Finding the Best Forex Broker: Surcharges VS Execution Types

Before choosing the ideal broker, be sure to check the following two factors: the spread provided by the broker and the execution speed and accuracy。

Finding the right broker is never easy, but it's a crucial step in determining your entire trading experience。Traders must recognize that the success of trading depends on their skills and the performance and transparency of the brokers they choose to work with.。Therefore, as a trader, you must ensure that the broker you choose is suitable and can truly help you achieve your trading goals。

But what makes a "good" broker??

In fact, there are many factors to consider before you choose to invest your money in a particular broker。Well, among the many offers and features, there are two basic factors that we must pay attention to before we start trading with a broker, namely the spread as a transaction fee and the accuracy and speed of execution when opening or closing a position。

Most traders believe that low spreads are always favorable because trading fees must be kept to a minimum to make as much profit as possible。But are you aware that even brokers with low spreads and fast execution still get negative reviews from their clients?

In fact, not all brokers are completely honest about the additional fees that may be charged during the trading process。

However, you can't comment on a broker based on a customer's evaluation alone。Try to analyze from a larger perspective and think objectively。In this article, we will discuss how to find a real broker based on spread and execution speed。

Beware of unpredictable additional costs

Before choosing a broker, be sure to collect information on its official website and learn about its services。Brokers usually mention all services and facilities on their pages and display information related to transaction fees and expenses every time a client sends a request (buy or sell order)。Ideally, brokers must act on these quotes。

In practice, however, many brokers do not remind their clients that they may charge additional fees in times of extreme market volatility。For example, when the market suddenly spikes in price after a major news release, additional fees are charged。

Many market participants will take advantage of this situation to trade at the same time, at the same price, and sometimes for the same purpose。This phenomenon affects market dynamics, especially the positions of buyers and sellers.。Some can profit from it, others can suffer huge losses。

As we all know, the currency market will change direction quickly in a short period of time, so it is sometimes difficult to predict。However, if brokers do not mention this condition in their products, then technically they are not transparent to their clients。Please be aware of two situations where additional charges may apply:

Slip point

A slippage occurs when there is a gap between the expected price of a trade and the execution price of the trade。Most slippage occurs when the market is highly volatile or illiquid, i.e., when there is a large gap between the volume of transactions and the asking price of buyers and sellers.。

Violent fluctuations usually occur during economic emergencies, political events such as elections, and other high-impact news.。During this period, many traders entered the market at the same price, making the price extremely volatile。Pending orders can be executed at the next price level, creating a gap that we call a slippage。

Depending on the circumstances, slippage may be positive or negative for your trading。When the order is executed, the price may be higher or lower than initially expected。This can be good for your trading (positive slippage) or harmful (negative slippage)。

Please see below:

Let's say you want to buy the USD / SGD currency pair, so you are in 1.3872 (close to the previous candle) open position。But due to low liquidity, the next candle chart opens at 1.3893。

This gap is considered a negative slippage you need to face because the price is higher than the figure you expected。Just imagine, if you encounter this situation, even if it is broker 0.A 1-point low difference will also give you a headache.。

floating point difference

Before the popularity of fixed spreads, the concept of floating spreads was well known and widely used by forex brokers。This spread basically uses the bid and ask prices closer to the market price.。Logically, the larger the gap, the higher the spread。

The main benefit of using this spread is that under normal market conditions, the spread can be lower than the fixed spread。InstaForex and FBS are brokers that have always offered this spread。

This alone has succeeded in attracting many traders, especially scalping traders and day traders。Since the trading time is only one day or less, they can choose to trade at a specific time with the lowest spread。

However, many traders do not realize that floating spreads can also be a disaster for their trading。When the market is unusually volatile, prices move and widen spreads due to lack of liquidity。In this case, trading will be very unprofitable and the trader's account deposits may run out little by little。

Sometimes, traders are tempted to open trades when the trend is good。However, keep in mind that this may also mean a sharp turn, resulting in a larger gap and a larger spread。

In order to avoid the risk of floating spreads, traders should be aware that they must avoid certain times if they do not want the spreads to widen extremely。If your broker uses floating spreads, it is best not to trade during news releases when market volatility is unpredictable and influential。IC Markets and Exness are well-known brokers that offer floating spreads to traders.。

|

point difference comparison |

||||

| Currency pairs | Exness | IC Markets | FXTM | ThinkMarkets |

| EUR/USD | 0.6 | 0.1 | 0.0 | 0.1 |

| GBP/USD | 0.7 | 0.1 | 0.0 | 0.4 |

| USD/JPY | 0.7 | 0.1 | 0.0 | 0.1 |

How fast and accurate is the broker?

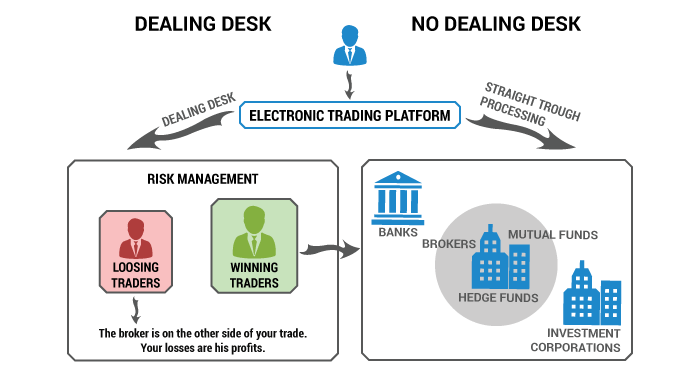

The answer to this question lies in the platform used by the broker。To choose the right broker, you must figure out whether the broker is a trading platform or a non-trading platform。

Trading Platform Broker

Trading platform brokers or market makers make money through spreads and providing liquidity to their clients.。In other words, such brokers act as principals and therefore usually risk their own lack of funds to create a market for their clients and thus assume the other side of the client's trade.。By creating their own market, these brokers can offer fast orders without re-quoting。

Simply put, this type of broker makes a profit by winning the client's trade。Thus, if the client makes a profit, the broker will pay out of the broker's cash rather than purely from the real market。And vice versa, if the client loses money, the broker will keep the money。

Suppose you want to buy 10,000 units of EUR / USD。As a liquidity provider, the broker will look for matching sell orders from other clients in its market。

Typically, trading platform brokers already have a significant number of clients, so the market is quite competitive, with interest rates in their markets comparable to interbank rates。If they can't find a matching order, they have to trade the other way.。

Using a trading platform broker can be risky, which is not entirely misleading, because your loss is basically the advantage of the broker, so they may use this against you and make you lose money。Sometimes, trading platform brokers come up with a number of trading terms and conditions as an excuse for not fulfilling their obligations to their clients。

But in fact, not all trading platform brokers have problems。As a trader, before choosing this type of broker, make sure it is legitimate and strictly regulated by a trusted regulator。

Non-trading platform broker

As you can see from the name, the job of a non-trading platform broker is very different from that of a trading platform broker。Non-trading platform brokers are basically the liaison between client requirements and the market.。It is important to know that the accuracy of non-trading platform brokers cannot be generalized because each broker uses a different liquidity provider。

Therefore, when you use this type of broker, you trade directly with the interbank market。In this case, sometimes the broker will ask for some additional fees because they only transfer the spread in the market directly to the client。

Otherwise, their services simply won't make money。This is why trading with non-trading platform brokers may be more expensive than trading platform brokers in the long run。

In summary, the following is a comparison between trading platform brokers and non-trading platform brokers:

结论

We can conclude that transparency is one of the most important aspects to consider before choosing a broker, especially when we talk about brokers that may charge additional fees for their spreads and execution services。

First of all, according to your trading objectives, make sure that the spread meets your needs。Calculate and recalculate the total fees you must pay to the broker by reading the broker's facilities and regulations, so you can better plan your trades from a strategic perspective。

Second, check the broker's pricing by comparing the price offered by the broker with the actual market price。Each broker has a different risk management strategy, so their approach to market volatility may also be different。

Finally, as a trader, there are many things to consider when choosing a broker。It can be quite a task even before you start trading。However, keep in mind that zero-risk trading is not possible, but we have ways to avoid risk, which we have explained in this article。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.