Longbridge Securities Longbridge Trading Stock Tutorial

This article introduces Longbridge Securities Longbridge's detailed operation diagrams of placing orders to buy stocks, ETFs, setting pending orders, and how to use the built-in currency exchange function and financing transactions to open the way to invest in Hong Kong and U.S. stocks.。

Longbridge Securities recently launched a one-stop online trading platform to provide investors with a convenient trading platform experience. The platform supports trading in eight financial markets including the United States, Hong Kong, and Singapore, covering a variety of financial products such as ETFs, REITs, money market funds, warrants, and bull and bear certificates. Users only need one account to easily place orders, and the platform provides Chinese and English interfaces, which are simple and smooth to use.

To help users better use the Longbridge App for trading, we have compiled relevant operation diagrams, including how to buy ETFs, set pending orders, and perform currency conversions. Finally, we will also provide two methods of using currency to purchase, so that investing in overseas markets becomes easier.

Tips before buying and selling stocks

After registering and joining the Jinchangqiao account, you can log in to the Longbridge App to open the trading window.

It should be noted here that the first step of registration is to click on the specific channel link to register an account first, then download the Longbridge App, log in to the App with the same mobile phone number when registering, and then fill in some personal information to complete the account opening.

The account balance of Longbridge itself is the margin account balance, which has a financing (margin) function. If you have not deposited funds at the beginning, you can use the account balance of 50,000 SGD for financing.

Please note that financing requires daily interest payments, which will start to accrue after the settlement of T+2 days after the transaction, with a minimum of 0.01 USD (HKD). The calculation method is:

Financing interest for the day = financing balance after the close of the trading day x (financing rate/365)

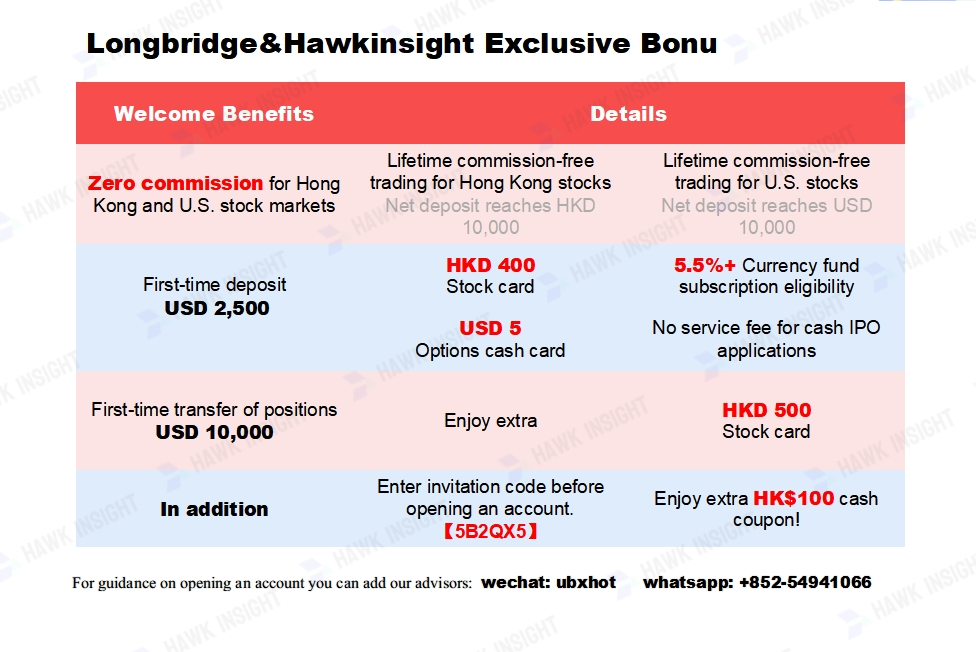

Hawk Insight Exclusive Bonus

Limited time event of Changqiao: Users who deposit HKD 10,000 can get commission-free Hong Kong and US stocks for life!

- Receive a 400HKD stock cash card

- Free cash subscription for new Hong Kong stocks

- USD money fund is about 5.5% annualized, HKD money fund is about 4.5% annualized

- Permanent commission-free Hong Kong stocks

- 5 USD option cash coupon

Longbridge Account Opening Invitation Code【5B2QX5】

In addition, if you open an account through this channel, you can also get a JD.com card worth 88 yuan.

Longbridge Official Group

Join Longbridge account opening exchange group to get first-hand discount information.

Longbridge Trading Platform Interface News

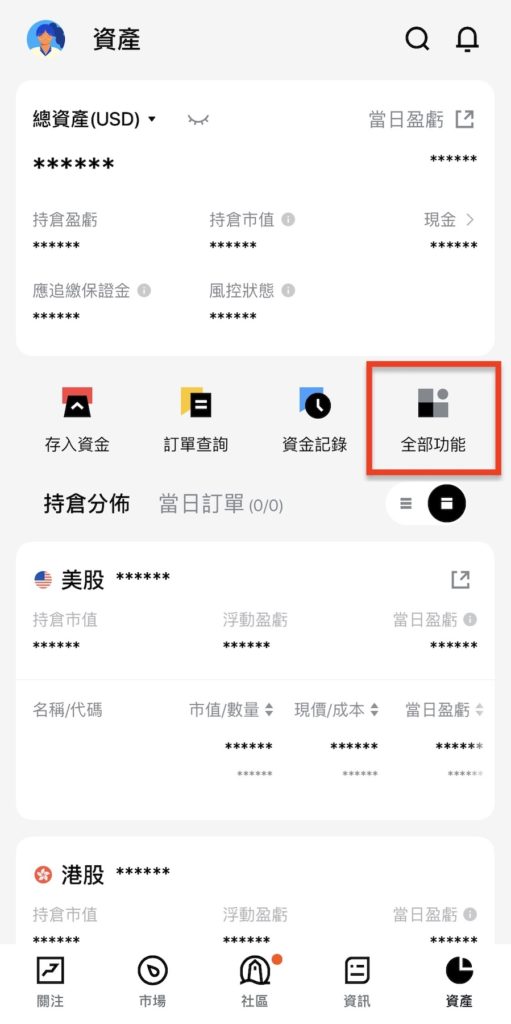

After opening an account, you will automatically open US stock, Hong Kong stock, and fund trading accounts. Log in to the Longbridge App and you can view account and total asset information on the "Assets" page, such as holding market value, holding profit and loss, cash balance, orders, fund records, and used fund transaction quotas.

Hong Kong stock and US stock accounts are displayed to facilitate users to track sample warehouses.

After the account and deposit are ready, immediately enter the order process and start trading!

Longbridge Order Process

The process of placing orders to buy and sell stocks and ETFs with LongBridge is simple:

- Select the target you want to buy or sell, and click enter or exit

- Set order data (order type, price, quantity, validity period, etc.)

- confirm the order information and send it out

The following order process teaching will be based on Longbridge App traditional Chinese, 1 minute to complete the order。If you want to switch to English or Simplified Chinese, you can adjust the settings at any time, the interface is the same。

How to change the language setting: go to the left toolbar > Settings > General > Language Settings > App language > select the desired language, click Save to save it。

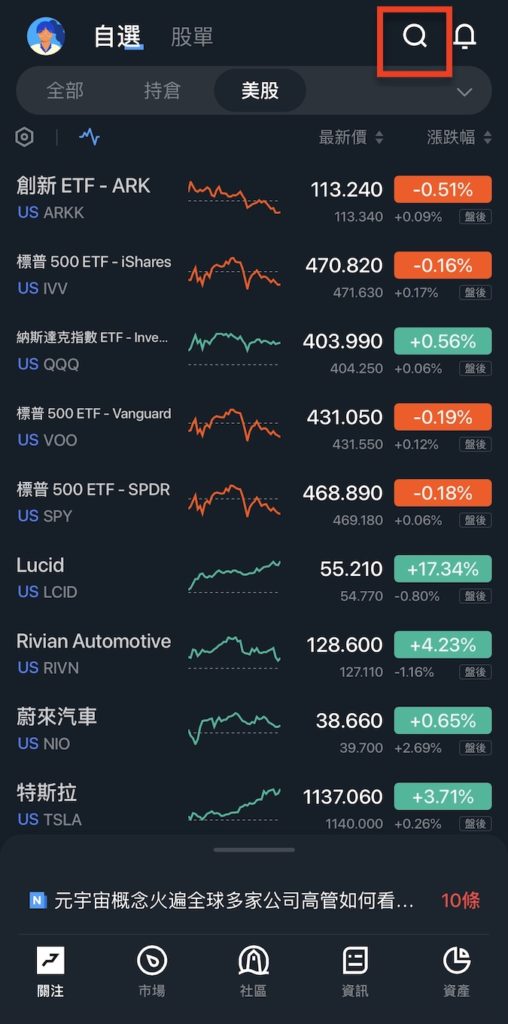

Step 1: Select the subject you want to place an order with

Log in to Longbridge Securities Longbridge App personal account, the main interface is the user's self-selected stock list (i.e., stock watch list Watchlist)。In the search bar at the top right of the interface, enter the name or code of an individual stock or ETF。For example, Apple stock Apple (code AAPL), the S & P 500 ETF that tracks the broader market index (code: SPY)。

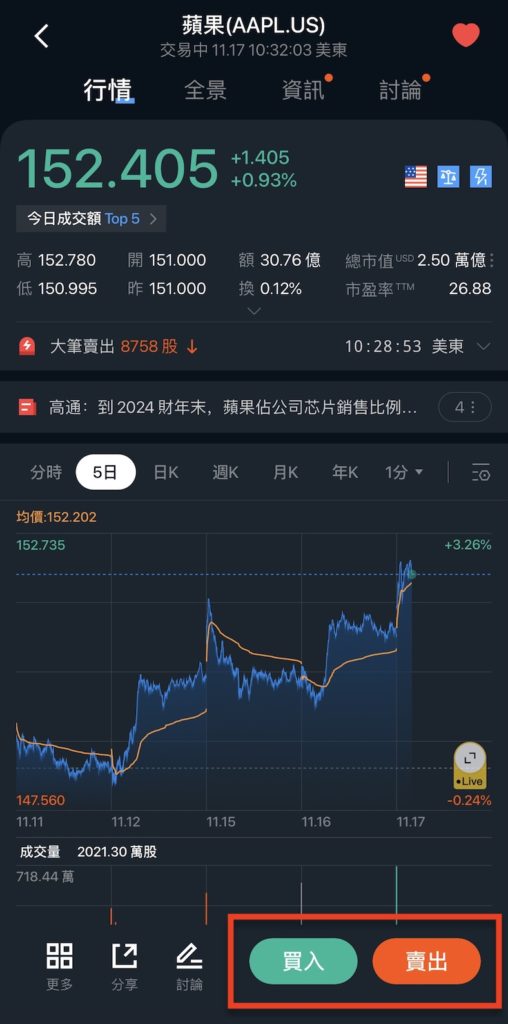

Here's an example of AAPL, enter AAPL in the search bar, and the relevant stocks, ETFs, and posts, information, etc. will appear.。Select the subject matter you want to trade (AAPL) and you will be taken to the detailed market page of the subject matter.。

Or you can find the underlying you want to trade directly from your own stock order and trade it.。

Step 2: Choose Buy or Sell

Choose Buy or Sell at the bottom。

It should be noted here that, in general, if you do not have a trading target, choose "sell" on behalf of the stock to short, that is, "margin" operation.。Changqiao Securities does not support the securities lending function for the time being.。

What is shorting / margin trading??

Shorting / margin trading represents shorting the stock and thinking that the stock will fall in the future, so borrowing stock trading with a brokerage firm to make a profit first。Buy back the stock when the contract expires and return it to the broker to earn the difference between selling high and buying low。

Step 3: Set up the order information (order type, price, quantity, validity period, etc.)

Before setting up your order profile, learn about the trade order settings, including order type, price, quantity, and expiration date。

Order Type

Longbridge Securities offers 4 types of orders, including limit orders, market orders, stop-loss limit orders and condition orders.。The difference between these four orders will be explained in detail below.。

Price

If you want to buy or sell the underlying trade at what price, you must set the price if you choose a pending order (non-market order).。

Quantity

Number of units bought or sold。The system will recommend the amount of money you can operate on this transaction based on the amount of cash you hold and the amount of financing available (margin)。

Note that the minimum threshold for U.S. stocks is 1 share, while Hong Kong stocks are 100 shares.。Longbridge does not support buying in U.S. stocks (fractional share) for the time being, but supports selling in fractional shares。If you want to operate broken strands, consider using Interactive Brokers。

Validity

At the time of pending orders (non-market orders), you can select the order validity period, including valid on the same day, valid before withdrawal, and custom validity period.。

The maximum validity period of the order is 365 days, the overdue system will automatically withdraw the order, the order expires.。

According to your investment strategy, after setting the order type, price, quantity and validity period, click "buy order" or "sell order"。

Step 4: Confirm the order information and open the transaction

Check the order data and confirm that it is correct. Click "Confirm Buy" or "Confirm Sell" to place the order successfully.。

Longbridge Securities Order Type

Longbridge Securities supports 4 order types, each of which is explained below.。

Limit Order

Limit Order (Limit Order) is to buy or sell the underlying at a specified price.。Transactions are executed and closed only in two cases:

When the specified price is reached, or when a better price is reached (lower than the specified bid price, or higher than the specified ask price)

The advantage of a limit order is the opportunity to trade the underlying at a better price, but there is also the opportunity to never trade and miss a good time to invest。

Market Order

Market Order (Market Order) is to buy or sell the underlying at the current market price, do not need to specify the price, only need to set the quantity you want to close.。Market orders can only be placed at the opening of the stock market.。

The advantage of a market order is that it can be closed as soon as possible, but the price of the transaction fluctuates with the market and cannot be controlled.。

Stop Limit Order

Stop Limit Order (Stop Limit Order) refers to the system automatically submits a buy or sell limit order when the market price reaches the user-specified trigger price (Stop Price).。

The biggest difference between a stop-loss limit order and a limit order is that it has an additional "stop-loss trigger" section.。

The stop limit order is divided into two parts: the trigger price (Stop Price) and the limit price (Limit Price), the general operation is "buy high and sell low," allowing users to buy or sell at a specific or better price.。

Simply put, when placing a buy order, the trigger price is higher than the current market price; when placing a sell order, the trigger price is lower than the current market price.。

Condition Order

Condition Orders (Condition Orders) are special trigger orders that require different trigger conditions, such as fixed-point trigger conditions, trailing stop conditions, trigger price, expiration date, order price, quantity, etc.。Before the specified effective date, the system will automatically submit a buy or sell limit order as long as the subject matter of the transaction meets the pre-set conditions.。

In general, if the user wants to set the trade's take profit, stop loss point (i.e. stop profit, stop loss), can use the condition sheet function.。The advantage is that you can pre-control the scope of profit or loss, in the event of extreme market fluctuations, not to miss any investment opportunities, but also to maximize the investment risk and loss to a minimum.。

Changqiao Securities Order Effective Period

The user can choose the validity period of the order when placing the order (limit order), and Long Bridge offers 3 validity periods, including valid on the same day, valid before withdrawal and valid before the expiration date.。

The maximum validity period of the order is 365 days, the overdue system will automatically withdraw the order, the order expires.。

Valid For The Day

Orders are only valid during the stock market trading session on the day the order is placed, and at the close of the stock market, if the order is not filled, the system will automatically withdraw the order.。

Good Till Canceled

The order will remain valid until the order is completed, cancelled by manual withdrawal, or the maximum validity period of 90 days is reached。

Valid before expiration date Set Validity

The user can set the effective date of the order, the upper limit is 365 days。

For example, suppose I place an order to buy shares of Y Company on November 22, 2021, and set "valid on the same day," which means that the order is valid today, and if there is no transaction, the order will be automatically cancelled after the market closes on the 22nd.

Set "valid until withdrawal," the order will remain valid, in the list of pending orders at any time until the transaction.。90 days can not be closed, the system will automatically cancel this order;

Set "effective before the expiration date," the validity period of the order can be extended, belongs to the long-term effective order。Before the set validity period, the order is not closed and will be automatically cancelled。The system will automatically cancel this order if the transaction cannot be completed within 365 days.。

Changqiao Securities supports pre-market after-market trading *

U.S. stock trading hours include ordinary trading hours, pre-market and after-market trading sessions, while Holders of Longbridge's consolidated account may submit orders for trading during the pre-market and after-market sessions of U.S. stocks。Standard account holders cannot trade U.S. stocks before and after the market.。

* Individuals holding Hong Kong bank cards can apply for integrated accounts, while other users hold standard accounts.。

The trading sessions are as follows:

Pre-market trading

Eastern time 4: 00 ~ 9: 30

Daylight Time Malaysia Time 16: 00 ~ 21: 30

Malaysia time in winter from 17: 00 to 22: 30

After-hours trading

Eastern time 16: 00 ~ 20: 00

Daylight Time Malaysia Time 4: 00 ~ 8: 00

Malaysia time 5: 00 ~ 9: 00 in winter

Half-day after-market trading

US Eastern Time 13: 00 ~ 17: 00

Daylight Time Malaysia Time 1: 00 ~ 5: 00

Malaysia time 2: 00 ~ 6: 00 in winter

How to trade U.S. or Hong Kong stocks in Malaysian dollars.?(trading in other currencies)

When placing an order, Longbridge Securities requires that the corresponding monetary assets must be invested in different markets.。For example, to trade the U.S. stock market, you must hold U.S. dollars; to trade the Hong Kong stock market, you must hold Hong Kong dollars.。

For example, if you want to invest in the Hong Kong market, but use the more convenient and cost-effective ringgit bank transfer deposit, then users cannot directly trade the Hong Kong stock market in ringgit.。The system will remind the account that there is no cash to buy, the transaction has "exceeded the current Hong Kong dollar cash purchasing power."。If you continue to trade, you will use the financing (margin) transaction, after T + 2 you will have to start paying interest, which is calculated on a daily basis.。

How to trade U.S. and Hong Kong stocks?Do you need to deposit gold in US dollars or Hong Kong dollars again??

The solution is to use the built-in currency exchange function to transfer to US dollars and Hong Kong dollars.。

Changqiao Securities currency exchange process, trading orders in other currencies

The process of currency exchange is simple, and the following is a demonstration of the process of transferring money from RMA to USD.。

Step 1: Go to the Assets page and choose Currency Conversion

Log in to the Longbridge App, in the Functions column in the middle of the Assets page, choose Open All Functions, and then choose Currency Swap。

Step 2: Set the currency and amount of the transfer.

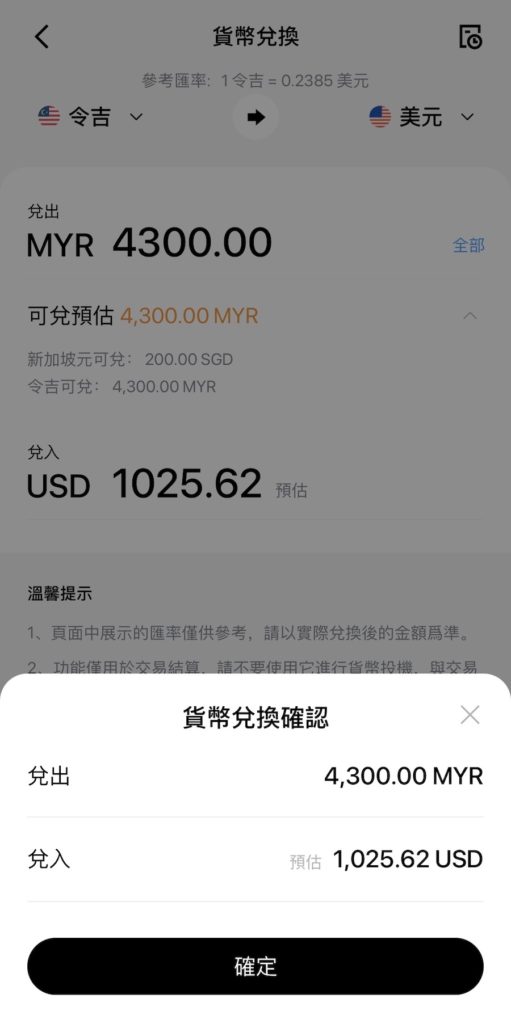

Next, set the currency for this transfer, such as the transfer of ringgit to the U.S. dollar.。The system will show what the exchange rate is for the day and what cash assets are on hand to perform this transfer operation.。

Enter the amount you want to exchange and the system will estimate approximately how much foreign currency you can exchange.。For example, if I want to exchange RM4,300 for U.S. dollars, the system estimates that I can exchange it for 1,025..62 USD。

Step 3: Confirm the exchange information and perform the exchange operation

Check the data of the exchange application, confirm that it is correct, and click "Apply for Exchange" to successfully exchange currency。

Currency completion time:

◇ Submit before 2pm on working days, the settlement date is T+1, which means it is expected to take 1 to 2 working days to process.

◇ Submit after 2pm on working days, the settlement date is T+2, which means it is expected to take 2 to 3 working days to process.

After the exchange is completed, you will receive an App push and email notification from Changqiao Securities.

Here are a few key points:

◇ The currency exchange supported by Changqiao Securities includes Hong Kong dollars, US dollars, offshore RMB, SGD, GBP, GBP, CAD and MYR.

◇ The maximum amount of currency exchange rate is based on the cash assets held in the account.

◇ There is no handling fee for currency exchange.

◇ The exchange rate displayed on the exchange page is for reference only and must be based on the actual amount after exchange.

◇ The account can hold multiple currencies at the same time.

Summary

Before trading, investors need to confirm the account balance and require them to pay margin.

When trading in markets such as US stocks, it is crucial to ensure that the US dollar assets raised in the account. This can avoid additional fees or inconveniences caused by exchange rate fluctuations. In addition, for investors who choose financing transactions, special attention should be paid to the calculation and payment of related fees. The interest fees generated by financing transactions are calculated after daily settlement and start to accrue interest on T+2. The minimum interest amount is US$0.01 (or HKD), and the calculation method is that the financing interest on the day is equal to the financing balance after the close of the trading day multiplied by the financing rate divided by 365.

Therefore, while establishing a long-term management mechanism, we also strive to ensure the smooth operation of the customer's balance sheet and ensure that the interests of customers are fully protected, so as to maximize customer value.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.