Central and Eastern Europe Economic Outlook: recovery growth, fiscal path divergence and continuing challenges

Higher policy rates in CEE countries compared to the euro area complicate market financing。

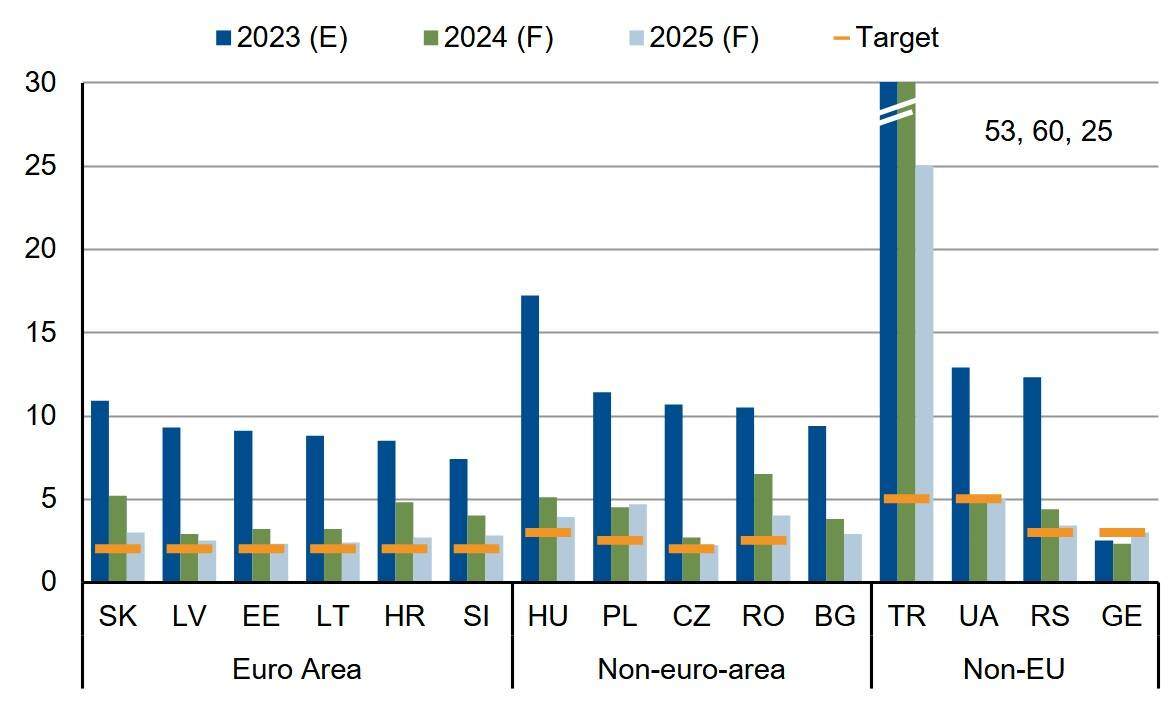

For the CEE EU member states (CEE-11) *, we forecast headline inflation to rise from last year's estimated 11.2% down to 4 in 2024.6% (Chart 1)。Strong nominal wage growth and potential wage spiral suggest downside risks。

The external deficit will remain relatively stable due to the gradual reversal of regional terms of trade, which constrains import growth in the face of low domestic demand and sufficient natural gas reserves.。At the same time, export performance remains lagging due to weak external demand。

Chart 1.Headline Inflation Rate, Annual Mean,%

Fiscal outlook remains challenging

While governments in the region are balancing the post-Covid budget deficit with the task of supporting strategic sectors and increasing spending on energy, infrastructure and defence, the fiscal outlook remains challenging.。In 2024, as interest payments rise for sovereigns with substantial borrowing needs and shorter debt maturities, the conundrum of raising persistent budget deficits becomes more complex。

Governance risks also remain。The flow of EU funds is crucial to the region's economic performance。Large EU transfers to Poland (A / Stability) and Hungary (BBB / Stability) hampered by rule of law issues constrains economic recovery。At the same time, higher policy rates in CEE countries compared to the euro area complicate market financing.。

Risk Balance of Sovereign Debt Credit Rating in Central and Eastern Europe

In terms of ratings, after a series of sovereign downgrades and outlook adjustments in 2023, the rating risk of sovereign issuers in Central and Eastern Europe is roughly balanced in 2024.。The downgrade of CEE sovereignty in 2023 reflects the continuing impact of structural economic risks and energy and inflation shocks, which affect real growth, public finances and economic resilience.。

Scope Ratings downgraded Hungary (to BBB), the Czech Republic (to AA-) and Poland (to A) last year and maintained a negative outlook for Slovakia (rating A +).。The agency downgraded the outlook for Estonia (rated AA- / negative), Latvia (rated A- / stable) and Lithuania (rated A / stable), reflecting economic challenges and rising geopolitical tensions caused by Russia's war against Ukraine.。Outside the EU, Scope has a negative outlook on Ukraine's CC external debt rating, while in January 2024 it revised its negative outlook on Turkey's B-currency rating to stable due to the recent shift towards more conventional monetary policy that supports a gradual rebalancing of the economy.。

* EU CEE-11: Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia, Slovenia

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.