IC Markets withdrawal instructions, withdrawal tutorial

IC Markets allows withdrawals via international bank wire transfers, Visa or MasterCard, and other secure credit and debit cards。For traders looking for an easier way to withdraw money, the best choices are PayPal, Neteller, UnionPay, Bpay, FasaPay, POLI, Rapidpay, Klarna, Qiwi and Skrill。

A broker's withdrawal process is one of the most important factors in determining its reliability.。Well, then,What is the withdrawal process for IC Markets??

Among the many Australian brokers,IC Markets is probably one of the most famous。The broker was created by a team of professionals in the financial services industry。At IC Markets, traders can enjoy a number of perks, the most popular of which is its original spread offer。In addition to providing 0 for MT4 and MT5.In addition to the 0 spread, IC Markets also provides the same raw spread for the cTrader trading platform.。IC Markets also offers free VPS for traders who meet certain conditions。

However, if the broker cannot guarantee a reliable withdrawal process, even with low spreads and advanced tools will not meet expectations。In fact, one of the most important factors in determining whether a broker is trustworthy is how they handle the withdrawal process。There are many factors to consider in determining a broker's reliability in handling withdrawals。

有关IC MarketsSome insights on withdrawals

1. Payment Options

Why withdrawal options are so important?There are many reasons for this, but one of the most obvious is to ensure that these methods are available in the country where the trader is located。The most popular way to withdraw money is probably by bank transfer。However, there are also some traders who may prefer the simpler way such asPayPal or other third-party options。In any case, the most important thing is to ensure that the broker offers multiple options。

在在There are many options to choose from in IC Markets withdrawals。IC Markets allows withdrawals via international bank wire transfers, Visa or MasterCard, and other secure credit and debit cards。For traders looking for an easier way to withdraw money, the best options are PayPal, Neteller, UnionPay, Bpay, FasaPay, POLI, Rapidpay, Klarna, Qiwi and Skrill。

Most importantly, withdrawals must be made from the same account that the trader uses as a deposit method。In addition, the country in which the trader is located may affect payment options。

2. Time required for withdrawal

Unlike deposits, broker withdrawals are rarely instant。That said, it's perfectly understandable that traders want to find the broker with the shortest withdrawal time。对于For IC Markets, ordinary withdrawals usually take 1 to 2 business days, and credit / debit card withdrawals take approximately 3 to 5 business days。Unfortunately, international bank wire transfers can take up to 14 days and can add additional intermediary and beneficiary fees to traders.。

It is understandable if traders tend to use e-wallets as a withdrawal option。For the most part, this method may be the fastest way to withdraw money。However, sometimes even with this payment method, the withdrawal process may take longer than usual。In this case, the trader can contact the customer support service。

3. IC MarketsMinimum Withdrawal Amount

Typically, brokers set a minimum withdrawal amount for their traders。但是This is not the case with IC Markets withdrawals。IC Markets does not have a minimum withdrawal amount, which makes traders more flexible when withdrawing profits。Still, IC Markets reminds traders to be cautious when making withdrawals。Depending on the withdrawal amount, bank charges may be higher than the amount expected by the trader。

4. IC MarketsWithdrawal costs

Fees are also considered when withdrawing funds from a broker。It is not uncommon for brokers to charge a certain amount of money for withdrawals。The amount of this fee may vary depending on the method used by the trader。Fortunately, mostNo fees are charged to traders for IC Markets withdrawals。

This includes domestic bank withdrawals, credit and debit cards, and other e-wallets (PayPal, Neteller, Skrill)。Still, not all IC Markets withdrawals are free。International bank withdrawals will be charged A $20 per withdrawal or equivalent currency。As for third-party surcharges, IC Markets is not responsible for paying。

How to get fromIC MarketsWithdrawal

Although the process is very simple, new traders may have some difficulty making withdrawals。For regular customers, may wish to learn from time to time tutorial。To be taken fromIC Markets withdrawals, traders need:

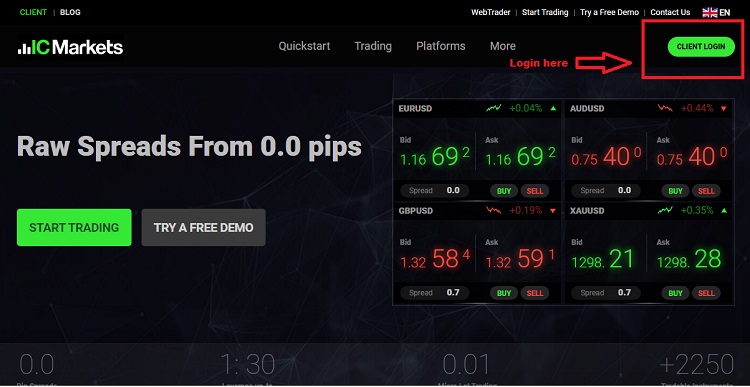

1.Log in to your personal account。

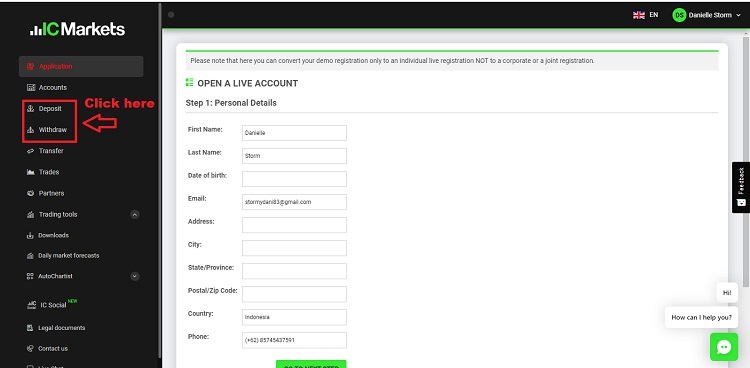

2.Select Withdrawal or Withdrawal of Funds in the menu。

3.Go to the desired withdrawal method。

4.Enter amount to withdraw。Sometimes, traders have to write down the reason for the withdrawal here, so please fill in as required。

5.Submit the request and wait for the funds to arrive。

By the way,IC Markets withdrawal request deadline is 12: 00 EST。Therefore, if a trader submits a withdrawal request before the deadline, the receipt will be processed on the same day。However, if the withdrawal request is submitted after the deadline, the withdrawal will be processed on the next business day。

IC MarketsWhether reliable?

There are many reasons to judge whether a broker is reliable。One of the most obvious reasons for this is their regulatory situation.。Taking into accountEstablished in Australia, IC Markets is regulated by the Australian Securities and Investments Commission (ASIC), one of the most trusted institutions for Forex and CFD brokers.。In addition, IC Markets is a member of the Financial Arbitration Service (FOS), an approved Australian external dispute resolution agency that specialises in resolving conflicts between consumers and financial service providers.。

IC Markets is an online forex broker affiliated with International Capital Markets Pty Ltd。Traders in Australian jurisdictions can access trading services through IC Markets AU, which is based in Australia and licensed by the Australian Securities and Investments Commission (ASIC).。

On the other hand, openingNon-Australian traders with IC Markets accounts will be registered under the Seychelles-based IC Markets SEY and regulated by the Seychelles Financial Services Authority (SFSA).。This dual operation is the result of ASIC's relatively new rules, which prohibit its regulated brokers from offering trading services outside Australia.。

IC Markets is classified as an ECN broker offering clients trading options on platforms such as MetaTrader 4, MetaTrader 5 and cTrader。The broker has also followed market trends with cryptocurrencies as one of its products, enriching an already wide selection of trading assets, including currencies, indices, metals, energy, soft commodities, stocks and bonds.。

The minimum deposit for IC Markets is in the middle of ASIC's regulated brokers, requiring a deposit of $200 per client。The broker also regularly prepares market analysis materials, providing valuable content for trading insights on the official website of IC Markets, proving their ability to provide traders with important content that market experts have specially crafted for them.。

For payment methods,IC Markets allows deposits and withdrawals via wire transfer, credit card, PayPal, Skrill, Neteller, FasaPay, UnionPay, and Bitcoin via BitPay。The more interesting aspect of the broker is its multiple base currencies, including the US dollar, Australian dollar, euro, British pound, Singapore dollar, New Zealand dollar, Japanese yen, Swiss franc, Hong Kong dollar and Canadian dollar。

因为The trading technology of IC Markets is equipped with a co-location server and extremely low latency (especially on cTrader). The broker is well known for its ability to meet the special needs of high-frequency trading and scalping trading。

All in all,IC Markets are ideal for the well-regulated brokers active traders are looking for。IC Markets also has flexibility in basic currencies and payment methods, showing that they welcome traders beyond their home countries.。By the end of 2019, IC Markets had expanded the number of international languages available on its official website to 18, including English, Korean, Indonesian, French, Spanish, Italian, Malay, German and Chinese.。

To ensure that traders' funds are effectively protected, the broker has adopted client fund segregation and insurance safeguards.。This insurance covers up to a maximum amount per trader.$1 million。It applies to all IC Markets raw traders and will only start in rare cases of bankruptcy。

Each broker has its own rules and policies regarding withdrawals。For example, some brokers only allow bank wire transfers, while others offer more withdrawal options。As one of the best brokers in Australia,IC Markets offers traders different options for free withdrawals。However, third parties may charge additional fees, so keep in mind that it may not be 100% free。

Many traders have long felt uneasy when withdrawing their accounts, fearing a scam。But in reality, withdrawal errors are more common than most people think。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.