How Payments UX / UI Design Guide Consumer Behavior?

As users navigate the payment interface, a variety of psychological factors are critical to creating an environment where design and behavioral economics principles are perfectly integrated, ultimately guiding users to make more conscious and beneficial financial choices。

As users navigate the payment interface, a variety of psychological factors are critical to creating an environment where design and behavioral economics principles are perfectly integrated, ultimately guiding users to make more conscious and beneficial financial choices。

The exploration of behavioral triggers goes beyond visual appeal to the nuances of user experience。Deliberate choices in payment design have gone beyond mere aesthetics to become a strategic tool for shaping user behavior。Each color, position, and visual cue is a well-designed element designed to influence the user's perception and decision-making。

This meticulous analysis aims to reveal the complex interplay between user behavior and behavioral economics principles。By understanding and strategically using these psychological triggers, designers aim to have a subtle and profound impact on users, shaping their interactions and decision-making processes throughout the payment process.。

Select Architecture: Designing Decision Processes in the Payments Interface

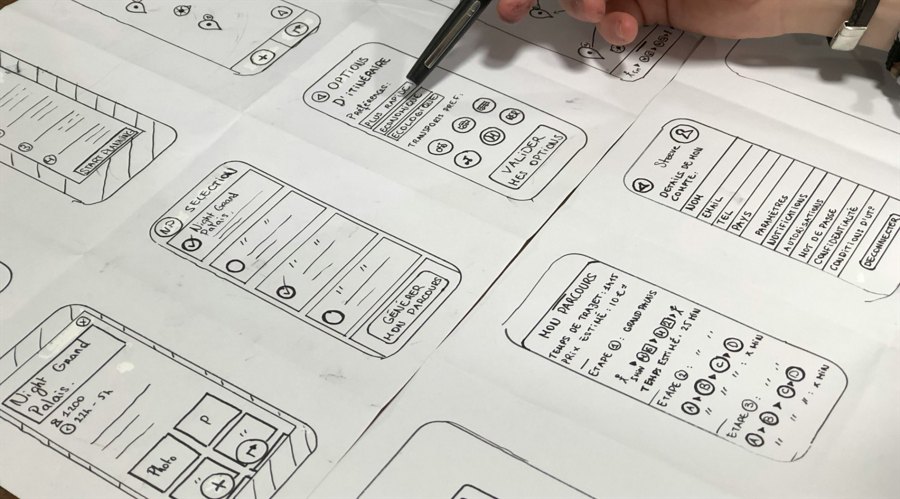

At this stage, every element, from the arrangement of options to visual cues, is carefully arranged。The payment interface becomes a carefully curated space, where various options not only meet the user's preferences, but also guide them in making decisions to facilitate financial transactions。

In this exploration of choice architecture, the designer plays the role of user decision designer。Incorporating behavioral economics principles into it is like constructing a framework to influence user choices during the transaction process。Our goal is to simplify decisions and make them more intuitive and user-friendly。

Therefore, the combination of payment interface design and behavioral economics undoubtedly has the potential to be a powerful catalyst for responsible financial decision-making, creating an environment in which users feel empowered and informed throughout their financial interactions.。

Reducing decision fatigue: simplified payments, user-friendly

In the field of payment design, decision fatigue is a real problem that designers want to alleviate.。By strategically setting default values, designers can reduce the cognitive burden on users and ensure a streamlined and efficient decision-making process。

Deliberate choices in the default settings are designed to minimize the mental work required by users during the transaction process, ultimately leading to a more intuitive and stress-free payment experience。This, in turn, signals our commitment to creating an interface that prioritizes user convenience, allowing individuals to seamlessly navigate payments without the unnecessary cognitive burden。

The Power of Anchors: Pricing Strategies in Payment Design

An exploration of pricing strategies in payment design reveals the important impact of anchor。Designers' strategic use of the anchoring principle shapes user perceptions of the value of payments, with lasting effects on consumer behavior and broader financial decisions。

Anchors serve as a subtle and powerful tool to guide users in assessing the value of a transaction, and as a psychological mechanism that designers use to influence perceptions throughout the payment process。

The study of pricing strategies goes beyond numerical values and reveals the nuanced artistry of payment design。Designers strategically set anchors in the payment interface to cleverly guide users to assess the fairness and value of transactions。

This exploration acknowledges the role of anchors in shaping consumer perception, highlighting the intricate dynamics of payment design。By cleverly using the subtle effects of anchors, designers shape not only a single transaction, but also the overall landscape of users' financial cognition and decision-making。

Integrating Norms: Shaping Collective Payment Behavior

Paying for user experience / user interface (UX / UI) design means that the integration of social norms will be an important consideration for designers。This multifaceted process involves a deep understanding of how designers can strategically leverage societal expectations, aiming to create interfaces that not only meet personal preferences, but also meet widely accepted standards.。

In this process, the designer acts as a designer of the financial environment, in which users are guided not only by personal preferences, but also by a common understanding of financial norms。Incorporating social norms into payment design reflects the commitment of the design interface to go beyond personal experience and help build a cohesive and responsible financial ecosystem that resonates with the broader social fabric。

Feedback Loop: Real-Time Interaction for Decision-Making

The feedback loop plays a pivotal role in shaping the payment UX / UI design, providing dynamic interaction between the user and the interface。In the field of behavioral economics, these feedback loops are a tool that can provide real-time information and have a significant impact on user cognition and behavior。

Through deliberate implementation, designers strategically use feedback mechanisms to guide users through the decision-making process and ensure that the user-centric experience is consistent with responsible financial behavior。Whether through visual cues, notifications, or tailor-made messages, these feedback loops help take a holistic approach to interface design and actively shape and enhance the user experience in the intricate world of payment design。

In payment UX / UI design, the feedback loop is not just a transaction function, it also becomes a catalyst for informed decision-making。Consciously integrating real-time feedback mechanisms is a proactive measure that enhances user insight, not only improves transparency, but also encourages responsible financial behavior。

As users navigate the payment interface, these loops provide ongoing dialogue, shape their perceptions, and help create an information and behavior-led environment for financial decision-making。

Other factors

Future developments may also lead to advances in personalized and adaptive interfaces。Using behavioral data, payment platforms can dynamically adjust the interface and optimize prompts based on each user's preferences and behaviors。This will lead to a more seamless and intuitive user experience, further improving the effectiveness of behavioral cues。

In fact, these trends in the payments industry have similarities to similar strategies implemented by other industries such as e-commerce and digital marketing.。The concept of using behavioral cues to influence consumer decisions is not unique to the financial industry。The success of personalized recommendations in online shopping or targeted advertising can also be applied to the payment interface to prove the effectiveness of catering to personal preferences。

In the broader context of technology and user interaction, the similarities extend to social media and mobile applications.。Platforms that use algorithms to curate content and attract users through personalized experiences have in common the principles used in payment UX / UI design。The implication here is that users respond positively to interfaces that match their personal preferences, and the financial industry can use these insights to create a more engaging and effective payment experience。

Conclusion

As the industry continues to evolve, a detailed understanding of user behavior may become more important。The insights gained from behavioral economics can not only provide a reference for the design of payment interfaces, but also for the development of innovative financial products and services。Future developments may incorporate advanced technologies such as artificial intelligence and machine learning to further refine and customize the user experience。

Integrating behavioral economics into payments UX / UI design is a transformative force with profound implications for the financial industry。As these trends evolve, the financial industry can foresee the spread of financial literacy, a more user-centric approach, and personalized interfaces。Lessons learned from similar trends in other industries can strengthen the effectiveness of catering to personal preferences。Looking ahead, the intersection of technology, behavioral insight and financial services is expected to create a more intuitive, inclusive and informed financial environment.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.