[SG Market] OCBC vs UOB vs DBS: Which one should you include in portfolio?

After the three banks released their latest earnings, we compared them to see which bank is best for your portfolio。

![[SG Market] OCBC vs UOB vs DBS: Which one should you include in portfolio?](https://hawk-oss.hawkinsight.com//hawk/image/202408/1074154974_329.jpg)

With the US central bank hinting at a possible rate cut in September this year, local banks are in the spotlight. This quarterly earnings season, Singapore's three major banks - DBS Group, UOB and OCBC Ltd - all released strong financial reports, mainly benefiting from the growth in net interest income driven by high interest rates.

Investors may be concerned about which of the three blue-chip banks has the upper hand in the face of a possible rate cut. The following will compare the three banks through a number of key indicators to help investors make an informed choice.

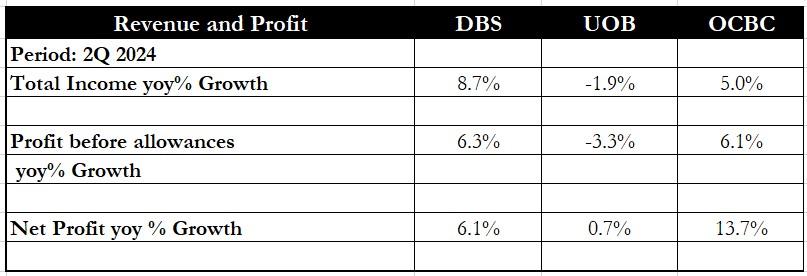

Financial Performance

In terms of financial performance, all three banks have released their financial reports for the second quarter of 2024. DBS Group's total revenue increased by 8.7% year-on-year, the best performance; OCBC followed closely behind, with quarterly total revenue increasing by 5% year-on-year to 3.6 billion Singapore dollars.

In terms of pre-tax profit, DBS Group and OCBC both increased by more than 6% year-on-year. It is worth noting that OCBC's net profit performance was particularly outstanding, increasing by 13.7% year-on-year to 1.9 billion Singapore dollars, thanks to a 43% reduction in provisions.

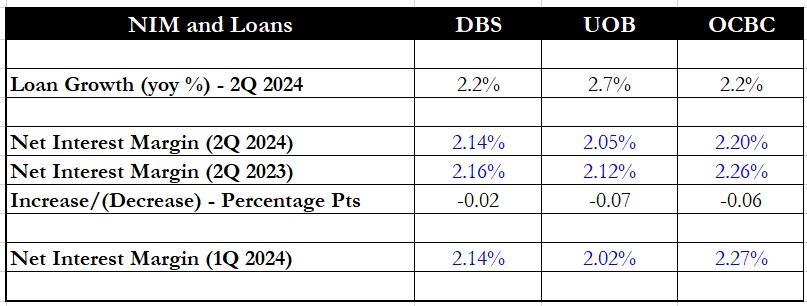

NIM and Loan Growth

In terms of NIM and loan growth, UOB performed best with a 2.7% YoY growth in its loan book. However, UOB had the lowest NIM (NIM) among the three banks at 2.05%. OCBC Bank performed well in terms of NIM, not only maintaining the highest NIM in Q2 2024, but also performing well in the previous quarter and the same period last year. In addition, although DBS's NIM declined by 0.02 percentage points YoY, the decline was the smallest.

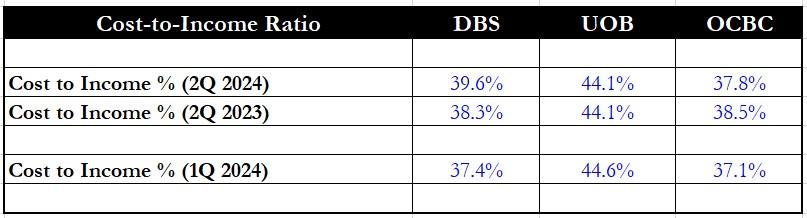

Cost-to-income ratio

In terms of cost-to-income ratio (CIR), a lower cost-to-income ratio means that the bank is more efficient in its operations and management. OCBC's cost-to-income ratio was 37.8%, the lowest among the three banks, and it only increased by 0.07 percentage points from the previous quarter. In contrast, DBS's cost-to-income ratio increased significantly by 2.2 percentage points to 39.6% from a relatively low level in the previous quarter.

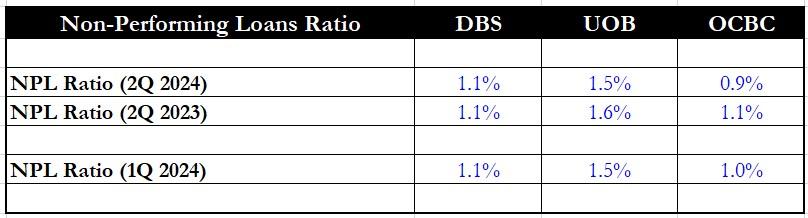

Non-performing loan ratio

In terms of non-performing loan ratio (NPL), OCBC's NPL ratio is 0.9%, the lowest among the three banks, and improved by 0.2 percentage points year-on-year.

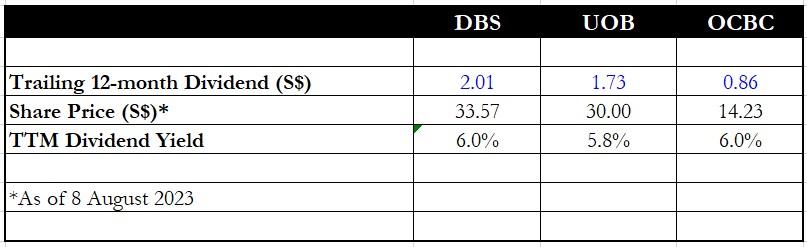

Dividend Yield

For income-focused investors, dividend yield is an important consideration. All three banks announced dividend distributions in the first half of 2024, with DBS Group and OCBC Bank both having a dividend yield of 6% in the past 12 months.

It is worth noting that DBS Group pays dividends quarterly, while UOB and OCBC pay dividends half-yearly. Based on S$0.54 per share, DBS Group's annualized dividend is S$2.16, and the forward dividend yield reaches 6.4%.

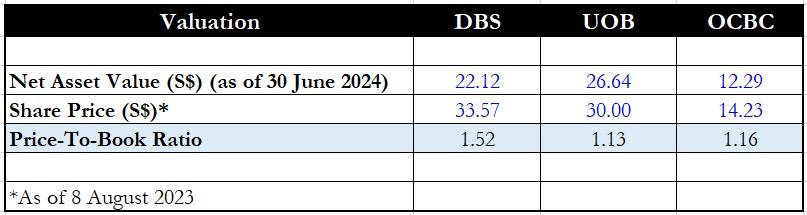

Valuation

In terms of valuation, UOB has the lowest valuation, followed by OCBC; DBS Group's price-to-book ratio is more than 1.5 times, the highest valuation among the three banks.

Based on the above analysis, OCBC Bank has performed well in many key indicators. Not only did the bank achieve the largest annual profit growth, it also had the highest net interest margin and the lowest cost-to-income ratio.

In addition, investors can enjoy a 6% dividend yield if they buy OCBC shares, and its valuation is relatively reasonable, with a price-to-book ratio of only 1.16 times.

However, for income investors who prefer quarterly dividends, DBS Group may be a more attractive option.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.