Best Forex Broker in UAE (2024 Edition)

Our team of expert editors reviewed dozens of regulated online brokers and trading apps for traders in the UAE。The main purpose of this guide is to help you find the right trading platform。

Foreign exchange (currency) trading in the United Arab Emirates is popular among residents。While forex brokers are advised to accept United Arab Emirates residents as clients, they are not required to be authorised by the Securities and Commodities Authority (SCA).。(The Securities and Commodities Authority is the financial regulator of the United Arab Emirates。)

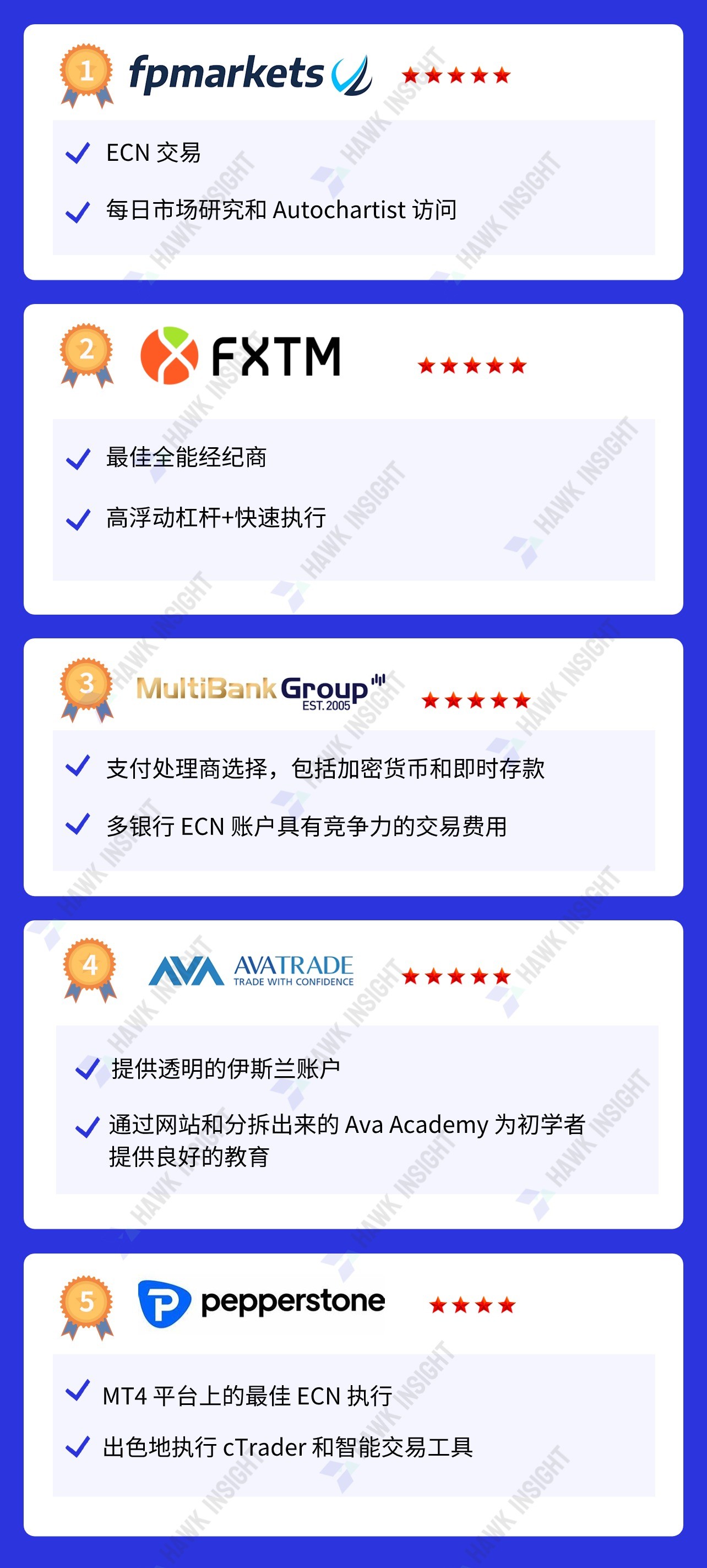

FP Markets: ECN trading leverage up to 1: 500。

FXTM Fortis: Best All-round Broker with High Floating Leverage and Fast Execution。

MultiBank Group: Deep Liquidity, No Trading Restrictions。

AvaTrade: highly regulated, with a choice of fixed or floating spreads。

Pepperstone: Excellent ECN execution on the MT4 platform。

▍ UAE Best Broker Comparison

○ FP Markets

There are many top Forex and CFD brokers in the UAE for traders to choose from。These include one of the world's most popular forex and CFD brokers FPMarkets。Founded in 2005 and headquartered in Australia, FPMarkets offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms as well as WebTrader and IRESS platforms.。Customers can trade more than 10,000 different stocks, as well as more than 60 forex currency pairs and crosses, five cryptocurrencies, 11 stock indices, all major commodities, and many of the top publicly traded stocks traded on the Sydney and Hong Kong stock exchanges.。

| Advantages | Disadvantages |

| Optional trading platform and auxiliary trading tools | Providing Iress is subject to geographical restrictions |

| Competitive cost structure and superior asset selection | |

| Low minimum deposit requirements and leverage of up to 1: 500 | |

| Perfect supervision, trustworthy |

○ FXTM · Futto

Forex traders in the UAE have many top Forex brokers to choose from and have a lot of leeway to trade in Forex, CFDs, Cryptocurrencies and more。Since its inception in 2011, the range of products offered has been quite wide, including many popular cryptocurrencies, 62 currency pairs and crosses, 11 stock index CFDs, 172 stock CFDs and 3 commodity CFDs.。Available bundled commodities include gold, silver, natural gas and crude oil。In addition, FXTM allows customers to trade shares that are not wrapped in CFDs, allowing traders to own shares directly and legally (buy shares), just as they do with traditional stockbrokers.。The FXTM brand consists of three main operating bases: namely FXTM Mauritius, FXTM Cyprus and FXTM UK。

| Advantages | Disadvantages |

| Excellent commission-based forex pricing environment and transparency | No Cryptocurrencies, Limited Commodity Options |

| Upgraded MT4 / MT5 Trading Platform and Proprietary Mobile Trading APP | |

| Quality market research and education content for junior traders | |

| Proprietary replication trading platform and high leverage |

○ MultiBank Group

MultiBankFX meets 10 regulatory requirements with offices in 20 countries, ensuring clients have an unparalleled global network with deep liquidity pools in major financial centres and core emerging markets。Traders can use the MT4 / MT5 trading platform (full support for algorithmic trading) and proprietary copy trading services。The asset selection includes 55 + currency pairs and 20,000 + equity CFDs and ETFs, while cryptocurrency traders have access to 11 highly liquid currencies.。MAM / PAMM accounts for traditional retail account management, VPS hosting for algorithmic traders, FIX API trading for advanced trading needs with customized solutions。In addition, there is a high-paying partner program。

| Advantages | Disadvantages |

| 20,000 assets with extensive coverage of financial markets | Access to the original spread requires a minimum deposit of $5,000 in the ECN account |

| The original spread is from 0 o'clock and the maximum leverage is 1: 500 | |

| MAM / PAMM account and proprietary copy trading platform | |

| ECN trading with deep liquidity, no need to re-quote |

○ AvaTrade

AvaTrade ranks among the best Forex brokers in UAE due to its choice of trading platforms。In addition to MT4 / MT5, there are Ava Options, Ava Social, WebTrader and AvaTradeGO。WebTrader and AvaTradeGO embed Trading Central services to give traders an advantage。Guardian Angel plugin upgrades MT4 / MT5 while fee-based Ava Protect insurance policy protects against trading losses。

Traders receive an affordable commission-free cost structure with a balanced asset selection including options, cryptocurrencies and ETFs。AvaTrade offers VPS hosting for 24 / 5 low-latency transactions。It serves the UAE through a subsidiary licensed by Abu Dhabi Global Markets Financial Services Regulatory Authority.。

| Advantages | Disadvantages |

| Provide high-quality education services through SharpTrader | Transaction costs are competitive, but nothing special |

| A variety of trading platforms to choose from to meet various trading needs | |

| Broad asset selection and cross-asset diversification opportunities | |

| Trusted Broker Regulated by Central Bank |

○ Pepperstone

Founded in 2010 and based in Australia, Pepperstone is one of the world's best-known ECN Forex brokers.。As an ECN broker, Pepperstone offers low spreads and low commissions, Pepperstone's "Razor" account offers the most competitive Forex trading costs。In addition to its global headquarters in Australia, Pepperstone has branches in London, UK, which is fully regulated by the Financial Conduct Authority (FCA), and Dubai, UK, which is regulated by the Dubai Financial Services Authority (DFSA).。

| Advantages | Disadvantages |

| Excellent trading platform consisting of MT4 / MT5 and cTrader | Demo accounts have a 30-day time limit |

| Market-leading MT4 / MT5 upgrade packages, Autochartist and API deals | |

| Support social trading with Myfxbook, MetaTrader Signals and DupliTrade | |

| Up to 1: 30 leverage and best-in-class trade execution |

▍ UAE Foreign Exchange Trading Regulation

Dubai's Forex Broker is one of the most trusted and regulated brokers in the Middle East, and its international footprint is expanding.。The Central Bank of the United Arab Emirates (CBUAE) is the main regulator of Forex / CFD brokers.。In addition, each emirate has its own financial regulator, of which the Dubai Financial Services Authority (DFSA) is the most established.。

CBUAE ensures that brokers adhere to established guidelines, including Sharia law。The requirements for a Forex / CFD broker to obtain a licence include: having a UAE citizen as a middleman for the Forex broker; at least 60 per cent of the paid-up share capital being funded by local banks and UAE citizens; and capital requirements of between AED 1 million and AED 3 million, or approximately US $270,000 to US $81 million..$50,000, depending on the scope of brokering activities。

Dubai has become a global financial centre and many international forex brokers have chosen Dubai as their hub in the Middle East and North Africa (MENA), making the Dubai Financial Services Authority (DFSA) the financial regulator of choice.。The Dubai Financial Services Authority maintains a trusted and competitive environment for foreign exchange trading。

▍ How to check if a broker is regulated by Dubai DFSA

Use the following link to access the DFSA website: www.dfsa.ae / register

Write the name of a Dubai or UAE foreign exchange trading company, such as Henyep Capital Markets, in the "Enter a keyword" field

Click Search

You will see the company's DFSA license number and all the details。

If you do not find any results, either the broker does not have a DFSA license or you have searched for the wrong company name。Most companies have different company names and brand names。

Important to look at: transaction name, license date, address。

▍ FAQs

Q: Is foreign exchange trading legal in Dubai??

In fact, since Forex trading became fully legal in the UAE, more and more retail investors living in the country are putting their money into this lucrative and dynamic sector!。

Q: What is the minimum capital to start Forex trading??

Many forex trading novices ask us how much money we need to start forex trading。In general, we recommend a minimum funding of $500。

This minimum capital depends on the minimum size of the position you want to trade (lots, mini lots or micro lots) and the financial leverage available, so even with this small capital, your risk per trade is only 1-3% of your account, as many professional traders do.。

However, the best start-up capital is $10,000 or more.。With $10,000, you can allocate 1% on a single trade, which is $100 per trade, and use leverage, such as 1: 200, to establish a position of $20,000, which is 0.2 standard hands。In this way, 1 point up / down will make you profit / loss $2。

Depending on your financial situation, you can decide how much money you can deposit。We recommend that you deposit small funds first, and when you are satisfied with the service, deposit more funds。

Q: What is a Forex Demo Account?

Forex Demo Account is a practice trading account where you have real prices, real charts, but the funds are virtual。You can test your forex trading strategy and benefit from it。

Q: How to open a real trading account?

The process of opening a forex trading account is very simple。Account identity verification is required when opening an account with a UAE regulated broker。Traders need to provide at least two documents。One is a document that proves identity (passport or driver's license, ID card, etc.), and the other is a utility bill that proves the address of residence。

Q: Do Forex traders pay taxes in the UAE?

UAE is a tax-free country。Foreign exchange transactions are not subject to capital gains tax, but UAE FX traders should consult a licensed professional to ensure compliance with local regulations。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.