Short sellers are eyeing Xiaopeng Auto's share price to stop here.?

Xiaopeng's share price has almost doubled in recent weeks, but at the same time the market's bearish bets on the company have reached record highs, suggesting investors are skeptical that the rally will last。

Xiaopeng's share price has almost doubled in the past month, but at the same time the market's bearish bets on the company have reached record highs, suggesting investors are skeptical that the rally will last。

According to IHS Markit, as of June 29, Xiaopeng Motors had a short position of about 12% of the shares listed and traded in Hong Kong, China.。Xiaopeng's shares have surged 92% since their June 1 low to reach overbought territory。But it fell on Tuesday, by more than 5 percent.。

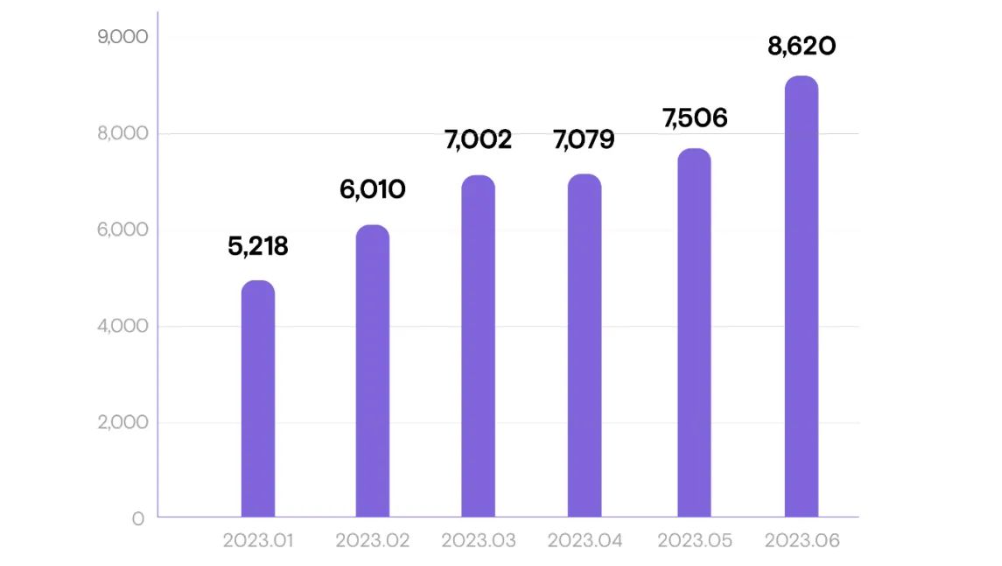

This year, Xiaopeng sales data has been less than ideal。On July 1, according to official data released by Xiaopeng Motors, the company delivered a total of 8,620 new cars in June, up 15% from the previous month, which is the fifth consecutive month of positive growth for Xiaopeng this year.。In the second quarter, Xiaopeng Motors delivered a total of 23,205 new cars, up 27% from the previous quarter.。A total of 41,435 new cars will be delivered in the first half of 2023.。Although the first half of Xiaopeng to achieve five consecutive rise, but until now, Xiaopeng this year has not broken through the "ten thousand" mark, the situation is still difficult to say optimistic。

Although the results are not very bright, but Xiaopeng's share price in June is "soaring," and the main reason to support Xiaopeng's share price rise is the fundamentals of good news。

Recently, the Ministry of Finance, the State Administration of Taxation, the Ministry of Industry and Information Technology and other three departments issued a notice announcing the extension of the new energy vehicle purchase tax reduction policy to December 31, 2027.。Specifically, in 2024 and 2025, the government will continue to exempt the purchase tax on new energy vehicles; in 2026 and 2027, the tax will be halved.。Previously, in order to support the development of the new energy vehicle industry, China has exempted the purchase of new energy vehicles from vehicle purchase tax since September 1, 2014, and later continued the policy three times in 2017, 2020 and 2022.。This year's policy is stronger than ever, with a direct one-time announcement of the next four years of relief plans.。

Sentiment was very positive on the back of this significant positive, with shares of several Chinese electric car manufacturers rising.。Ideal and NIO are both up more than 30 per cent since early June, but Xiaopeng has outperformed the others as analysts applauded the competitive pricing strategy for its new G6 electric SUV model, which it unveiled last week.。

But after signs of overheating, and fears of an intensifying price war, market sentiment appeared to turn cautious.。There has also been a subtle shift in analyst recommendations, with the proportion of Xiaopeng's "sell" rating in June from 12 a month earlier..5% to 13.3%。Xiaopeng's 30-day volatility is also the highest among the 50 components of the Hang Seng China Enterprises Index.。

In the first four months of this year, dozens of automakers cut prices by about 40% in an effort to retain market share amid a "price war" in China's auto market.。But the impact of "big price cuts" on sales is not very obvious, because many consumers think that there will be more substantial price cuts, so they are hesitant。

However, according to a research report by CITIC Securities, many consumers who were waiting to see further price cuts have now decided to "enter the market" because they feel that this "price cut carnival" is over.。

In the next Chinese new energy vehicle market, Xiaopeng's newly listed G6 will be a strong competitor.。On June 29, Xiaopeng's super-intelligent coupe SUV-G6 was officially launched. This car is widely regarded as Xiaopeng's important hope for a "turnaround."。New car launched a total of 5 versions, the price range of 20.990,000 yuan - 27.690,000 yuan, which is about 20% lower than Tesla's Model Y。As of June 28, G6 pre-sale orders have exceeded 3.50,000 units, the current Max version of the model to buy more than 70%。

Analysts at Daiwa Capital Markets Hong Kong Limited said: "G6 sales may be good due to low prices, but it also means that the company's profitability will be weaker in the coming quarters.。Worried about Xiaopeng's profitability, he gave Xiaopeng a "sell" rating.。Earlier, Xiaopeng's first-quarter results showed that the company's net loss in the first quarter reached 23.400 million yuan, a loss of 17.0 billion yuan, net loss recorded year-on-year expansion。In addition, its gross profit also declined, with the company's gross profit in the first quarter being only 0.700 million yuan, down 92% year-on-year.6%, down 84.9%。

Now, it seems that more and more people are not optimistic about Xiaopeng's earnings prospects.。According to IHS Markit data, while short selling on Xiaopeng's U.S.-listed shares has fallen from its December peak, it still accounts for more than a third of the company's outstanding shares, making the stock one of the most heavily shorted shares in Chinese companies' American depositary receipts.。

Citigroup analysts wrote in a note on Monday that the company's third-quarter gross margin and volume growth will be key factors in measuring the sustainability of the rally.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.