Like A Roller Coaster! Japanese and Korean Markets Surge Dramatically on Tuesday

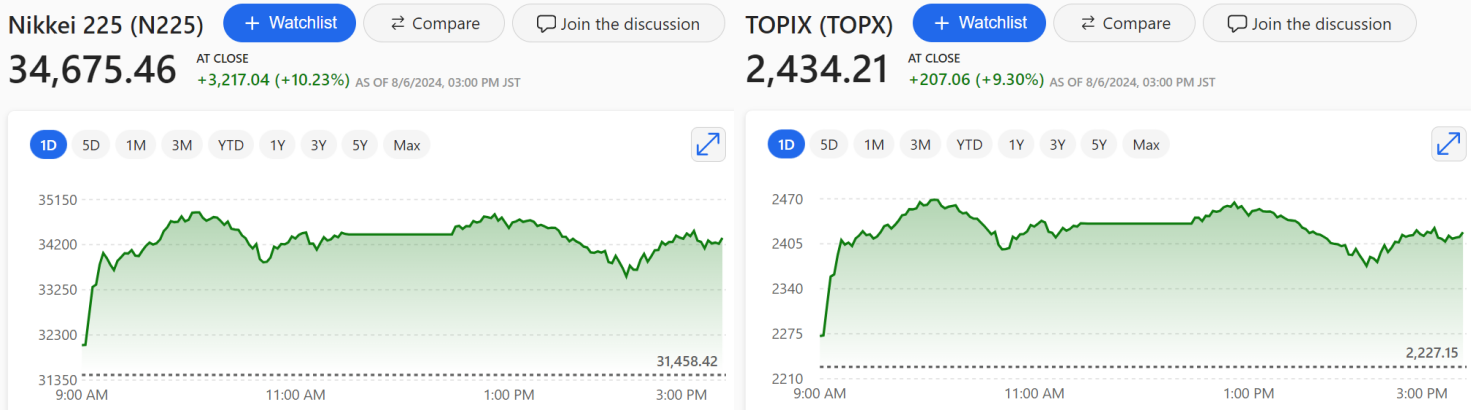

At Tuesday's close, the Nikkei 225 was up more than 10 percent, Japan's TOPIX was up 9.3 percent and South Korea's KOSPI was up 3.3 percent.

After the "Dark Monday", Japan and South Korea stock markets both ushered in a big rebound on Tuesday.

At the close of trading on Tuesday, the Nikkei 225 index rose more than 10% to 34,675.46 points, the largest increase since October 2008. Japan's TOPIX index rose 9.3 percent to 2,434.21. Both indexes had slumped more than 12 percent the day before.

South Korean stocks also saw a rebound. South Korea's KOSPI index rose more than 5% at one point during trading on Tuesday, eventually closing up 3.3% at 2,522.15 points, after the index fell 8.78% yesterday.

On Monday, stock markets in Japan, South Korea and even many parts of the world experienced panic selling, and many analysts believe that the reasons behind this include concerns about a recession in the U.S., as well as the yen's rebound, which led to the continued unwinding of yen carry trades.

Affected by Monday's decline in many global stock markets, the three major U.S. stock indexes, which opened later in the day, also closed collectively lower. The Dow closed down 2.60%, the Nasdaq closed down 3.43%, and the S&P 500 closed down 3%.

U.S. stocks fell less than Japan and South Korea, on the one hand, investors gradually digested the negative sentiment, on the other hand overnight ISM released another data to the U.S. economic deterioration prospects to ease the pressure.

The latest ISM data showed that the U.S. ISM non-manufacturing index came in at 51.4 in July, better than the expected 51 and 48.8 in June, returning to expansionary territory and reversing the worst contraction in nearly four years recorded in June.

Tomo Kinoshita, global market strategist at Invesco Asset Management Japan, said: "Market participants are now realizing that the correction is overdone as Japanese stocks fell far more than Europe and the U.S. yesterday. But this does not mean that the market adjustment is over. Weak U.S. economic indicators could still bring further selling in the U.S. and the rest of the world, including Asia."

Nomura Securities believes that this panic selling in the Japanese stock market may be over and investors will buy back stocks. Citi strategists believe that Japanese stocks have largely digested the mild U.S. recession and the yen's move to 140 against the dollar, with limited downside. But at the same time, it is expected that the shift in the recovery will take time and the safe-haven trade will dominate for the time being.

As of writing, the dollar-yen exchange rate (USD/JPY) has recovered from Monday's lows near 142 to around 144.

This rare plunge in the Japanese stock market has also led to some voices questioning the timing of the Bank of Japan's interest rate hike.

Nobuyasu Atago, chief economist at the Rakuten Securities Economic Research Institute and a former BOJ official, said, "The BOJ needs to remain humble about economic data and the market. The fact that the BOJ is raising rates in the face of poor economic data shows that it doesn't take the data seriously."

According to Mari Iwashita, chief market economist at Daiwa Securities, "This is a poorly timed rate hike. The BOJ will have to wait and see if the U.S. economy will fall into recession or have a soft landing before it can take the next step. At the very least, a rate hike in September and October is out of the question."

According to media reports, Japan's Ministry of Finance, the Bank of Japan and the Financial Services Agency held a tripartite meeting on Tuesday afternoon to discuss international financial markets. After the meeting, Japan's Ministry of Finance is responsible for international affairs vice minister Jun Mimura (Atsushi Mimura) said the meeting exchanged views on the stock market trend, will continue to pay attention to the financial market and foreign exchange market changes and progress, the government will work closely with the Bank of Japan, the view of Japan's economic recovery has not changed.

In other news, Jun Azumi, a senior member of the Japanese opposition party, said Bank of Japan Governor Kazuo Ueda (Kazuo Ueda) will be called to participate in a parliamentary committee meeting this week or early next week, on the Bank of Japan's latest policy decisions to be questioned.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.