CCB Q2 revenue reduction and profit increase deposit term trend is obvious, non-performing loan ratio is basically flat.

On August 23, China Construction Bank released its semi-annual report for 2023.。According to the report, CCB achieved revenue of 4,002 in the first half of the year..RMB 5.5 billion, down 0% YoY.59%; net profit of 1,672.9.5 billion yuan, up 3.12%。

On August 23, China Construction Bank (CCB) released its semi-annual report for 2023.。

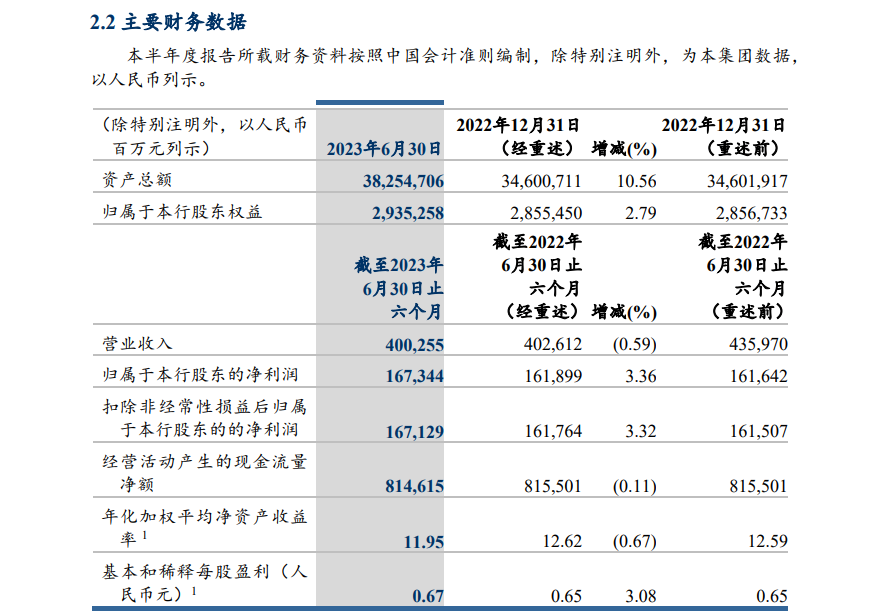

According to the report, CCB achieved revenue of 4,002 in the first half of the year..5.5 billion yuan (RMB, the same below), down 0.59%。Operating profit was 1,969.8.8 billion yuan, up 2.22%。Net profit was 1,672.9.5 billion yuan, up 3.12%。Earnings per share 0.$67, no dividend action。

Net interest income declined in the first half of the year, while non-interest income recorded an increase.

● CCB's main source of revenue, net interest income, achieved 3,121 in the first half of the year.8.5 billion yuan, down 1.73%, accounting for 78% of total revenue.00%。

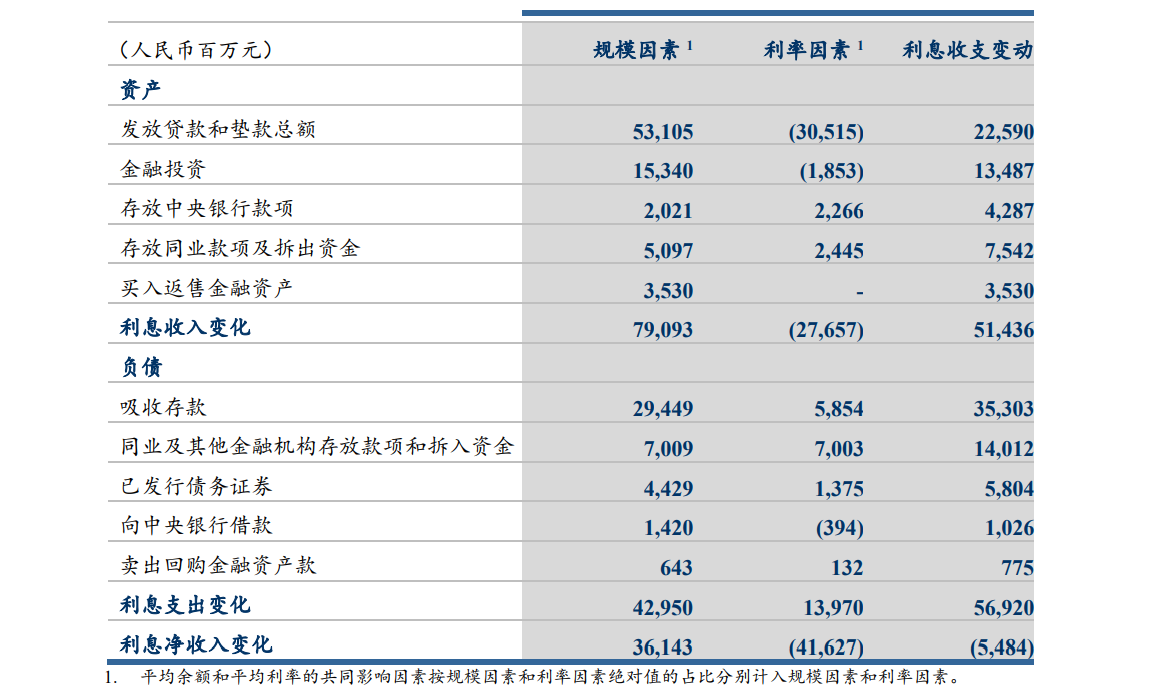

In the first half of the year, CCB's net interest income was mainly affected by interest rate factors, which eventually led to a negative change in interest income and expenditure, a decrease of 54% from the same period last year..8.4 billion yuan。Of which, changes in the average balance of assets and liabilities led to an increase in net interest income of 361.4.3 billion, with changes in average yield and average cost rate driving a decrease in net interest income of 416.2.7 billion yuan。

Specifically, interest income and interest expense。

In terms of interest income, CCB realized interest income of 6,167 in the first half of the year..5.3 billion yuan, an increase of 9.1%。

Among them, as CCB continued to increase its support for the real economy, interest income from loans and advances increased by 5% year-on-year in the first half of the year..47%, to 4,355.7.7 billion yuan。The proportion of interest income from loans and advances is 70..63%。

In terms of interest expense, CCB's interest expense reached 3,045 in the first half of the year..6.8 billion yuan, an increase of 22.98%。

Among them, the proportion of interest expense on deposit absorption is 75..02%。In the first half of the year, CCB's deposit absorption maintained a growth trend, with the average balance of deposit absorption increasing by 14% compared to the same period last year..62%, and the annualized average cost rate also increased by 5 basis points year-on-year.。This led to an 18% increase in CCB's deposit-taking interest expense in the first half of the year..27% to 2,284.9.6 billion yuan。

In addition, CCB's interest expense on issued debt securities in the first half of the year was 260.5.8 billion yuan, up 28.66 per cent, mainly due to a 20 per cent year-on-year increase in the average balance of debt securities issued..82%, while the annualized average cost ratio increased by 19 basis points year-on-year.。

In the first half of the year, CCB issued multiple bonds。In March, CCB issued 20 billion yuan of secondary capital bonds and 10 billion yuan of green financial bonds; in May, CCB issued "biodiversity" and "Belt and Road" dual-theme green bonds abroad, raising a total of about 7..800 million dollars。In addition, CCB completed the issuance of 30 billion yuan of capital bonds with no fixed maturity in July.。

● As another component of CCB's revenue, non-interest income for the first half of the year was 880.700 million yuan, an increase of 3.68%, accounting for 22% of total revenue.00%。Of which, net fee and commission income was 706.01 billion yuan, up 0% year-on-year.50%。Other non-interest income was 174.6.9 billion yuan, an increase of 18.87%。

In terms of regional segments, in the first half of the year, except for the Pearl River Delta and the head office, all regions recorded year-on-year growth in revenue.。In terms of profits, the Pearl River Delta and the head office are also the only regions where profits have declined year-on-year.。

Both corporate and personal deposits achieved double-digit growth, with a clear trend towards regularization.

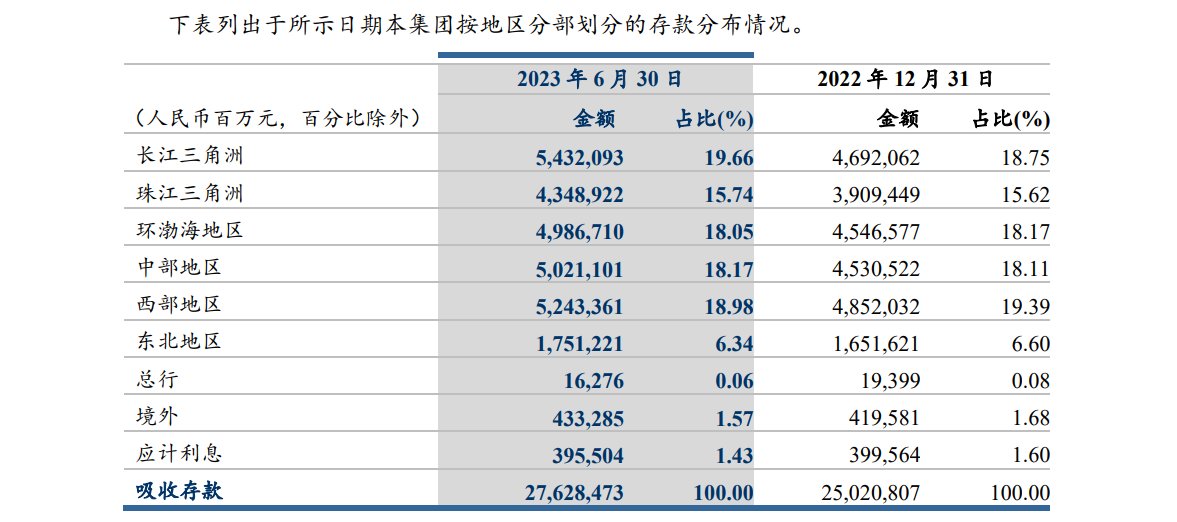

Currently, CCB's deposit taking is mainly divided into corporate deposits (44% of total deposits.28%), personal deposits (52% of total deposits.62%) and deposits taken by foreign machine subsidiaries (1% of total deposits..67%)。

At the end of June, CCB's domestic absorption of corporate deposits was 12.23 trillion yuan, up 10.22%, the proportion of domestic deposits decreased by 0..22 percentage points to 45.70%。Domestic absorption of personal deposits is 14.54 trillion yuan, up 11.19%, with a corresponding increase in the share of domestic deposits of 0.22 percentage points to 54.30%。Deposits taken abroad and by subsidiaries 4,625.8.7 billion yuan, accounting for 1% of total deposits..67%。

Judging from the deposits absorbed by CCB in the first half of the year, the trend of regularization is clear。There were 12 domestic demand deposits at the end of June..51 trillion yuan, up 3.80 per cent, a decrease in the share of domestic deposits 3.12 percentage points to 46.72%。There are 14 domestic time deposits..26 trillion yuan, an increase of 17.64%, with a corresponding increase in the share of domestic deposits 3.12 percentage points to 53.28%。

At the end of June, CCB in China's domestic regions to absorb deposits, the Yangtze River Delta over the western region, took the first place in the first half of the amount of domestic deposits。The top three are the Yangtze River Delta, the western and central regions, accounting for 19.66%, 18.98% and 18.17%。

Non-performing loan ratio was basically flat month-on-month, with asset custody exceeding $20 trillion

In terms of capital requirements, CCB's non-performing loan balance at the end of June was 3,166..3.6 billion yuan, an increase of 238 from the end of the previous year..1.1 billion yuan; non-performing loan ratio of 1.37%, down 0% from the end of the previous year.01 percentage points; proportion of concerned loans 2.50%, down 0% from the end of the previous year.02 percentage points。As of June 30, CCB's leverage ratio was 7.30% to meet regulatory requirements。

At the end of June, CCB's capital adequacy ratio was 17.40%, Tier 1 capital adequacy ratio 13.39%, Core Tier 1 Capital Adequacy Ratio 12.75%, all meet regulatory requirements。Compared to the end of the previous year, the capital adequacy ratio, Tier 1 capital adequacy ratio, and core Tier 1 capital adequacy ratio decreased by 1.02 、 1.01, 0.94 percentage points, the company explained, mainly because of the service to the real economy and help the development of various businesses, risk-weighted assets grew faster, while the impact of dividends, the accumulation of endogenous capital slowed down.。

At the end of June, CCB's total assets were 38.25 trillion yuan, up 10.56%。Cash and deposits with the Central Bank increased by 2,724 compared to the end of the previous year..8.6 billion yuan, an increase of 8.62%。At the end of June, CCB's total liabilities were 35.30 trillion yuan, an increase of 11.27%。

In terms of asset management, as of the end of June, CCB's asset management business was 5.22 trillion yuan, of which the scale of the asset management business of Jianxin Wealth Management, Jianxin Fund and Jianxin Trust was 1.47 trillion yuan, 1.34 trillion yuan, 1.33 trillion yuan。The scale of asset custody exceeded 20 trillion yuan, reaching 20.37 trillion yuan, up 9,754 from the end of the previous year.5 billion yuan。

Online channels active, offline channels continue to optimize

● Online channels

In terms of mobile banking, CCB has 4 personal mobile banking users..5 billion households, up 5.27%。Mobile banking monthly live user peak exceeded 1..3.8 billion households, average monthly live 1.3.2 billion households。Enterprise mobile banking users reached 495.730,000, up 41% from the same period last year.99%。

CCB's "CCB Life" platform has accumulated 1 registered user.1.3 billion households, 3 million daily active users。With the increase in scale, the value of platform traffic conversion was gradually released, and in the first half of the year, 680,000 customers were acquired outside the bank, 3.22 million customers with zero assets were activated, and more than 980,000 "CCB Life Cards" were opened.。In the second quarter, CCB also focused on promoting cooperation with new energy vehicle scenarios to complete the access of GAC New Energy and BYD.。

In terms of online banking, the number of individual online banking users reached 4.100 million households, an increase of 1.49%。Number of corporate online banking users reached 1,328.130,000, up 7% from the end of the previous year.46%。

Significant growth in online payments。Online payment transaction volume in the first half of the year 296.6.5 billion, up 21.43%; transaction amount 11.11 trillion yuan, up 10.33%。The transaction share of payment institutions such as Alipay, Douyin, Meituan, Pinduo and Jingdong ranks first in the industry.。

In terms of remote smart banking services, customers were served in the first half of the year 2.3.4 billion person - times and 98% customer satisfaction.89%。Continue to strengthen the construction of "China Construction Bank Customer Service" WeChat public number platform, the number of public number fans exceeded 26.5 million.。

● Offline channels

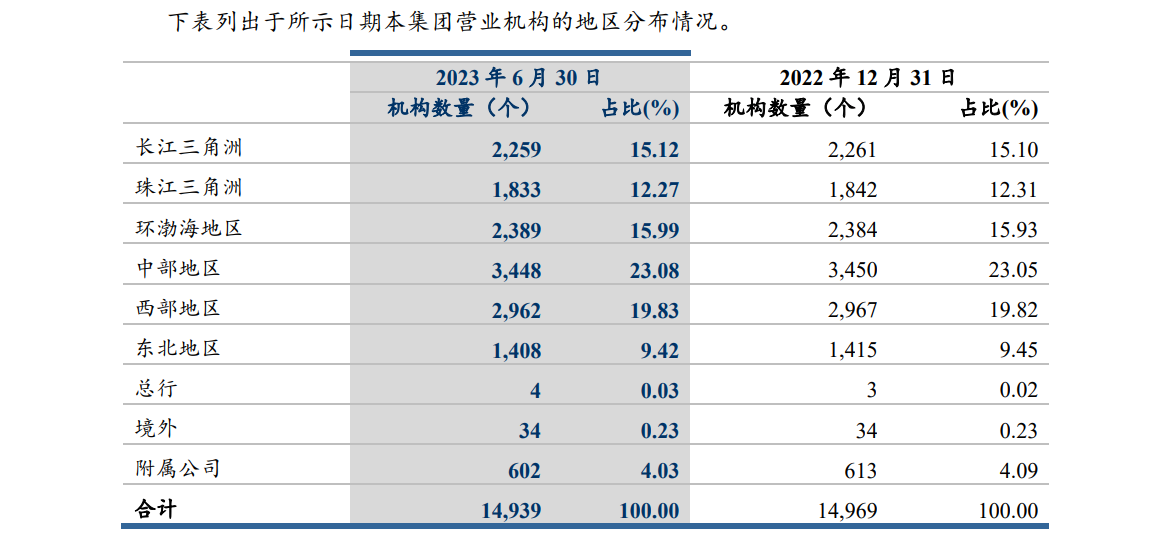

During the reporting period, CCB continued to optimize the layout and construction of its outlets, focusing on ensuring the investment of resources in regional and county channel construction such as Beijing-Tianjin-Hebei, Yangtze River Delta and Guangdong-Hong Kong-Macao Greater Bay Area.。At the same time, increase the city's inefficient and dense network removal and relocation efforts, expand the urban planning of new areas and county network coverage, the end of June county network 4,238, accounting for nearly 30%。

At the end of June, CCB had a total of 14,337 business establishments.。Of these, 14,303 are domestic institutions and 34 are foreign institutions.。The top three regions in the number of CCB's business institutions are the central, western and Bohai Rim regions.。

A number of major banks maintain CCB's "buy" rating.

HSBC Global Research released a research report saying that CCB's earnings per share growth in the first half of the year was solid, loan loss reserves and non-performing loan coverage improved slightly, but the accelerated growth of corporate loans may lead to increased future asset quality risks, medium-term results are slightly negative, maintain CCB's "buy" rating, target price 6.HK $8。

Bank of America Securities, for its part, said CCB's net profit outperformed expectations in the first half of the year, with return on equity down 0% year-on-year in the first half..7 percentage points to 12.1%, Bank of America decided to cut its net profit forecast for 2023 to 2025 by 3 to 7%, lowering its price target from 7.HK $05 to 6.HK $3, maintain "buy" rating, CCB asset quality remains stable despite increase in non-performing loans involving real estate。

Goldman Sachs released a research report saying that CCB's operating profit and net profit before provisioning in the second quarter were RMB136 billion and RMB78 billion, compared to the bank's forecast of RMB142 billion and RMB74 billion.。Rmb44bn was set aside in the quarter, less than the Rmb50bn forecast by Goldman Sachs。Goldman Sachs Says Weak Second Quarter Net Interest Income and Expense Income Meets Market Expectations。Goldman Sachs maintains CCB's "buy" rating with a price target of 5.HK $8 to 5.14 Hong Kong dollars。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.