Is the war over?Citron Announces No Longer Short GameStop, Roaring Kitten Suspected Selling Options

On Wednesday, the trading volume of some short-term GameStop option contracts surged, leading some market participants to believe that investor Keith Gill, nicknamed Roaring Kitty, may have sold some of his GameStop option positions.

The battle between bulls and bears in GameStop seems to be beginning to subside.

Roaring Kitten Suspected of Selling GameStop Options

On Wednesday, the trading volume of some short-term GameStop option contracts surged, leading some market participants to believe that Keith Gill, an investor named Roaring Kitty, may have sold some of his GameStop option positions.

Gill was a key figure in the 2021 "retail investors short selling Wall Street" incident. Recently, Gill announced a comeback and released a screenshot on Reddit on June 2nd, revealing his significant holdings of GameStop stocks and options.

The screenshot shows that he holds 120,000 GameStop June 21 call options with an strike price of $20 and a buy price of $5.6754 per contract, with a total value of up to $68.1 million. The screenshot also shows that on June 2nd, he held 5 million GameStop shares worth $115.7 million.

On Wednesday, June 12th, data showed that approximately 93,000 GameStop June call options changed hands, with some contracts having a trading volume of 5,000 or more.

According to TradeAlert data, considering Wednesday's trading volume, the average transaction price of these contracts is $7.65. TradeAlert's data shows that many transactions are below the buying price, indicating that sellers may be attempting to sell contracts.

In this situation, some strategists suspect that Gill may be attempting to sell off his options position. "It seems like he's closing his position," said Chris Murphy, co head of derivatives strategy at Susquehanna International Group.

Murphy said, "Although he hasn't completed the liquidation, if he wants, there may be enough cash now to exercise the remaining power."

According to TradeAlert data, the trading volume of GameStop options jumped to 1.2 million contracts on Wednesday, 66% higher than the average daily trading volume of the stock options in the past month.

Since Gill disclosed his options position, participants in the options market have been closely monitoring. Gill's options position has experienced significant fluctuations in recent trading days, with the value of the options position jumping to $341 million, followed by a brief loss of $7.5 million on Tuesday.

Steve Sosnick, Chief Strategist at Interactive Brokers, said, "We'll have to wait until the data on open contracts is available to determine, but I can't imagine anyone else selling at a discounted price."

If calculated at the closing price of $6.40 per contract, Gill's total value of 120,000 contracts held would reach $76.8 million, approximately $8.7 million higher than when he bought them.

Citron Research announces stop shorting

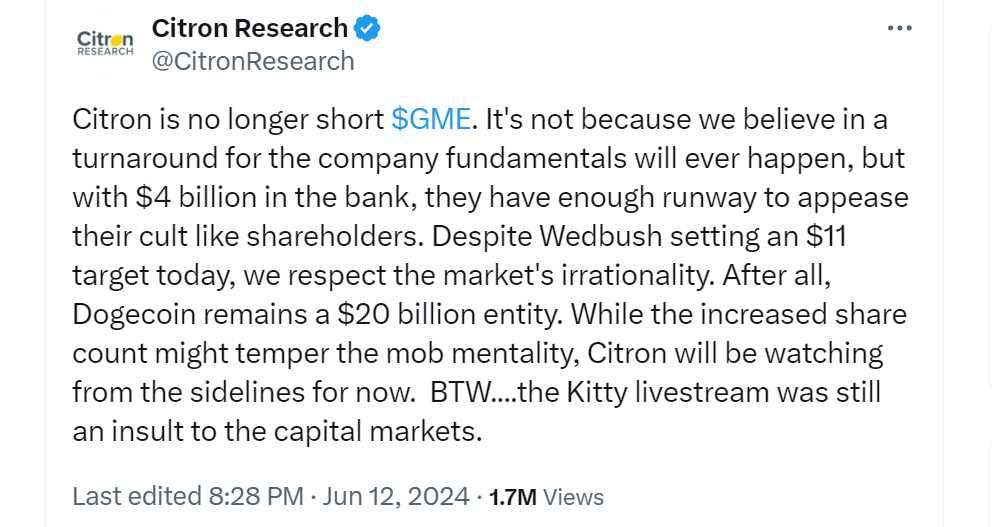

It is worth noting that on Wednesday, the day before the surge in trading volume of GameStop option contracts, US short selling firm Citron Research announced on X on June 12th that it would no longer short GameStop.

In the post, Citron Research explained its decision to stop short selling: "It's not because we believe in a turnaround for the company fundamentals will ever happen, but with $4 billion in the bank, they have enough runway to appease their cult like shareholders. Despite Wedbush setting an $11 target today, we respect the market's irrationality. After all, Dogecoin remains a $20 billion entity. While the increased share count might temper the mob mentality, Citron will be watching from the sidelines for now."

Although they are no longer short selling, Citron Research has expressed dissatisfaction with Roaring Kitty, claiming that Roaring Kitty's livestream was still an insult to the capital markets.

Andrew Left, founder of Citron Research, stated in an interview that if GameStop's stock price reaches a level of $45-50, he will short the stock again. In addition, he also stated that although Citron Research closed its positions, it still made a profit, but he did not disclose the specific size.

GameStop's stock price closed down 16.5% to $25.46. Since the beginning of this year, the stock has risen by 45%.

Since the 2018 fiscal year, GameStop has not been profitable.

In its latest quarterly financial report, GameStop reported a loss of $32.3 million in the first quarter, slightly better than the $50.5 million in the same period last year. But sales continue to decline, with sales in the first quarter dropping from $1.2 billion in the same period last year to $900 million.

As of May 4th, GameStop has approximately $1 billion in cash. The company stated that after raising $933.4 million in May, it cashed out approximately $2.14 billion in profits from stock sales last week. The important reason why GameStop chose to sell gloves last week was that Roaring Kitty announced a long position on GameStop again after three years, which led to the stock's rise.

GameStop stated that the company intends to use this funds for general corporate purposes. B. Riley Financial's Chief Market Strategist, Art Hogan, stated that it will only be known in the future whether GameStop can make good use of these cash out funds and convert them into a profitable business model.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.