After receiving a capital injection of 1.5 billion euros from Stellantis Group, zero-run cars plunged 10%

On October 26, Zero Run announced that the company has established a global strategic partnership with Stellantis Group。Meanwhile, the Stellantis group will inject about 1.5 billion euros (about 115.800 million RMB)。

On October 26, Zero Run, one of the new forces in Chinese car-making, announced that the company had established a global strategic partnership with Stellantis Group.。The company said the partnership aims to build a highly competitive and efficient electric vehicle business in China and around the world.。

At the same time, the two companies announced that the Stellantis group will inject about 1.5 billion euros (about 115.800 million RMB)。The investment will give Stellantis a stake of approximately 20% in Zero Run, making Stellantis a significant shareholder in Zero Run.。Stellantis Group to Have 2 Seats on Zero Run Car Board。

Zero Run said the proceeds will be used for research and development investment, marketing, capacity enhancement, as well as working capital and general corporate purposes.。

The transaction also establishes that Stellantis Group and Zero Run will form a joint venture called Leapmotor International at a ratio of 51% to 49%.。With the exception of Greater China, the joint venture has exclusive export and sales operations to all other markets around the world, as well as exclusive rights to manufacture zero-run automotive products locally.。The CEO of the joint venture company Zero Run International will be appointed by Stellantis Group。

For Zero Run, this partnership will not only focus on further increasing its sales in China, the world's largest automotive market, but will also rely on the Stellantis Group's mature commercial footprint in other markets around the world to significantly increase the sales of the Zero Run brand in the local market, with the European market being the starting point for its globalization.。

For the Stellantis Group, the company will help Stellantis achieve its electrification goals in the "Dare Forward 2030" strategic plan with the help of the electric vehicle ecology of zero-run vehicles.。The goal is that by 2030, all passenger cars sold by the Group in Europe will be pure electric vehicles, and 50% of passenger cars and light trucks sold in the United States will be pure electric vehicles.。Stellantis Group said it may assemble electric cars for zero-run cars at its own factory.。

The two parties believe that Zero Run's electric vehicle products complement the Stellantis Group's existing technology and brand portfolio, and that they will bring more mobility solutions with price-to-product advantages to customers around the world.。

Carlos Tavares, global CEO of Stellantis Group, said: "With the integration of strong electric vehicle start-ups in the Chinese market, a small number of new electric vehicle companies like Zero Run, which are efficient and flexible, will occupy the mainstream segment of the Chinese electric vehicle market, a trend that is becoming increasingly evident.。We believe now is the perfect time for the Stellantis Group to support it and assume a leading role in Zero Run's global expansion plans。"

Zhu Jiangming, founder and CEO of Zero Run, said: "Today is an important milestone in the history of Zero Run's development, and I am pleased to be able to witness this important moment with Mr. Tang Weishi and his team.。Through our independent and global technology research and development capabilities, Zero Run has brought the best electric vehicle products of the same level to the market in the most cost-competitive way.。We believe that the strong alliance formed in the rapidly changing market environment will bring mutual benefit and win-win partnership to both sides.。Together with the Stellantis Group, we will continue to innovate in the areas of technical and commercial synergies and will sell our zero-run vehicle products worldwide.。"

Tang also said that with this strategic investment, a potential area of Stellantis Group's business model will be developed, and Stellantis Group will also profit in China and other markets through the competitiveness of zero-run cars.。

Zero-run vehicles deliver new energy vehicles in 2022 11.10,000 units, among the first echelon of China's new car-making forces。In the first three quarters of 2023, Zero Run delivered a total of 88,827 units, with an average monthly delivery of nearly 10,000 units.。Among them, 15,800 new cars were delivered in September, an increase of 11.27%, a record high。

At present, Zero Run is currently in mass production and sales of smart pure electric car T03, smart super-enjoy electric SUV C11 and smart luxury electric car C01 three electric vehicles, as well as C11, C01 two range-extending vehicles。In September of this year, Zero Run Auto unveiled the IAA MOBILITY 2023 Munich International Auto Show with its first global product C10 and new technology, opening a global strategy。

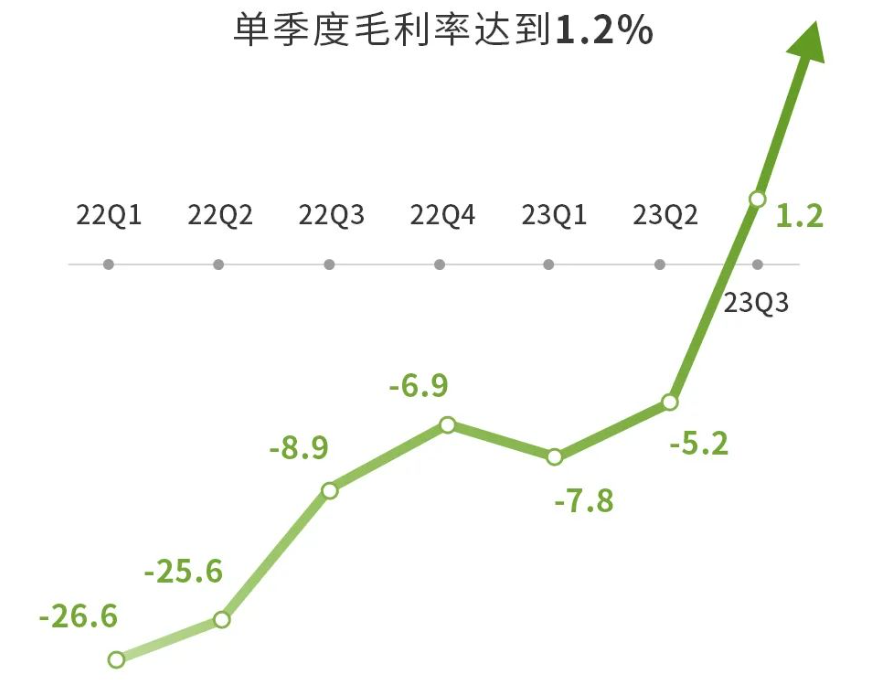

On October 16, Zero Run released its third-quarter earnings report.。Performance data show that the company's revenue in the third quarter was 56.RMB 5.6 billion, up 31% YoY.9%, a new record for single-quarter revenue。Gross margin also turned positive for the first time in the third quarter, reaching 1.2%。

It is worth noting that after the disclosure of the above transaction, Zero Run Motors closed down more than 10% today and is now at 32.HK $8。

The Stellantis Group was founded in early 2021 as a result of the merger of two former Peugeot Citroen and former Fiat Chrysler groups, each more than a century old.。In the first half of 2023, the Stellantis Group achieved net revenue of €98.4 billion and net profit of €10.9 billion, with its 14.4% adjusted operating margin continues to be one of the most profitable companies in the global automotive industry。At this stage, Stellantis is still facing a strike at a U.S. plant, and the company has yet to negotiate effectively with the union.。

In addition, the final completion of this transaction will be subject to customary delivery conditions, including regulatory approval.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.