U.S. and Hong Kong Stock Brokers Comparison: Futu vs Tiger Securities

This article provides an in-depth comparison of U.S. and Hong Kong-listed Internet brokers Futu Securities (Singapore) and Tiger Securities (Singapore), analyzing differences in commission fees, security, investment products, and trading thresholds.

Futu Securities (Singapore) and Tiger Brokers (Tiger Brokers) are well-regarded U.S. and Hong Kong stock brokerage firms that are gaining prominence in the investment world.。For investors investing in U.S. and Hong Kong stocks, choosing the right broker is crucial, while Futu Securities and Tiger Securities have become one of the top choices for many investors.。

This article will introduce the latest account opening and deposit offers of Futu Securities and Tiger Securities to provide investors with more choices.。If you are interested in investing in U.S. and Hong Kong stocks and want a more comprehensive understanding of Futu Securities and Tiger Securities, I believe this article will provide you with useful information.。If you have any questions or discussions, please share them with us in the message area.。

| Brokers | Futu Securities (Singapore) Moomoo | Tiger Brokers |

| trading market | US, Hong Kong, Singapore, Shanghai and Shenzhen (China A-shares) | US, Hong Kong, Singapore, Shanghai and Shenzhen (China A-shares), Australia, London |

| Trading products | Stocks, ETFs, REITs, options, warrants, funds, etc. | Stocks, ETFs, REITs, options, warrants, funds, etc. |

| Trading Commission (US Stock) | Zero Commission | USD 0.005 / share minimum USD 0 per order.99 |

| Platform Fee (US Stock) | 0.$99 / share | USD 0.005 / share minimum USD 1 per order |

| Trading Commission (Hong Kong Stock) | 0.03% * Transaction value Minimum HKD per order 3 | 0.03% * Transaction value Minimum HKD per order 7 |

| Platform Fee (Hong Kong Stock) | HKD 15 per order | 0.03% * Transaction value Minimum HKD per order 8 |

| Regulators | US SEC, FINRA Hong Kong SFC Singapore MAS | US SEC, FINRA Hong Kong SFC Singapore MAS Australia ASIC New Zealand FSP |

| Deposit expenses | Zero | Zero |

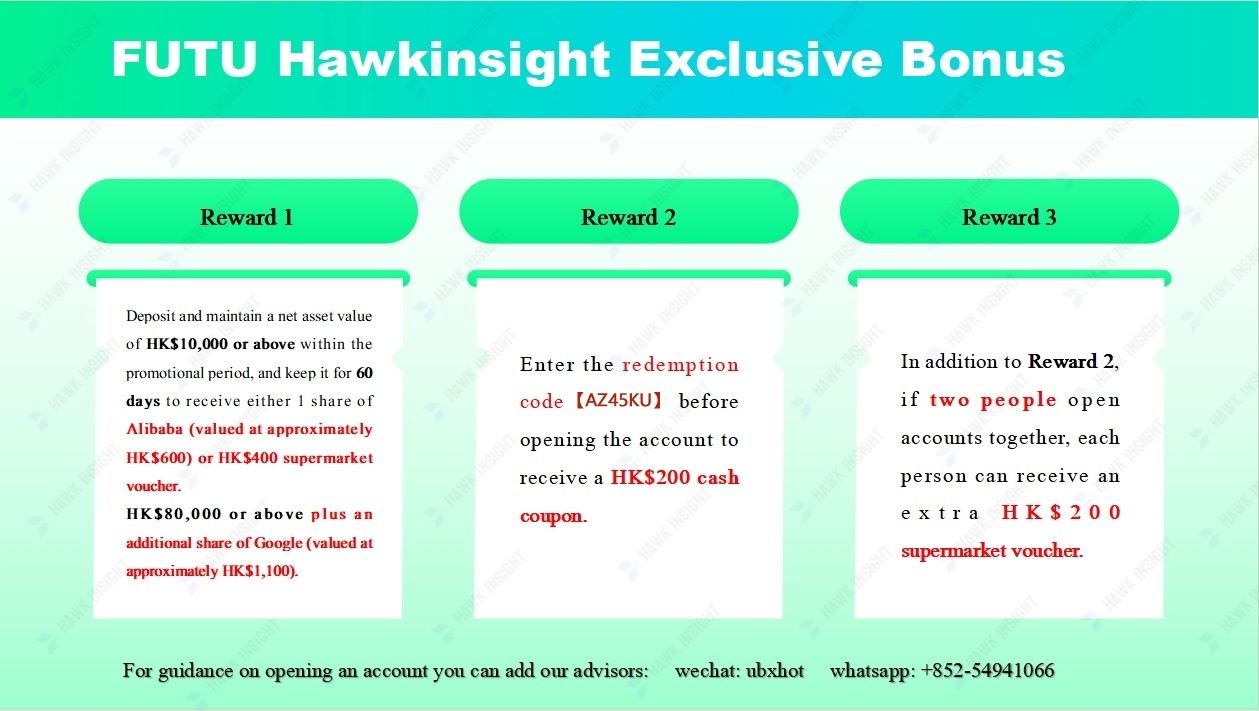

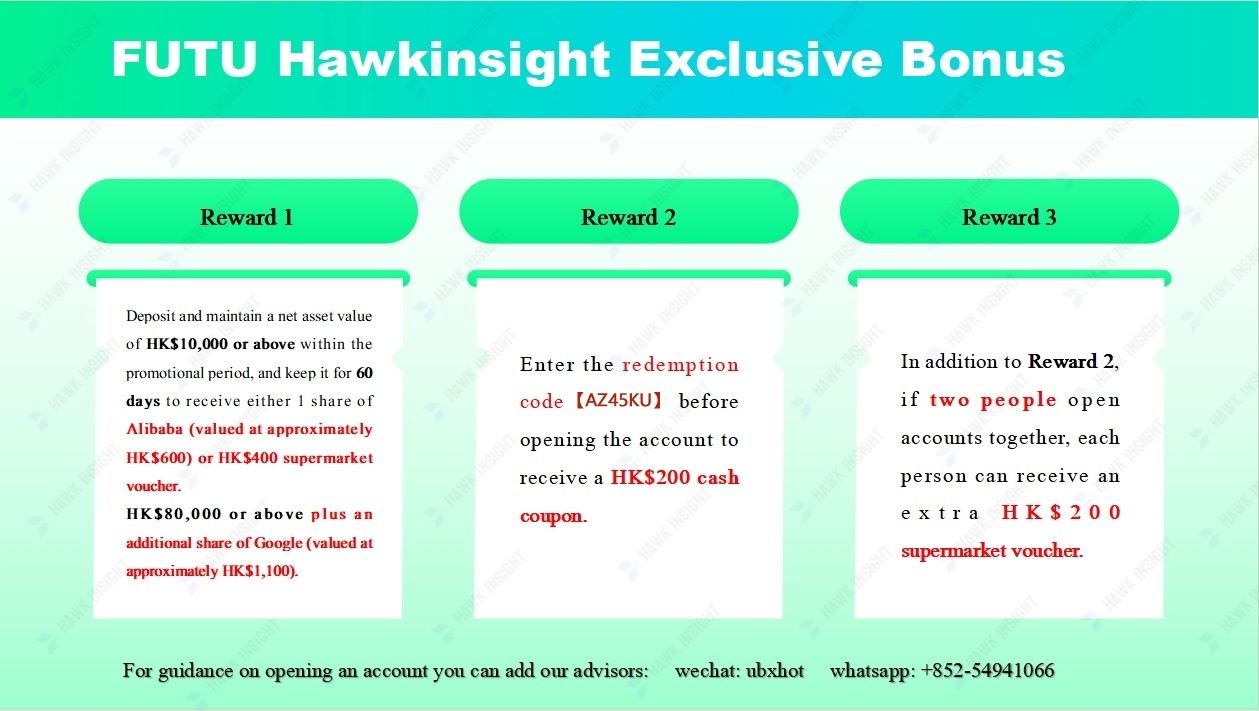

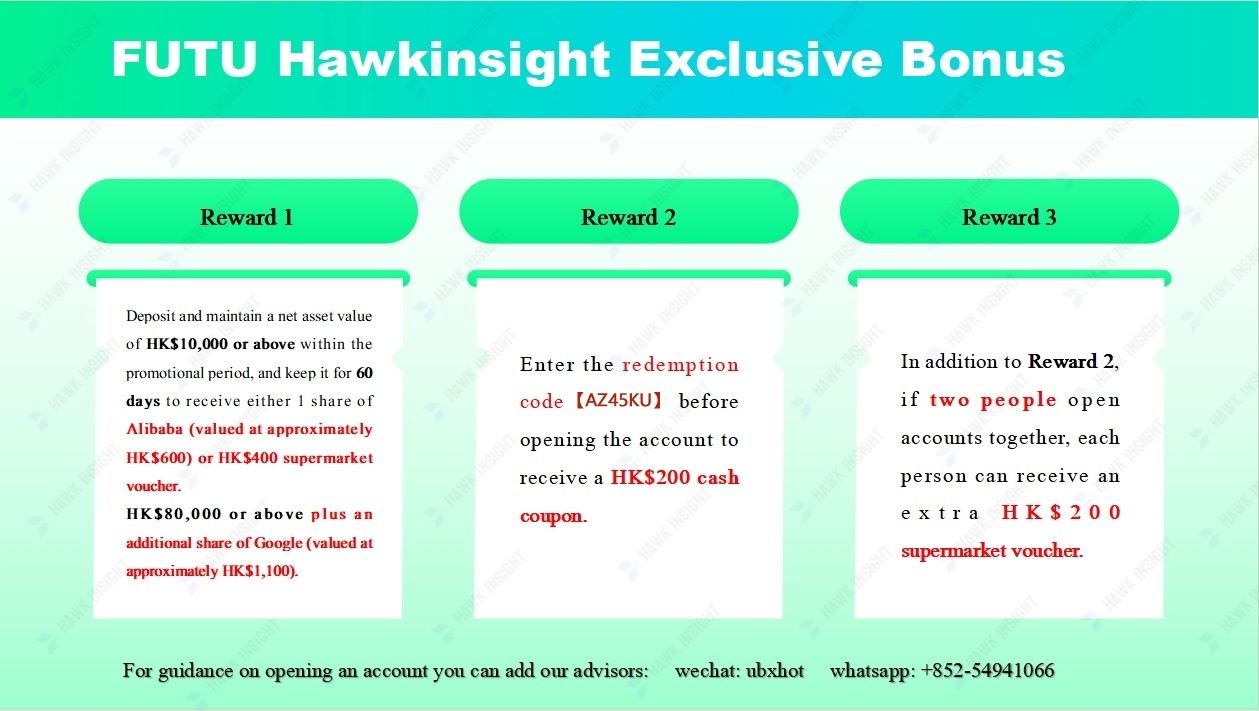

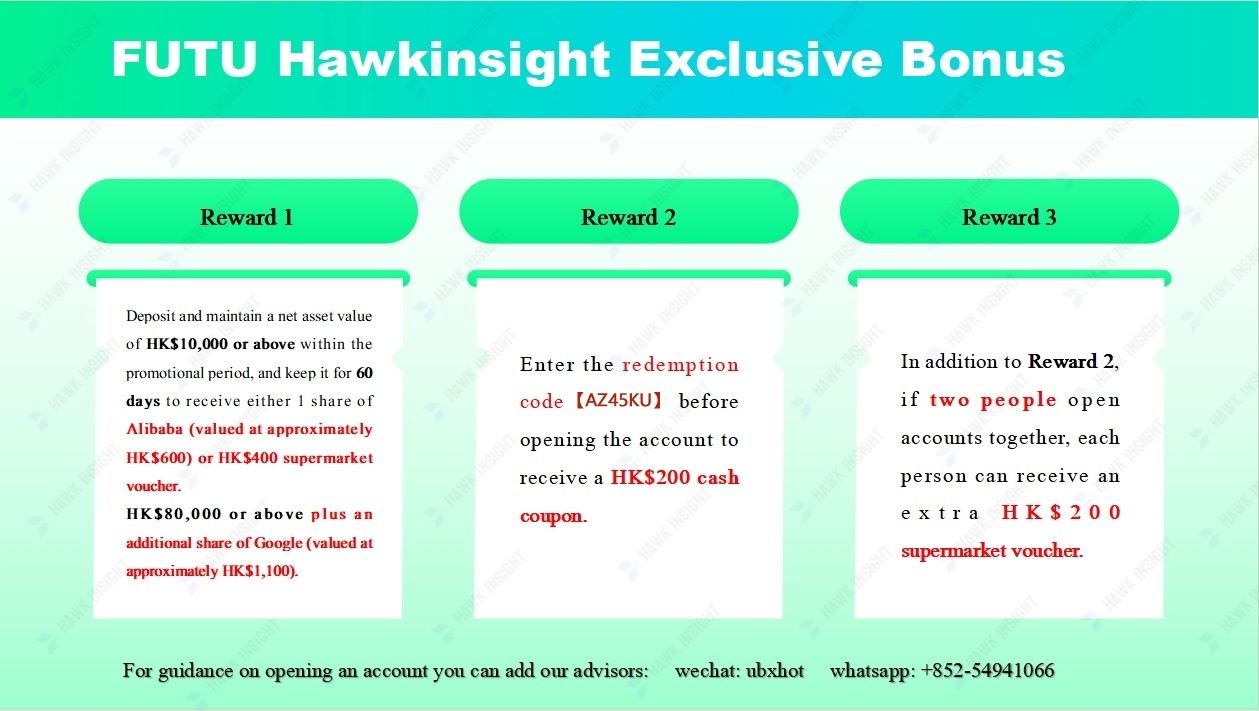

| Account opening discount | 1) U.S. stocks, Hong Kong stocks, Singapore stocks, China A-shares free premium quotes 2) SGD 40 vouchers. | 1) 180 unlimited times U.S. stock commission-free trading 2) free 1 share of GRAB stock |

| First Gold Award | Initial deposit of S $2700 and above, 1 free share of stock (value S $20 to S $1000) | An initial deposit of more than S $2,000 is subject to an additional share of free stock worth S $8 to S $1,200. |

| Preferential account opening | Open an account immediately | Open an account immediately |

Broker background

1.Futu Securities (Singapore)

Futu Securities (Singapore) (Futu Singapore Pte.Ltd) is a subsidiary of Futu Holdings (NASDAQ: FUTU), a NASDAQ-listed company in the United States, which is regulated by the Monetary Authority of Singapore (MAS) and holds a capital markets services licence (licence number: CMS101000).。

Fortis Securities was founded in 2012, following the launch of the investment platform Fortis Bull and moomoo to provide investors with multi-country financial trading services, access to Tencent (Tencent), Jingwei Ventures (Matrix) and Sequoia Capital (Sequoia Capital) strategic investment.。

Futu Holdings' subsidiaries hold 43 financial licenses and qualifications in all major financial markets around the world, covering U.S. stocks, Hong Kong stocks, A-shares, funds, futures, bonds and other aspects, with a total of more than 14 million platform users.

Highlights of the following simple startup Futu Securities (Singapore):

| Year of Establishment | Established in 2012 |

| Trading platform | Moomoo trading platform supports computer version (Windows, macOS) and mobile app version (iOS, Android) |

| Account Type | Managed Account (Custodian Account) |

| tradable market | United States, Hong Kong, Singapore, China |

| Investment products | Stocks, ETFs, options, warrants / vouchers, CBBCs, futures, funds, REITs, etc. support new share subscriptions. |

| Platform features | Provide U.S. stock level 2 free advanced quotes, ultra-low commission speed; in-depth big data analysis, fundamental and technical analysis are suitable, online customer service response is fast. |

2.Tiger Brokers

Tiger Brokers (Tiger Brokers) was established in 2014, officially listed on the Nasdaq: TIGR in 2019, and entered the Singapore market in February 2020, becoming a very popular Internet broker for U.S. and Hong Kong stocks in Southeast Asia.。

The creative team has many years of financial and Internet experience, with core members from Morgan Stanley (Morgan Stanley), Tencent, Baidu, Alibaba, etc., and has received strategic investments from investment institutions such as Xiaomi Technology, Real Fund, Xianfeng Evergreen, Huagai Capital, PAC (Prospect Avenue) Capital), and Oriental Hongtai (Hontai Capital).。

Tiger Securities focuses on "one account, invest globally" one-stop investment experience, through the exclusive development of the trading platform Tiger Trade, an account can invest in multi-country markets, access to financial data of listed companies, valuation and read global economic news.。

The following is a brief summary of the highlights of Tiger Securities Tiger Securities.

| Year of Establishment | Established in 2014 |

| Trading platform | Tiger Trade supports PC (Windows, macOS) and mobile apps (iOS, Android) |

| Account Type | Managed Account (Custodian Account) |

| tradable market | US, Hong Kong, Singapore, Shanghai and Shenzhen (China A-shares), Australia, London |

| Investment products | Stocks, ETFs, options, warrants / vouchers, CBBCs, futures, funds, REITs, indices, metals, bonds, etc. support new stock subscriptions |

| Platform features | Extreme online account opening, no minimum deposit threshold; strong functionality of the operating platform, both fundamental and technical analysis are suitable. |

At the same time, we are from the trading market, which investment products to support trading, access fees, commission fees, platform supervision and capital security, account opening and deposit concessions and other six aspects, rich comparison of securities (Singapore) and Tiger Securities.。

Market Comparison

The more the trading market covers, the more investment options are naturally available to investors.。In contrast, Futu Securities (Singapore) covers the US, Hong Kong, Shanghai and Shenzhen (China A-shares) and Singapore markets, while Tiger Securities has more options for the Australian and London markets。

| trading market | Futu Securities (Singapore) | Tiger Securities |

| 美国 | ✓ | ✓ |

| Hong Kong | ✓ | ✓ |

| Shanghai and Shenzhen (China A-shares) | ✓ | ✓ |

| Singapore | ✓ | ✓ |

| Australia | X | ✓ |

| London | X | ✓ |

Comparison of investment products

There are many investment trading products in the market, each with its own characteristics, stability, advantages and disadvantages, as well as investment risks.。Diversified investment trading product options can enrich the portfolio, further optimize the asset allocation structure, but also achieve the purpose of diversification of investment risk.。

Futu Securities (Singapore) and Tiger Securities support trading in roughly the same investment products, including stocks, ETFs, options, warrants / vouchers, CBBCs, futures, funds, REITs, etc.。

Currently, currency brokers do not support trading crypto。

| Trading products | Futu Securities (Singapore) | Tiger Brokers |

| Stock | ✓ | ✓ |

| ETF | ✓ | ✓ |

| Options | ✓ | ✓ |

| Warrant | ✓ | ✓ |

| CBBC | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Fund | ✓ | ✓ |

| REITs Real Estate Trusts | ✓ | ✓ |

| Index | X | ✓ |

| Metal | X | ✓ |

| Bonds | X | ✓ |

| Cryptocurrency | X | X |

Comparison of the cost of entry and exit fees

In terms of deposit fees, as the brokerage firms all have subsidiaries in Singapore, hold Singapore bank accounts and deposit in Singapore dollars without any charges.

Assuming that the deposit is made from an overseas bank, you can only use Telegraphic Transfer to remit SGD, USD, HKD, EUR, etc.。Equivalent to the brokerage firm also does not charge, but the remittance bank and transit bank used for wire transfers may incur fees, wire charges, etc.。The fee is subject to the bank.。

Note that no matter which brokerage platform is used, as long as cross-border wire transfers are involved, the transfer bank and transit bank used will involve fees, telegraphic charges, etc.。You can check the relevant charges from individual banks.。

In terms of payment fees, there is no charge for any currency of payment to DBS / POSB Bank in Singapore;

Assuming a deposit to a non-Singapore DBS / POSB bank, an overseas bank, the equivalent of a brokerage firm also does not charge, but the receiving bank and the transit bank may incur fees。The fees are the same as those of other banks.。

| Futu Securities (Singapore) | Tiger Brokers | |

| Minimum amount of deposit and withdrawal | X | X |

| Deposit method | Singapore Bank Transfer, Wire Transfer (TT) | Singapore bank transfer, wire transfer (TT), Wise deposit initiated in App |

| Deposit expenses |

x Note: Remittance banks and transit banks will have operating charges |

x Note: Remittance banks and transit banks will have operating charges |

| Payment expenses |

x Note: Remittance banks and transit banks will have operating charges |

x Note: Remittance banks and transit banks will have operating charges |

Commission Comparison

The following collates the commission fee structure of Futu Securities (Singapore) and Tiger Securities, including commission rates and platform fees for equities, ETFs and options in the US, Hong Kong and Singapore markets。

1.U.S. stocks

Fortis Securities (Singapore) has a preset commission for U.S. stocks and ETFs, no commission per trade, but 0 per transit order..$99 platform fee, so a minimum of 0 per transaction.99美元。

Tiger Securities has a commission of 0 on U.S. stocks and ETF trading..$005, minimum 0 per transaction.$99; platform fee is 0.$005, minimum $1 per transaction。Yes, a minimum per transaction means the same payment of 1.99美元。

2.Hong Kong Stock

The Hong Kong stock trading commission of Fu Fu Fu Securities (Singapore) is 0..03% * Transaction value, minimum HK $3 per transaction; platform fee is HK $15 per transaction。Meaning, you have to pay a minimum of HK $18 per transaction.。

Tiger Securities' Hong Kong Stock Trading Commission of 0.03% * transaction value, minimum HK $7 per transaction; platform fee of 0.03% * Transaction value, minimum HK $8 per transaction。Meaning, you have to pay a minimum of HK $15 per transaction.。

3.Singapore Unit

Rich Securities (Singapore) 's Singapore stock trading channel commission is 0.03% * transaction value, minimum 0 per transaction.S $99; platform fee is 0.03% * transaction value, minimum 1 per transaction.S $50。Meaning, each transaction requires a minimum of 2.S $49。

Tiger Securities' Singapore Share Trading Commission of 0.04% * transaction value,Minimum S $1 per transactionPlatform fee is 0.04% * transaction value,Minimum 1 per transaction.88 Singapore dollarsMeaning, each transaction requires a minimum of 2.88 Singapore dollars。Tiger Securities does not currently involve single transaction commissions and platform fees until February 22, 2022.。

4.U.S. Stock Options

Futu Securities (Singapore) 's US stock options commission is 0 per contract.$65, minimum of 1 per transaction.$99; the platform fee is 0 per contract.30美元。Meaning, each transaction requires a minimum of 2.29美元。

Tiger Securities' U.S. stock contract commission is 0 per contract..$65, minimum of 1 per transaction.$99; the platform fee is 0 per contract.$30, minimum $1 per transaction。Meaning, each transaction requires a minimum of 2.99美元。

5.Hong Kong Stock Options

Futu Securities (Singapore) does not offer the option to trade Hong Kong stocks for the time being.

The Hong Kong stock agreed commission for Tiger Securities is 0 per contract..2% * transaction value, minimum HK $3 per transaction; platform fee is HK $15 per contract。Meaning, you have to pay a minimum of HK $18 per transaction.。

Hong Kong brokerage firms charge roughly the same fees, which are among the lowest in the market。If you really want to compare carefully, one of the U.S. stock options of Futu Securities (Singapore) and Singapore stocks pay less for a single transaction; Tiger Securities pays less for a single transaction.。

Investors can choose according to their own investment interests.。

| Investment products | Futu Securities (Singapore) | Tiger Brokers |

| U.S. stocks, ETFs | Zero commission platform fee 0.$99 / order | Commission USD 0.005 / share minimum USD 0 per order.99 Platform Fee USD 0.005 / share minimum USD 1 per order |

| U.S. Stock Options | Commission USD 0.65 / piece minimum USD 1 per order.99 Platform Fee USD 0.30 / sheet | Commission USD 0.65 / piece minimum USD 1 per order.99 Platform Fee USD 0.30 / piece minimum USD 1 per order |

| Hong Kong Stock | Commission 0.03% * Transaction Value Minimum HKD 3 Platform Fee per Order HKD 15 / Order | Commission 0.03% * Minimum transaction value per order HKD 7 Platform Fee 0.03% * Minimum transaction value per order HKD 8 |

| Hong Kong Stock Options | – | Commission 0.2% * Transaction Value Minimum HKD 3 Platform Fee per Order HKD 15 / Sheet |

| Singapore Stock | Commission 0.03% * Minimum transaction value per order SGD 0.99 Platform Fee 0.03% * Minimum transaction value per order SGD 1.50 | 0.04% * Minimum SGD 1 platform fee 0 per order transaction value.04% * Minimum transaction value per order SGD 1.88 * There is currently no minimum commission and platform fee requirement |

security comparison

Whether the brokerage platform is safe and how many financial licenses it holds is a matter of great concern to many investors when speculating on brokerages。Because this is related to whether the brokerage firm is under the control of the SEC, so that the funds will be relatively safe, and there will be no concerns about problems when transferring the funds.。

The following comes from both regulators and asset custody to assess the safety of Futu Securities (Singapore) and Tiger Securities to reduce risk and secure funds。

1.Regulators

(1) Futu Securities (Singapore)

Futu Holdings' subsidiaries jointly hold 43 financial licenses and qualifications in all major financial markets around the world.。

In terms of U.S. regulation, Futu Holdings (U.S.) is regulated by the U.S. Securities and Exchange Commission (SEC) and the U.S. Financial Industry Administration (FINRA).。SEC Registration Number is 8-69739, FINRA Central Registration Number is CRD: 283078。He is also a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).。

SIPC provides coverage for up to $500,000 (including $250,000 in cash) for users of Futu Securities' U.S. stock accounts.。

In terms of Singapore regulation, Futu Securities (Singapore) is regulated by the Monetary Authority of Singapore (MAS) and has obtained a Capital Markets Services License (CMS License) with the license number CMS: 101000.

(2) Tiger Securities

Tiger Securities is regulated and certified by regulators in the United States, New Zealand, Australia and Singapore.。

In terms of U.S. regulation, Tiger Securities is regulated by the U.S. Securities and Exchange Commission (SEC) and the U.S. Financial Industry Administration (FINRA).。SEC Registration Number is 8-65324 and FINRA Central Registration Number is CRD: 120583。He is also a certified member of the U.S. Securities Investor Protection Corporation (SIPC), the National Futures Association (NFA), the U.S. Depository Trust Company (DTC), and the National (U.S.) Securities Xiamen Company (NSCC).。

SIPC provides maximum protection for users of Tiger Securities up to $500,000 (including $250,000 in cash);

In terms of regulation in Hong Kong, the Hong Kong stock transactions of Tiger Securities are held in trust in Interflow Securities (IB), which is cleared by IB and regulated by the Securities and Futures Commission (SFC) of Hong Kong.

In terms of Singapore regulation, Tiger Securities is regulated by the Monetary Authority of Singapore (MAS) and has obtained a Capital Markets Services License (CMS License).

In terms of Australian regulation, Tiger Securities is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services Licence (AFSL) with a registration number of 505213.

In terms of New Zealand regulation, Tiger Securities is a registered financial services provider in New Zealand with registration number FSP 473106。

2.Asset Custody

Generally speaking, the broker will not deposit the investor's funds in the company's bank account, but will leave it to another qualified securities dealer or commercial bank as a custodian to ensure that the investor's money is properly and independently kept.。

(1) Futu Securities (Singapore)

Rich Securities (Singapore) states, "Your assets will be held in safe custody by a licensed custodian appointed by us; your funds may be held in custody with a licensed custodian bank and held separately from the assets and funds of Rich Securities (Singapore)."。

Cooperative stock exchanges include the Nasdaq Stock Exchange, the New York Stock Exchange, the Chicago Stock Exchange, option price reporting agencies, the Shanghai Stock Exchange, the Shenzhen Stock Exchange and the Singapore Stock Exchange.。

The parent company, Futu Holdings, received strategic investments from China's Tencent Holdings, U.S. Jingwei Ventures, and U.S. Sequoia Capital Land.

(2) Tiger Securities

The user's funds are hosted at DBS Commercial Bank。The assets are then held in safe custody with a third-party licensed custodian in separate trading markets.

◇ U.S. equities: liquidated and held by Interactive Brokers

◇ Hong Kong shares: kept by Interactive Brokers

◇ Singapore shares: kept by DBS Custodian Bank

Futu Securities (Singapore) vs Tiger Securities, how to choose?

Rich Securities (Singapore) and Tiger Securities in the United States and Hong Kong stocks in the Asian market competition is very fierce, from the comparison of the content of the text can also be seen in the way brokers in all aspects of the difference is not big, the trading platform interface fluency, the use of good experience, and both support simplified and traditional Chinese and English interface, convenient for users in different languages.

The bull ring of Futu Securities (Singapore) is not on a par with the tiger community of Tiger Securities, which is hotly discussed, and many investors around the world share their views on individual stocks and current affairs news, allowing investors to refer to different investment thinking and strategies.

However, if you value the commission fee component very much, Futu Securities (Singapore) is slightly better than Tiger Securities because Futu Securities (Singapore) has made a permanent commission adjustment for trading U.S. stocks, and the fees incurred in trading U.S. stocks will be slightly lower than Tiger Securities.。

What should investors do if the commission fee part is not taken into account?

Summarize the differences between Futu Securities (Singapore) and Tiger Securities in their respective scoring.

| Brokers | Futu Securities (Singapore) Moomoo | Tiger SecuritiesTiger Brokers |

| trading market | There is still room for progress | Win |

| Trading products | There is still room for progress | Win |

| Trading Commission (US Stock) | Win | There is still room for progress |

| Platform Fee (US Stock) | Flat | Flat |

| Trading Commission (Hong Kong Stock) | Win | There is still room for progress |

| Platform Fee (Hong Kong Stock) | Flat | Flat |

| Regulators | Win | There is still room for progress |

| Deposit expenses | Flat | Flat |

| Account opening discount | Win | There is still room for progress |

| First Gold Award | There is still room for progress | Win |

| Preferential account opening | Open an account immediately | Open an account immediately |

In the comparison of the trading market, Futu Securities (Singapore) and Tiger Securities are both high-profile options。Futu Securities (Singapore) covers the US, Hong Kong, Shanghai and Shenzhen (China A-shares) and Singapore markets, while Tiger Securities has a broader product range, including options in the Australian and London markets。Both are suitable options for investors who focus only on the U.S. and Hong Kong stock markets。

In terms of investment products, Tiger Securities has a broader product range, covering a variety of asset classes such as equities, ETFs, options, warrants / vouchers, bulls and bears, futures, funds, REITs, foreign exchange indices, metals and bonds.。This makes Tiger Securities ideal for investors looking to diversify their asset allocation。

Except for a comparison of U.S. stock commission rates, commission charges for U.S. stock options, Hong Kong stocks and Singapore stocks do not differ significantly between Futu Securities (Singapore) and Tiger Securities。However, it should be noted that Futu Securities (Singapore) does not currently support Hong Kong stock options trading, which may require additional consideration for investors interested in investing in Hong Kong stock options。

Taken together, each broker is unique and there are subtle differences in commission rates。Therefore, the selection of a brokerage firm needs to be based on a combination of factors based on individual investment preferences and needs。No brokerage firm is perfect, and the final choice should be based on the individual's investment goals and strategy。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.