already underway. At press time, this sits at -0.83.

The BoP measures the relative strength of buying versus selling pressure in the market. When the BoP is negative, it indicates that selling pressure outweighs buying. It suggests that more investors are looking to liquidate their positions than to accumulate, which could lead to downward price movement.

XRP Price Prediction: Selling Momentum Threatens to Push Price Lower

As selling activity gains momentum, XRP’s price will fall further from its all-time high. According to readings from its Fibonacci Retracement tool, the altcoin’s price could drop to support at $2.45.

Conversely, a shift in the market trend toward accumulation would invalidate this bearish projection. In that case, XRP’s price would rally to its all-time high and attempt to break above it.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.