Binance Raises Flags: 11 Altcoins Risk Future Delistings

Binance’s new monitoring tags on 11 altcoins raise delisting concerns, impacting prices. Learn about the potential risks involved.

- Binance tags 11 altcoins for monitoring, sparking delisting concerns and price drops.

- Monitoring tags indicate higher volatility and potential delisting risks.

- Some of the altcoins have plummeted after Binance's monitoring tags announcement.

Binance, one of the leading crypto exchanges, has expanded its Monitoring Tag to cover 11 more altcoins, igniting discussions about potential future delistings.

The price of some of these 11 altcoins has suffered after the announcement. This is because, on previous occasions, Binance has delisted some altcoins after attaching a monitoring tag to them.

Why Binance Attaches Monitoring Tag to Certain Altcoins?

The newly tagged tokens include Balancer (BAL), Cortex (CTXC), PowerPool (CVP), Convex Finance (CVX), Dock (DOCK), Kava Lend (HARD), IRISnet (IRIS), MovieBloc (MBL), Polkastarter (POLS), Status (SNT), and Sun (SUN).

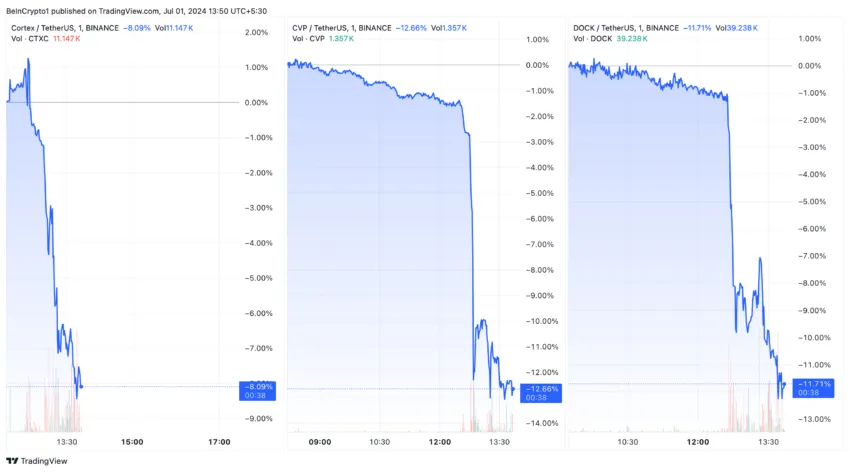

Following this announcement, notable market reactions were immediate. CTXC saw a sharp decline of 8.09%, CVP dropped by 12.66%, and DOCK also decreased by 11.71%. On the other hand, the other tagged altcoins experienced more modest drops.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

Binance uses the Monitoring Tag for tokens that show significantly higher volatility and risks compared to others. This tag warns investors that these tokens could fail to meet Binance’s rigorous listing standards in the foreseeable future.

“Keep in mind that tokens with the Monitoring Tag are at risk of no longer meeting our listing criteria and being delisted from the platform,” Binance warned.

Furthermore, to trade these marked tokens, Binance mandates that users must periodically pass a quiz every 90 days, available on both Binance Spot and Binance Margin platforms. This ensures that traders are fully aware of the associated risks. The Monitoring Tags are displayed on the relevant trading pages, and a risk warning banner is also prominently shown.

The review criteria for these tokens include several important factors, such as the project team’s commitment, the quality and level of ongoing development, trading volume and liquidity, and network stability. The exchange also evaluates responsiveness to its due diligence requests and checks for any unethical or fraudulent activities.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in July 2024

On a positive note, Binance has announced that it will remove Enzyme (MLN) and Horizon (ZEN) from the monitoring list. This update implies a stable and secure status for these altcoins, removing the immediate threat of delisting.

Disclaimer: The views in this article are from the original author and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.