Buffett Sells Nearly Half of Apple Shares, Buys Beauty and Defense Stocks in Q2

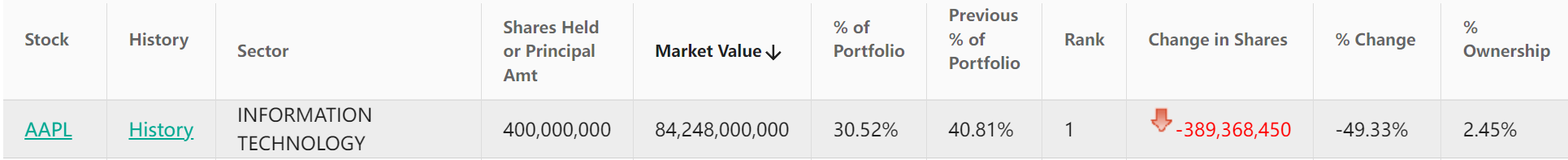

In the second quarter of this year, Berkshire Hathaway reduced its stake in Apple shares by more than 389 million shares, with the number of shares falling to 400 million from 789 million in the first quarter, a decrease of 49.3% from the previous quarter, nearly decimating the stock.

August 14, the U.S. Securities and Exchange Commission (SEC) disclosed Warren Buffett's Berkshire Hathaway (Berkshire Hathaway) company filed a 13F, let's take a look at the second quarter of the "God of the Stocks" positions have what changes.

First of all, look at the reduction. Although previously mentioned in the Berkshire Hathaway in its earnings report to reduce a lot of Apple's shares, but when the specific reduction of positions out, or to the outside world is very surprised. In the second quarter of this year, Berkshire Hathaway reduced its holdings of more than 389 million shares of Apple stock, the number of shares from the first quarter of 789 million shares down to 400 million shares, a ring reduction of 49.3%, nearly decapitated.

After the reduction, Apple's share of Berkshire Hathaway's portfolio fell to 30.52%, down more than 10 percentage points sequentially. Berkshire now owns about 2.6% of Apple, which is worth about $88 billion based on Friday's closing price of $219.86.

In the first quarter, Berkshire Hathaway cut its stake in Apple stock by 13%, to which Buffett responded that the move was for tax reasons. In May of this year, Buffett also said that unless there is a major event that really changes the allocation of capital, Apple will remain its largest investment.

According to CFRA research analyst Cathy Seifert, while the sale of Apple's stock is more of a responsible portfolio management, as Apple makes up a large portion of Berkshire Hathaway's holdings, it does look like Buffett is preparing for a recession.

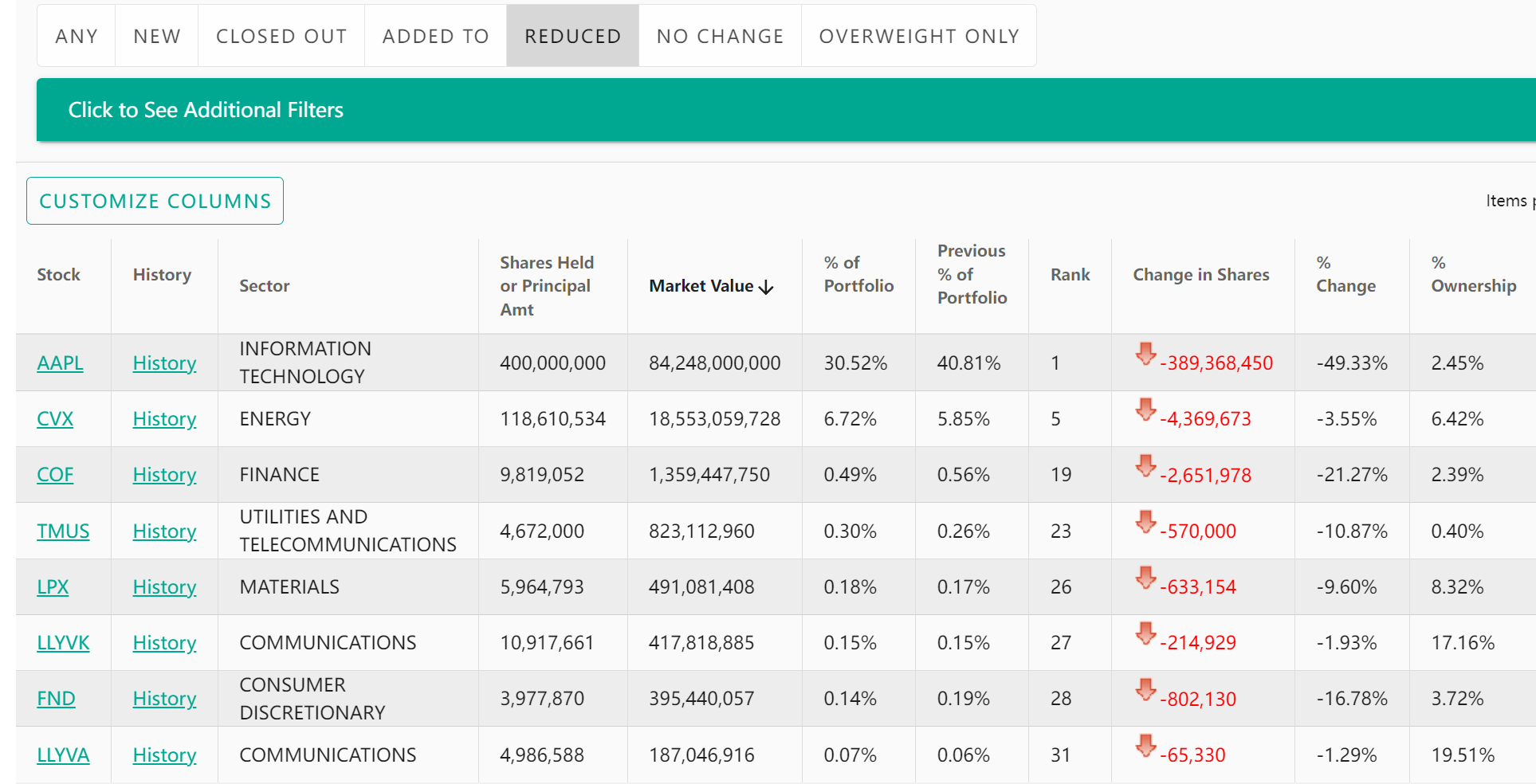

In addition to Apple, Berkshire Hathaway cut its stake in Capital One Financial by 2.65 million shares in the second quarter, dropping its holdings by about 21% QoQ. Other stock reductions included Chevron (4.37 million shares, a 3.55% QoQ drop in holdings) and T-Mobile (570,000 shares, a 10.9% QoQ drop in holdings).

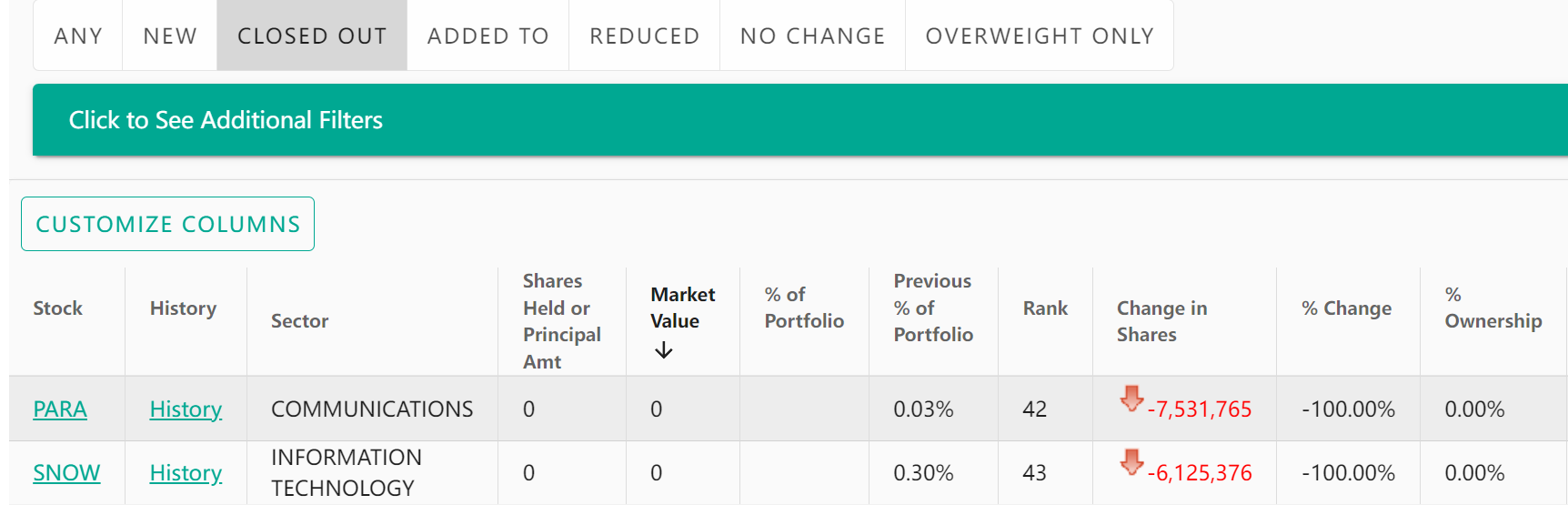

During the second quarter, Buffett also liquidated two positions in Snowflake and Paramount Global, though both were smaller portions of his portfolio. Specifically, Buffett sold about 6.13 million shares of Snowflake (0.30% of his portfolio) and 7.53 million shares of Paramount Global (0.03% of his portfolio).

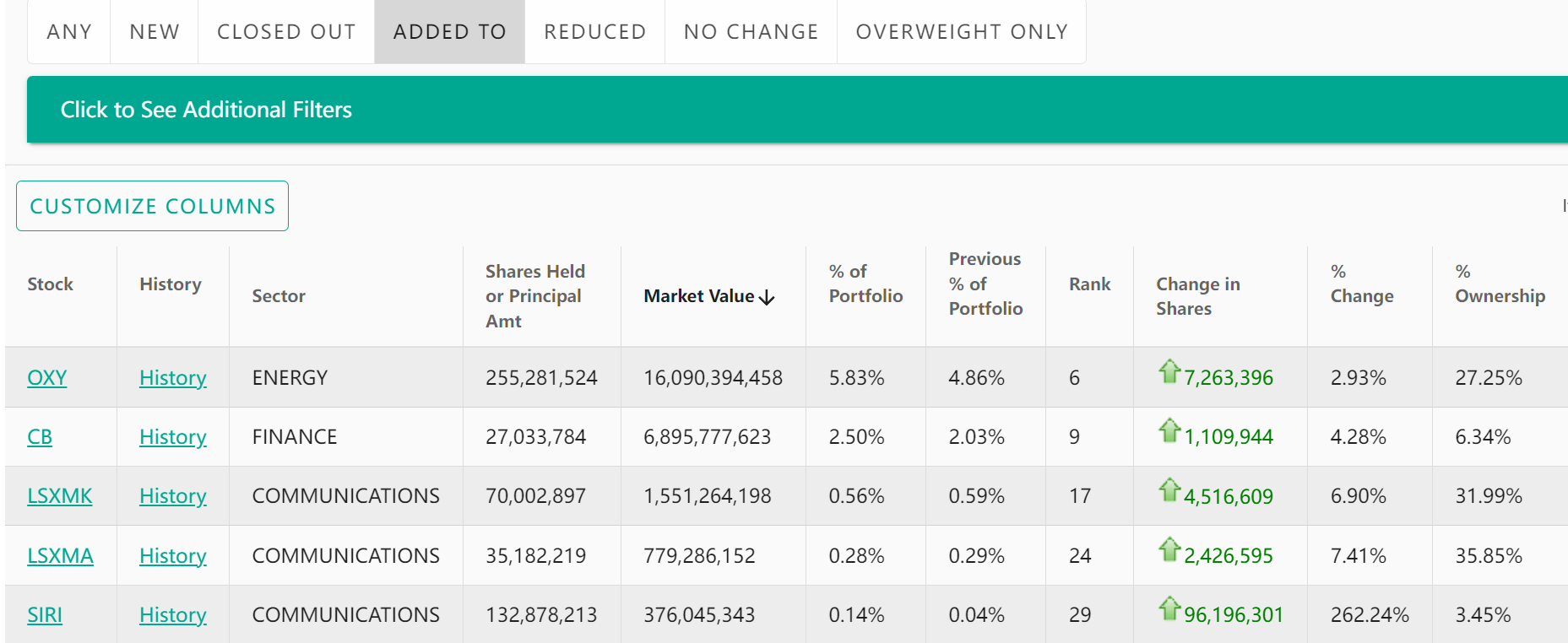

In terms of stock holdings, Berkshire Hathaway increased its holdings of five stocks in the second quarter. Among the top ten stocks, Berkshire Hathaway continued to buy Buffett's "old favorite" Occidental Petroleum and "new favorite" Andersen Insurance.

Specifically, Berkshire Hathaway in the second quarter increased its holdings of 7.26 million shares of Occidental Petroleum stock, the number of shares rose 2.9%, in the company's investment portfolio accounted for 5.83%. For ACE, which he just bought in a big way earlier this year, Buffett continued to buy in the second quarter, adding a total of 1.11 million shares, an increase of about 4.3% QoQ in the number of shares held, and a slight increase in the share of his portfolio to 2.50% after the increase.

Other holdings increased include satellite radio company Sirius XM and Liberty SiriusXM Class C and Class A shares. In particular, Warren Buffett increased his holdings in Sirius XM by about 96.2 million shares, up 262.2% QoQ.

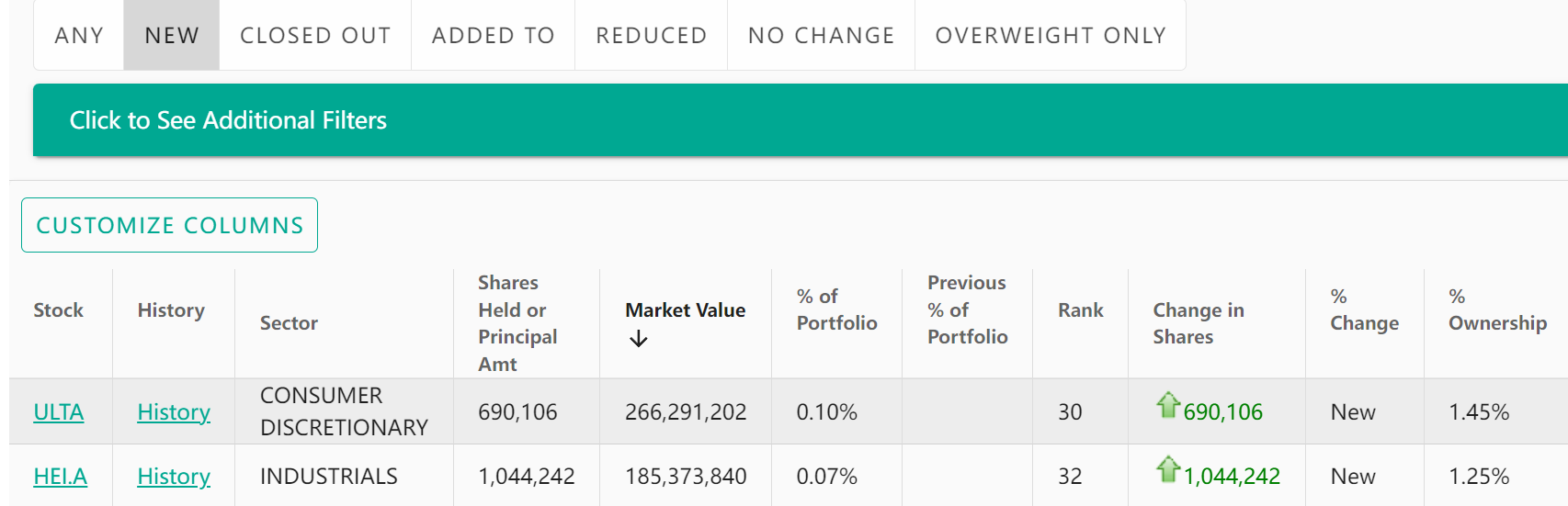

Berkshire Hathaway also built a position in two stocks during the second quarter. One stock was beauty company Ulta Beauty, which bought 690,000 shares worth about $267 million, or 0.1% of its portfolio. The other stock was military company Heico, which built a position of 1.04 million shares, or about 0.07% of its portfolio, for a total investment of about $185 million.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.