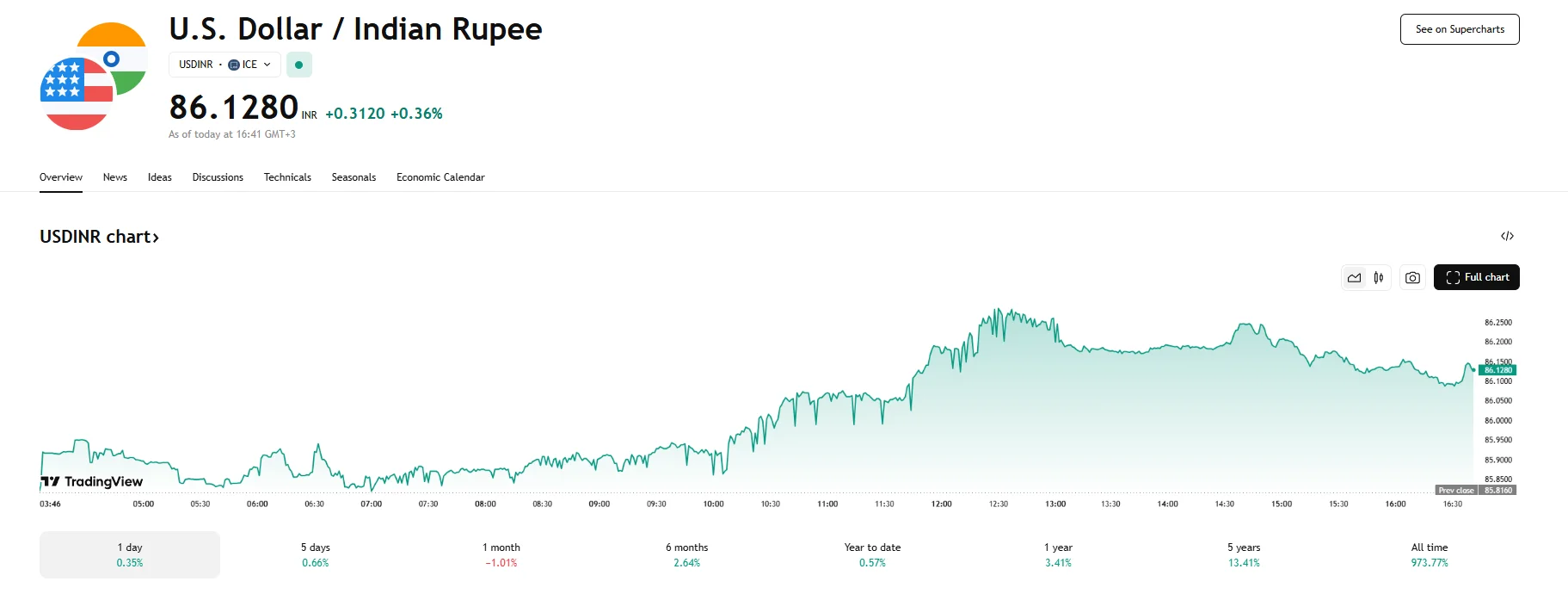

USD/INR Reaches 86.1280 Following Rupee’s Two-Week Low USD/INR Reaches 86.1280 Following Rupee’s Two-Week Low

Key momentsThe USD/INR pair rose 0.36% to 86.1280 on Tuesday.The Indian rupee fell even further earlier in the trading session, dropping to a low last witnessed in March as the USD/INR jumped to 86.29

Key moments

- The USD/INR pair rose 0.36% to 86.1280 on Tuesday.

- The Indian rupee fell even further earlier in the trading session, dropping to a low last witnessed in March as the USD/INR jumped to 86.29.

- Tuesday saw the Nifty 50 enjoy gains, climbing 1.69% to close at 22,535.85 INR.

Dollar Gains Momentum Against Rupee

The exchange rate between the United States dollar and the Indian rupee experienced an upward shift on Tuesday, with USD/INR increasing by 0.36% to 86.1280. This rise signified a weakening of the Indian currency against the greenback. Earlier in the trading session, the rupee had depreciated even further, with the USD/INR pair touching 86.29. This particular point marked the Indian rupee’s steepest drop since March.

The factors contributing to these fluctuations in the INR’s value are multifaceted. One significant element appears to be the movement of the Chinese Yuan. A weaker Yuan often weighs on other regional currencies, including the rupee, due to interconnected trade dynamics and investor sentiment.

Furthermore, corporate hedging activities, specifically demand from Indian importers seeking to cover their dollar-denominated liabilities, also played a role in the rupee’s depreciation as they bought dollars, increasing demand and thus the dollar’s value relative to the rupee. Broader weakness across emerging market currencies, possibly triggered by escalating global trade tensions, further contributed to the rupee’s decline. China’s imposition of retaliatory tariffs on American goods has heightened market uncertainty, resulting in investors pulling capital from emerging markets such as India, thereby weakening their currencies.

While the Indian rupee faced selling pressure, India’s benchmark equity index, the Nifty 50, rose on Tuesday. Bucking the trend of the weakening currency, the Nifty 50 closed with a substantial climb of 1.69%. The top-performing constituents of the Nifty 50 during this session included Shriram Finance Ltd., which saw its shares rise by a notable 5.05%, Bharat Petroleum Corp. Ltd., with an increase of 4.15%, and Bharat Electronics Ltd, which gained 3.68%.

However, despite the optimism in the equity markets, the underlying pressures on the Indian rupee remained evident. Market participants were also anticipating the Reserve Bank of India’s (RBI) upcoming interest rate decision, scheduled for later in the week. Should the RBI implement a rate cut as expected, this could exert further downward pressure on the rupee by reducing the attractiveness of rupee-denominated assets for foreign investors.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.