Japan's Ministry of Health, Labor and Welfare relaxed policy restrictions on digital currency payment in April last year.

Recently, SoftBank Group Corp. PayPay, its mobile payment platform, is piloting the use of digital currency to pay employee wages for the first time in Japan.This move not only marks a substantial step in Japan's digital currency application field, but also provides a new practical case for global digital currency payments.

Japan is gradually exploring the application of digital currency in the field of salary payment

SoftBank Group, a world-renowned investment holding company, through its subsidiary PayPay, paid part of the September salary to employees willing to participate, in the form of digital currency.This innovative initiative was supported by KDDI, a major Japanese telecom operator, and ten Group, Inc., Japan's leading e-commerce company) responded positively, and they also applied to Japan's Ministry of Health, Labor and Welfare for "au PAY" and "Lotte Cash" to enter the digital currency wage payment business.

Japan's Ministry of Health, Labor and Welfare relaxed policy restrictions on digital currency payment in April last year and designated PayPay as the first operator in August this year.This policy change aims to simplify the salary recharge process for employees and encourage companies to attract young workers who are accustomed to using mobile payments.

The implementation of digital currency to pay wages is believed to expand the "economic circle" of mobile payment companies.NTT DOCOMO, Inc., Japan's largest mobile communications operator) and Mercari, Japan's well-known online marketplace and recruitment platform, are also actively preparing applications to enter this emerging market through "d-Pay" and "merpay" services.PayPay plans to expand its services to companies outside SoftBank Group within the year and has received inquiries from more than 300 companies.

Sakai Moving Center, a well-known moving service provider in Japan, is considering paying part-time employees through PayPay.Given that most of the part-time employees it employs during the peak season are young people, it is expected that there will be a greater demand for digital payments.The company plans to implement digital currency payments starting with the daily and weekly salaries of part-time employees.

In addition, Japan Gas Co., Ltd.,An energy supplier headquartered in Shibuya, Tokyo) also plans to pay wages to its approximately 2000 employees through PayPay, with a maximum of 100,000 yen (approximately RMB 4740) per person.PayPay executive director Masahiro Yanase said that he hopes to promote the digital wage system to achieve its widespread use.

Japan's exploration in the field of digital currency payment not only provides convenience to enterprises and employees, but also provides new ideas and experiences for the application and development of global digital currencies.With the participation of more companies and policy support, digital currency payments are expected to be more widely used in Japan and even around the world.

Digital payments ushered in explosive growth after the epidemic

Against the background of the rapid development of financial technology, the digital payment field has ushered in unprecedented growth momentum.Especially under the impact of the global epidemic, contactless payment methods have been widely favored for their ability to reduce the risk of infection.

According to a research report by Mastercard, approximately 79% of consumers around the world choose contactless payments to reduce the risk of infection, while 46% of cardholders have shifted their payment methods from traditional credit cards to mobile payments, digital wallets and contactless options such as online banking.Consumers generally say they will continue to use these payment methods even if the epidemic is brought under control, showing the long-term growth potential of digital payments.

Fortune predicts that the global digital payment industry will continue to maintain strong growth in the next three years, with the total market size expected to reach US$17,643.35 billion by 2027, with a compound annual growth rate of approximately 23.7%.

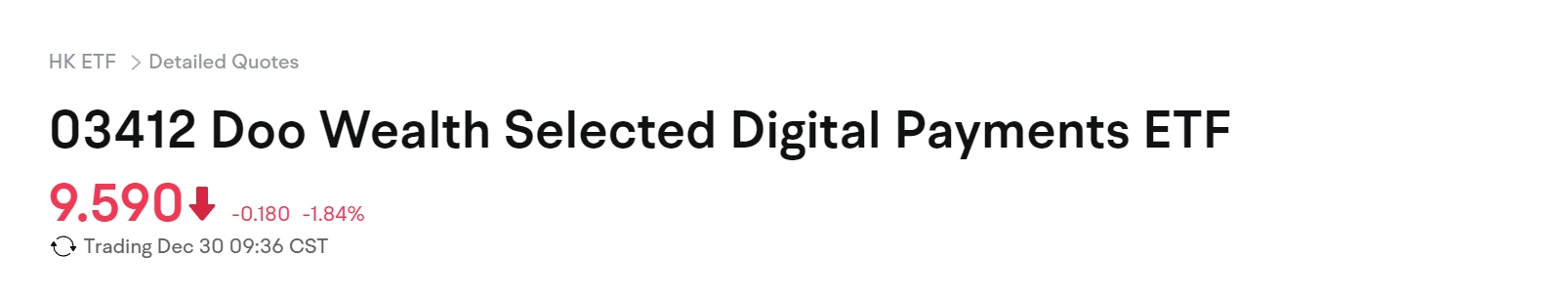

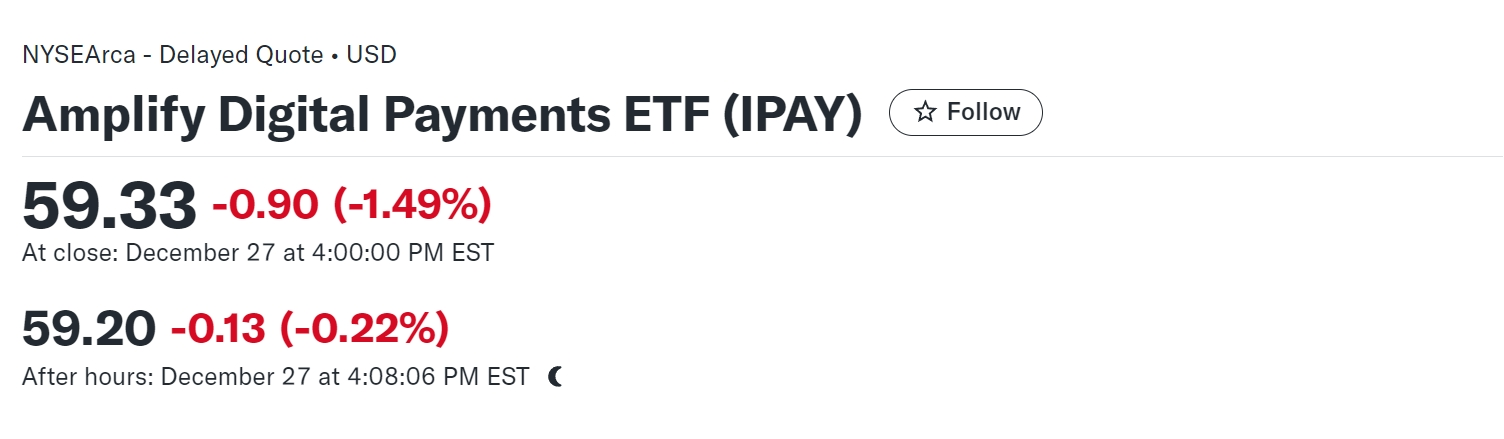

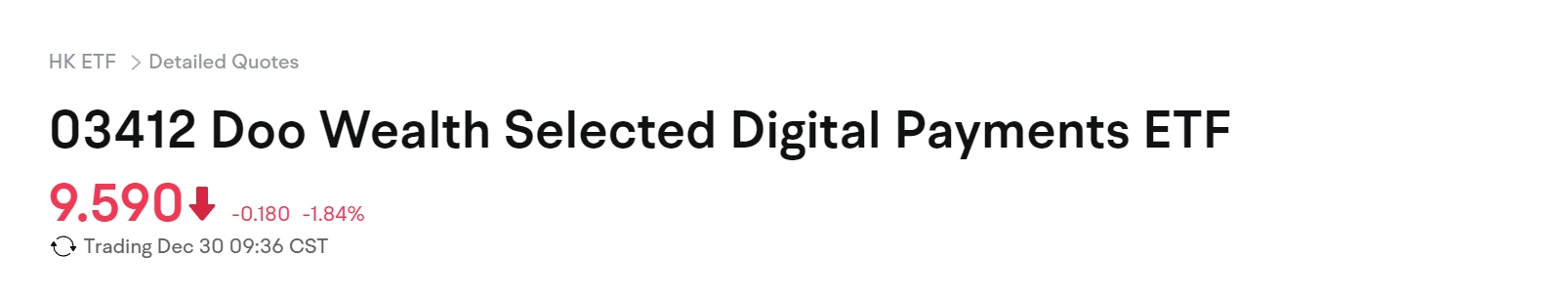

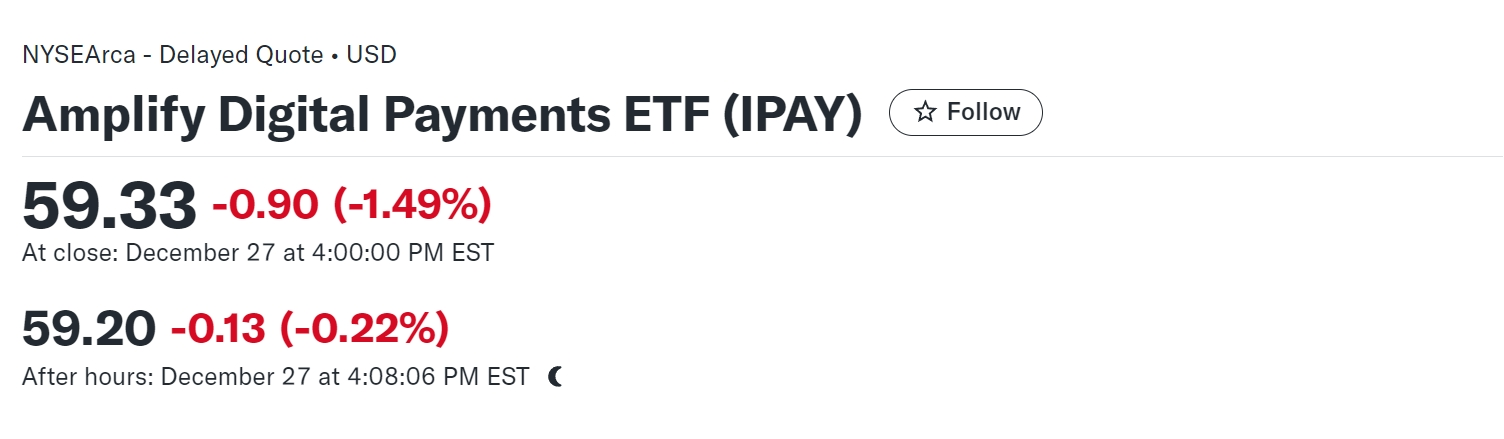

For individual investors, it is particularly important to seize investment opportunities in the digital payment era.Buying exchange-traded funds (ETFs) has become a relatively safe option.With its diversified investment advantages, ETFs allow investors to avoid stock picking problems while participating in the growth of the digital payments market at a lower cost.In addition, compared with a single stock, ETFs have no risk of suspension or delisting. In extreme market conditions, investors still have the opportunity to stop losses.

Some representative digital payment ETFs on the market include but are not limited to:

The above information is for reference only and does not constitute any investment advice.Investors should conduct independent research and risk assessment before making investment decisions.