Gumming table HKEx: market share of more than 16% for China's largest mass now-made tea shop brand.

According to the HKEx, on January 2, Gumming Holdings Limited submitted a listing application to the HKEx Main Board, with Goldman Sachs and UBS Group as co-sponsors.。

According to the Hong Kong Stock Exchange, on January 2, Gu Ming Holdings Limited (hereinafter referred to as "Gu Ming") submitted a listing application to the main board of the Hong Kong Stock Exchange, with Goldman Sachs and UBS as joint sponsors.。

Company Profile

According to the disclosure, Gumming is an industry-leading, fast-growing Chinese beverage manufacturer, committed to providing consumers with high-quality products that are fresh, delicious, consistent and affordable.。

Gu Ming's stores focus on the popular now-made tea market, featuring three types of beverages: (i) fruit tea drinks, (ii) milk tea drinks and (iii) coffee drinks and others.。

As of December 31, 2023, Gumming had established a network of stores in eight provinces that exceeded its critical size.。Together, these eight provinces contributed 87% of Guming's GMV in 2023 and have made Guming the largest brand of mass-produced tea shops in China.。

According to the Insight Consulting report, in the nine months ended September 30, 2023, Gumming achieved more than 25% of the market share of Volkswagen's existing tea shops in the eight provinces mentioned above.。Among them, in Zhejiang, Fujian and Jiangxi, which were the first to reach a key scale, Guming's market share in Volkswagen's current tea shops reached more than 45% during the same period, and its market share in the full-price current tea shop brand was also the first in the industry.。

As of December 31, 2023, Guming has established a layout in 15 provinces across the country and will continue to increase the density of its store network, while there are still 19 provinces that have not yet been laid out, which together have brought a broad growth space for Guming.。While maintaining the continuous growth of its huge store network, Gumming maintained same-store GMV growth in each of the three years ended December 31, 2023 in the country and the eight provinces with dense store networks mentioned above.。

Market size

According to the Insight Consulting Report, based on GMV for the nine months ended September 30, 2023, the "Gu Ming" brand is China's largest brand of mass-produced tea shops, with 16.4% market share。In 2023, the GMV of Gu Ming reached 19.2 billion yuan (RMB, the same below), an increase of 37% over 2022..2%。

According to the number of stores, "Gu Ming" brand is also China's largest mass now-made tea shop brand, but also the world's top five now-made beverage brands.。As of December 31, 2023, Gumming's store network had 9,001 stores, an increase of 35 from December 31, 2022..0%。In particular, in second-tier cities and below, the "Gu Ming" brand accounted for about 20% of the market share of Volkswagen's existing tea shops in terms of GMV in the nine months ended September 30, 2023.。

As of December 31, 2023, the number of registered members of the Gummy Mini Program had reached approximately 94 million.。Of these, the number of quarterly active members in the fourth quarter of 2023 exceeded 36 million.。The average quarterly repurchase rate for the full year 2023 reached 53%, which, according to the Insight Advisory report, far exceeds the average repurchase rate of less than 30% for Volkswagen's current tea shop brands.。

In terms of franchisees, as of December 31, 2021, 2022 and 2023, Gu Ming had 2,381, 2,949 and 4,614 franchisees, as well as 5,689, 6,664 and 8,995 franchisees, respectively.。

Financial Overview

Gumming's revenue mainly comes from the sale of goods and equipment to franchisees and the provision of services.。

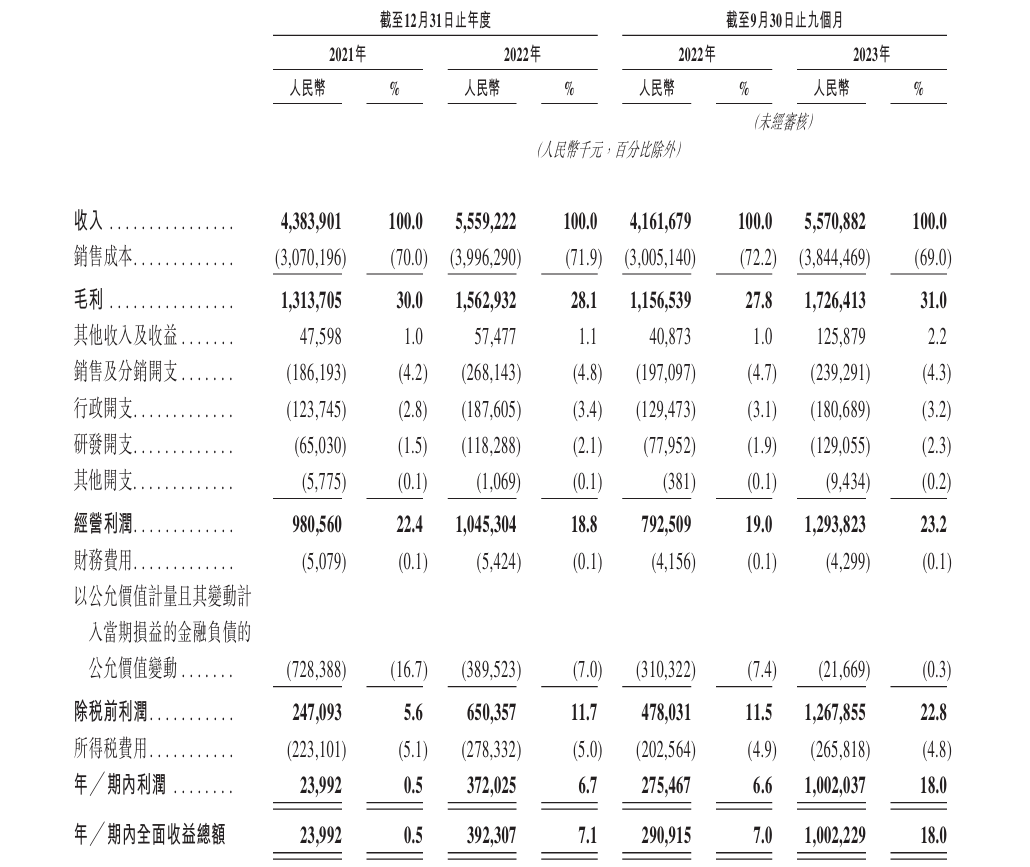

The prospectus mentions that during the track record period, Gumming achieved strong growth。The income of ancient tea will be 43 in 2021..8.4 billion yuan (RMB, the same below) increased by 26.8% to 55% by 2022.5.9 billion yuan。In the first nine months of 2023, Gu Ming's income was 55.7.1 billion yuan, up 33% from the same period last year.9%。

In terms of profit, from 2021 to 2022, the annual profit of ancient tea was 24 million yuan and 3 million yuan, respectively..7.2 billion yuan。In the first nine months of 2023, the profit of ancient tea reached 10.02 billion, compared to 0 in the same period last year..7.6 billion yuan。

Funding purposes

In the prospectus, Gu Ming said that the funds raised will be used to (1) expand Gu Ming's information technology team and continue to improve the digitalization of business management and store operations;。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.