GameStop ushered in a big rise! "Retail investors forced Wall Street" drama will be staged again?

On Monday (June 3rd), the opening price of GameStop was $40.19, an increase of nearly 70%. Subsequently, the increase in gaming stations fell slightly, closing at $28 on Monday, up 21%.

In 2021, a battle of individual investors pushing Wall Street short has attracted global attention. After three years, with the protagonist of the event making a comeback, a new multi air battle is also approaching.

In 2021, some hedge funds believed that the physical game store model of GameStop was on the decline, and therefore wanted to make huge profits by short selling GameStop. At the same time, an investor named Keith Gill, using the username DeepF Value, called on retail investors to buy stocks on Reddit to counter short sellers. In addition, Keith Gill continues to promote buying GameStop stocks under the name Roaring Kitty on X and YouTube.

At his call, a group of retail traders joined forces to fight against hedge funds in the short selling GameStop. Many Reddit users have organized on the WallStreetBets forum to share emojis and song imitations, promoting the purchase of GameStop stocks. They also began to support other stocks that were heavily shorted, such as AMC.

As a result, the drama of "retail investors forcing Wall Street short" has officially begun. In this round of trading frenzy, the stock price of GameStop soared more than 20 times, and in the end, many bears were forced to close their positions.

After three years of silence, Keith Gill released a picture of a man leaning forward in mid May, sparking speculation that Gill had returned and that he was really coming.

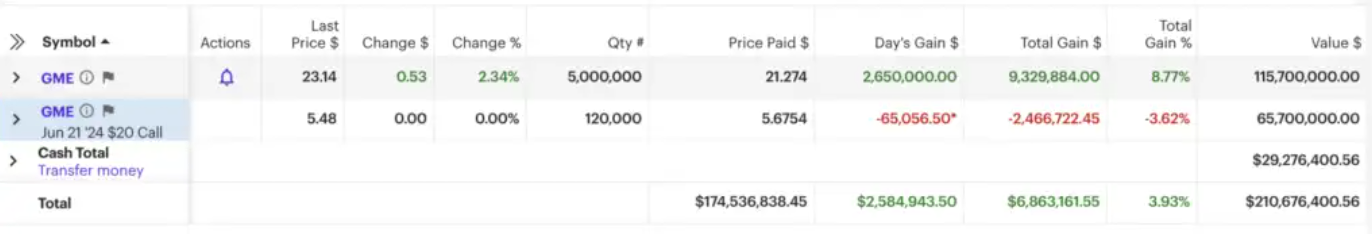

Last Sunday evening (June 2nd), Gill posted another picture on social media, this time about his holdings. According to an account snapshot posted on the Redditr/SuperStonk forum, as of last Friday (May 31), Gill held 5 million shares of GameStation stock worth $115.7 million, with an average purchase price of $21.27. The stock closed at $23.14 last Friday. In addition, he also holds 120,000 call options for the GameStop, with an exercise price of $20, which will expire on June 21, and the purchase price for each option is approximately $5.68.

Gill's return to social media has triggered a surge in the stock price of gaming stations. Last month, GameStop rose 490% in eight days, but gave up most of the increase in the following three days.

On Monday (June 3rd), the opening price of GameStop was $40.19, an increase of nearly 70%. Subsequently, the increase in gaming stations fell slightly, closing at $28 on Monday, up 21%.

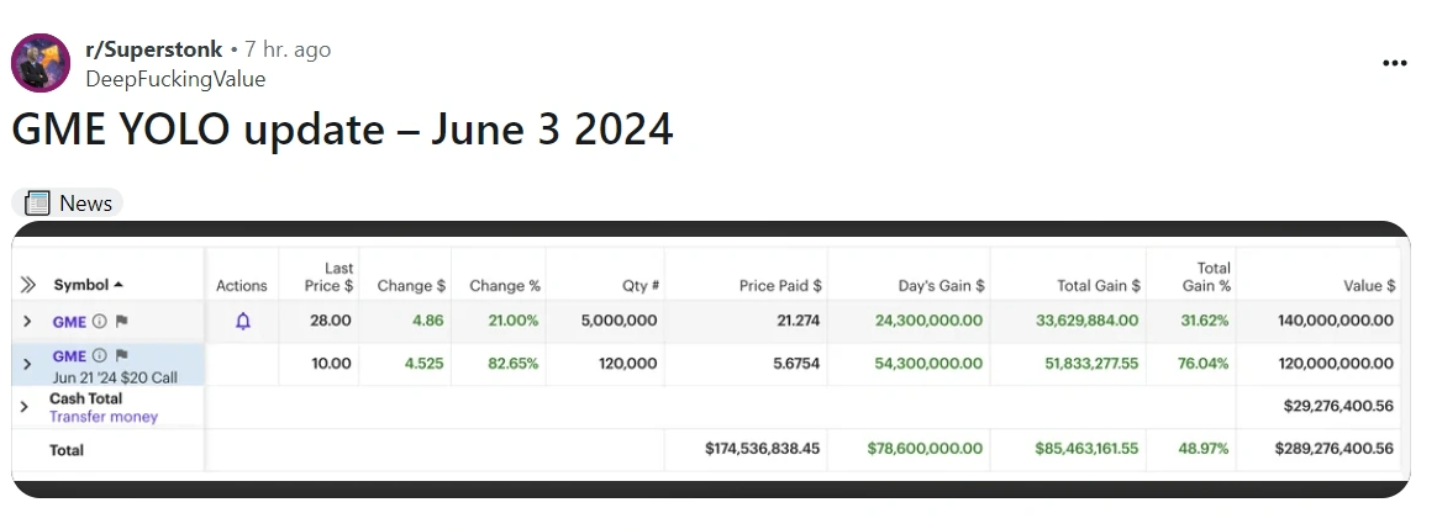

After Monday's close, Gill updated his position on Reddit again. The screenshot shows that his gaming station stock had a single day floating profit of 31.62% on Monday and a single day floating profit of 76.04% on options, making a huge profit of 78.6 million US dollars in just one day. If calculated based on Monday's opening, Gill's floating profit is even more substantial.

After Gill's return, a new long air battle seems to be approaching.

Andrew Left, founder of the bearish Citron Research Company, which was defeated by the bulls led by Gill in 2021, recently publicly stated that he will once again short GameStop. Last month, Left announced its short position in gaming stations. Recently, he stated that he has replenished his short positions in May.Based on the current rise in gaming stations, bulls still have the upper hand.

According to data analysis company Ortex Technologies, the surge in gaming stations on Monday resulted in a book loss of nearly $1 billion for short positions in the stock. It is understood that the current short position of the GameStop is 57.6 million shares, accounting for 18.4% of the circulating shares.

However, the good show has just begun, and the final outcome of this long air battle remains to be seen.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.