BoJ Chief Cautious on Rate Hike, Officials Urge Gradual Increase

Iwata also mentioned the need for time to determine how to handle the exchange-traded funds (ETFs) held by the bank, rather than considering immediate disposal.

Bank of Japan Governor Kaho Iwata stated on Wednesday that the bank has maintained its pace of Japanese government bond purchases during the March policy shift to minimize disruption.

In a parliamentary session, Iwata indicated that the bank would continue buying Japanese government bonds at the current pace but would consider reducing purchases in the future to lessen the central bank's sovereign debt holdings. He anticipates that wage increases for small and medium-sized enterprises in Japan will surpass last year's levels, with real wage growth expected to turn positive in the near future.

Iwata also mentioned the need for time to determine how to handle the exchange-traded funds (ETFs) held by the bank, rather than considering immediate disposal.

Bank of Japan Ends Negative Rate Era

On March 19, the Bank of Japan announced the end of its eight-year negative interest rate policy. However, market consensus suggests that the symbolic significance of this monetary policy adjustment outweighs its practical implications, with little likelihood of a swift and aggressive shift by the Bank of Japan.

Firstly, the amount involved in Japan's policy negative interest rates is not substantial. Previously, the Bank of Japan's rate control primarily consisted of two aspects: short-term rate operations and long-term rate operations. Regarding short-term rate operations, the bank explicitly imposed a -0.1% rate on a portion of funds held by financial institutions in Bank of Japan accounts. Financial institutions' funds in Bank of Japan accounts can be divided into three parts, known as the "three-tier structure": the first tier is the "basic balance," calculated with reference to financial institutions' funds in Bank of Japan accounts in 2015; the second tier is the "macro add-on balance" represented by reserve requirements; and the third tier consists of funds other than those mentioned above.

The so-called "negative interest rate" imposes a "custodial fee" of 0.1% on funds in the third tier, aiming to stimulate financial institutions to activate currency for lending. According to Nomura Research Institute and the Bank of Japan's estimates, the total amount of funds in the third tier is approximately 5 trillion yen, while Japan's total reserve requirements exceed 500 trillion yen.

Secondly, the Bank of Japan has always maintained a conservative stance on the sustainability of inflation. For years, the Japanese economy has been caught in a cycle of price decline, which has suppressed corporate profits, hindered wage growth, and led to stagnant private consumption. Efforts to combat deflation have been ongoing for many years.

However, starting in 2022, international market commodity prices experienced rapid increases, remaining at relatively high levels, exerting inflationary pressure on Japan, which has a high dependency on imports of energy and food. Furthermore, the divergence in monetary policies between the United States and Japan has led to a significant depreciation of the yen, further amplifying Japan's inflationary pressures from imports.

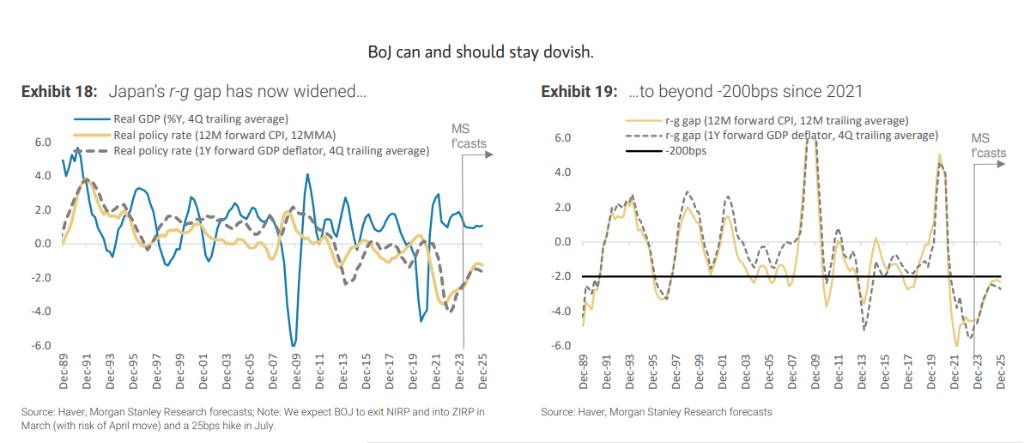

With the Consumer Price Index (CPI) emerging from deflation on September 21, 2022, and rising to well above 2% since then, real interest rates have become severely negative. The r-g gap in the fourth quarter widened to over -200 basis points in the third quarter of 2021 and has remained above -200 basis points for the past ten quarters, reaching historically high levels.

Despite this, Iwata has maintained a "cautious, patient" approach to monetary policy since the end of 2023. He believes that close attention must be paid to the trends in financial and foreign exchange markets and their impact on the Japanese economy and prices; he will patiently maintain loose monetary policy and, if necessary, take additional easing measures without hesitation.

Additionally, Takeshi Watanabe, a professor of economics at the University of Tokyo known as the "first person in Japan's price research," pointed out that while Japan has made significant progress in overcoming chronic deflation, it has not yet reached a state of steadily increasing prices by about 2% and wage increases of around 3% annually.

Bank of Japan Board Member: Hopeful to Roll Back Large-Scale Monetary Easing Policy

Nevertheless, some economists within the Bank of Japan have begun to call for a steady progression toward normalizing monetary policy.

On Wednesday, Bank of Japan board member Naoki Tamura stated during a speech to local business leaders in Aomori City, northeastern Japan, "From now on, it is very important to handle monetary policy, making slow but steady progress in the normalization process, to roll back the unusually large-scale monetary easing policies of the past."

Although Tamura did not provide a clear hint about the next normalization measures, most Bank of Japan watchers expect the central bank to raise rates again in October.

Tamura is one of the leading hawks among the nine members of the Bank of Japan's board. He was the first member to publicly speak after the Bank of Japan ended negative interest rates on March 19. He also emphasized the role of interest rates in the economy, implying that the Bank of Japan's rate hike work is not yet finished.

It is noteworthy that after the Bank of Japan's rate hike, the yen's exchange rate against the dollar plummeted, falling to its lowest level in two weeks. Although theoretically, a positive interest rate benefits the yen's exchange rate, the short-term fluctuations in the exchange rate lack indicative significance as the market had already digested this news through anticipation before the Bank of Japan's decision.

Analysts believe that after the Bank of Japan exits negative interest rates, there will be liquidity issues between major yen assets and dollar assets. Japan's external assets will sell off a portion, in addition to flowing back into Japan. Obviously, the upward movement of Japan's asset prices

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.