Promoting cooperation: the role of data sharing in financial institutions

The emergence of data sharing in the intricacies of financial services will redefine inter-agency collaboration。

The emergence of data sharing in the intricacies of financial services will redefine inter-agency collaboration。The transformative potential of sharing data, breaking down silos and creating a connected financial ecosystem is unquestionable: from strengthening risk management to unlocking new business opportunities, the collaborative power of shared data is expected to reshape the financial sector.。

Enhanced Collaborative Intelligence for Risk Management

Data collaboration and sharing is a powerful tool for financial institutions to strengthen risk management strategies.。In a changing environment, the collective insights gained from shared data enable financial institutions to strengthen their defenses against potential risks。

Aggregated data resources provide a comprehensive understanding of emerging trends, weaknesses and forward-looking risk mitigation strategies, laying the foundation for improving the resilience of the financial industry。

The shift to collaborative intelligence marks a move away from an isolated approach to risk management。Armed with shared data insights, institutions can fully understand market dynamics to identify systemic risks and potential threats before they escalate。The collective intelligence obtained from different data sources allows them to flexibly respond to uncertainty and thus stand at the forefront of effective risk reduction。

Breaking down silos: Creating a collaborative environment

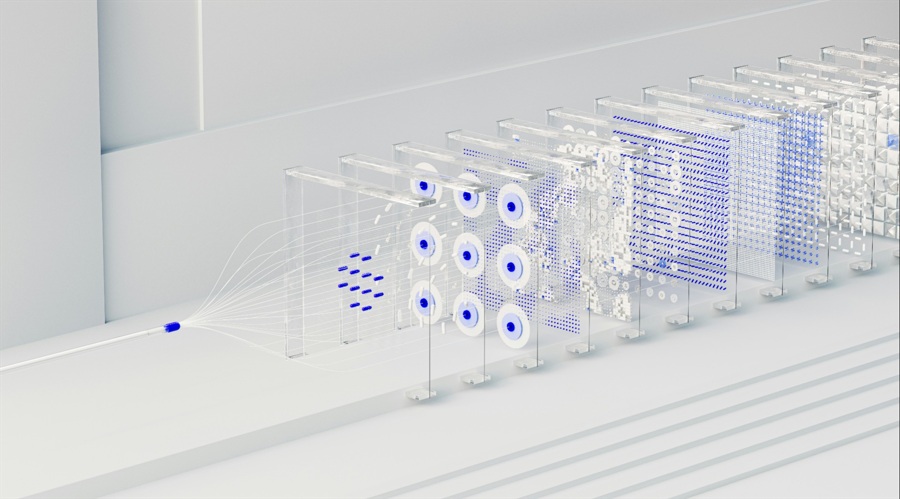

Breaking down organizational silos is a natural consequence of a robust data sharing program。Traditionally isolated sectors within financial institutions restrict the flow of information and impede the ability of organizations to make full use of collective wisdom。The emergence of shared data has brought about a paradigm shift, creating a collaborative environment that seamlessly connects insights from different departments。

This cross-functional collaboration is not just about sharing data, but about breaking down communication barriers and encouraging an open culture。

When departments share data transparently, organizations get a 360-degree view of their operations。This newfound visibility makes decisions smarter, processes more rational, and adapts quickly to market changes。The collaborative environment created by shared data becomes a catalyst for innovation, with teams working together to achieve common goals。

Unlocking Opportunities: The Business Potential of Shared Data

Collaborative use of data goes beyond risk management and is at the forefront of unlocking new business opportunities。The collective wisdom gained from shared data sets can uncover potential market trends, identify underserved market segments, and reveal pathways to product and service innovation。Shared data has the power to drive unprecedented growth in the financial industry, making it a hotbed of innovation and development。

In terms of business potential, shared data has become a strategic asset。

Institutions can use this collective wisdom to tailor products and services to their customers' changing needs.。Collaboratively share data to make understanding of customer behavior, market trends, and emerging opportunities more nuanced。This newfound flexibility allows them to stay ahead, identify niches, and create innovative solutions that resonate with changing financial dynamics。

Challenges in the Collaboration Process

Despite the potential, effective data-sharing initiatives face challenges。Data privacy concerns, regulatory compliance, and the need for standardized protocols are all critical considerations。Striking a balance between collaboration and protecting sensitive information is critical to building trust and ensuring ethical use of shared data resources。

Data privacy is a top issue in collaboration。Organizations must navigate a complex regulatory environment to ensure that customer information is handled responsibly。Establishing robust cybersecurity measures and complying with data protection laws are imperative to reduce risks associated with data sharing。

Regulatory compliance adds another layer of complexity。

Financial institutions operate within the framework of rules and regulations designed to safeguard the integrity of the financial system。To navigate these regulatory waters while engaging in collaborative data sharing requires a delicate balance that requires a proactive approach to compliance and a commitment to transparency.。

In the quest for seamless exchange of data, the need for standardized protocols becomes apparent。Creating interoperable systems that enable the smooth flow of data while maintaining safety standards requires industry-wide collaboration。Establishing common frameworks and protocols ensures that data sharing initiatives are not hindered by technical barriers, thereby promoting a more efficient and effective cooperative ecosystem。

Summary: Achieving Collaboration Excellence

The role of data sharing in facilitating cooperation among financial institutions marks a paradigm shift in industry dynamics。Beyond competition, synergistic use of data resources paves the way for a connected, resilient and innovative financial ecosystem。

From strengthening risk management to discovering new business prospects, shared data has the potential to propel the financial industry into an era of collaborative excellence in which collective intelligence transcends the capabilities of individual entities.。Organizations that are good at addressing these challenges can not only strengthen their risk management practices, but also uncover unprecedented business opportunities and create a collaborative ecosystem that thrives on shared intelligence and collective innovation.。

The future of financial services is therefore in the hands of those who embrace the collaborative power of shared data, who will lead the industry to new heights of excellence and resilience.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.