Introduction to Admiral Markets

Admiral Markets has many features to meet the needs of all types of traders around the world。

Admiral Markets has many features to meet the needs of all types of traders around the world。

Admiral Markets has been operating globally since 2001 and is considered one of the world's most popular brokers, aiming to provide clients with many benefits in trading and education.。As a licensed and regulated trading provider, Admiral Markets offers its customers multiple layers of financial protection。What most people don't know is that the broker operates in many jurisdictions, including the UK, Australia, the European region, and even the Kingdom of Jordan.。

Introduction to Admiral Markets

Admiral Markets Global, also known as Aglobe Investments Ltd, is registered as a securities dealer by the Seychelles Financial Services Authority with registration number SD073.。Aglobe Investments Ltd (registration number 8426894-1) has been licensed and approved to operate under the "Admiral Markets" brand, according to a legal statement on its website.。

The broker offers many interesting features, but here are some conditions worth noting:

1.Trading Account

Typically, brokers allocate different trading accounts for different types of traders。It is important for traders to check their trading account type before applying to a broker as each account may have different conditions and some accounts may not be suitable for certain traders。As for Admiral Markets, trading accounts are divided according to trading platforms, there are two available trading platforms, MetaTrader5 and MetaTrader4。

Account types in the MT4 platform include Trade.MT4 and Zero.MT4。As the name suggests, Zero.MT4 has 0 spreads, while Trade.The minimum spread of MT4 is 1.2 points, with a minimum deposit of $25 per account。

On the other hand, the MT5 platform comes with an Invest.Additional account for MT5 where traders can trade stocks and ETFs with 0 pips spread and a minimum deposit of $1。

2.Leverage

Admiral Markets offers a wide range of leverage, Forex leverage is 1: 3 to 1: 1000, while for indices, traders can use leverage from 1: 10 to 1: 500。Since the regulator (Seychelles Financial Services Authority) does not implement such restrictions, there is no need to apply as a professional customer to enjoy high leverage。

3.Education

Many traders are overwhelmed when they start learning to trade, there is a lot to learn and sometimes it is difficult to find where to start。Admiral Markets tries to help traders learn through different education methods。

For traders who like to read, Admiral Markets offers a large number of articles covering the basics of trading, analysis, scenarios, indicators, etc. For those who prefer more interactive learning, they can apply for webinars。Admiral Markets also provides traders with a glossary of terms to help them understand what each term means in the trading and investing world.。

4.deposit and withdrawal

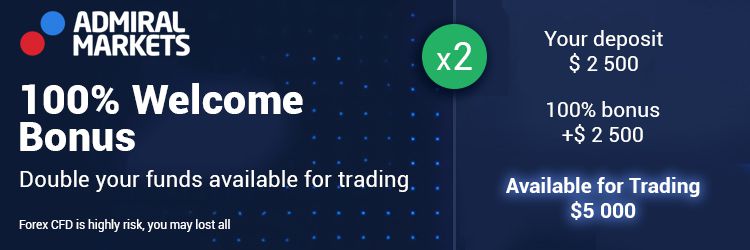

Admiral Markets offers deposit and withdrawal services through bank wire transfers, Skrill, Neteller, Visa and MasterCard, Perfect Money and cryptocurrencies, with no deposit fees for all funds transactions except bank wire transfers。Traders are required to pay €25 or US $for bank wire transfer deposits, except for deposits over €1,000 or US $, and Admiral Markets also offers a welcome bonus for new traders。

As for withdrawals, traders will have a free withdrawal request once a month, after which a 2% fee will be charged (minimum 1 euro)。The condition applies to all ways except Visa and MasterCard, which will be charged €5 or USD after the free request has been exhausted。

5.Trading products

Choosing a multi-asset brokerage firm is always a good idea to give traders more options when it comes to trading tools。Admiral Markets is well known as a CFD provider with over 50 Forex CFD, 43 Index CFD, 3000 + Stock CFD, over 370 EFT CFD, Commodity CFD, Cryptocurrency CFD and Bond CFD。

In addition, Admiral Markets allows traders to buy their favorite stocks at extremely low prices through piecemeal stocks.。In this case, traders can buy S & P500, NASDAQ, DAX40 and more global indices for just 1 euro or 1 dollar。Fragmented shares can be as small as 1 / 100th of the full share price, making it an affordable way for traders in the stock market to diversify their portfolios and also receive a proportional dividend on the dividend stock。

6.financial security

Security is a key factor to check before applying to the broker, as the broker will be entrusted with the custody of the client's funds。Admiral Markets keeps traders' funds in specially segregated customer accounts at internationally recognized banks to protect the safety of customers' funds。In addition to this, Admiral Markets "money protection insurance policy has been in effect since July 1, 2022, and all traders are eligible for up to 100.Higher level of protection of $000。Negative balance protection is also a security feature that is integrated with the broker system。

Considering that a lot of fraud happens now, Admiral Markets make sure their traders have a place to report such cases。Traders can contact them 24 hours a day from Monday to Friday at + 2484671940 for potential fraud and Admiral Markets also strongly recommends that traders activate two-factor authentication for trading room accounts。

7.Special

Admiral Markets offers documentary trading for all types of traders。The documentary trading platform allows traders to become part of a community of leading traders and investors. Traders can choose providers based on win rates, profit charts, average return on investment and other data in their profiles; on the other hand, traders can also Try to be a trading provider to get passive income every time other traders subscribe to their trades。

Conclusion

With such flexible and relaxed trading conditions, Admiral Markets aims to meet the needs of traders around the world, and its regulatory base may not be as reliable as that of UK Admiral Markets and Australian Admiral Markets, but their financial security measures are equally reliable.。Overall, the strength of Admiral Markets is its ability to welcome new traders with low minimum deposits and high leverage。

For a better understanding, please review the table below。

| Company | Admiral Markets Pty Ltd |

| Area | Australia |

| Regulators | AFSL (License No. 410681) |

| Type of account |

|

| Minimum deposit |

|

| Minimum order size | 0.01 |

| Spread |

|

| Deposits | Forex and Metals - Per 1.0 Hand 1.8 to 3.0 USD USD Cash Index - Per 1.0 Hand 0.05 to 3.0 USD USD Energy - Per 1.0 lots 1 USD USD Stocks and ETFs - 0 per share.02 USD USD from Single Share and ETF CFDs - 0 per share.02 USD USD from Other tools: No commission |

| Leverage |

|

| Account currency | AUD, EUR EUR, GBP, USD, SGD |

| Re-offer | ❌ |

| 💻Trading platform | MetaTrader 4, MetaTrader 5 |

| 📱Mobile transactions | Android, iOS |

| 🤖Expert advice | ✅ |

| Hedging | Allow in addition to Invest.Used in all accounts except MT5 |

| ● Negative balance protection | Allow in addition to Invest.Used in all accounts except MT5 |

| Islamic accounts | Only for Trade.MT5 |

| Deposit and withdrawal methods | Bank wire transfers, Visa and MasterCard, Skrill, Neteller and Poli |

| Product | Forex, Forex CFDs, Index CFDs, Equity CFDs, Bond CFDs, Cryptocurrency CFDs, and Commodity CFDs |

| Security | independent fund Negative Balance Protection Fraud information and help Two-factor authentication for trading rooms |

| Education | Webinars on Forex and Contracts for Difference Articles and Tutorials From Zero to Hero Course Forex 101 Course Trading video Trader's Glossary FAQs E-book |

| Investigation and analysis | Forex Calendar Trading News Global Market Dynamics Advanced Analytics Weekly Deal Podcast Market heat map Market Sentiment Trading Center |

| Trading instruments | MT5 Real-Time Web Trader Admirals Mobile APP MetaTrader Extreme Edition StereoTrader Virtual Private Server Parallel MAC |

Admiral Markets is a Forex and CFD brokerage firm,Since 2001, it has been committed to providing smart financial solutions for global traders.。The main services revolve around three key activities: learning, trade and investment。To this end, it has a number of registered subsidiaries, including Admiral Markets UK Ltd, Admiral Markets Pty Ltd (Australia), Admiral Markets AS Jordan Ltd, Admiral Markets Cyprus Ltd, Admirals SA (Pty) Ltd (South Africa) and Aglobe Investments Ltd (Seychelles), for global markets。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.