On December 10, Mao Geping Cosmetics Co., Ltd.(hereinafter referred to as "Mao Geping") was officially listed on the Hong Kong Stock Exchange, ending the eight-year "long-run listing".

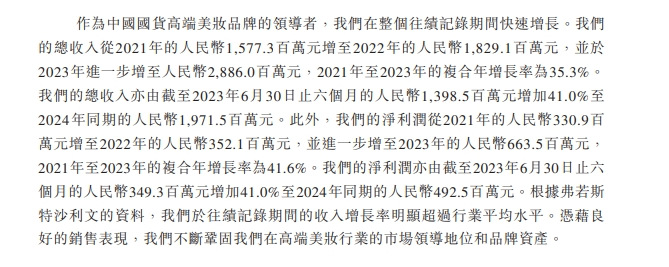

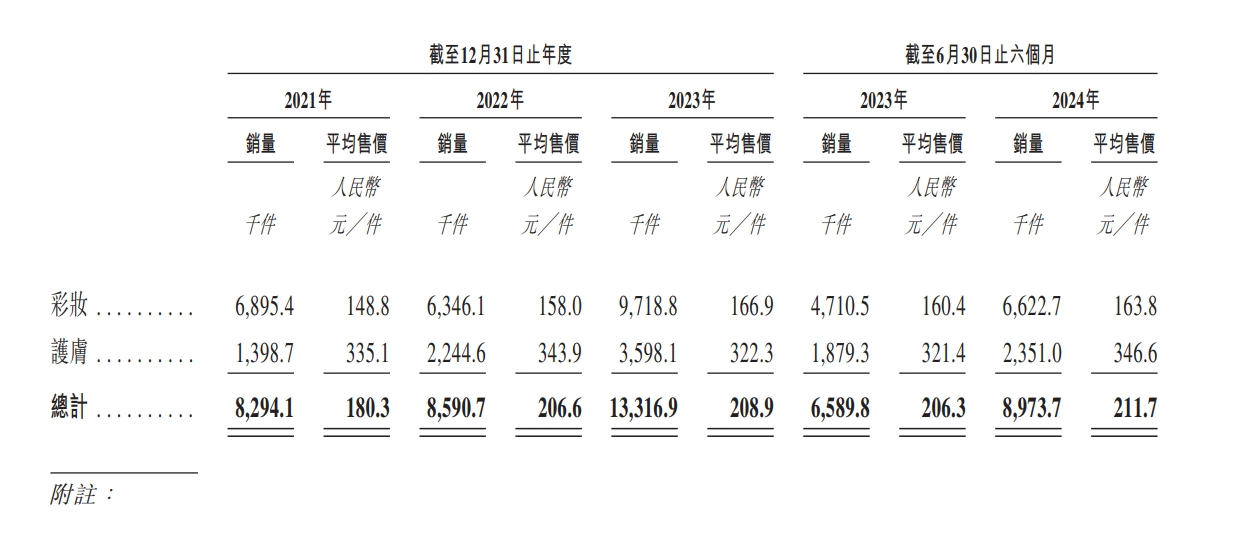

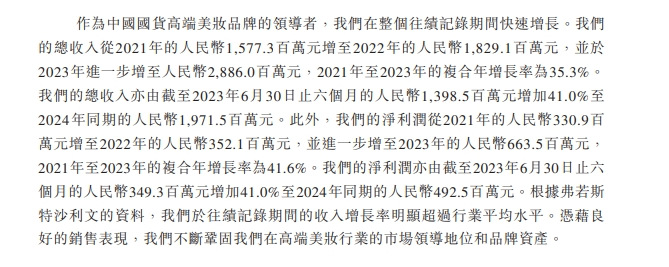

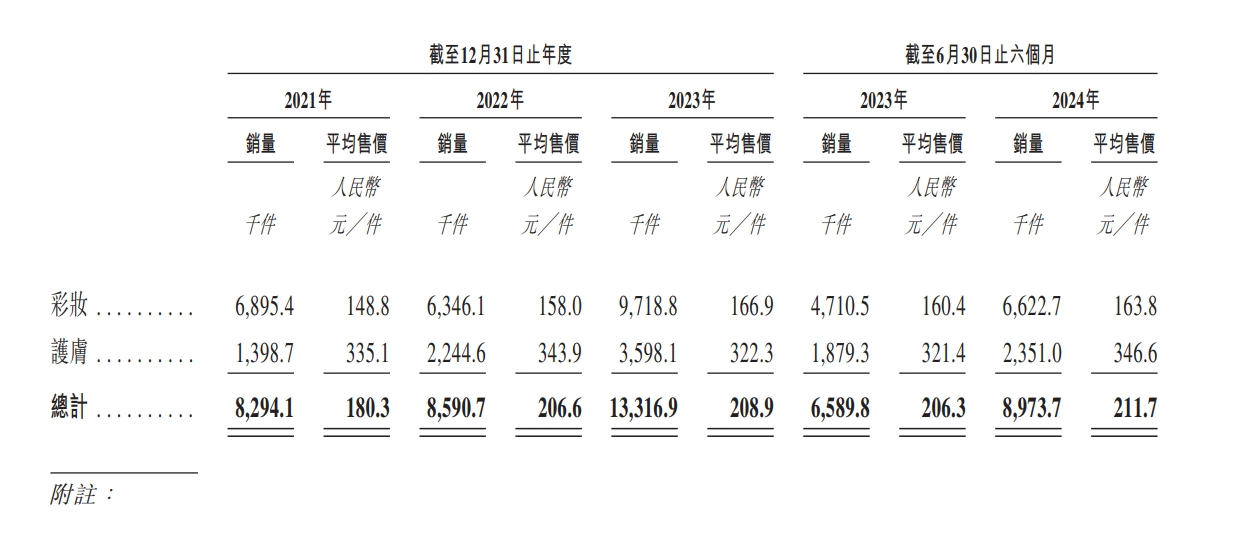

The prospectus shows that Mao Geping was founded in 2000 by Mao Geping, a makeup artist in the beauty industry in China. From 2021 to the first half of 2024, Mao Geping achieved revenue of 1.577 billion yuan, 1.829 billion yuan, 2.886 billion yuan and 1.972 billion yuan respectively; Net profit was 331 million yuan, 352 million yuan, 664 million yuan and 493 million yuan respectively.

In addition, the high-end brand route allows Mao Geping to obtain ultra-high gross profit margins: Mao Geping's gross profit margins from 2021 to 2023 are 83.4%, 83.8%, and 84.8% respectively.In the first half of this year, its gross profit margin reached 84.9%, and its net profit margin reached 25%.

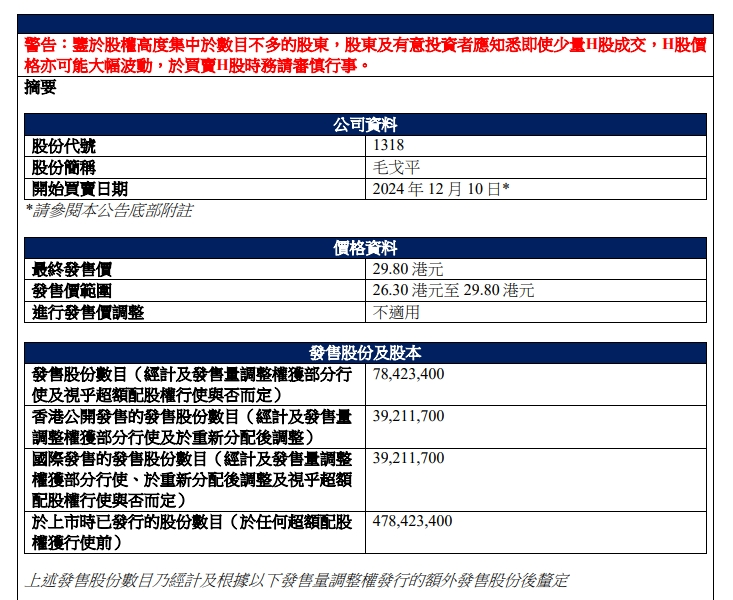

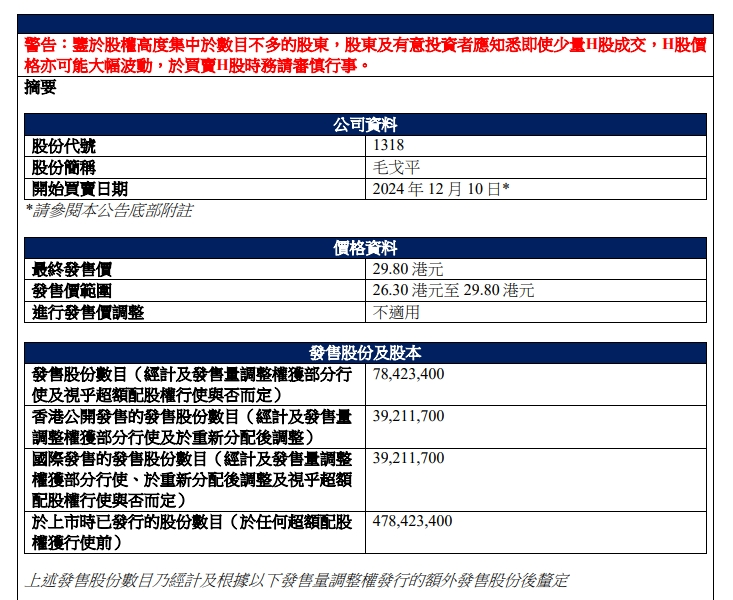

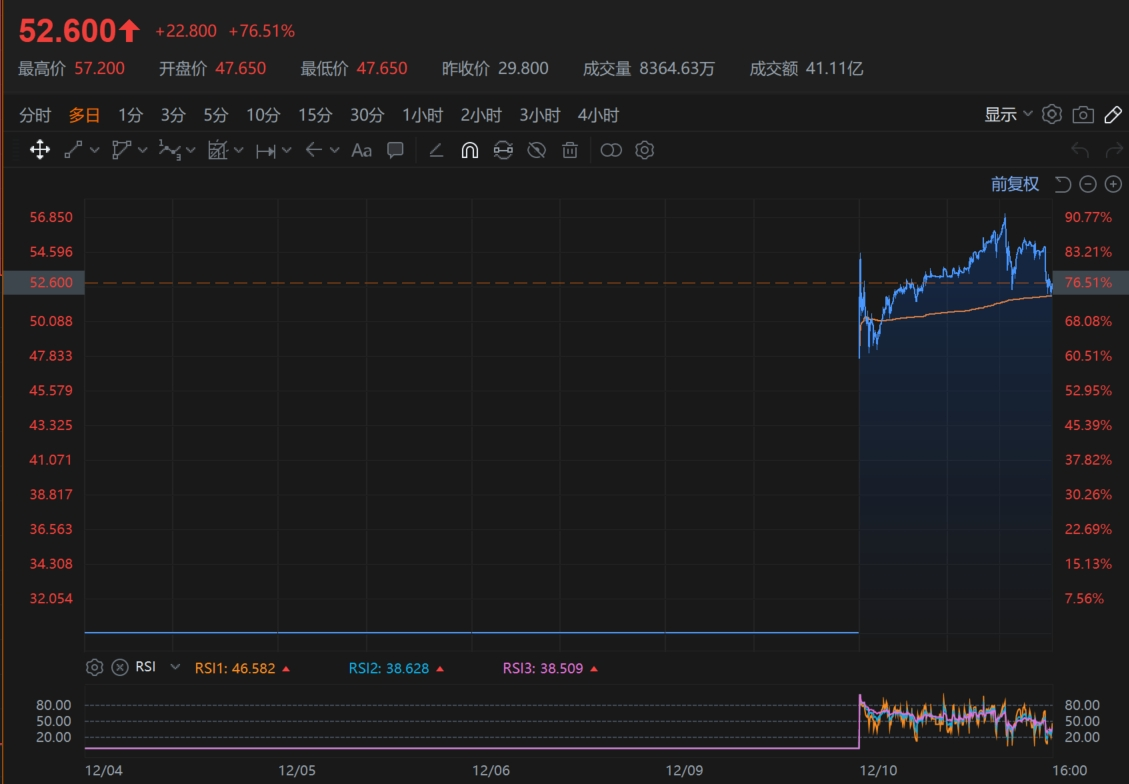

According to public information, Mao Geping's final offer price is set at HK$29.80 per share, which is at the upper limit of the previously announced offer price range of HK$26.30 to HK$29.80.On December 5, the public offering of Mao Geping announced the deadline.Mao Geping's IPO subscription total reached HK$173.814 billion, surpassing China Resources Beverages's HK$132.39 billion, becoming the "frozen capital king" for new Hong Kong stocks during the year.

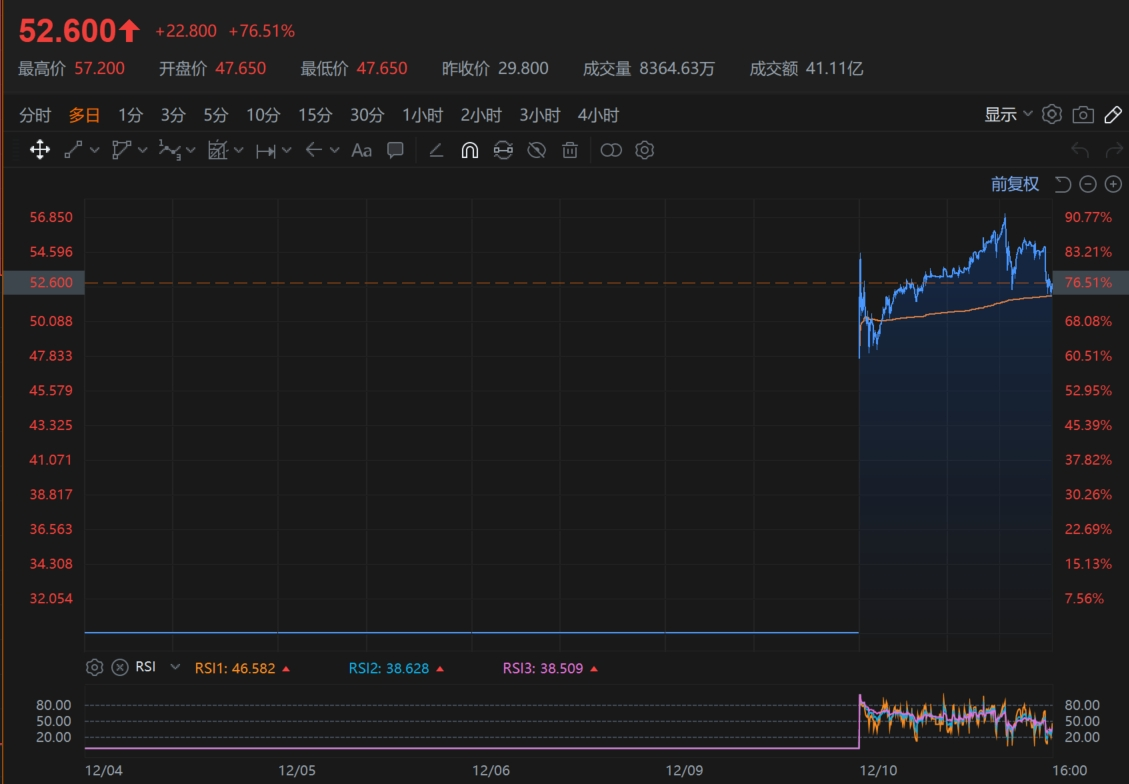

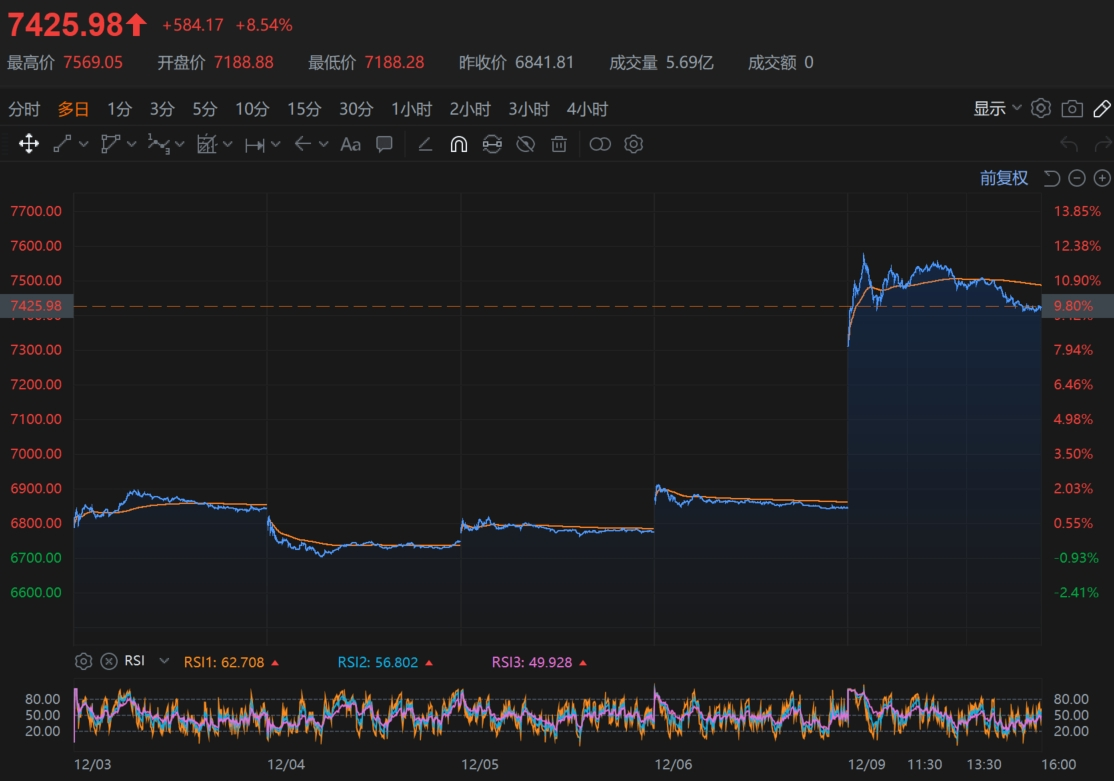

On the first day of listing, Mao Geping lived up to expectations, surging 76.51%, hitting an intraday high of HK$57.20 and closing at HK$52.60.

8-year long-running listing from Shanghai Stock Exchange to Stock Exchange

Since 2016, Mao Geping has launched its IPO (initial public offering) journey in the capital market.In December 2016, the company submitted IPO application documents to the Shanghai Stock Exchange for the first time, marking that it became the first cosmetics company in China to seek a listing on the main board of A-shares.

In September 2017, Mao Geping updated the IPO application documents.By October 2021, the company's IPO application received preliminary approval from regulators.However, in March 2023, Mao Geping updated his IPO prospectus and planned to raise up to RMB 1.121 billion through this public offering.Unfortunately, in September of the same year, due to the validity period of the financial report, the Shanghai Stock Exchange decided to terminate the IPO review process for Mao Geping.

Entering 2024, Mao Geping voluntarily withdrew his IPO application on the Shanghai Stock Exchange in January, and did not receive further feedback from the China Securities Regulatory Commission or the Shanghai Stock Exchange before withdrawing.

After the IPO attempt in the A-share market was frustrated, Mao Geping turned to the Hong Kong capital market in April 2024 and submitted a listing application to the Hong Kong Stock Exchange.However, due to the failure to complete the hearing process within the required six months, his listing application document was declared invalid on October 8.Immediately afterwards, on October 9, Mao Geping submitted an IPO application to the Hong Kong Stock Exchange again, this time with CICC serving as the exclusive sponsor.On December 2, Mao Geping announced specific plans for his Hong Kong IPO, including the planned issuance of 70.5882 million shares, and determined a specific timetable for the IPO and listing.

As for the funding arrangements after the initial public offering, the prospectus shows: The proceeds from Mao Geping's fundraising are roughly used-25% for expanding sales networks, 20% for brand building, 15% for overseas expansion and acquisitions, 10% for strengthening production and supply chain capabilities, and 9% for product design and development, 6% for cosmetics art training institutions, etc., approximately 5% for operations and information infrastructure digitization, and approximately 10% for working capital and general corporate purposes.

Hong Kong stocks are strong and open higher, and domestic beauty products are "supporting"

On December 10, as the heavyweight meeting was held as scheduled and positive guidance was given, stocks rose sharply overnight. The Nasdaq China Golden Dragon Index rose more than 8%, the largest one-day gain since September 26.Fangduo rose by more than 52%, and three times in the session were blown, with the highest rise exceeding 160%; Tiger Securities rose by more than 26%.

In the China market, driven by emotion, all three major Hong Kong stock indexes opened higher today, and then continued to decline. As of the close, the Hang Seng Index fell 0.5% to 20,311.28 points, the Hang Seng Technology Index fell 1.39%, and the State-owned Enterprise Index fell 0.74%.

In addition to Mao Geping's surge on the first day of listing, other domestic beauty brands also performed well in the Hong Kong stock market.

Shangmei shares, known as the "No. 1 stock in Hong Kong and domestic beauty products", have risen by 45.60% this year. As of the close of business on December 9, the market value of Shangmei shares is approximately HK$14.5 billion.Financial report data shows that Shangmei's revenue and net profit growth in the first half of 2024 ranked first among domestic beauty listed companies.

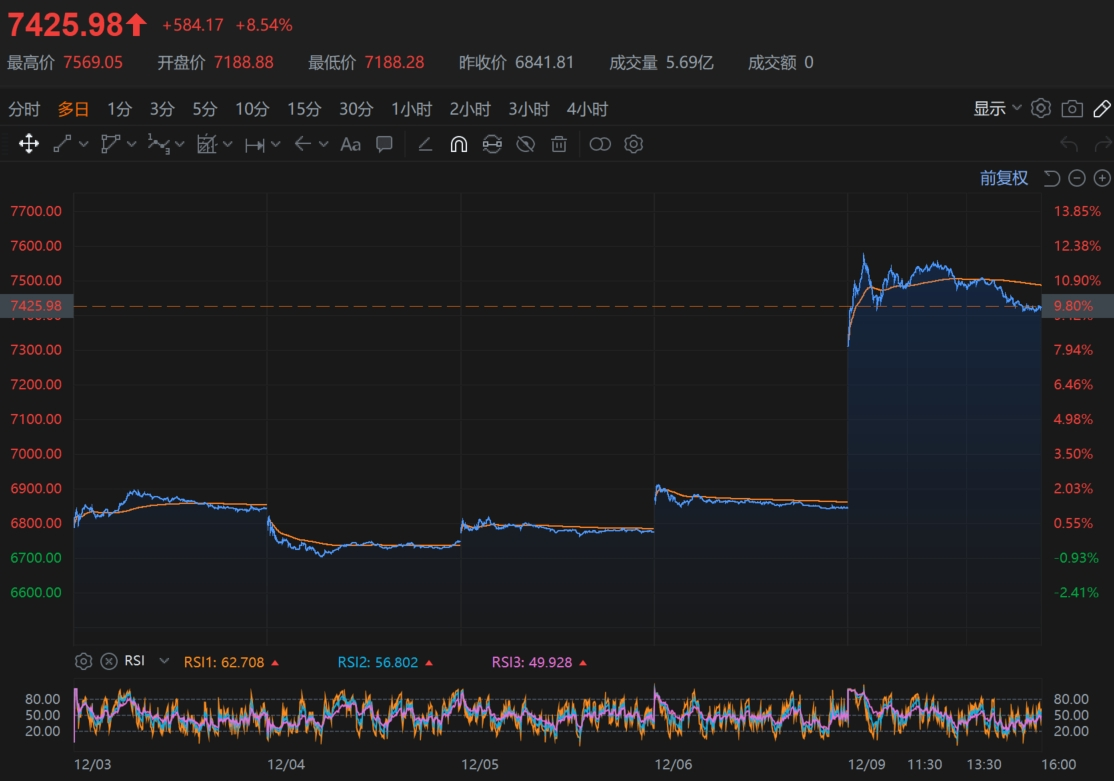

Equally eye-catching are giant creatures.On December 5, the Center for Medical Device Technical Evaluation of the State Food and Drug Administration issued the "Announcement of Review Results of Medical Device Priority Approval Applications (No. 17 of 2024)".According to the "Results Announcement", Juzi Biotech's "Recombinant Collagen Filler for Injection" belongs to "medical devices included in the national key research and development plan". Projects that meet the priority approval situation are planned to be given priority approval.Affected by the news, the company once rose nearly 9%.

2024 is a big year for domestic beauty. In the current China market, in sharp contrast to the slowdown in growth and even withdrawal from the market experienced by foreign beauty brands, domestic beauty brands generally achieved revenue and net profit in the first half of 2024. Double-digit year-on-year growth.

According to statistics from the chief consumer officer, six of the eight beauty companies, including Peléya, Shanghai Jahwa, and Betany, achieved year-on-year growth in revenue and net profit in the first quarter or first half of 2024., and only two companies experienced year-on-year declines in revenue and net profit or expanded losses.

Data from the National Bureau of Statistics show that in 2023, my country's cosmetics retail sales will reach 414.2 billion yuan, a year-on-year increase of 5.1%.Relying on domestic first-class manufacturing capabilities, cutting-edge domestic brands have become popular one after another, and the pace of "going out to sea" has accelerated. Domestic beauty brands have become a beautiful landscape in the beauty industry. Relevant market data shows that sales of domestic brand cosmetics in 2023 will increase year-on-year. 21.2%, showing a strong trend of accelerating growth.