FxPro How to verify an account

Account verification is required to get the full benefits FxPro has to offer。Read this article for everything you need to know。

Account verification is required to get the full benefits FxPro has to offer。Read this article for everything you need to know。

FxPro is a leading brokerage firm founded in 2006。The broker is currently regulated by several institutions, namely CySEC Cyprus, SCB Bahamas, FCA UK and FSCA South Africa。As a regulated broker, FxPro must comply with existing regulations in order to provide a safe trading environment for its clients.。As a result, they must verify the customer's identity before allowing them to trade。

Therefore, when opening an account in FxPro, you must upload a copy of certain documents to complete the verification, which can be your international passport, ID card or driver's license。In addition to security issues, you also need to have a fully verified account to enjoy all the advantages FxPro has to offer。

In other brokers, account verification can take hours to days to complete and can be quite time consuming, especially for those who want to trade as quickly as possible。Fortunately, FxPro offers a quick verification process that takes just a few minutes to complete。

You simply prepare the file and start the process from your desktop or phone。Read this guide for more details。

Verify required files

During the verification process, you will need to provide copies of multiple documents containing personal information such as name, nationality and address of residence。In FxPro, you need to provide two types of documents, namely:

- Proof of identity: a copy of a valid international passport, ID card or driver's license。

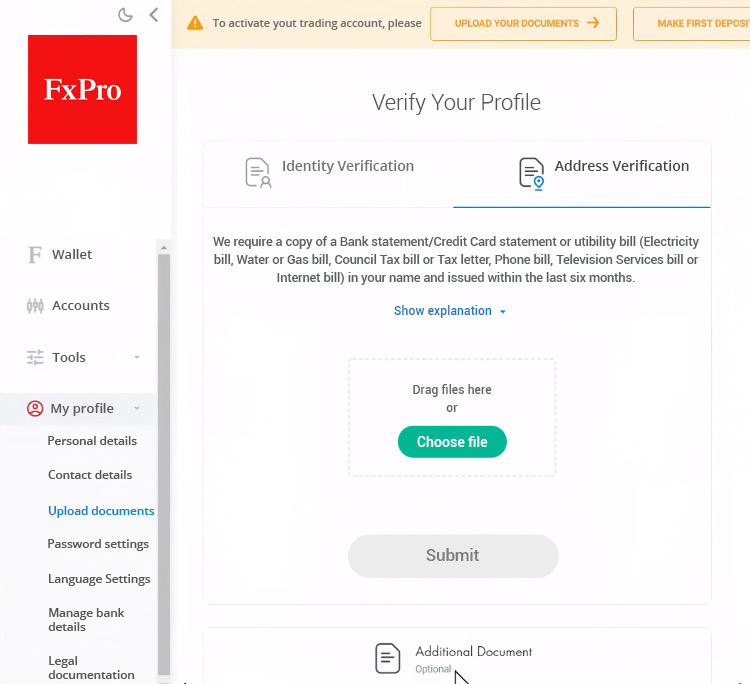

Proof of Residence: A copy of an official document issued within the last 6 months showing your full name and address, which can be a recent bank / credit card statement or utility bill (electricity bill, water or gas bill, council tax bill, tax letter, telephone bill, TV service bill, or Internet bill)。

The following are the basic requirements for documentation:

- Broker only accepts JPG / JPEG, PNG, TIFF, BMP, PDV, DOC and GIF document files。

The size of each uploaded file must not exceed 10 MB。

The document must be in your name and should not expire and should not be valid for more than 6 months at the time of review。

Make sure the photo is clear and all information is readable。

Verification occurs only in FxPro Direct or the mobile app and does not accept files submitted via email。

How to verify your FxPro account from the desktop

1.Create a new live trading account or sign in to FxPro Direct using your existing account。

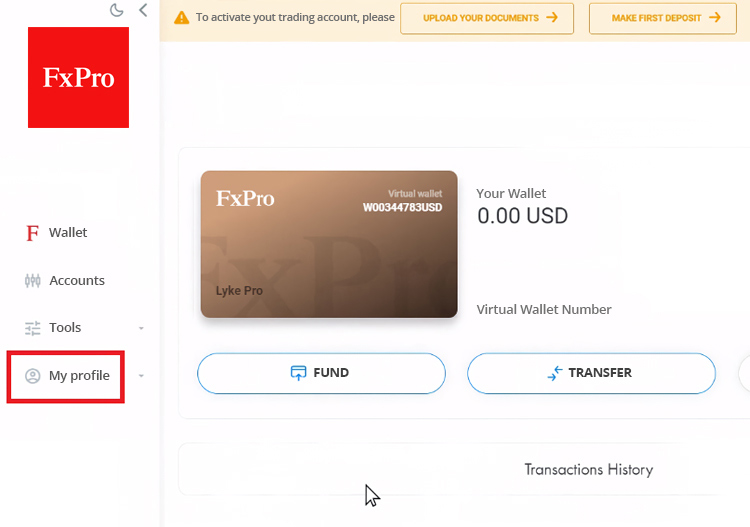

2.Go to "My Profile" section and select "Upload Document" to start the verification process。

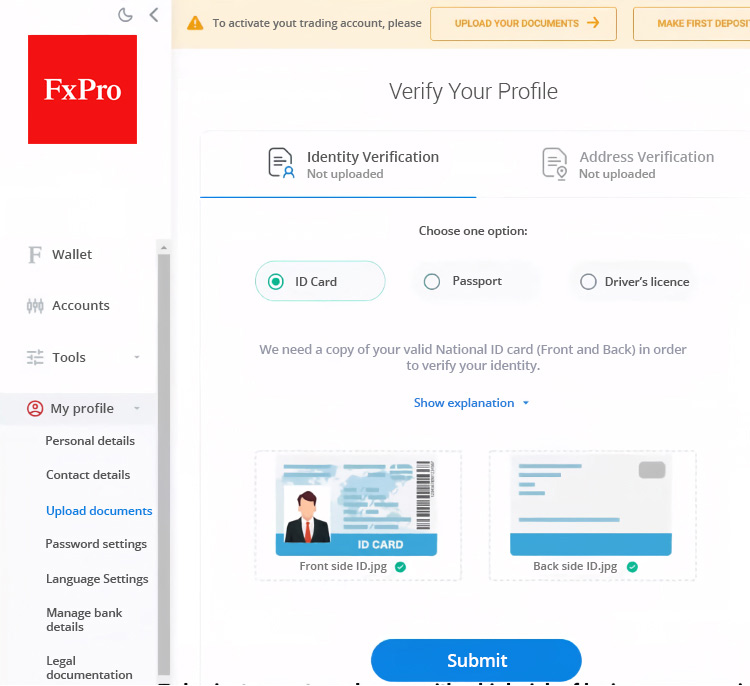

3.Be ready to take a photo of the document or prepare an existing file on your device, making sure to select the correct section and the type of document you want to provide。As shown in the figure below, if the document is double-sided, you need to provide double-sided。

4.FxPro will provide the option to add additional documents if needed。After that, click Submit。

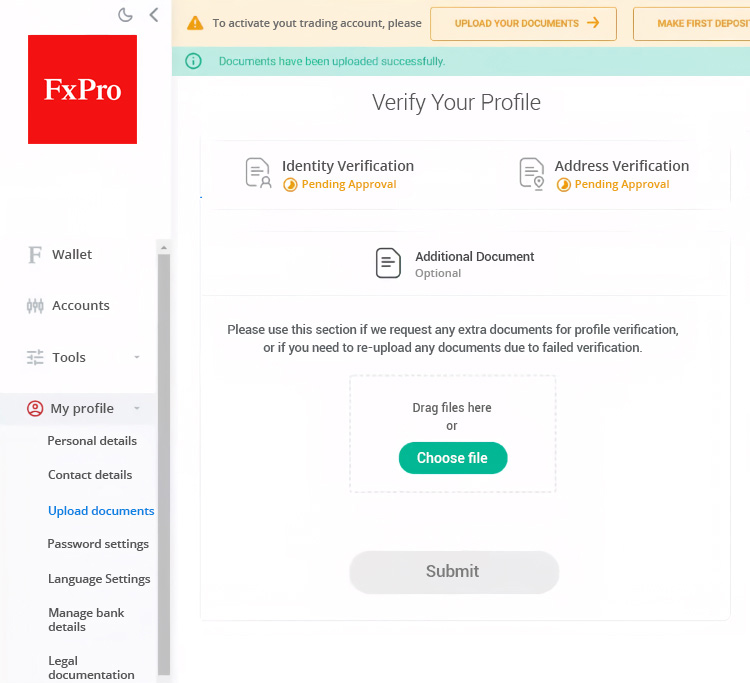

5.Waiting for the broker to approve your documents。Once the account is verified, the broker will send a notification to your email。Alternatively, you can also check the status of your account in the same section of FxPro Direct。

Since its inception in 2006, FxPro has successfully expanded to serve retail and institutional clients in more than 170 countries and is headquartered in London, UK.。

FxPro UK Limited has been licensed and regulated by the FCA since 2010。Meanwhile, other subsidiaries, such as FxPro Financial Services Limited, have been authorized and regulated by CySEC since 2007 and by FSCA since 2015.。So traders no longer have to worry about their money。As a staunch supporter of transparency, it sets the highest security standards for client funds, as companies choose to keep their money in major international banks, completely segregated from corporate funds.。

They always strive to provide transparent and ethical practices in the global trading industry。In 2018, 74.65% of market orders are executed at the requested price, 12.8% of customer orders are executed with positive slippage。In addition, only 1 of all instant orders.4% received a re-offer, of which 0.72% received a better price at the time of execution。

FxPro's total number of transactions increases year by year。In 2018, trading volume reached 53.6 million。Based on the trust of customers, FxPro won the UK's Most Trusted Forex Brand Award 2017 from Global Brand Magazine。In addition, they became the first broker to sponsor an F1 team in 2008 and FxPro has won around 60 UK and international awards.。

They are committed to creating a dynamic environment that provides traders with all the tools they need to gain a trading experience.。Open an account with FxPro to access more than 250 CFDs across 6 asset types, including FX, equities, spot indices, futures, spot metals and spot energy。They want to provide clients with top-of-the-line liquidity and advanced trade execution without the need for trading desk intervention.。Average execution time less than 11.06 milliseconds, up to 7,000 orders per second。These advantages allow traders to benefit from tight spreads and competitive prices。

In addition, FxPro is recognized as an innovative broker。The company allows customers to enjoy a wide range of trading platforms such as MetaTrader 4, MetaTrader 5, cTrader and FxPro Edge。Web-based versions and mobile applications are also available so that traders can access financial markets anytime, anywhere。

Traders can choose the platform according to their needs。Traders for MT4 provide instant execution and easy-to-use trading platform。In this account, leverage is as high as 1: 500, with spreads from 1.From 6: 00, no commission。

Traders should opt for an FxPro MT5 account if they want to gain experience with more modern technologies。In this account, the spread from 1.5 start, leverage up to 1: 500, no commission。

Another type of account is FxPro cTrader。Compared to other account types, it is suitable for traders who prioritize execution speed and have the strictest spread limits。FxPro cTrader is a powerful trading platform that provides the best bid and ask prices, orders can be completed in just a few milliseconds。The platform also provides market depth and trade analysis tools, in which the spread is only from 0.From 3 o'clock。However, traders must pay a commission of $45 per $1 million of forex and metals trades (opening and closing positions).。

The main difference between MetaTrader 4, MetaTrader 5 and cTrader is the range of CFD products available。The MT4 platform provides traders with the opportunity to open positions in all 6 asset classes, while MT5 does not support stocks and cTrader does not support stocks and futures。

In addition to the above 3 types of platforms, you can also access FxPro Edge when trading in FxPro。The platform provides customers with a new way to trade the market in the form of spread betting。

Every broker has advantages and disadvantages, and FxPro is no exception。In addition to the advantages explained earlier, FxPro also has a high minimum deposit amount。In addition, FxPro does not offer many types of payment and withdrawal methods。Some types of methods even require the trader to pay a fee。However, it is still important to note that customers can trade forex, stocks, indices, metals and energy in Fxpro with a limited risk account at no additional cost。

Regardless of the pros and cons, FxPro can be one of the best brokers with advanced technology of choice for traders who are ready to trade with funds starting at $500。

How to verify FxPro account with mobile phone

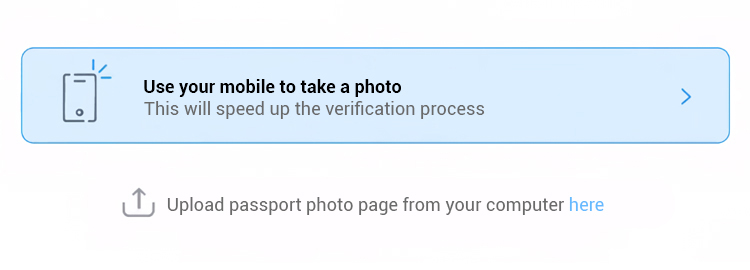

In order to speed up the application process, you can choose to use your mobile phone to verify your identity。You can take a document photo directly and use a special facial recognition system。

1.Sign in to FxPro Direct with an email address and password。Then, open the validation page。

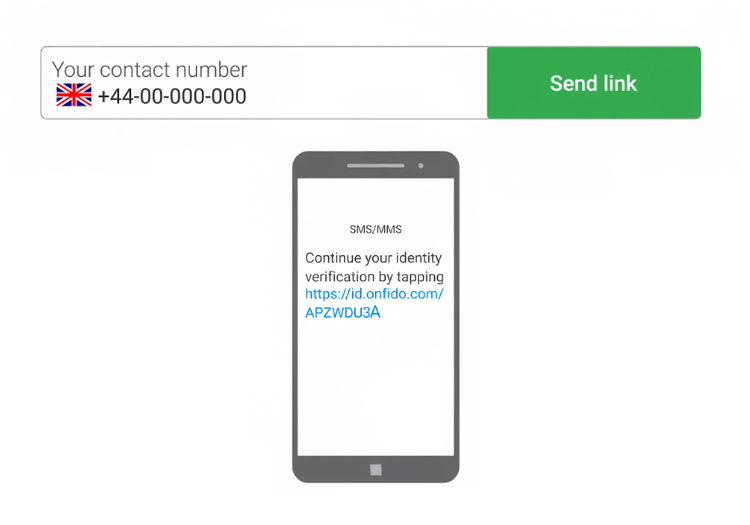

2.Select "Take photo with mobile phone" and enter mobile phone number。

3.You will receive a text message from FxPro with a secure link to continue with the remaining steps。Please do not close or refresh the browser。

4.After opening the link, place the document directly in front of the camera and take a picture, you can choose to provide a passport, driver's license or ID card。When taking photos, make sure that all four corners are visible and the photo is not blurred。

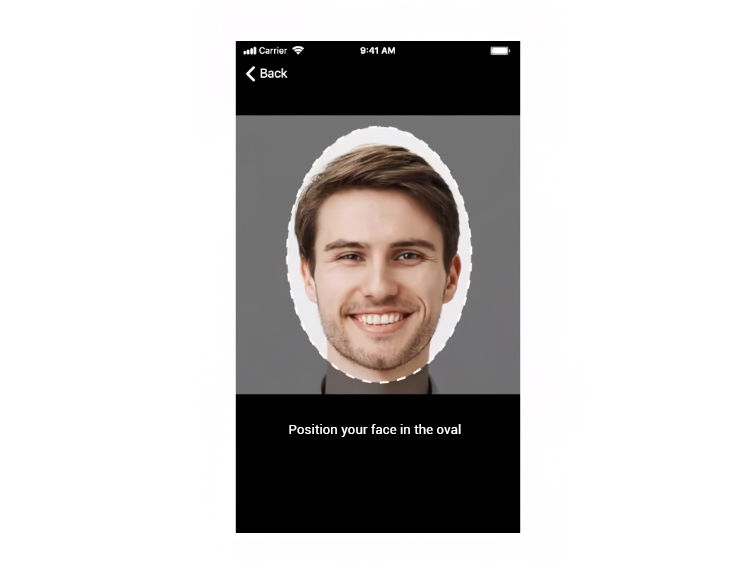

5.The next step is to take a selfie with the front camera。Make sure your face is in the middle of the oval and wait for the approval of the recognition system。

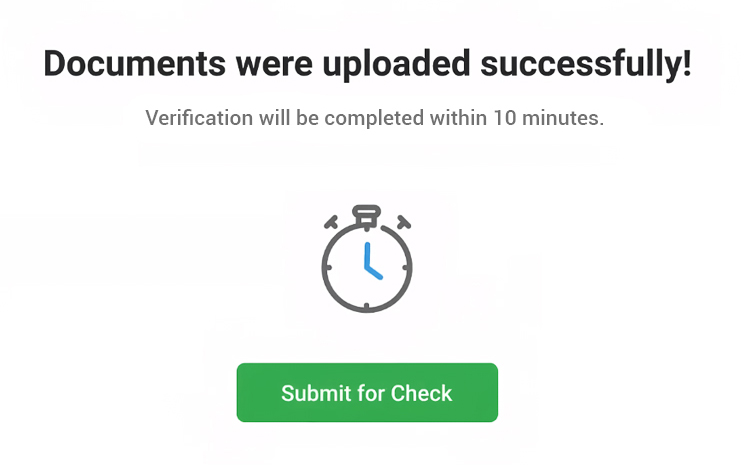

6.Validation takes about 10 minutes to complete。After completion, you will receive an email or you can manually check the status of your account in FxPro Direct。

Fxpro Verifying Account FAQs

Why account verification is important?

Verification is required to ensure customer identity and the validity of the information, and it is also part of the anti-money laundering policies implemented by the financial institutions that regulate FxPro。But in addition to this, verification is required to access the full functionality of the trading account and to receive certain bonuses。How long does account verification take in FxPro?

FxPro takes about 10 minutes to process validation files。However, most brokers typically take about 24 hours or more to verify a client's account。Is FxPro trustworthy??

Yes, FxPro is considered a safe trading broker。Regulated by a number of global financial institutions, including the UK FCA, Cyprus CySEC, South Africa FSCA and the Bahamas SCB。When investing through FxPro, your funds will be protected in a variety of ways, such as negative balance protection, fund segregation and investor compensation funds。

FxPro has been a leading Forex and CFD broker since its inception in 2006。The company is regulated by a number of top financial regulators, including the UK's FCA, and offers tradable instruments such as oil, gold, currency and more contracts for difference (CFD) with spreads below 70% of the market.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.