Best Forex Broker in Pakistan (2024 Edition)

How to invest in Forex trading in Pakistan?Which broker has the lowest commission in Pakistan?

Foreign exchange trading in Pakistan is not only legal, but also increasingly popular with residents as the economy develops。Pakistan is one of the "next 11 developing economies" and is expected to become one of the largest economies of the 21st century.。

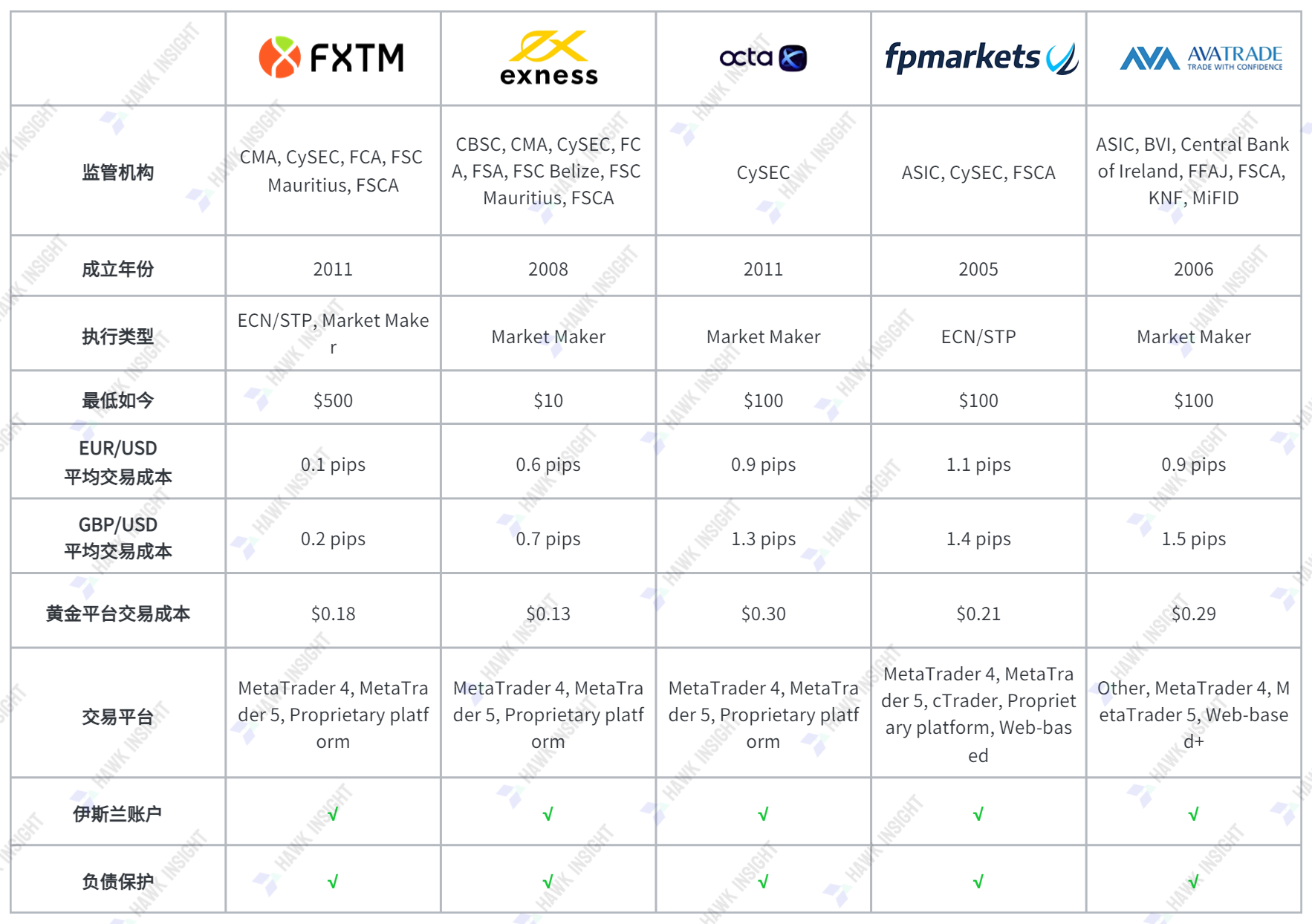

▍ Pakistan Best Broker Comparison

○ FXTM

FXTM offers no overnight interest accounts for Muslim traders。The fees that may be incurred if a user holds multiple leveraged positions overnight and exceeds the daily limit without overnight interest are also transparent。As a result, FXTM has become one of the most transparent brokers in Qatar's foreign exchange trading.。

At the same time, FXTM is one of the cheapest forex brokers in the whole industry, with 0 for traders through the "Advantage account" account..Original spread from 0, every 1.0 Trading bill fee commission for standard lots at 0..$80 to $4.Between $00。

Traders can use the MT4 / MT5 trading platform, where FXTM upgrades MT4 via the Pivot Point Strategy plugin, and mobile traders can use the FXTM Trader app。

| Advantages | Disadvantages |

| Excellent commission-based forex pricing environment and transparency | No Cryptocurrencies, Limited Commodity Options |

| Upgraded MT4 / MT5 Trading Platform and Proprietary Mobile Trading App | |

| Quality market research and education content for junior traders | |

| Proprietary replication trading platform and high leverage |

○ exness

Exness official website has been localized to 15 languages, customer service across 13 languages, of which 11 languages service time is 24 hours a day, five days a week, and English and Chinese customer service is 24 hours a day, seven days a week。

Exness uses the leading trading platforms in the global marketplace, including MT4 / MT5 and web terminals。Traders can develop and implement trading strategies of various levels of complexity through MetaTrader 4, as well as submit most types of trade orders by using both order execution methods, instant execution and market execution.。

| Advantages | Disadvantages |

√ 24 / 7 multilingual customer service |

* No education for beginners |

| √ Multi-regulated broker with excellent order and volume statistics | |

| √ High transparency and financial audit of the big four accounting firm Deloitte | |

| √ Instant withdrawals from trusted brokers with numerous payment processors |

○ OctaFX

OctaFX offers traders a very competitive choice of cryptocurrencies, one of the most competitively priced Forex brokers。Its commission-free cost structure is from 0..6 pips (or $6 per standard hand.00) start, while the MT5 trading platform it offers does not charge any overnight swap fees, providing a unique advantage for leveraged overnight trading strategies。World Finance names Octa Islamic account as best Islamic forex account in 2020。

In addition to the core MT4 / MT5 trading platform, OctaFX also offers its proprietary mobile app。This, together with its internal copy trading service, provides a competitive solution for Indonesian traders。The minimum deposit of $100, the maximum leverage ratio of 1: 500 and the generous bonus together ensure its competitive advantage.。

| Advantages | Disadvantages |

√ Quality educational tools and generous bonuses |

× Asset Selection Priority |

| √ Minimum deposit amount of $100 and maximum leverage ratio of 1: 500 | |

| √ Proprietary Copy Trading Service and Mobile APP | |

| √ No commission, no swap cost structure |

○ FP Markets

FP Markets traders benefit from 12 plug-in upgrades for MT4 / MT5 as well as Autochartist and Trading Central。FP Markets also offers cTrader, which ensures that traders can choose their preferred algorithmic trading platform, as well as an integrated copy trading service。The MAM / PAMM module supports traditional account management services, and replication traders can try FP Markets' proprietary social trading solution, Myfxbook Autotrade, or the subscription-based Signal Start.。

FP Markets can offer swap-free Islamic accounts on request, which requires onboarding team checks to ensure non-Muslim traders do not abuse swap-free offers。

| Advantages | Disadvantages |

| Optional trading platform and auxiliary trading tools | Providing Iress is subject to geographical restrictions |

| Competitive cost structure and superior asset selection | |

| Low minimum deposit requirements and leverage of up to 1: 500 | |

| Perfect supervision, trustworthy |

○ AvaTrade

AvaTrade offers a wide range of available trading platforms and investment options while being commission-free。Traders can choose MT4 or MT5 according to their needs, and MT5 has been upgraded with the Guardian Angel plugin。Both MT4 and MT5 support algorithmic trading, with MT4 being widely used in the industry to support copy trading capabilities。Users who are used to trading on the PC side can use WebTrader, and AvaTradeGO is a great choice for mobile traders.。

Options trading is available using the proprietary AvaOptions platform, with both Ava Social and DupliTrade meeting the needs of replication traders.。It also offers swap-free Islamic accounts, which are important factors in AvaTrade's ranking in Forex trading.。

| Advantages | Disadvantages |

| Provide high-quality education services through SharpTrader | Transaction costs are competitive, but nothing special |

| A variety of trading platforms to choose from to meet various trading needs | |

| Broad asset selection and cross-asset diversification opportunities | |

| Trusted Broker Regulated by Central Bank |

How to Start Forex Trading in Pakistan

Although Pakistan does not have a reputable international forex broker, Pakistani traders are not restricted from opening trading accounts with forex brokers in other countries, thus meeting the needs of Pakistani forex traders.。There are two facts to consider when looking for a top Forex broker in Pakistan:

First, there is unlikely to be a Pakistani rupee (the country's official currency) account, so currency exchange may be required for transactions;

Second, Urdu is the official language, but many international brokers may not offer Pakistani forex trading services in Urdu.。

Pakistan, with a population of over 22,000, is a huge growth market。The tech-savvy young population is likely to allocate spending power to foreign exchange trading, which is a sought-after market due to lower capital requirements for starting portfolios。Our "Best Forex Trading Brokers in Pakistan" list will provide a good start for traders to choose the right broker and start their forex trading journey。

Here are the common steps that a novice trader in Pakistan must follow to successfully navigate the market。

○ Opening foreign exchange accounts in Pakistan

All brokers can process an account application through an online application, which usually takes only a few minutes to complete。Regulated brokers must comply with AML / KYC requirements。In general, a copy of the trader's ID card and a certificate of residence not exceeding three months will meet the requirements。

▍ Pakistan which trading application APP best?

It depends on personal preference。Some forex brokers are better suited to choose a trading strategy than others。Different traders have different requirements, but here are the aspects that each trading app should provide traders to rank among the best。

The core content that every trading application must provide for traders:

✔ The most advanced trading platform with full support for algorithmic trading;

FX traders should look for an upgraded version of the MT4 / MT5 core trading platform, as most platforms offer core versions that are sub-standard solutions.

✔ Low transaction costs, EUR / USD 1 standard lot at 4.$00 to $7.Between $00, the above prices are expensive, regardless of how the Forex broker advertises it.

Business-friendly regulation or membership in the Hong Kong Financial Commission, and third-party excess loss insurance;

✔ Low minimum deposits, support the strategy of building a portfolio through monthly deposits;

✔ Low-cost online payment processors offer flexibility to traders, and cryptocurrency deposits are an added bonus。

Needs attention:

✔ Novice traders can benefit from high-quality educational platforms, while research can provide trading ideas for forex traders without profitable strategies.

✔ Algorithmic traders should focus on API trading and free VPS hosting services;

✔ Scalpers need a cash rebate scheme based on transaction volume。

Is Forex Trading Legal in Pakistan??

Despite some confusion in the online forex trading community, forex trading is legal in Pakistan。The Securities and Exchange Commission of Pakistan (SECP) is responsible for regulating the domestic financial market, including foreign exchange transactions, and international brokers can accept foreign exchange traders from Pakistan without the need to obtain a license from the SECP, thus not restricting Pakistani resident foreign exchange traders from opening offshore foreign exchange accounts.。Some brokers choose not to accept Pakistani forex traders for undisclosed reasons。

Pakistan has no restrictions on foreign exchange transactions, and the SEC has adopted a relaxed regulatory approach to foreign exchange transactions, but has stepped up efforts to reduce money laundering。Pakistan is one of the "next eleven" emerging economies, and as the country's overall prosperity continues to increase, interest in foreign exchange trading has risen.。This is an important growth market for forex brokers who understand the needs of Pakistani forex traders where copy trading and managed account trading are the main strategies。

Foreign Exchange Regulations of Pakistan

The Securities and Exchange Commission (SECP), which oversees foreign exchange transactions in Pakistan, operates in Islamabad and oversees the banking, insurance and other sub-sectors of the financial system.。International brokers do not need to be licensed by SECP to accept Pakistani forex traders unless they have a physical office in Pakistan。

▍ Verify SECP authorization

The SECP does not maintain an online database as most regulators do, but traders can contact the SECP to verify that the company is authorized.。

▍ Which Forex brokers accept Pakistani Rupee (PKR)?

No international Forex broker offers Pakistani Rupee (PKR) as account base currency。Many brokers allow bank wire transfers or credit / bank card deposits in Pakistani rupees and convert them to the base currency of the selected account。Currency exchange incurs additional fees, which Pakistani forex traders should take into account when choosing a deposit method。

Resident foreign exchange traders in Pakistan should opt for a basic US dollar account, as more than 80 per cent of foreign exchange transactions are denominated in US dollars, thus reducing the impact of currency exchange on trading profits and losses.。With multi-currency accounts from local banks or online providers, traders can significantly reduce currency exchange fees。

The Risks of Foreign Exchange Trading in Pakistan

The foreign exchange market is the most liquid market in the world, with nearly $7 trillion traded every day.。Therefore, liquidity is a risk for all traders, but it also brings opportunities。New retail traders may struggle with technical terms, but glossaries can make up for that。The biggest risks of trading come from traders, including lack of discipline and patience, lack of funds to trade, unrealistic expectations, and lack of attention, focus and appreciation for forex trading。

▍ FAQs

○ How to invest in Forex trading in Pakistan?

You must select a forex broker - preferably a regulated international broker - to open an account and inject capital。

○ Which broker is best suited for Forex trading in Pakistan?

All five brokers in our list of top five best Forex brokers in Pakistan are the best to trust。

○ Can I trade forex with $10??

While $10 is enough to fund an account at some forex brokers and to open a small position, it is not enough for normal forex trading unless you use a nano account.。

○ Is foreign exchange income taxable in Pakistan??

In Pakistan, foreign exchange earnings are taxable and foreign exchange traders residing in Pakistan must be tax filers under the Finance Act 2018。Forex traders should consult a qualified professional with tax assistance to ensure that traders comply with local laws and regulations。

Does Pakistan ban foreign exchange transactions??

Foreign exchange is not banned in Pakistan, but must be done through an onshore broker within Pakistan.。

○ What time does Pakistan's foreign exchange market open?

Since the foreign exchange market is a decentralized over-the-counter market, it is traded five days a week, 24 hours a day.。In each country, the opening hours of the domestic stock market are usually the most active times for domestic activity。In Pakistan, the opening hours are from 9: 15 a.m. Monday to 5: 30 p.m. Thursday and from 9: 00 a.m. to 6: 30 p.m. Friday。

○ How to withdraw money from a foreign exchange broker in Pakistan?

Each broker lists the payment processors it supports。They always include bank and credit / debit cards。Many brokers offer modern online payment processors that reduce transaction costs and processing times。

○ How to invest foreign exchange in Pakistan?

The most convenient way is to open an account with a reputable foreign exchange broker with low transaction costs, low deposit requirements, low payment processing costs.。

What does SECP mean??

SECP is short for "Securities and Exchange Commission of Pakistan"。

○ Who does SECP supervise?

The Securities and Exchange Commission of Pakistan (SECP) oversees capital markets, financial companies, insurance companies and the corporate sector in Pakistan。

○ What are the aims and objectives of SECP?

The aims and objectives of SECP are:

- Protecting the rights of investors

- Developing an efficient and dynamic regulatory framework

- Maintaining orderly, efficient and fair capital markets

- Promoting a strong insurance and corporate sector Promoting capital formation

Who is Pakistan's biggest broker??

No detailed information about Pakistan's largest broker, it also depends on the indicator that defines Pakistan's largest broker。As forex brokers do not provide a breakdown of their traders, it is not possible to draw conclusions from Pakistan's largest broker。

○ Which broker has the lowest commission in Pakistan?

FXTM offers the lowest commission in the industry, with commissions as low as 0 per lot for active traders.$80 compared to an industry-standard commission of 6 on competitively priced forex brokers.00 美元。FXTM maximum commission of 4 per lot.00 dollars, cheaper than any competitor。

○ Which is the number one trading application APP in Pakistan?

As MT4 is the leading trading platform in the industry, the MT4 mobile app is still the number one app in Pakistan, but there is no detailed data information.。

▍ Summary

Pakistan is a huge growth market for Forex trading and the improvement of economic conditions will boost the growth of online Forex trading in Pakistan。So be cautious if something sounds too good to be true, especially from unverified or unregulated sources.。Perform proper due diligence when choosing a forex broker or pick one from our list of best forex brokers in Pakistan。

If you are unsure about the legal aspects, you should consult a professional who is well versed in Pakistan's forex trading legal services。Most Forex brokers accept traders living in Pakistan。Invest in your education, make sure you have enough money to trade, and develop a deposit plan。Patience and discipline will help you become a profitable forex trader, but you have to put aside unrealistic expectations in your trading strategy。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.