Bitcoin Halving in 2024 and the Cryptocurrency Industry

Bitcoin halving is one of the most important events in the Bitcoin ecosystem, which is the halving of rewards for mining new blocks。The event occurs approximately every four years and has profound implications for the cryptocurrency industry.。

Bitcoin halving is one of the most important events in the Bitcoin ecosystem, which is the halving of rewards for mining new blocks。The event occurs approximately every four years and has profound implications for the cryptocurrency industry.。

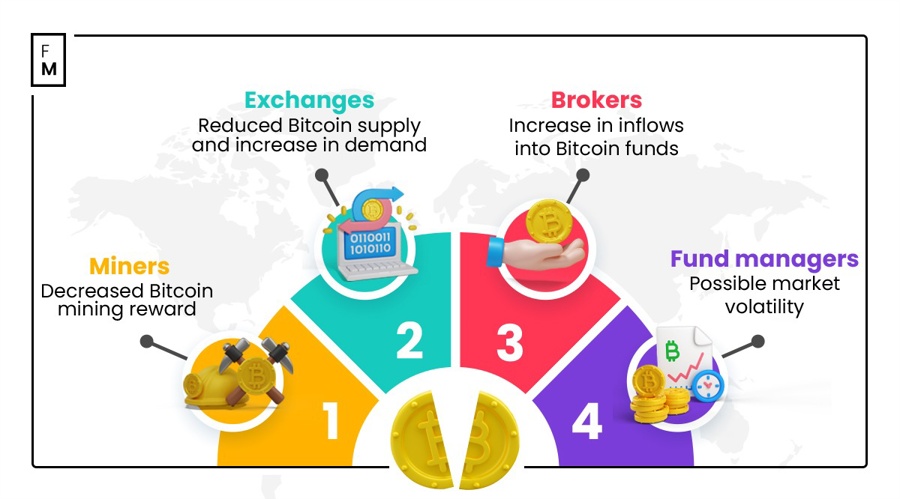

The halving is a pivotal moment for the cryptocurrency industry, which affects everything from miner income to overall market sentiment.。Industries such as mining, exchanges and funds could all be affected。The impact of the halving on these industries includes:

Miners: Unless the price of Bitcoin rises significantly, the immediate impact is a reduction in revenue, or the elimination of less efficient miners and a temporary decline in network hash rates。

Cryptocurrency Businesses or Exchanges: A reduction in the supply of new bitcoins could lead to increased demand and bullish sentiment in the market, provided that demand remains the same or increases。Before and after a halving event, expectations alone tend to lead to significant price volatility and a bias to the upside。

Fund managers and investors: may notice the trend of a sharp rise in the price of Bitcoin after halving in the past。While past performance is not always a harbinger of future results, halving is a cornerstone event that no integrated cryptocurrency investment strategy can ignore.。

In addition, for brokers and exchanges, an effective way to deal with Bitcoin halving may involve planning to manage issues such as liquidity, trading volume, and customer engagement.。

One thing to keep in mind may be to ensure that the exchange has enough liquidity to accommodate the increase in trading activity after the halving。This may involve optimizing trading algorithms, enhancing order matching systems and strengthening liquidity reserves.。

The exchange may also want to do everything it can to keep customers informed of possible disruptions and changing market conditions before and after the halving event.。Engage users with educational content, market insights, and promotions to help maintain interest and activity levels while fostering a sense of community within the platform。

Precautions for the 2024 Halving Period

As the 2024 halving event approaches, investors may need to pay attention to the dynamics that help judge the direction of the market。

Cryptocurrency-related activity has seen a huge surge, and the halving is still about a month away, which could signal a bigger movement to come.。

The spot Bitcoin ETF is the most successful ETF offering in history, with more than $10 billion in inflows in less than two months。Companies like MicroStrategy continue to buy BTC, while more institutions are starting to offer ETFs to clients。Bank of America and Wells Fargo, for example, have just announced that they will support ETFs。

During this halving cycle, there are specific indicators to watch, such as:

- On-Chain Metrics: How Large-Scale Holders Handle Their Assets?How many bitcoins are stored for long periods of time in self-contained warehouses that have not moved for months or years?

- Exchange Activity: Does Bitcoin Exit from or Transfer to an Exchange?Large withdrawals tend to indicate bullish sentiment, while large deposits tend to indicate selling intent。

- ETF Inflows and Outflows: How Quickly Funds Continue to Flow into ETFs?This can serve as a powerful indicator of market sentiment and investor demand for Bitcoin。

- Historical comparison: How does this halving cycle compare to past cycles?Many argue that returns diminish with each new cycle。However, this time it seems different as BTC / USD has never been so close to creating a new ATH before halving。

- Bitcoin and the Forex Market: How many currencies around the world are at record lows relative to Bitcoin?How many countries have reached an all-time high in the price of Bitcoin?As of March 2024, the price of Bitcoin relative to a dozen different currencies has reached an all-time high.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.