2 Deposit Ways in Longbridge Securities

This article introduces the Longbridge Securities deposit process, breaking down the complete process of RM transfer and SGD transfer deposits in a multi-graphic format, as well as the required fees and precautions.

Today will continue to share how to deposit Longbridge Securities (multi-graphic process explanation) and deposit fees, as well as related notes to help you successfully complete the deposit action. The content is recommended for Malaysian and Singaporean users.

How to deposit to Changqiao Securities?

Currently, Longbridge Securities' main deposit method is bank remittance, which is divided into 2 categories: Hong Kong banks and other banks (Singapore, other non-Hong Kong banks). We support multi-currency deposits, including USD, HKD, SGD and MYR.

For Malaysian users, the most convenient deposit is to use other non-Hong Kong banks, direct deposit in Malaysian dollars, the lowest cost and the most cost-effective, the fastest 1 working day to the account.

Similarly, Singapore users use Singapore banks to deposit in SGD, which is the most cost-effective; users in Hong Kong and Macau use Hong Kong banks to deposit in HKD, which is the most cost-effective.

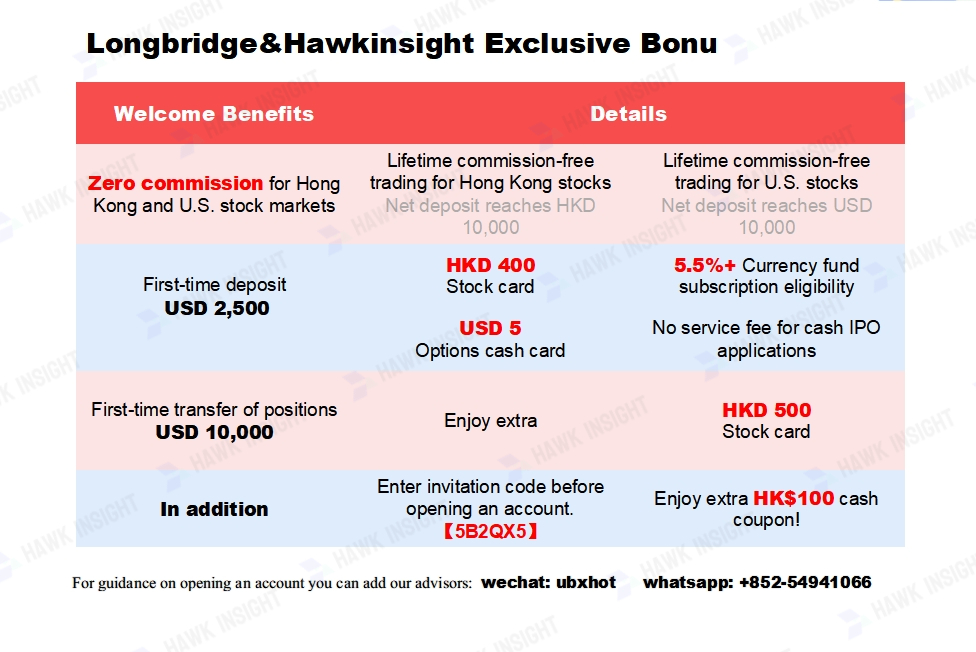

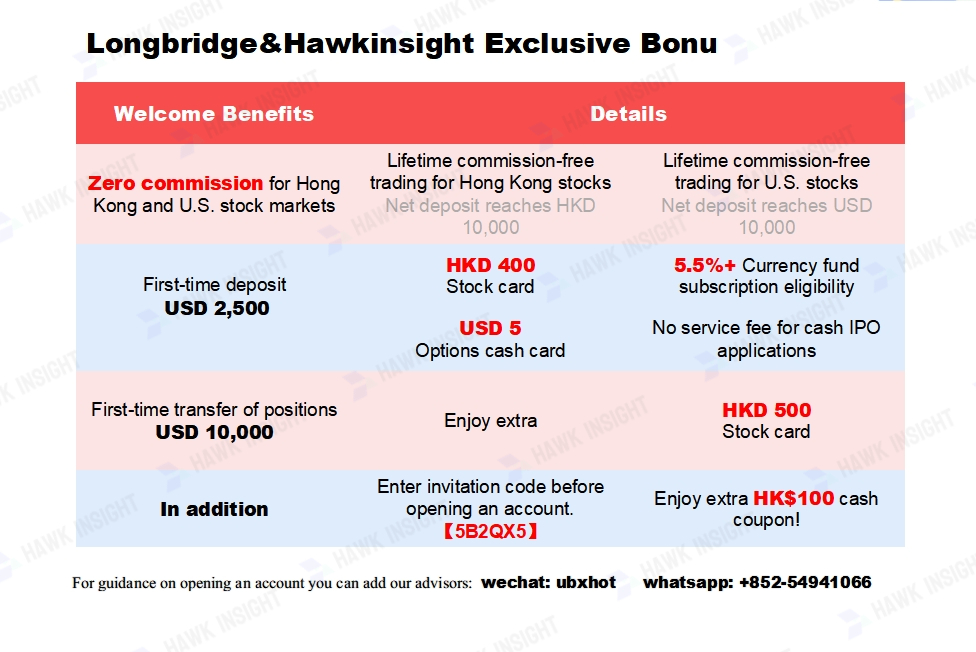

Hawk Insight Exclusive Offer for Newcomer Account Opening at Longbridge Securities

For a limited time, users who deposit HKD1w can get lifetime commission free for HK and US stocks!

- Get 400HKD stock cash card

- HK stock cash for new trades free of charge

- Approx. 5.5% p.a. for USD currency funds, 4.5% p.a. for HKD currency funds

- Lifetime commission free for HK stocks

- Option Cash Coupon $5

Longbridge Securities Account Opening Invitation Code【5B2QX5】

In addition, open an account through this channel, you can get another HK$100 cash gift pack and exclusive peripherals!

Precautions for depositing funds in Longbridge Securities

1. Deposits can only be made after a successful account opening.

2. There is no minimum or maximum deposit limit for Longbridge Securities. New users who register a new account through Everbridge's exclusive benefits link will receive 1 share of Intel (NASDAQ: INTC) as a bonus for their first deposit of more than USD1,000 (or RM4,200) and 1 share of Apple (NASDAQ: AAPL) as a bonus for their first deposit of more than USD2,000 (or RM8,400).

3. Longbridge does not charge any fees for deposits. Deposits made in RM or SGD are fully credited to the account, and the remittance bank used generally does not incur any fees.

4. Longbridge stipulates that you can only use your personal bank account to transfer funds (must be in the same name as your Longbridge account), and does not accept third party bank accounts, joint bank accounts, third party payment platforms (e.g. Wise), cheques, etc., and does not support credit/debit cards, e-wallets, and other methods of deposit for the time being.

Longbridge Securities Deposit Instruction

Next, we will introduce the complete process of depositing funds by RM transfer and SGD transfer respectively in multi-graphic format, both using the “Other Non-Hong Kong Bank” option.

This tutorial will be based on Longbridge Longbridge App, Traditional Chinese interface, and it will take about 5 minutes to complete the deposit action. You can switch to Simplified Chinese or English at any time!

The method is to go to the left toolbar > Settings > General > Language Settings > App language > select the desired language, click Save to save.

Procedure of transferring funds in Malaysian Dollars (Handling Fee: $0)

◇ Applicable to: Malaysian bank account holders

◇ Handling Fee: $0 for both Longbridge and bank side (belongs to general bank transfer)

Generally speaking, Malaysian users can only use wire transfer to deposit funds to overseas securities dealers, and in the middle of the process, they have to pay an opaque fee, such as the wire transfer fee (Foreign Telegraphic Transfer Charge) levied by the bank of the outgoing payment, the transit bank fee, and the handling charge levied by the bank of the arriving account. Coupled with the exchange rate conversion, the cost of each wire transfer deposit is very high.

One of the biggest advantages of Longbridge (for Malaysian users) is that it accepts deposits in RM by bank transfer, and the full amount will be credited to Longbridge account in RM, with 0% commission in the middle. Longbridge does not charge any fees, and local bank transfers are usually free of charge as well.

Transferring funds to Lombardi Securities is the same as a normal bank transfer, you can choose to use online banking or go to the bank counter in person to do it. Below is a demonstration of how to transfer funds from Maybank online banking. The process of transferring funds to other banks is similar.

Step 1: Login to your account and choose the deposit method - other non-Hong Kong banks

After your account has been successfully opened and approved, you need to deposit funds to start trading.

Login to Longbridge App > Click on “Assets” in the lower right corner > Deposit Funds, you can see that there are 2 deposit methods: Hong Kong banks, other banks.

Continue to choose the deposit method, here we choose “Other Non-Hong Kong Banks”.

Step 2: Select Deposit Currency (USD/HKD/Ringgit)

Select the currency you want to deposit, here we choose “Ringgit”.。

Step 3: Get Transfer Information

Next you can see the bank receipt information of the custodian of Longbridge Securities. Currently, Longbridge's custodian is Phillip Securities Pte Ltd (PSPL), so all funds will be deposited in Phillip Securities' third-party bank custodian.

For example, if you deposit RM, Phillip Securities' third party bank custodian is Maybank Malaysia.

The system will display detailed information about the transfer, including the payee's name, account number, country, SWIFT code of the payee bank, payee's bank, payee's address, the currency of the transfer, and very importantly, the Remarks of the transfer. These are the information you need to enter when transferring funds.

* Remittance Remarks: Contains your Longbridge account number and name, which is an important basis used by Longbridge to audit and reconcile funds, so it must be filled in.

Step 4: Make a local bank transfer

Next, you can start transferring money to your local bank, you can choose to do it via online banking or go to your bank's counter/ATM machine to make a bank transfer.

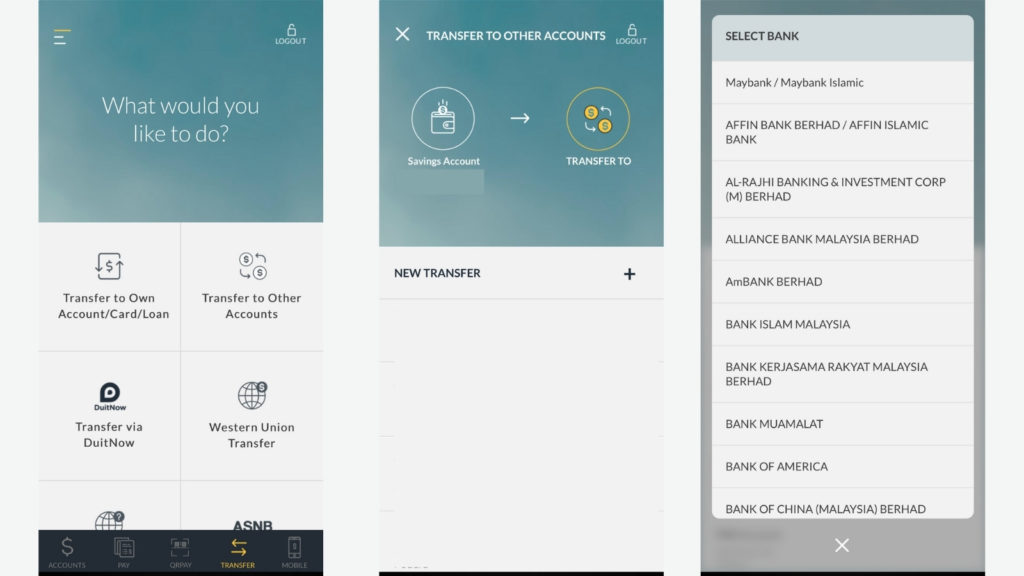

You can choose any one of the banks to make the transfer, below I will use Maybank App to make the transfer, the process is the same as normal bank transfer to other people.

Login to Maybank online banking account > Transfer to Other Accounts > New Transfer > select Maybank / Maybank Islamic.

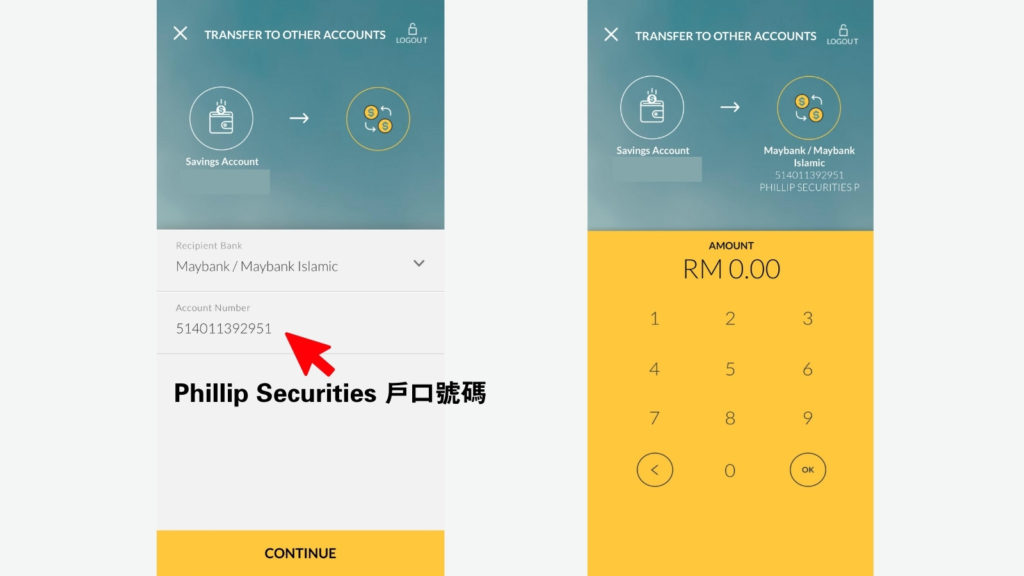

Enter the transfer page and enter the bank collection information obtained above for the custodian of Longbridge Securities, including.

◇ Phillip Securities account number

◇ Transfer amount (how much money to be paid)

◇ Recipient Reference Fill in remittance remarks

Finally, click Proceed > Confirm & Transfer to complete the transfer。Remember the screenshot or download the remittance voucher (Receipt)。

Here to pay attention to a few key points:

Use Instant Transfer instead of IBG。

◇ Be sure to fill in the remittance notes (Long Bridge account number and name) provided by Long Bridge Securities in the Recipient Reference so that the Long Bridge team can confirm the remittance.。

◇ Remember the screenshot to confirm the successful remittance page (Receipt), and then you need to send the remittance voucher to Changqiao。

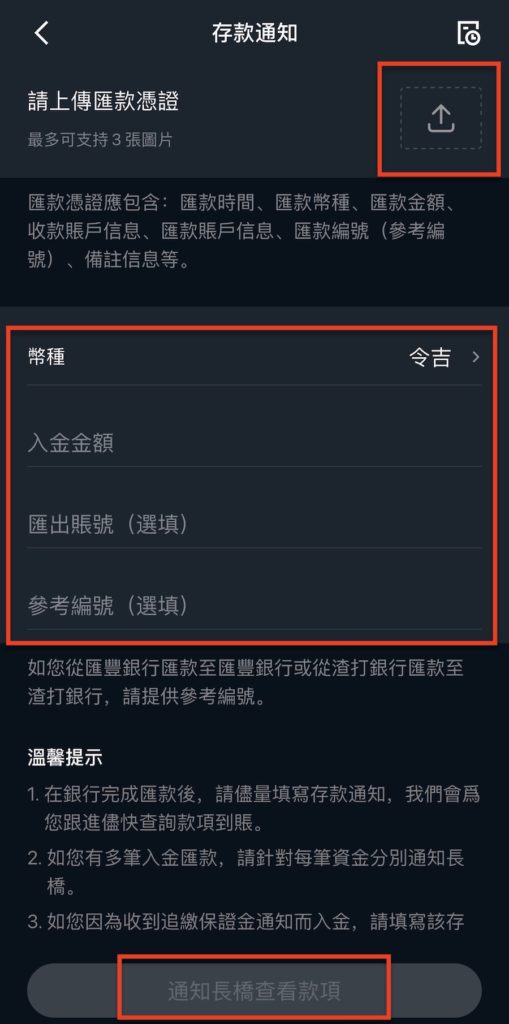

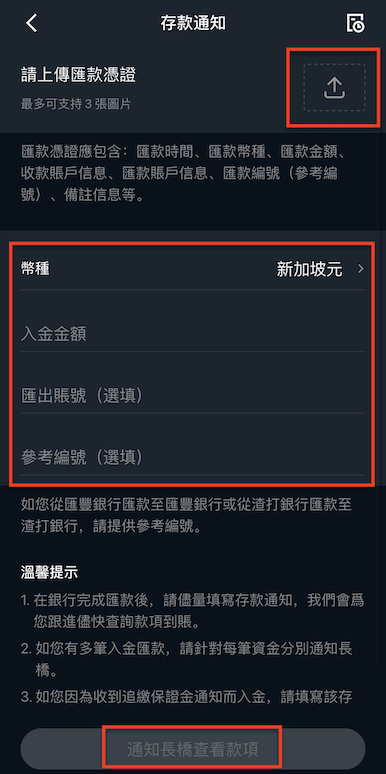

Step 5: Upload the remittance voucher and issue a deposit notice

Proceed to the next step and issue a deposit notice。Return to the remittance page of the Longbridge App, click "Upload remittance voucher now," upload the remittance voucher (Receipt) and fill in the remittance information, including:

The currency: ringgit

◇ Amount of deposit

◇ Remittance account number: the personal bank account number of the money you remitted (can be filled or not)

◇ Reference Number: Reference Number on the remittance voucher (optional)

Finally, click "Notify Long Bridge to view the payment" to complete the deposit action.。Filling out deposit notices can speed up the process of matching and confirming remittances within Long Bridge Securities。

Step 6: successful deposit, received notification

It usually takes 1 to 3 working days for the transfer of ringgit into the account.。After the success of the deposit, you will receive long bridge securities App push and email notification。

You can also log in to your Longbridge account and view the deposit status at Assets > Deposits > "Deposit Notice History" in the upper left corner.。If you have not received the notification for more than 3 days, you can click "Help and Customer Service" to ask the online customer service。

Actual arrival time of ringgit transfer deposit

My actual measurement is that I received the deposit at 2: 00 p.m. on Friday and notified Changqiao, and received the deposit completion notice at 8: 00 a.m. the next day (Saturday), and the rate of arrival was not bad.

New currency transfer deposit process (fee: 0 yuan)

◇ Applicable object: have a Singapore bank account

◇ Handling fee: the handling fee on both the long bridge and the bank side is 0 yuan (belongs to the general bank transfer)

If you have a Singapore bank account, you can also choose to transfer the Singapore currency into the long bridge account, to Singapore's Phillip Securities (Phillip Securities) third-party bank custody.。The same is the full amount of new currency to the long bridge account, the intermediate fee is 0.。Longbridge does not impose any fees, and Singapore bank transfers are generally zero fees.。

With UOB (UOB), OCBC (OCBC), DBS (DBS) deposits in Singapore, you only need to select Billing Organisation > Phillip Securities Pte Ltd at the time of transfer.。

Of course, you can also open a Singapore bank account based on the CIMB SG that we wrote about earlier, which you can also open at home, and incorporate it into the gold and new currency.。

* If you use CIMB SG as a deposit, you can select Transfer via FAST at Cimb Clicks Singapore to remit money to a bank account below Phillip Securities (provided by Longbridge Securities Customer Service)。Be sure to fill in the remittance note in Message to Recipient (Longbridge account number and name)。

Before remittance, it is recommended to confirm the bank transfer information to the online customer service again.。

The following is the process for transferring deposits using UOB Online Banking in Singapore:

Step 1: Log in to your account and select the deposit method - other banks

Also log in to Longbridge App first > click on "Assets" > Deposit Cash in Deposit Funds in the lower right corner。

Continue to choose the deposit method, here we choose "other banks" > UOB。

Step 2: Select the currency to be credited (Singapore dollar)

Choose the currency you want to deposit money in, here we choose "Singapore Dollar"。

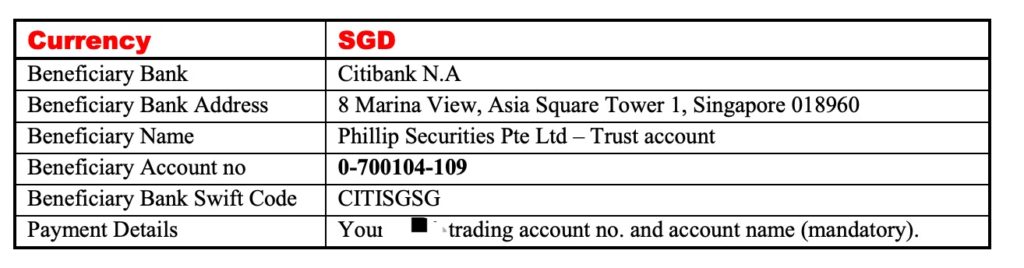

Step 3: Get the transfer information

Next, you can see the bank collection information of the custodian of Long Bridge Securities, that is, the information of Phillip Securities Pte Ltd (PSPL) in Singapore, including Billing Organization, Billing Reference remittance notes and remittance currency.。

* remittance notes: your long bridge account number (7 digits), the actual content of the long bridge App display shall prevail, be sure to fill in the remittance notes, convenient long bridge audit and reconciliation of funds。

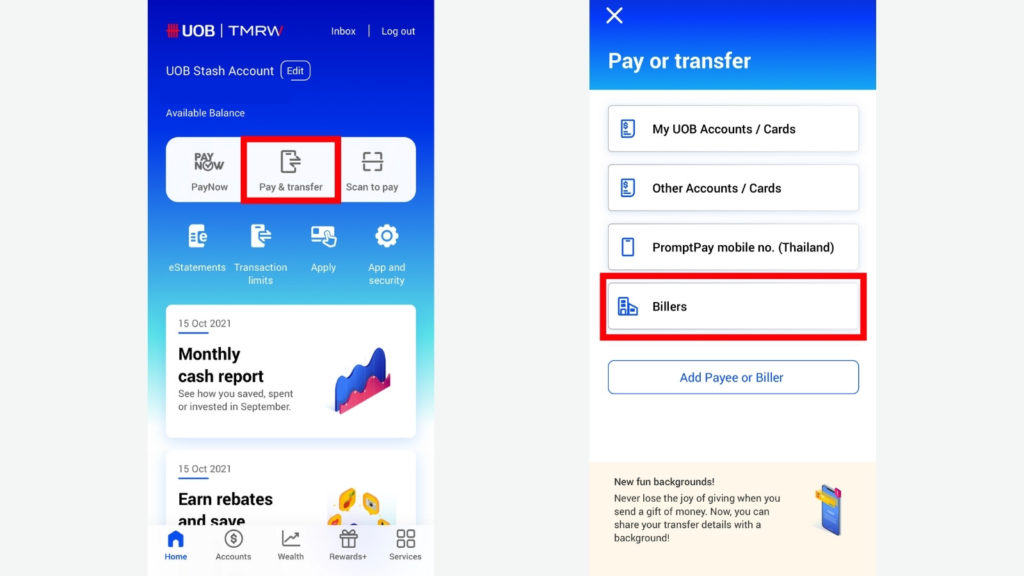

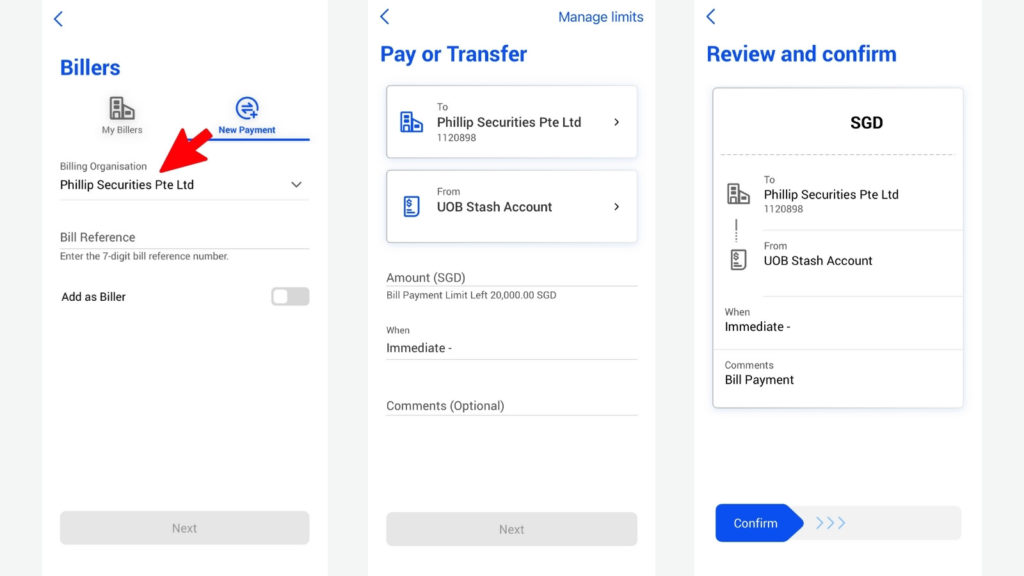

Step 4: Make a Singapore Bank Transfer

Next to start the transfer, log in to the UOB TMRW Online Banking App > click Pay & Transfer > Billers to start the transfer。

Go to the Transfer page and enter information, including:

◇ Billing Organization: Phillip Securities Pte Ltd ◇ Billing Reference Remittance Remarks: Longbridge account number (7 digits) ◇ Transfer amount (how much to deposit)

Finally, click Next > Confirm to complete the transfer。Remember the screenshot or download the remittance voucher (Receipt)。

Step 5: Upload the remittance voucher and issue a deposit notice

Finally, go back to the remittance page of Longbridge App, click “Upload Receipt Now” to upload the Receipt and fill in the remittance information, including:

◇ Currency: Singapore Dollar

◇ Deposit amount

◇ Outgoing Account Number: the account number of your personal bank where you remit the money (can be filled in or not)

◇ Reference Number: Reference Number on the remittance voucher (can be filled in or not)

Finally, click “Notify Changqiao to check the payment” to complete the deposit action.

Step 6: Deposit successfully and receive notification

Deposits in SGD generally take 2 business days to arrive. You will receive an app push and email notification from Longbridge Securities after successful deposit.

Actual Deposit Time for SGD Deposit

In my test, I made a deposit and notified Longbridge on Friday at 3pm, and received a notification that the deposit was completed on Tuesday at 8am, which took one working day to process and arrive in my account.

Summary

Overall, Malaysian investors generally respect the use of RM bank transfers for deposits, which is considered to be the quickest and most cost-effective way. Among the many securities brokers, Longbridge Securities is the only one that supports RM deposit to account, thus making it more user-friendly for Malaysian users. The deposit process is similar to a normal bank transfer but takes a day to arrive.

For those investors who are interested in investing in Hong Kong and US stocks, they can utilize the built-in currency conversion function to convert their funds to HKD or USD after completing the deposit. This provides investors with a convenient way to trade in the international market.

In the next part of our investment process, we will share the detailed process and fees associated with stock trading using Longbridge Securities. If you have any questions or need further communication, please feel free to leave a message in the comment section and we will be happy to answer your questions.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.