Better late than never! The Riksbank of Sweden announces a rate cut of 25 basis points, with the possibility of three more cuts within the year.

In its statement, the Riksbank of Sweden indicated that if the inflation outlook remains unchanged, the policy rate may be lowered by two to three more times this year.

The European rate cut matrix adds another country.

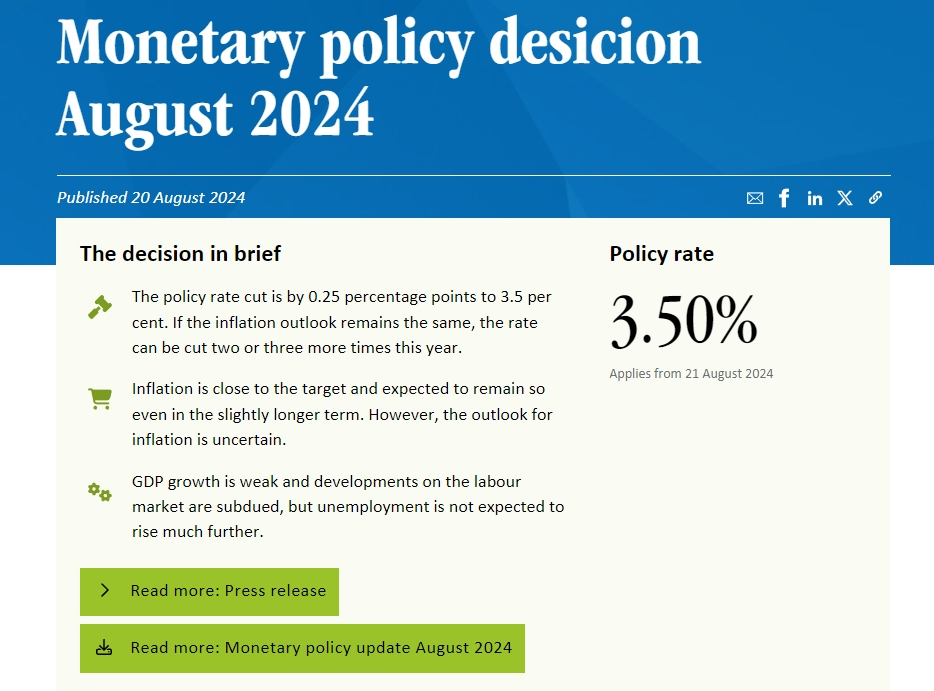

On August 20th, against the backdrop of economic slowdown and inflation below target, the Riksbank of Sweden took rate cut measures, lowering the benchmark interest rate by 25 basis points to 3.5%. This decision was in line with market expectations. The central bank also hinted that if the inflation outlook remains unchanged, there may be further rate cuts of two to three times in the second half of this year. This move is an adjustment of monetary policy taken by the Riksbank under the dual influence of economic pressure and declining inflation rates.

The Riksbank's decision was made against the backdrop of a weak economy. Although Riksbank Governor Erik Thedeen and his colleagues have been cautious in monetary policy, the increasing calls for rapid easing of monetary policy have grown nationwide as inflation has been below the bank's 2% target since June. Almost all analysis institutions anticipated this rate cut before the announcement of the decision.

In its statement, the Riksbank pointed out that if the inflation outlook remains unchanged, the policy rate may be lowered two to three more times this year, indicating the central bank's concern about the current economic situation and its commitment to the inflation target. Compared with the assessment in June, this decision shows that the central bank has accelerated the pace of adjustment of monetary policy.

However, this decision is not without controversy. Some critics believe that the Riksbank's rate cut may exacerbate currency devaluation, thereby putting upward pressure on the prices of imported goods. For example, the Swedish krona has depreciated by 1.3% against the euro since June, which may pose a challenge to the central bank's efforts to control inflation. On the other hand, the rate cut expectations of the eurozone and the United States may provide some comfort to the Riksbank, as the rate cuts in these regions may reduce concerns about the devaluation of the Swedish krona.

It is worth noting that the Swedish economy is more sensitive to monetary policy than many European countries because its mortgage interest rates are usually fixed for relatively short periods. Although the easing expectations earlier this year had boosted the mood of the Nordic economy, economic data show that the expected recovery has not yet gained momentum. Sweden's second quarter GDP preliminary value even showed a considerable contraction, and labor market statistics also show that unemployment is rising. In summary, the economic outlook for Sweden is not optimistic.

In addition, the Riksbank's somewhat sluggish rate cut decision also contrasts with the monetary policy adjustments of other countries. For example, the Swiss National Bank became the first major Western central bank to cut rates two months ago, followed by the European Central Bank and the Bank of England, while the Riksbank waited until almost September to start cutting rates, which has caused dissatisfaction in the market.

Despite the decision to cut rates, the Riksbank still warned that there is uncertainty in the inflation outlook, whether it rises or falls. The central bank said that factors that may currently cause Swedish inflation to heat up again include: the strong performance of the US economy, geopolitical tensions, and the weakening of the Swedish krona exchange rate. Therefore, the next monetary policy adjustment will be characterized by caution, gradually lowering the policy rate.

After the interest rate decision was announced, the Swedish krona quickly fell against the euro, with a drop of 0.1%, to 11.4401, because the narrowing interest rate gap with the European Central Bank is considered to put pressure on the future trend of the Swedish krona. This risk-sensitive currency has rebounded from the lowest level this year set after the market crash at the end of July and has become one of the best performing currencies in the G10 group so far in August.

For this rate cut, Danske Bank A/S said that compared with our base forecast (that is, an additional reduction of two to three times), the Riksbank's rhetoric is slightly dovish but in line with current pricing. The bank also said that the exchange rate changes should not be understood as an overly dovish stance by the central bank.

Swedbank AB also said that the central bank's interest rate guidance is "soft", and they predict that the central bank will cut rates three more times in the remaining three meetings of this year (September, November, and December) to release a more relaxed monetary indicator.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.