Traditional powerhouses who did not layout AI tracks early have suffered a wave of cleansing.

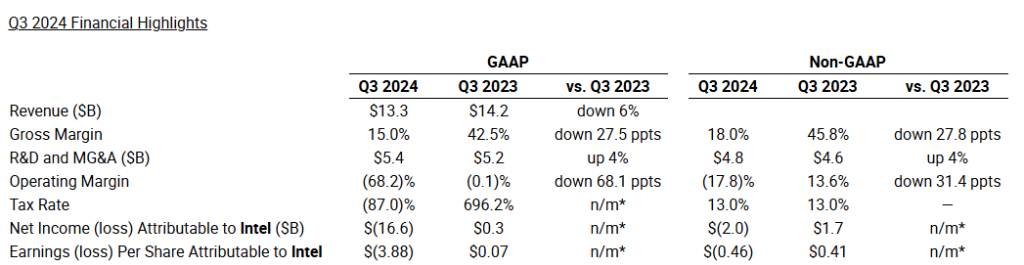

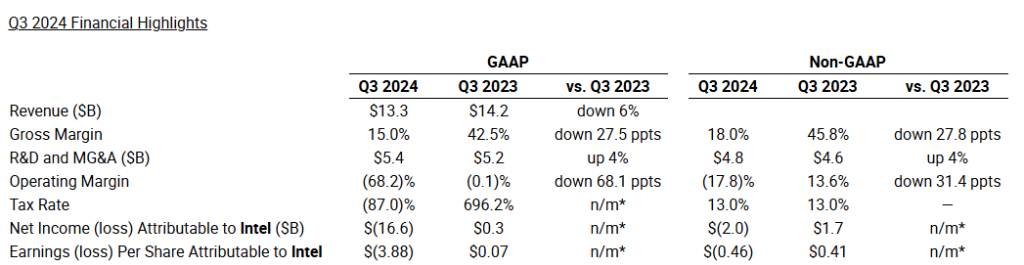

After the close of trading on October 31, US Eastern Time, Intel, which was significantly behind on the AI track, announced its third-quarter 2024 financial report.Surprisingly, the company's AI-related data center revenue reached US$3.35 billion, better than market expectations; revenue during the reporting period reached US$13.28 billion, also higher than analysts 'expectations.At the same time, Intel also provided strong guidance for fourth-quarter results, which exceeded Wall Street's original expectations.

Affected by multiple positive factors, Intel once rose more than 14% after hours.

Since 2022, with the rapid rise of artificial intelligence, market demand has undergone fundamental changes, catching Intel, which is based on established chips, by surprise.Because Intel has basically made little achievements in AI chips, its original customers have turned to advanced process companies such as Nvidia, which has promoted the rapid rise of this track.As the market slowly abandons Intel, the company's share price has plunged 60% so far this year.

Faced with pain, Intel announced drastic reform plans, including large-scale restructuring and cost control plans including the spin-off of its OEM business and the suspension of overseas factories, aiming to cut spending by US$10 billion a year to restore financial stability.In addition, Intel is also working hard to sell its own Gaudi AI accelerators, but due to the overall adoption rate being slower than expected, Intel has forecast that this year's US$500 million Gaudi revenue target will not be achieved.

If the US$500 million sales target cannot be achieved, it will be difficult for the market to remain optimistic about the prospects of Intel's AI accelerator business.In contrast, Intel's much smaller competitor Advanced Micro Devices earlier this week raised its sales forecast for similar products to more than $5 billion, or ten times that of Intel.Needless to say, leader Nvidia, whose artificial intelligence chip division is expected to generate more than $100 billion in revenue this year.

In this way, Intel is just an insignificant player on the artificial intelligence track.

Under the impact of artificial intelligence, the valuation rankings of global chip manufacturers have been reshaped, and traditional giants who did not deploy AI tracks early have been subjected to a wave of cleansing.Intel, once the world's largest chipmaker, has fallen behind TSMC by more than $700 million in market value.Samsung has the same experience as Intel.Four years ago, Samsung and SMIC had similar market capitalizations. Today, Samsung's market capitalizations are less than one-third of SMIC's.

Because of this, even if Intel's share price soared after the results and the company gave strong guidance for the fourth quarter, many people on Wall Street still couldn't swallow this big cake.

Adam Crisafulli, founder of Vital Knowledge, wrote in a report that Intel's business has been branded as traditional chips.The cold weather of Gaudi chips means that the company is destined to make no waves on the artificial intelligence track.

Goldman Sachs also said it would be an "tough battle" for Intel to turn a profit and compete with companies such as Nvidia, AMD, and TSMC.It will take some time for companies to match their technology, especially artificial intelligence chips, to competitors, if they can do it.