How important is it to choose the right forex trader and how to choose?

Why you need a good, fair Forex trader who is the middleman in the Forex market and can make you a winner。

Why you need a good, fair Forex trader who is the middleman in the Forex market and can make you a winner。

Have you ever seen a group of traders pick up the phone in the forex market and call out for trading orders?These people are collective forex traders who actively help traders allocate funds and execute market orders.。With their help, it is possible for every trader to make a profit。

Why You Need a Forex Trader?

Traditionally, in the foreign exchange market, a trading lot needs to be about100,000 units of base currency to effectively enter the market。For example, in the GBP / USD (GBP / USD) trading pair, a standard lot is equivalent to £100,000。

This is how leverage works:

Thomas only$10,000, he is short of $90,000 (part of the 100,000 base currency) to trade a standard hand in USD / JPY。In short, he needs a forex dealer to lend him enough money。

Toms found a forex dealer who offeredLeverage of 1: 50。Without hesitation, Thomas accepted the offer。Now, he can trade on 2% margin of the original lot, equivalent to $2,000。In fact, he has $8,000 left to trade on the forex market until the margin warning line is reached.。

In short: if you're not like WarrenBuffett is so rich that you need a forex trader to lend you enough money to participate in the forex YOLO game.。

Factors to consider when selecting a trader

You can start trading online through almost any forex trader。However, if you want to really make a profit, you have to choose carefully。In order to do this, you need to check all of the following:

A. Check their identity and legitimacy

The first thing to consider is the quality of Forex traders。Needless to say, the quality of Forex traders is directly related to how and where they are regulated。

By the way, did you know that an irregular forex trader can operate on an offshore island without clear regulation?Yes, this is the dark truth in the reality of the foreign exchange market。Be careful, my friends! If you are tempted by their overly unrealistic offers, we are here to wake you up!

To avoid these pitfalls, you need to carefully review the legality of your trader。Go ahead and find the answers to these questions:

Where is the headquarters??Does the address written on the website actually refer to a real place?

Yes, you need to find their actual address。If you can't find it on the internet global map, chances are it's a fake address。

Who are they supervised by?Are they under the jurisdiction of regulators??

A good, legitimate forex dealer will be subject to statutory regulators。Some examples include: North AmericaNFA and CFTC, FCA in the UK, ASIC in Australia and CySEC in Cyprus。

To whom should I complain or ask questions?Can I get a satisfactory answer?

As a rule, the brokerage company will provide customer service to answer all your questions。If the answer is satisfactory to you, it's a good sign to start trading with them。

In addition, you must look for traders who implement strong security measures to protect your funds and personal information.。Check if they use encryption protocols and maintain separate customer accounts。Also, consider the reputation and reliability of traders, including their trading infrastructure and stability。

B. Check Transaction Terms and Conditions

We know that it is not easy to understand the pile of words that Forex traders impose to cover up their true intentions。But don't worry, here we will make it easy!

First step, check their market model!

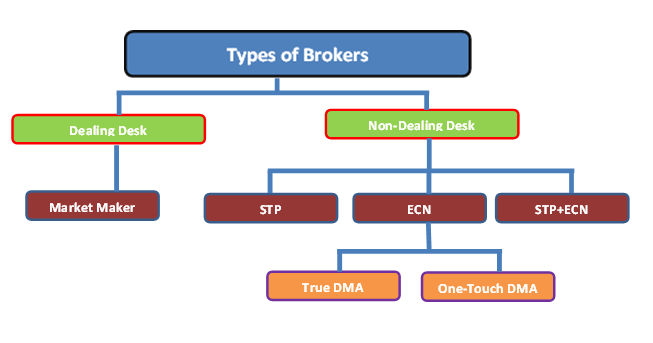

The market model is the way a forex trader transmits your trade request to the market。For example, a good regular forex trader will passSTP or ECN

Step two, check their transaction costs!

Forex traders can charge for their services in a number of ways, such as:

Spread:The spread is the difference between the buy (bid) and sell (ask) prices of a financial instrument.。Traders make money by charging spreads on each trade。Spreads can be fixed or variable, depending on market conditions, liquidity and the trader's pricing model。AvaTrade, easyMarkets, FBS and FxPro are well-known traders who offer 1-point fixed spreads.。At the same time, lower spreads are usually more popular because they can reduce transaction costs。

Commission:Some traders charge a commission on each trade, especially in certain markets such as equity or futures markets。The commission is usually a fixed fee or a percentage of the value of the transaction.。They can vary depending on the dealer, the type of account and the volume of transactions performed。IC Markets, eToro, Admiral Markets, XM and Pepperstone are ASIC regulated traders offering low commissions。

Overnight financing:If you are in Forex orWith overnight positions in the CFD market, traders may charge you or credit overnight financing costs, also known as overnight interest。These costs are related to the interest rate differential between the currencies traded.。The cost of financing depends on the size of the position and the current interest rate.。Some traders offering no overnight fees include OANDA, ThinkMarkets and Vantage FX。

Slip Point:The slippage is the difference between the actual execution price and the expected price。It usually occurs during periods of high volatility or low liquidity.。If you are unable to execute a trade at the price you want, slippage may result in additional costs。因此 ,You can chooseXTB, FP Markets, eToro, IC Markets or Roboforex, which offer no slippage in your trading。

Inactivity Fee:Some traders may charge an inactivity fee when your trading account remains inactive for a certain period of time.。This fee encourages active trading or as a maintenance fee for maintaining an account with a dealer。

Deposit and Withdrawal Fees:Dealers may charge for deposits or withdrawals from your trading account。These fees may vary depending on the payment method used, such as bank transfer, credit card or e-wallet。There are some dealers who charge zero for deposits or withdrawals, such as.Exness, OctaFX, FXOpen, FBS, XM, and FXOptimax。

Data costs:Access to real-time market data and research tools may incur additional costs for traders。These fees may include exchange data fees, subscriptions for advanced research or analysis tools, or access to advanced charting platforms。

Before opening an account, it is important to carefully review the dealer's fee structure and transaction costs。Consider your trading strategy, trading volume and the financial instruments you plan to trade to assess the impact of these fees on your overall profitability。So make sure you can keep these costs to a minimum!

Step 3: Read more below!

C. What they offer?

Think again!The CFTC and NFA have strict rules on leverage and bonus deposits! One reason for this is the risk of over-trading and trading on limited margin.。In other words, traders basically lend you large amounts of money and lure you to trade like blind, hungry rats! And guess what, the rats fall and the traders turn your losses into their profits!

We understand that as a retail trader, you only have a limited amount of capital。But don't use this as a reason to over-trade with irresponsible forex traders。Instead, choose a fair and reliable forex trader with realistic offers! Remember, trade with a fair forex trader and win like a boss!

In addition, there are other offers that should also be considered, such as:

Trading platformMake sure it is easy to use, stable, and provides the features and tools you need。A good platform should provide real-time charts, order types, technical analysis metrics, and a range of order execution options。

Scope of financial instruments:In addition to Forex, you may also be interested in trading other assets such as stocks, commodities or cryptocurrencies。If you have a broader trading strategy, choose a trader who offers diversified market access。

Educational resources and research:Evaluation of educational resources, market analysis and research tools provided by traders。For beginner traders, these can be beneficial as they provide valuable insights and educational materials to improve trading skills。

D. How Forex Traders Maintain Their Clients?

It's probably one of the most important things。A good trader doesn't wash you out and leave you like a rag!?

A good trader should provide responsive and knowledgeable support through various channels such as phone, email or live chat。If possible, test their support beforehand。Research and read reviews from other traders about their experience with traders。Although individual opinions may vary, a recurring positive reputation is usually a good indicator。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.