Best Forex Broker in Ireland (2024 Edition)

Is binary options trading legal in Ireland??What spread types are available from Irish Forex Brokers?

As one of the fastest growing European economies in recent years, Ireland has recently begun to attract the attention of investors.。Its foreign exchange market is fully regulated and both foreign exchange trading and CFD trading are legal in the country.。

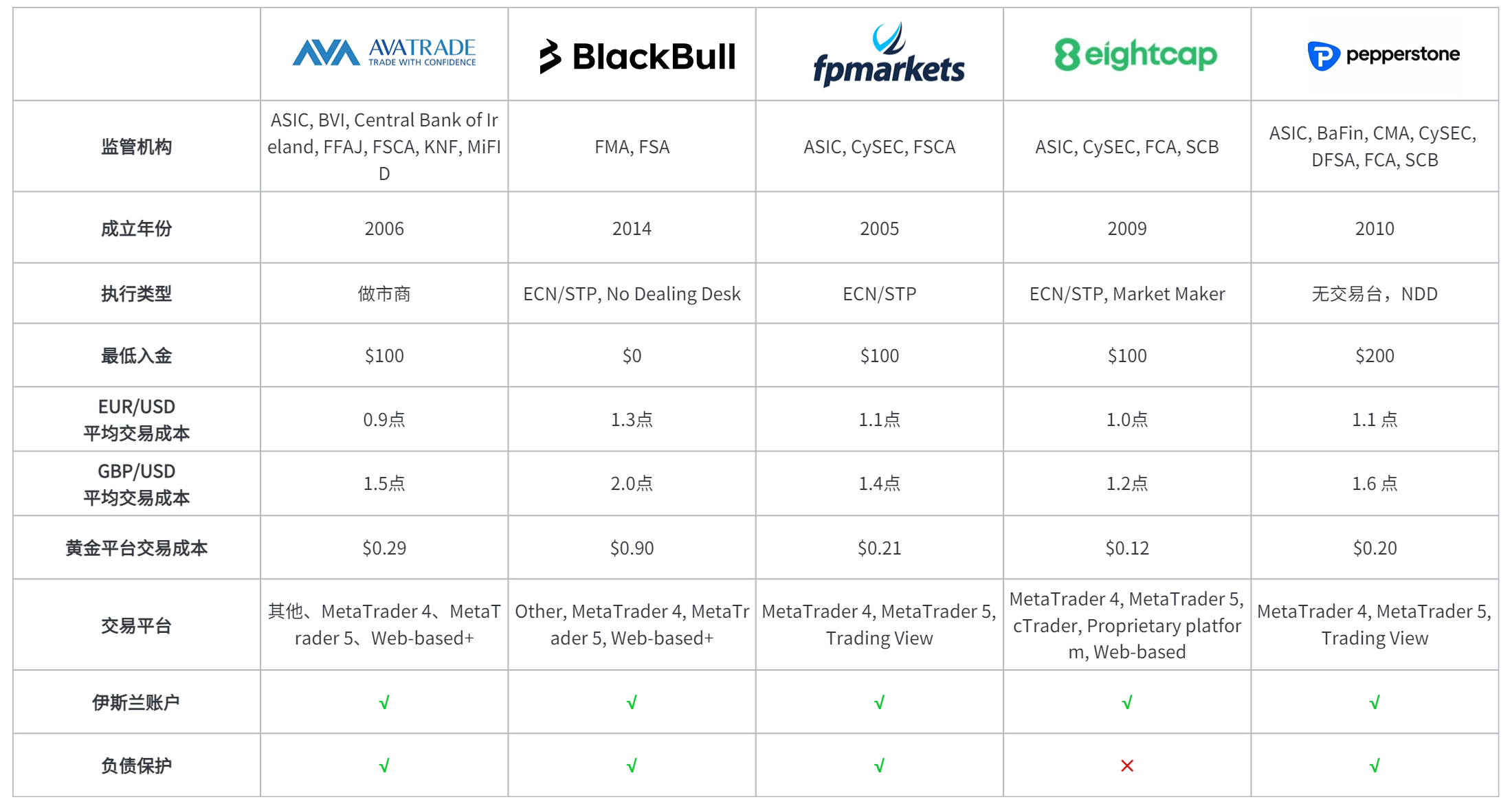

▍ Best Forex Broker

▍ Best Forex Broker

○ AvaTrade

AvaTrade is an online trading platform founded in 2006 that specialises in trading a wide range of financial instruments including Forex, Stocks, Commodities, Indices and Cryptocurrencies.。The platform is headquartered in Ireland and offers services worldwide.。

AvaTrade Key Features:

Trading tools: AvaTrade offers forex trading, contracts for difference (CFD) trading, and a variety of other financial instruments。Users can participate in global financial markets through the platform。

Cryptocurrency trading: AvaTrade also supports cryptocurrency trading, enabling users to trade digital assets such as Bitcoin, Ethereum, and Litecoin on the platform。

Platform selection: AvaTrade offers a variety of trading platforms, including popular trading software such as MetaTrader 4 and MetaTrader 5, as well as their home-developed AvaTradeGO app。

Educational resources: To help users better understand financial markets and trading strategies, AvaTrade offers a wide range of educational resources, including video tutorials, market analysis, and trading tools。

Financial regulation: AvaTrade is regulated in several countries, which helps increase user trust in the platform。Its regulators include the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC) and others.。

○ BLACK BULL

BlackBull Markets is a financial services provider focused on Forex and Contracts for Difference (CFD) trading.。Here are some key pieces of information about BlackBull Markets:

Services: BlackBull Markets offers online trading services for a wide range of financial instruments such as Forex and CFDs。Users can participate in global financial markets through their trading platform。

Trading Platforms: BlackBull Markets offers popular MetaTrader 4 and MetaTrader 5 trading platforms that are widely used for Forex and CFD trading。These platforms typically offer real-time charting, technical analysis tools, and other trading features。

Cryptocurrency trading: BlackBull Markets also supports trading in cryptocurrencies, allowing users to participate in the market for digital assets such as Bitcoin, Ethereum。

Financial regulation: BlackBull Markets is regulated by multiple regulators to ensure compliance in the financial services sector。Regulators usually include the New Zealand Financial Markets Authority (FMA).。

Execution Modes: BlackBull Markets offers different types of execution modes, including Straight Through Processing (STP) and Electronic Communication Network (ECN), among others。These patterns affect how transactions are executed and market access。

| Advantages | Disadvantages |

| √ ECN / NDD Execution Model with Deep Liquidity | x Limited deposit options |

| √ Institutional-level pricing for retail traders through proprietary price aggregation | |

| √ ZuluTrade and Myfxbook for social trading | |

| √ Leverage up to 1: 500 |

○ FP Markets

FP Markets is a financial services provider focused on Forex and Contracts for Difference (CFD) trading.。Here are some key pieces of information about FP Markets:

Scope of Services: FP Markets provides online trading services for a wide range of financial instruments such as forex, indices, commodities, stocks and cryptocurrencies。Users can participate in global financial markets through their trading platform。

Trading Platforms: FP Markets offers MetaTrader 4 and MetaTrader 5 trading platforms, both of which are widely used as professional platforms for Forex and CFD trading。These platforms typically offer real-time charting, technical analysis tools, and other trading features。

Financial regulation: FP Markets is regulated by the Australian Securities and Investments Commission (ASIC)。ASIC is Australia's financial regulator, which oversees financial markets and companies to ensure they operate in compliance.。

Execution Modes: FP Markets offers different types of execution modes, including Straight Through Processing (STP) and Electronic Communication Network (ECN)。These patterns affect how transactions are executed and market access。

Educational resources: To help users better understand the financial markets and improve their trading skills, FP Markets offers a wide range of educational resources including market analysis, video tutorials and trading tools。

-

Advantages Disadvantages √ Selection of trading platforms and auxiliary trading instruments * Iress availability is geographically limited √ Competitive cost structure and excellent asset selection √ Low minimum deposit requirements and leverage up to 1: 500 √ Perfect supervision and trustworthy

○ EightCap

EightCap is a financial services provider focused on Forex and Contracts for Difference (CFD) trading.。Here are some key pieces of information about EightCap:

Services: EightCap provides online trading services for a variety of financial instruments such as foreign exchange, indices, commodities and stocks.。Users can participate in global financial markets through their trading platform。

Trading Platforms: EightCap offers MetaTrader 4 and MetaTrader 5 trading platforms, both of which are widely used as professional platforms for Forex and CFD trading。These platforms typically offer real-time charting, technical analysis tools, and other trading features。

Regulatory: EightCap is regulated by the Australian Securities and Investments Commission (ASIC)。ASIC is Australia's financial regulator, which oversees financial markets and companies to ensure they operate in compliance.。

Execution Modes: EightCap offers different types of execution modes, including Straight Through Processing (STP) and Electronic Communication Network (ECN)。These patterns affect how transactions are executed and market access。

Educational resources: To help users better understand the financial markets and improve their trading skills, EightCap offers market analysis, video tutorials, and other educational resources。

-

Advantages Disadvantages √ Low minimum deposit and leverage up to 1: 500 * Limited leverage in some areas √ Competitive cost structure √ Excellent technical infrastructure and experienced management team √ Daily research and quality education content

○ Pepperstone

Pepperstone is an Australian Forex broker founded in 2010.。The company focuses on providing Forex trading and Forex rebate services to traders worldwide.。Pepperstone has offices in several international locations, including the Bahamas, China, Thailand, Ukraine, the United Kingdom and the United States, to better serve its broad customer base。Pepperstone offers customers a choice of account currencies, including Australian, Canadian, Swiss Franc, Euro, British Pound, Japanese Yen, New Zealand, Singapore, US and Hong Kong dollars to meet the needs of traders in different regions and。

○ Pepperstone's main features and services:

① Trading tools: Pepperstone provides trading services for a variety of financial instruments such as foreign exchange (Forex) and contracts for difference (CFD).。This includes forex currency pairs, stock indices, commodities, cryptocurrencies, etc.。

Trading Platforms: Pepperstone offers popular trading platforms including MetaTrader 4, MetaTrader 5 and cTrader。These platforms provide chart analysis tools, real-time quotes, order execution and more.。

③ Regulatory: As an Australian Forex broker, Pepperstone is globally regulated by the Australian Securities and Investments Commission (ASIC).。This regulation helps ensure that companies comply with financial services regulations and increases the trust of traders。

④ Account types: Pepperstone offers different types of trading accounts, including standard accounts, bonus accounts and interest-free accounts.。Such diversification can meet the needs of different traders。

⑤ Education and Analysis: Pepperstone offers a variety of educational resources and market analysis to help traders upgrade their trading skills。This may include training videos, market commentary, economic calendars, etc.。

| Advantages | Disadvantages |

| √ Very competitive spreads and commissions | * Not available in US / Canada / Japan etc |

| √ Extensive trading platform across all operating systems | x Very few CFDs |

| √ Users can use Autochartist and Smart Trader toolkit for free | x No liability protection |

| √ Commission-free and low spread cost |

Ireland's National Regulation

Irish investors can legally trade a variety of financial instruments, including spot forex and contracts for difference (often referred to as CFD).。As the birthplace of Halloween and St. Patrick's Day, Ireland has become an attractive destination for traders and brokerage firms, and we attribute this to Ireland's low corporate tax rate and a good regulatory environment under the MiFID structure.。

The forex industry is regulated by two important laws that apply to all EU member states, including Ireland。These two laws are the Markets in Financial Instruments Directive (MiFID) and its supporting framework, the Markets in Financial Instruments Regulation (MiFIR).。Together they are called MiFID II。

MiFID I was originally implemented in early November 2007 to harmonize the regulatory framework for investment services and securities in all countries of the European Union and the European Economic Area (EEA).。In 2018, it was replaced by a revised set of regulatory rules, collectively known as MiFID II.。

The latter regulates providers of investment services in financial instruments, including investment firms, brokerage firms, financial advisers and credit institutions.。MiFID also applies to overseas companies that provide investment services to clients in EU member states。

The main advantage of the Directive is that it ensures a standardized licensing process in all EU Member States。According to MiFID, forex brokers can serve clients in all member states as long as they are authorized by another EU country's regulator.。

This is why some Forex brokers in the Irish market are actually licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) or the UK Financial Conduct Authority (FCA).。

The launch of MiFID was accompanied by the creation of the European Securities and Markets Authority (ESMA).。It is a Paris-based regulator whose two main functions include coordinating and improving financial markets in the old continent.。

In addition, ESMA is committed to improving customer protection。Most EU member states, including Ireland, regulate their foreign exchange markets in line with ESMA's guidelines.。Therefore, brokers serving the Emerald Island market must provide transparent prices to their clients and meet minimum starting capital requirements.。

In addition, negative balance protection is provided to prevent traders from losing more than their available balance。Another condition states that authorized financial firms must separate the client's funds from their working capital。This way, if the company fails, the trader can get his money back instead of irreparably losing it。

The Irish market is regulated by the Central Bank of Ireland, which manages the Investor Compensation Scheme (ICS).。The latter is designed to protect the clients of authorized investment firms (such as stock and insurance brokers) that declare bankruptcy.。

Up to €20,000 in compensation per Irish customer。It is important to note that the plan does not include losses due to improper investment decisions and recommendations。

Authorized brokers can offer spot and margin foreign exchange trading for CFDs as long as they meet certain criteria。These companies must be fully transparent about the risk level of margin trading.。They should post a disclaimer on their website stating to potential retail customers the percentage of customers who lose money through margin trading。

A careful assessment should be made in advance to determine whether retail customers have sufficient capacity to trade volatile CFDs。Authorized brokers should not allow inexperienced retail clients to get involved in such high-risk derivatives。

CFDs are leveraged instruments that allow traders to expand trading volumes well beyond their initial investment。Clients do not have to own the underlying assets to buy CFDs。

They just speculate on the price movements of the above assets and if the price movements are in their favor, they can make a profit。Otherwise, traders could suffer catastrophic losses from leverage。As a result, Ireland has strict regulation of CFDs under ESMA guidelines。Read on to learn more about leverage limits on CFDs trading in the Emerald Isle。

Irish Financial Regulators

Ireland's foreign exchange market is regulated by the Central Bank of Ireland。The financial institution was established in February 1943 and was responsible for issuing Irish banknotes and coins until Ireland adopted the euro in 2002.。

Its statutory responsibilities include ensuring financial and price stability, protecting consumers, providing economic advice and statistics, and regulating financial services in Ireland.。All brokerage firms that accept Irish clients must be licensed by the Central Bank or have a licence issued by other well-regulated member states of the European Union.。

The financial regulator has a very informative website where Irish traders can find a detailed database of all brokers with valid local licences。If you are not sure if the broker you are interested in is properly licensed, we recommend that you check the regulator's registry。

Authorised companies must adhere to a strict regulatory framework and act in the best interests of Irish customers.。To obtain a license, a company must demonstrate that it is financially sound and meets minimum capital adequacy standards。The Central Bank strictly monitors licensed companies to ensure that they operate in strict accordance with its guidelines.。

Irish regulators recently decided to step in and contain the risks associated with leveraged trading as a wave of complaints from retail customers left them suffering huge losses.。

An inspection conducted between 2013 and 2014 found that 75 per cent of Irish retail CFD traders ran away with an average loss of €6,900。A similar investigation by CySEC, the Cyprus regulator, came to much the same conclusion.。

Up to 290,000 retail accounts from 18 major CFD providers were analysed between January and August 2017.。The results show that an average of 76% of customers suffered losses during this period.。Similar trends have been seen in other EU jurisdictions such as Spain, Croatia and France.。

The Central Bank of Ireland subsequently concluded that CFD trading was an activity not suitable for retail customers.。The regulator decided to limit the maximum leverage provided by brokers for such complex derivatives under the European Securities and Markets Authority (ESMA) restrictions.。Before the regulator intervenes, retail customers with little experience can increase the leverage ratio of their derivatives to a maximum of 400: 1, and in some cases even 500: 1。

According to the June 2019 CFD Intervention, licensed brokers serving the Irish market must not provide more than 30: 1 leverage for major currency pairs such as EUR / USD and GBP / USD.。Note that the limit depends on the volatility of the financial instrument。

The higher the risk of a particular product, the lower the upper limit of leverage allowed。The maximum leverage limit for major indices, gold, small currency pairs and special currency pairs, respectively, is 20: 1, while all other commodities must not exceed 10: 1.。Leverage ratios for individual stocks and cryptocurrencies are limited to 5: 1 and 2: 1, respectively.。

▍ Irish foreign exchange payment method

Irish traders pay in a variety of ways, with regulated brokers serving the local market offering customers plenty of choice when it comes to deposits and withdrawals。

The most common way to fund an Irish trading account is by using a debit or credit card。Although customers in the Emerald Island tend to use Mastercard, Maestro and Visa cards, almost all brands of credit cards can be used。American Express Card Usage Is Much Lower。Bank card deposits are efficient, fast and safe.。Transactions are strictly encrypted to protect customers from hackers。

Still, some Irish traders are reluctant to use bank cards。A common alternative in this case is to use digital wallets, such as those offered by major financial service providers such as PayPal, WebMoney, Skrill and Neteller。All four e-wallets are widely accepted by brokers in Ireland。

When initiating an e-wallet transaction, the trader does not disclose any sensitive information, thereby adding additional security。They simply enter the password and username of their e-wallet account and it will be forwarded to the wallet provider's platform。

Another common option for Irish brokers is bank transfers。You can transfer funds from your bank account to the broker's account on the spot at the bank or through the online banking system.。

Unfortunately, this method is not the fastest, and most bank transfers are processed within 2 to 5 business days.。On the bright side, this is usually available for deposits and withdrawals。

Irish traders should choose the local euro as the base account currency。This will avoid them paying additional exchange fees。As for the minimum deposit, it varies depending on the brokerage firm in which it is traded.。

In most cases, the minimum deposit for a standard account ranges from €100 to €500。Some brokers offer small and micro accounts where you can start trading with a much smaller initial investment。

Last but not least, some brokers charge an additional idle fee if a trader's account is dormant for three months or more。Inactivity fees generally start at €10, but the fees are still based on the broker's specific circumstances.。

▍ Ireland popular trading software

As a forex trader, forex trading is more flexible because the market is open 24 / 7 on weekdays。This allows investors to execute trades anytime, no matter what device they choose to use。All reliable Irish brokers are compatible with desktop computers, smartphones and tablets。

However, the quality of your trading experience ultimately depends on the software implemented by your chosen broker。A good trading platform should be easy to use - intuitiveness is an ideal quality in the eyes of both beginners and advanced traders。In addition, the platform should further enable seamless execution of orders and provide users with a set of analysis tools to help them evaluate market trends。

Some Irish-friendly brokers tend to develop platforms in-house, while others opt for third-party software developed by companies such as MetaQuotes.。The Russian company is responsible for developing the world's most popular trading platform MetaTrader 4 and its successor MetaTrader 5。

Which one to choose depends on the type of instrument you intend to trade。MetaTrader 4 is designed for Forex trading。Subsequent versions support other instruments such as bonds, options, stocks and futures.。Either way, users benefit from multiple time frames, technical indicators, different chart types and languages。

Spotware Systems' cTrader platform is next in popularity。The software tends to be overshadowed by the two MetaQuotes platforms, but still has several advantages。Many ECN brokers use cTrader, which provides standard market depth tools that enable users to track market dynamics。

It has a user-friendly charting area that traders can choose to customize。They can choose from multi-chart, free-chart and single-chart modes。The platform allows the use of many different time frames and offers more than 50 technical indicators for market analysis。

Some companies develop proprietary software and then lease it to third-party brokers, as is the case with ZuluTrade。The most prominent feature of the platform is support for social transactions。With this feature, you can follow traders with years of experience behind them and copy trades directly from their portfolios。

Mobile trading in Ireland

Mobile devices are an integral part of today's modern lifestyle。More and more people like to surf the Internet through their smartphones or tablets。The situation is no exception in Ireland, where the number of smartphone users was 3.2 million in 2016 and is forecast to rise to 4.06 million by 2022.。

Irish nationals use mobile devices to surf the web, check email and stay connected to social media platforms。More and more Irish traders are also using mobile devices to trade。The good news is that all major brokers operating in the Irish market have optimized their platforms for use on portable devices。

Even better, the experience on mobile devices is the same as on desktop computers, and traders can choose from a wide range of financial instruments and markets such as spot forex, CFDs, indices, stocks and commodities。

Some brokers have developed proprietary mobile apps, while others prefer to use the MetaQuotes app, which is available for free download on the App Store and Google Play, two official mobile content platforms.。

Either way, mobile traders in Ireland can access real-time quotes, a variety of analysis tools, multiple languages, multiple different time frames, and advanced charting tools in the Forex market anytime, anywhere。With these apps, traders in Ireland stay on top of the latest market trends and prices。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.