Solana User Activity 26x Higher Than Ethereum as SOL Price Targets $300

Solana’s activity surge, fueled by the TRUMP token, signals bullish potential. A $300 rally hinges on breaching $270 resistance.

- Solana’s active addresses are 26x higher than Ethereum’s, driven by TRUMP token activity, showcasing the blockchain’s scalability.

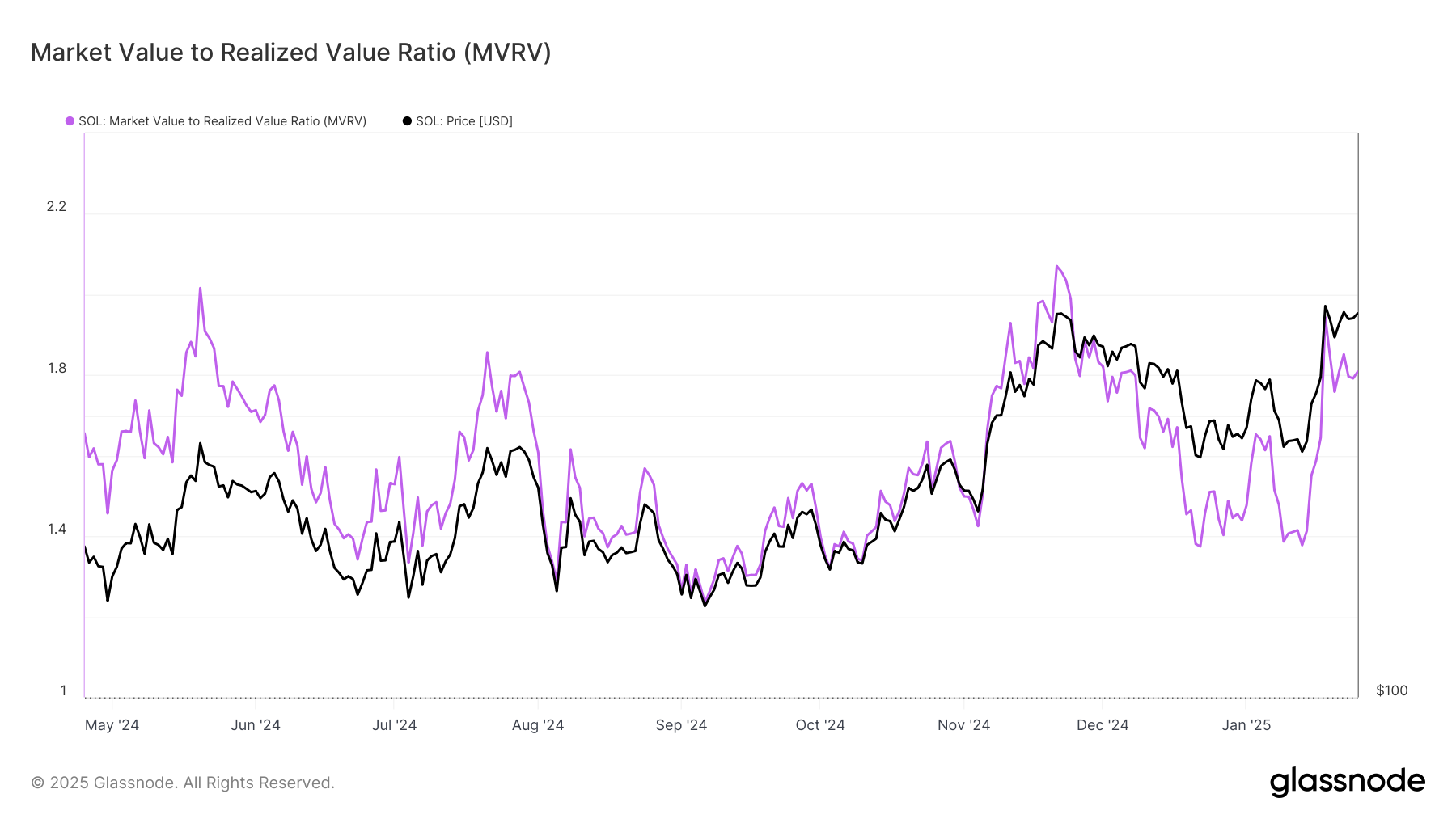

- SOL’s MVRV Ratio of 1.80 indicates stabilization, signaling a healthier long-term rally toward new highs without abrupt retracements.

- Flipping $270 into support could push Solana past its $295 ATH to $300, while failure risks a pullback to $241 or $221.

Solana (SOL) has recently experienced a notable price surge, reaching a new all-time high (ATH) and showcasing increased demand for its ecosystem.

This growth has been partly fueled by the popularity of the OFFICIAL TRUMP (TRUMP) token, which has heightened activity on the Solana blockchain. These developments position SOL as a strong contender to overcome historical bearish trends and sustain its rally.

Solana Overtakes Ethereum

The growing adoption of the Solana blockchain is evident, with active addresses per hour currently 26 times higher than Ethereum. This surge in activity highlights the network’s scalability and efficiency, making it a preferred choice for developers and investors alike.

The launch and rising demand for the TRUMP token have further bolstered Solana’s ecosystem. The increased activity from TRUMP transactions has underscored Solana’s ability to handle high transaction volumes, indirectly boosting its reputation and demand. This rising popularity is a positive indicator of SOL’s price trajectory as the network’s utility continues to expand.

Solana’s overall momentum is reflected in its Market Value to Realized Value (MVRV) Ratio, currently hovering around 1.80. Historically, surpassing this threshold has led to corrections for the altcoin. However, despite crossing this mark, SOL has avoided significant retracements, with its uptrend merely pausing.

This stabilization is a promising sign, as it provides the altcoin with an opportunity to cool off before potentially resuming its rally. While some may view this as a bearish signal, it ultimately supports a healthier and more sustainable price rise in the long term.

SOL Price Prediction: Aiming Beyond The ATH

At the time of writing, Solana is trading at $253, maintaining a strong support level at $241. The primary hurdle for SOL is flipping the $270 resistance level into a support floor, a move that has eluded the altcoin so far.

If Solana manages to secure $270 as support, it could pave the way for the token to surpass its previous ATH of $295 and aim for the $300 mark. Achieving this would require a 17% price increase, a feasible goal given the current bullish momentum and network growth.

On the flip side, a failed attempt to breach the $270 resistance could lead to a pullback. In this scenario, Solana’s price might fall to $241 or even lower to $221, effectively invalidating the bullish outlook. Such a drop would reflect broader market uncertainties, highlighting the importance of sustained buying pressure to maintain upward momentum.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.