Powell's speech was ambiguous and pessimism eventually prevailed.

Powell said: "A complex mix of old and new issues complicates our task of balancing the risks of tightening monetary policy.。"Given the uncertainties and risks, and the progress we have already made, the Committee is proceeding with caution."。"

On October 19, local time, Federal Reserve Chairman Jerome Powell delivered an important speech at the Economic Club of New York.。In this speech, Powell will once again model two can "traditional art" to carry forward, he said, the Fed will "cautiously" to promote further interest rate adjustment。But he also said the central bank may need to raise interest rates further if economic data continues to be hot。

The US economy is in a strange circle.

In his speech, Powell first elaborated on the complexity of the Fed's decision-making in its current position: the Fed is currently trying to weigh two objectives - both to be able to fully control inflation and to avoid doing so much more to contain the economy that it will cause unnecessary damage to the economy.。

But, for now, the complexity of the economic situation is that - even in the Fed's high interest rate environment, the U.S. economy is still surprisingly strong。Consumer activity remains strong, the labor market continues to be hot, and despite signs of slowing wage growth, the overall growth trend remains upward。The U.S. economy seems to be in a strange circle - no matter how high the policy interest rate, it seems unable to iron out the fiery economic activity in the United States。

On the issue, Powell also acknowledged that "we are concerned about recent data that show the resilience of economic growth and labor demand."。Sustained above-trend growth, or more evidence that labor market tensions are no longer easing, could worsen inflation further and may require further tightening of monetary policy.。"

Powell also called the recent growth data "surprising," saying it came at a time when consumer demand was much stronger than expected - a sign that the U.S. economy seems to be in a strange circle - and that no matter how high policy rates are, they don't seem to be able to iron out the hot U.S. economic activity.。

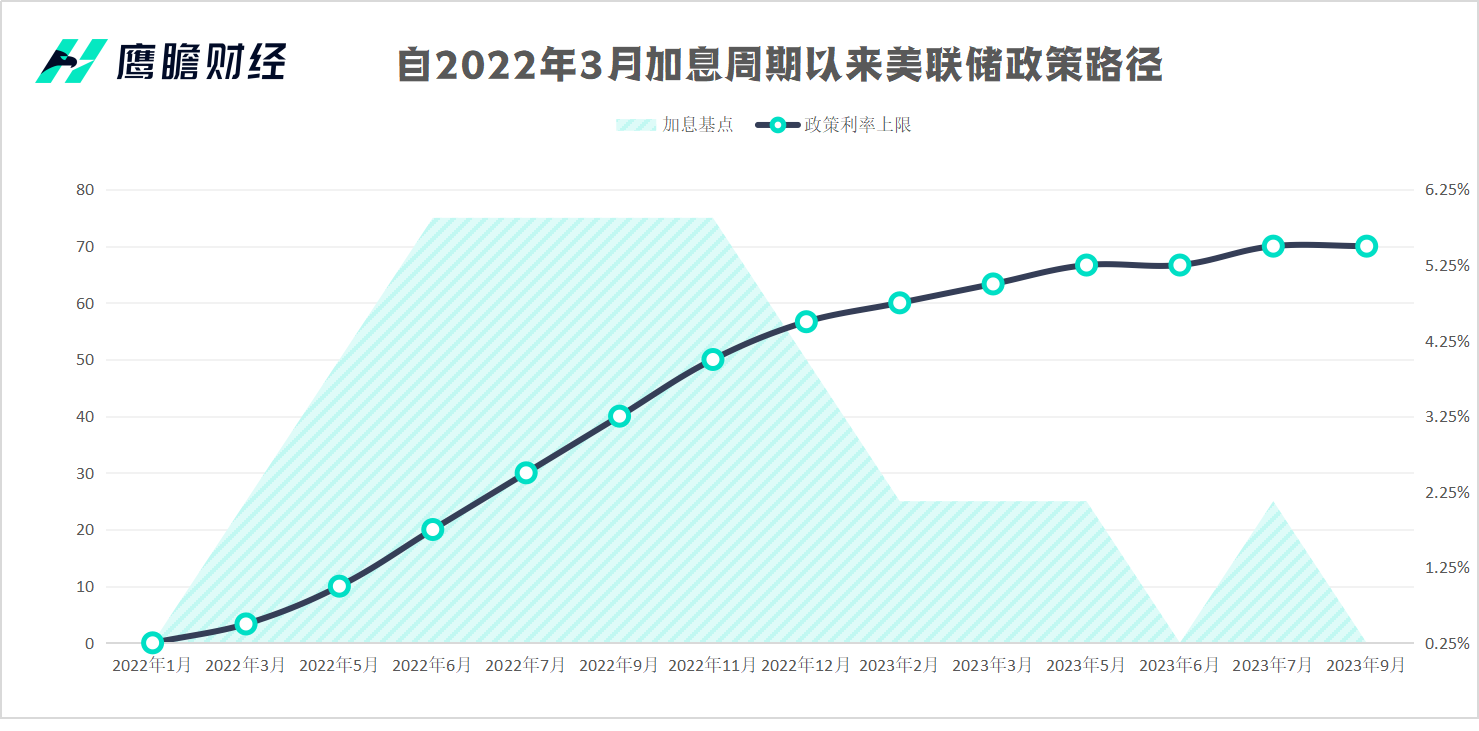

In this context, some Fed officials and economists have suggested that the Fed may need to keep policy rates "higher and longer" in the future.。In Powell's words, (the current economic heat) is due to the fact that we haven't stopped long enough in a high interest rate environment。

But the Fed's protracted rate hikes have not been without accomplishments。Powell revealed that the Fed has sharply raised short-term interest rates over the past period of time, and these moves "may" still be working to slow economic growth.。Importantly, long-term interest rates in the market have risen sharply over the past two months, making it significantly more expensive to borrow to buy a home or car。

In fact, the federal funds rate that the Fed adjusts in every rate resolution is actually the U.S. overnight lending rate, which is the short end of the U.S. money market.。However, the persistently elevated interest rate structure has had an impact on long-term U.S. Treasury and long-term lending rates。This month, U.S. 10-year Treasuries suffered a historic sell-off, and U.S. 30-year mortgage rates reached their highs in recent years。It can be said that the difficulty for Americans to obtain mobility is gradually increasing。

For the reasons for the recent increase in long term rates, Powell noted that there are several possible reasons behind this: high growth, high deficits, the Fed's decision to reduce its own securities holdings, and technical market factors。

Economists: Fed will skip November rate hike by another 25 basis points at the end of the year

At this point, Powell's attitude towards future monetary policy has become somewhat elusive。

At first, the Fed expressed concern about the inflation outlook, saying that it may have to tighten monetary policy further, which is the signal of the eagle; later, Powell began to explain that the cost of access to liquidity in the market is rising, which is consistent with the "monetary policy lag effect" he has repeatedly mentioned in the press conference, which is a dovish statement.。

So yesterday's stock market followed Powell's argument and began to fluctuate up and down, eventually, the S & P 500 closed down nearly 1% and the U.S. 10-year Treasury yield rose above 5% for the first time since 2007.。This suggests that while investors struggle to understand what Powell's comments mean for the current interest rate outlook, pessimism prevails in the end。

Economists said that while the Fed is unlikely to raise interest rates at its upcoming November meeting, Powell's remarks suggest that the bank is highly likely to continue to raise policy rates by another 25 basis points at its December meeting.。Michael Feroli, chief U.S. economist at JPMorgan Chase, said: "He certainly didn't close the door on further rate hikes, but he didn't send any imminent signals either.。

Nick Timiraos, a well-known journalist known as the "New Federal Reserve News Agency," also wrote that Powell continued the comments of his colleagues in recent days, and most of them also said they were prepared to keep central bank interest rates unchanged at the November meeting, partly because the rise in U.S. debt rates over the past month has achieved the effect of raising interest rates.。

Timiraos also said Powell did not announce the end of the rate hike on Thursday because the recent stronger-than-expected economic activity data made it difficult for them to make a decision now.。Earlier this month, the jobs report showed a spurt in non-farm payrolls, and this week's retail sales also continued a series of data-positive performances.。

Finally, Powell said, "A complex mix of old and new issues complicates our task of balancing the risks of tightening monetary policy.。"Given the uncertainties and risks, and the progress we have already made, the Committee is proceeding with caution."。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.