The impact of interoperability on digital assets

Currently, major institutions are expanding their adoption of digital assets, with companies like HSBC and BlackRock beginning to offer digital products.

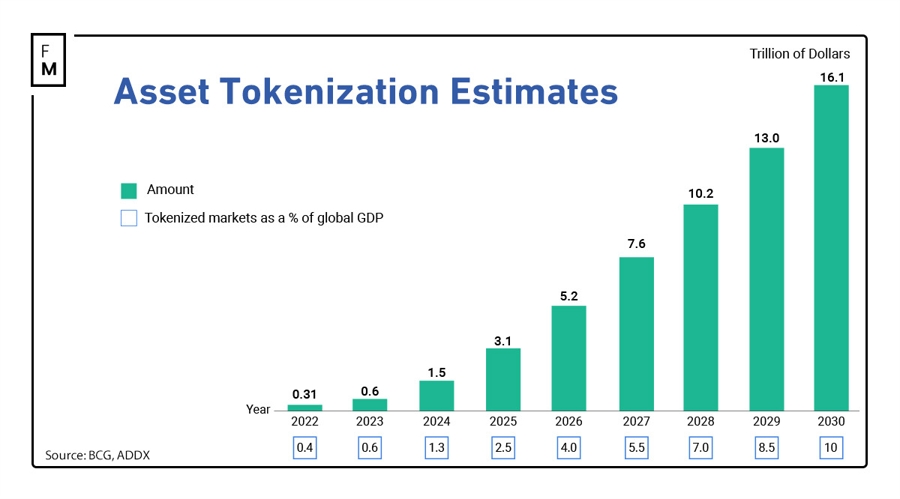

Currently, major institutions are expanding their adoption of digital assets, with companies like HSBC and BlackRock beginning to offer digital products. Predictions suggest that by 2030, the market size of digital assets could reach $16.1 trillion.

Institutional involvement has long been seen as a necessary step for the wider adoption of digital assets, hence the market's welcome of these new products. Despite all this sounding very positive, there remains a significant barrier to overcome before we see broader acceptance and use of digital assets: isolated liquidity.

Boundaries of Isolation

Currently, there are many different blockchain networks that, in most cases, do not readily share resources, including public networks, private networks, and sidechains, making asset transfers between them challenging.

For instance, JPMorgan Chase has its own private blockchain called Onyx. Despite being a massive global company capable of serving clients on this chain, it remains isolated from larger public networks like Ethereum and other institutional networks.

Compare this situation to the adoption of the internet about 30 years ago. It wasn't until we had a "world wide web" accessible through a single gateway without needing to understand internet protocols that it truly took off. The entire Web3 needs to operate in a similar manner to have an impact on business.

Challenges of Asset Transfer in Web3

To address these issues, companies like Deutsche Bank have begun experimenting with building "bridges" to connect different institutional networks.

Bridges are not entirely new to Web3; they are third parties that facilitate asset transfers between different networks. However, cross-chain transfers are generally costly processes, often incurring fees on both chains.

Furthermore, bridges are controlled by centralized operators, making them one of the easiest elements to attack in the modern Web3 landscape. While we haven't seen what Deutsche Bank will ultimately create, bridges are typically not financially attractive solutions for financial institutions or the retail users who will soon be using them.

A Universal Solution

Instead of a series of isolated solutions, what is needed is a universal, interoperable layer that can connect liquidity across all these networks without the need for bridges or multiple cross-chain hops incurring associated costs.

Zero-Knowledge (ZK) technology allows for near-instantaneous transactions between different networks, completely secure, and in terms of transaction fees, almost costless. These protocols can generate an encrypted "proof" that can verify the authenticity of any data without revealing what that data is.

ZK proofs enable assets to be securely transferred between networks without the need for overly complex third-party protocols. The cryptographic underpinnings of these proofs mean that instead of "bridging" assets, a single proof can be sent without revealing any details of the given transaction, all with minimal resource usage.

Implementing an interoperability layer driven by ZK technology would be an "aggregative" approach, which will be key to creating a Web3 space that feels like a single chain, much like the modern internet feels like a single service with all protocols and providers seamlessly integrated into the end user's experience.

This will usher in a wave of new institutions and their products into the revolution as it breaks down the barriers currently hindering broader institutional adoption. By making the networks built around specific assets inconsequential, all liquidity will be unlocked across the entire Web3 ecosystem. This will be more attractive for institutions to roll out new products and attract more retail investors, further expanding the entire market. By offering truly financial tools without barriers or obstacles, Web3 can ultimately realize a vision of a fair, digital future.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.