What are the No Trading Desk (NDD) brokers?

Traderless brokers are often favored due to reduced conflicts of interest。However, it is not always advantageous for some traders to trade directly through a trader-free platform。

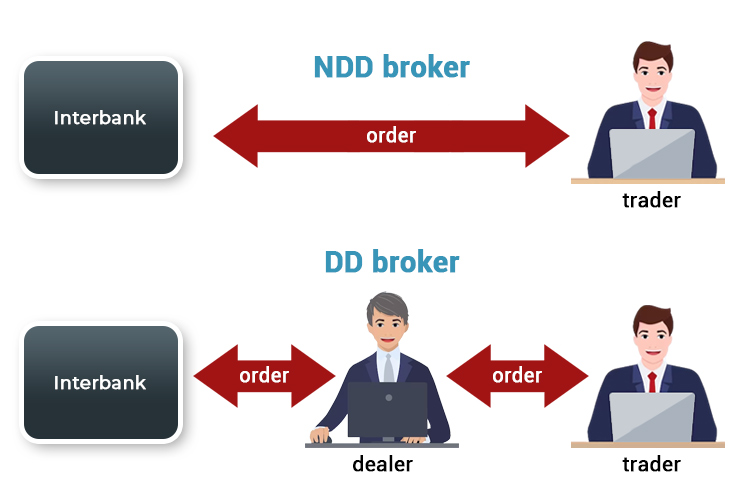

There are usually two types of CFD brokers: trading platforms (DD) and non-trading platforms (NDD)。No trading desk refers to an online trading service provided by a forex broker with direct access to interbank exchange rates without interference from the trading desk.。

While trading desks must exist for financial markets to function properly, NDD brokers are often favored by retail traders due to reduced conflicts of interest。

They may be the right choice, especially if you are an experienced trader, a large market trader, or a high frequency trader。However, if you are a beginner or a small-cap trader, direct access to interbank rates is not always advantageous。

NDD Brokercharacteristics of quotient

Unlike DD brokers, which are counterparties to their clients, NDD brokers are intermediaries between traders and liquidity providers that generate interbank rates。Here is a list of the differences between DD and NDD brokers:

NDD brokers aggregate quotes from numerous suppliers in the interbank market, provide clients with various spreads, and connect opposing trades made by two (or more) participants in the market。The more liquidity providers you work with an NDD broker, the deeper its liquidity and the lower the spread that clients receive。

In this case, NDD brokers typically offer: floating spreads, high commission fees, higher initial deposit requirements, and lower leverage compared to DD brokers。

NDD brokers cannot offer fixed spreads because the normal price in the market is not fixed。They also have to pay huge fees to maintain links with multiple liquidity providers and are therefore unable to offer trading services at cheaper fees.。

In addition, they must require a higher margin to support all the complex risk management and legal requirements needed to maintain their services.。

What are NDD Brokers??

Here are a few of the leading NDD brokers that offer direct market access to Forex and CFD traders:

Dukascopy

Founded in 1998, Switzerland-based Dukascopy offers trading services with a minimum deposit requirement of $100 and a maximum leverage ratio of 1: 200 and is one of the few brokers with a reliable banking license and highly regulated services.。

eToro

Popular online broker eToro has been thriving since 2007。The eToro online trading platform and mobile app is known for its ability and reliability in multi-asset replication trading, allowing users to replicate top trading strategies in real time.。

FP Markets

As a reputable international broker, Australia-based FP Markets offers more than 10,000 CFDs products in the forex, equity, index, commodity and cryptocurrency markets.。Thanks to cooperation with top banks and non-bank financial institutions, FP Markets offers raw spreads from 0.From 0 o'clock。

FXOpen

FXOpen has declared itself as an STP / ECN broker since 2003 and does not trade with clients.。Nonetheless, they are also known as affordable brokers。With a minimum deposit requirement of $1 and a maximum leverage of 1: 500, it is one of the most popular real accounts in the industry.。

IC Markets

IC Markets is a well-known choice for professional traders who want to run automated trading strategies on the MetaTrader and cTrader platforms。Minimum deposit as low as $200, maximum leverage up to 1: 500。

Advantages of NDD Brokers

Traders using NDD brokers are immediately exposed to the interest rates available to retail consumers in the interbank market。As a result, NDD brokers can offer relatively transparent quotes, often with effective no-quote policies and faster order execution.。

Most experienced traders and wealthy market participants, especially those who use high-frequency trading methods, appreciate these qualities。As a result, they may be willing to pay more to enjoy the services of an NDD broker。

Disadvantages of NDD Brokers

Many traders mistakenly believe that NDD brokers offer narrower spreads that benefit everyone。However, this is not the case。

The raw spreads on the market are highly volatile。Under normal market conditions, it may be close to zero, but it may soar due to reduced liquidity or unexpected market turmoil。Without a trading desk as a buffer, traders will be directly exposed to the impact of any turmoil。

In January 2015, the SNB made the controversial decision to lift the Swiss franc's peg to the euro, and in the ensuing chaos, some NDD brokers were destroyed along with their clients, but DD brokers were safe and sound.。

These risks are accompanied by higher transaction costs。Therefore, it is not recommended for beginners and traders with less money to work with NDD brokers。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.