MAG`s Blockchain Move: $500 Million in Real Estate Tokenization with Mantra`s Platform

MAG and Mantra partner to introduce a $500 million tokenized real estate vault, offering secure yields and fractional ownership for investors.

- MAG and Mantra to tokenize $500 million in real estate, offering secure, high-yield investments.

- A $75 million mega-mansion will over-collateralize the initial vault to ensure investor protection.

- Mantra is focusing on the UAE market due to regulatory clarity, with plans for global expansions.

MAG, a real estate developer based in the Uni Arab Emirates (UAE), has partnered with Mantra, a layer-1 (L1) blockchain platform specializing in tokenized real-world assets (RWAs).

MAG and Mantra’s collaboration aims to establish a new standard for real estate investment in the Middle East region.

Real Estate Meets Blockchain: Secure Yields and Transparency for Investors

This partnership will provide long-term benefits to investors and customers. Introducing the real estate financing vault on Mantra’s platform will also attract investors seeking secure and transparent investment opportunities.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

The total transaction value of projects slated for tokenization will amount to $500 million, structured into multiple tranches. Investors participating in the vault can earn yields in stablecoins and Mantra’s native tokens, OM. They can achieve an estimated annual percentage yield (APY) of approximately 8% from stablecoins, further augmented by OM tokens.

A $75 million mega-mansion at The Ritz-Carlton Residences, part of the Keturah Resort in the Dubai Creekside development, will over-collateralize the initial vault. This collateral, backed by MAG’s corporate credit, ensures investor protection while driving innovation in real estate investment through tokenization.

“The tokenization engine that we’re going to be using is Libre, with whom we are linked through Laser Digital, who are our investors and hold a VARA license in Dubai,” Mantra’s spokesperson told BeInCrypto.

Additionally, the spokesperson stated that their focus is on the UAE market due to more crypto-friendly regimes and clearer regulatory frameworks. They have been very targeted in the UAE and plan to expand this approach globally.

MAG and Mantra’s partnership also shows the growing trend of RWA tokenization to unlock new investment opportunities and enhance market accessibility. Tokenization allows fractional ownership, making it easier for smaller investors to participate in high-value real estate projects.

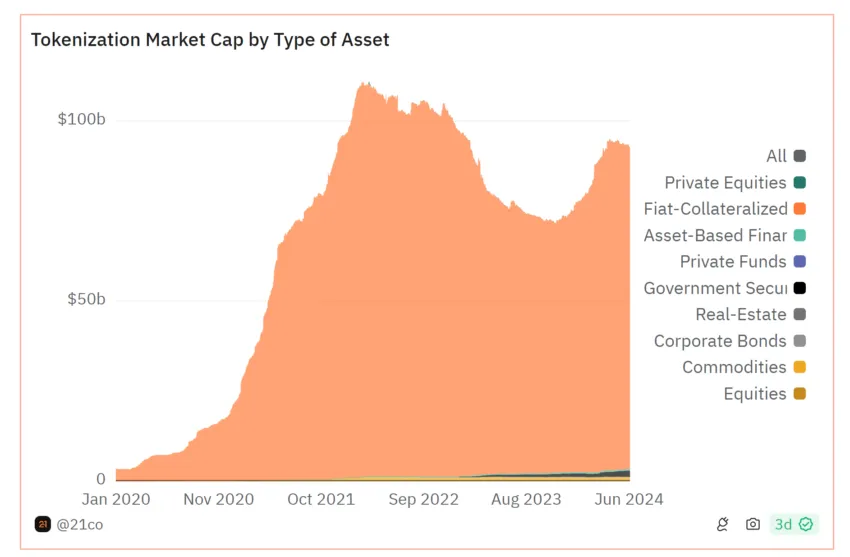

As of June 30, data from Dune shows that the market capitalization of tokenized real estate was $182.08 million. This figure represents 0.19% of the total tokenization market capitalization of $93.55 billion, highlighting the sector’s potential for growth.

Read more: Where To Buy Tokenized or Fractionalized Real Estate and Art

Despite this development, the market’s reaction to OM’s price has been mixed. Over the past 24 hours, OM experienced a decline of 11.6%, now trading at $0.73. However, over a longer period, OM saw a 9.5% increase over the last fourteen days, indicating a positive long-term outlook.

Disclaimer: The views in this article are from the original author and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.