U.S. December ADP employment data released: services contribute significantly to the number of jobs more than expected

U.S. Service Employment Grows 15 in December.50,000, contributing significantly to ADP's employment surge。

Local time on January 4 (Thursday), known as the "small non farm" of the United States private ADP employment data released。

U.S. December ADP Data Grows

U.S. ADP employment up 16 in December, data shows.40,000, far more than 12 economists.50,000 expected; revised previous value of 10.10,000, compared to the original 10.Decreased compared to 30,000.。

In addition, U.S. job wage growth slowed in December, falling to the weakest level of growth since September 2021, with incumbents' pay up 5.4%, down from 5 last month.6%; job-hoppers' wage growth from 8.3% to 8.0%, the lowest since May 2021。Shortly after the ADP data was released, the United States announced that the number of first-time jobless claims last week was 20..20,000, below expectations of 21.60,000 people。

Nela Richardson, chief economist at ADP, said on the company's website: "Our labor market is returning to pre-pandemic levels.。While wages have not driven recent inflation, wage growth has now fallen back and any risk of a wage-price spiral has all but disappeared。"

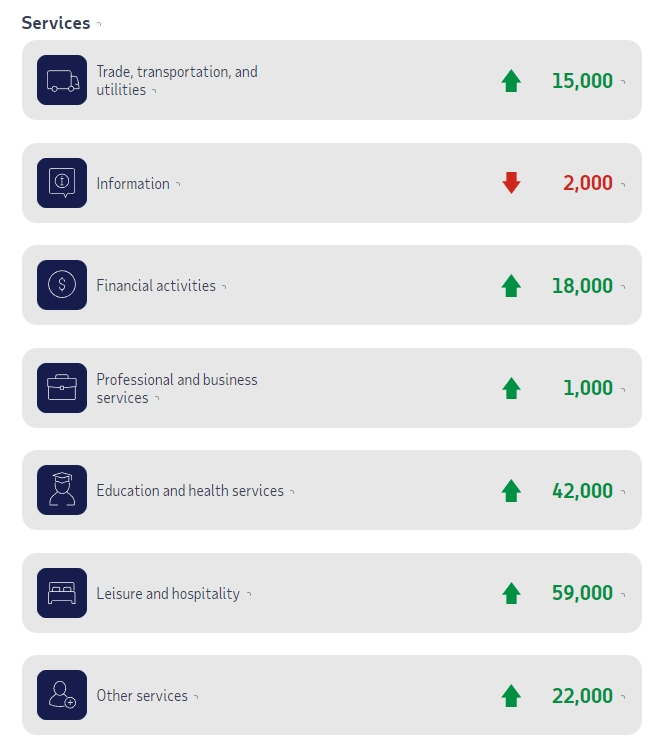

Bright performance in the service sector Small institutions create the most jobs

Specifically, U.S. service sector employment jumped 15 percent in December..50,000, contributing significantly to ADP's employment surge。Of which, new jobs were created in the trade / transport / utilities sector1.50,000; information sector reduces jobs 0.20,000; financial activity sector adds jobs 1.80,000; new jobs in the professional / business services sector 0.10,000; new jobs in education / health services 4.20,000; new jobs in leisure / hospitality sector 5.90,000; new jobs in other service sectors 2.20,000。

December commodity manufacturing for the United States intestinal dry 0.90,000 jobs。Among them, the natural resources / mining sector reduced employment 0.20,000; new jobs in the construction sector 2.40,000; manufacturing job losses 1.30,000。

By Size, Small U.S. Institutions Created 7.40,000 jobs; medium-sized institutions created 5 in Dec..30,000 jobs; large institutions created 40,000 in Dec.。In terms of wages, wages are rising in large, medium and small U.S. institutions。Among them, the United States size of 50-249 institutions have the largest salary increase, with an annualized increase of 5.7%; 1-19-person institutions have the smallest pay increases, with an annualized increase of 4.6%。

Market concerns about the Fed's delay in cutting interest rates set its sights on non-farm data

On Wednesday, the Federal Reserve released the minutes of its December 12-13 policy meeting.。Fed officials appear increasingly convinced that inflation is under control and "upside risks" are diminished, and they are increasingly concerned that "overly restrictive" monetary policy could harm the economy, the minutes show.。However, Fed officials also noted that participants noted the "unusually high level of uncertainty" about the outlook for rate cuts and that further rate hikes are still possible.。

Fed Balkin also stressed the possibility of further rate hikes by the bank.。Barkin said a soft landing was increasingly likely, but by no means certain.。Demand, employment and inflation have all soared but now appear to be returning to normal。He said strong demand does not solve the problem of above-target inflation, which is why the possibility of further rate hikes remains。

Market fears that the surge in U.S. employment data will re-ring the inflation alarm for the Fed and slow the rate cut process。

The Bank of China said the minutes of the Federal Reserve's December 12-13 meeting, released on Wednesday, showed that policymakers are increasingly aware that inflation is under control and are concerned about the central bank's "excessive restrictions" on the risks of monetary policy to the economy.。The content of the minutes seems to show more clearly that Fed policymakers are also beginning to acknowledge that inflation is better controlled and are also beginning to worry about the impeding impact of high real interest rates on the future development of the economy.。

The bank also said that Thursday's good performance of private private employment data indicates that the U.S. economy is still in a healthy state and may be promising to achieve the economy's soft landing target.。As a result, even if the Fed enters the interest rate cut phase this year, it is expected to be a slow rather than a precipitous downgrade.。

It is reported that the market has now turned its attention to the upcoming U.S. December non farm data released later today。U.S. nonfarm payrolls to fall back to 16 in December, according to economists.80,000, expected to be 19.90,000 people reduced by 3.10,000。

B.Art Hogan, chief market strategist at Riley Financial, said: "If we see non-farm payrolls numbers above 250,000, then one might think that we have to cancel bets on a March rate cut and possibly cut rates once this year.。Frankly, we know the Fed has now finished raising rates。If so, it's clear that good news may be good news。It's just that the news is good enough that hopes of a rate cut may be pushed into the second half of the year。"

As of press time, according to CME "Fed Watch": the Fed kept interest rates at 5 in February..25% -5.The probability of the 50% interval being constant is 93.3%, the probability of a 25 basis point rate cut is 6.7%。The probability of keeping interest rates unchanged by March next year is 35.4%, with a cumulative probability of a 25 basis point cut of 60.4%, with a cumulative probability of a 50 basis point rate cut of 4.2%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.