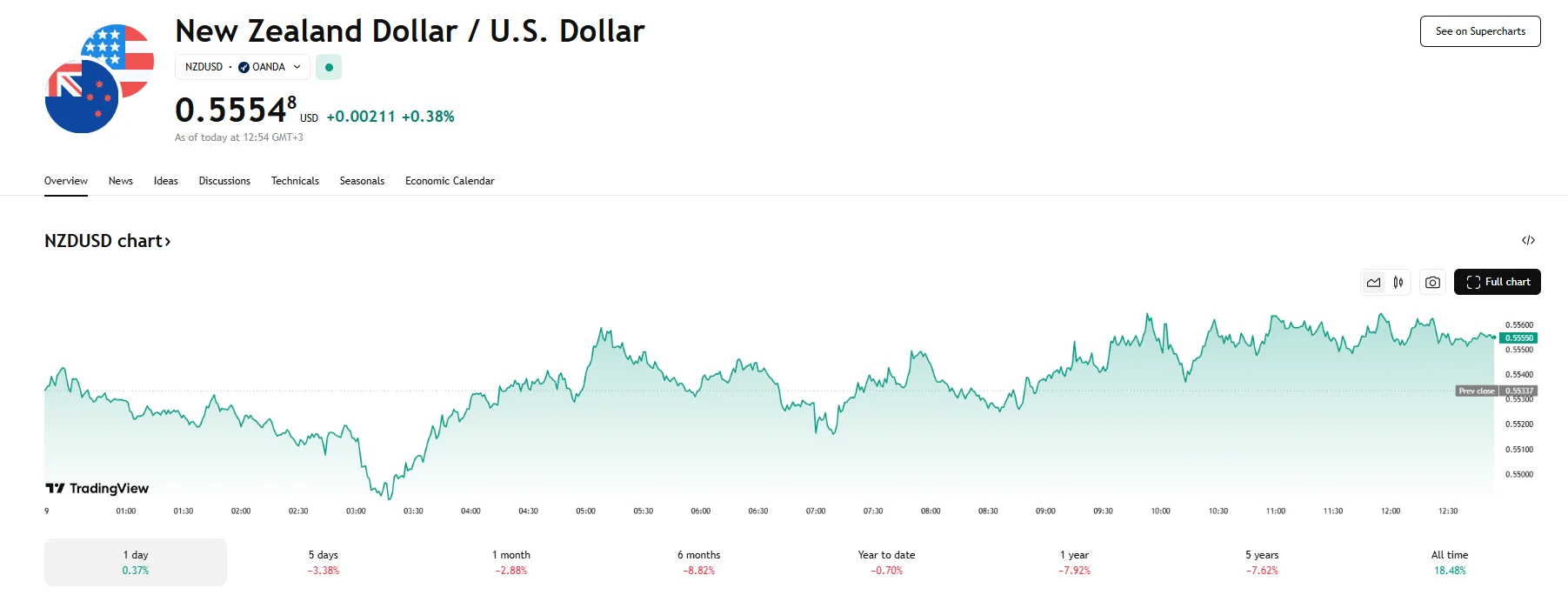

RBNZ Cuts Interest Rates to 3.50%, NZD/USD Surges Above 0.5550 RBNZ Cuts Interest Rates to 3.50%, NZD/USD Surges Above 0.5550

Key momentsThe NZD/USD exchange rose 0.38% to 0.5554 on Wednesday.Global markets struggle as the Trump administration’s import tariffs come into effect.The Reserve Bank of New Zealand opted to reduce

Key moments

- The NZD/USD exchange rose 0.38% to 0.5554 on Wednesday.

- Global markets struggle as the Trump administration’s import tariffs come into effect.

- The Reserve Bank of New Zealand opted to reduce the country’s interest rate by 25 basis points.

Kiwi Dollar Gains Post-RBNZ Rate Cut

The New Zealand dollar achieved an upward trajectory against its US counterpart on Wednesday, defying expectations in the wake of a widely anticipated interest rate reduction by the Reserve Bank of New Zealand (RBNZ). The NZD/USD exchange rate saw a notable appreciation of 0.38%, successfully breaching the 0.5550 threshold.

The RBNZ’s decision to lower the official cash rate was in line with the consensus among market analysts. The central bank implemented a 25 basis point cut, bringing the rate down to 3.50%, after having previously signaled its intention to ease monetary policy in response to growing tariff-driven headwinds across markets the world over.

Wednesday marked the day that Donald Trump’s recently announced tariffs came into effect, and New Zealand was among the numerous countries hit with a new 10% levy on its exports to the US. This development poses a potential threat to New Zealand’s export sector and could weigh on its economic growth in the future.

The RBNZ’s Monetary Policy Committee has also noted that the recently announced increases in global trade barriers weaken the outlook for global economic activity. According to their assessment, these developments pose downside risks, potentially hindering economic activity and fueling inflation within New Zealand. Accompanying statements from the RBNZ indicated a readiness to implement additional rate cuts as the effects of these trade tensions become more apparent.

Despite these highlighted risks and the central bank’s actions, the initial market reaction saw the New Zealand dollar gain ground. The NZD’s momentum could be attributed to hopes of a potential trade deal between the US and countries affected by the tariffs. Moreover, as the rate cut itself was in line with expectations, this might have exerted less pressure on the currency. Some analysts also speculate that the extent of future reductions of rates by the RBNZ might be less aggressive than initially feared by the market.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.